Popular Spot

SATS is currently operating in a bullish channel, suitable for buying and holding.

WLD can be slightly monitored, as there are quite a few low-point signals.

Pay more attention to CORE; if it breaks the bearish trend, there will be a nice upward wave.

CFX should be closely monitored to see if it can break through and stabilize at 0.19280; if it stabilizes, consider entering.

The above four spots have been around for over ten days. If you just saw this, do not enter blindly; feel free to leave a message or join the community for discussion.

Market Interpretation

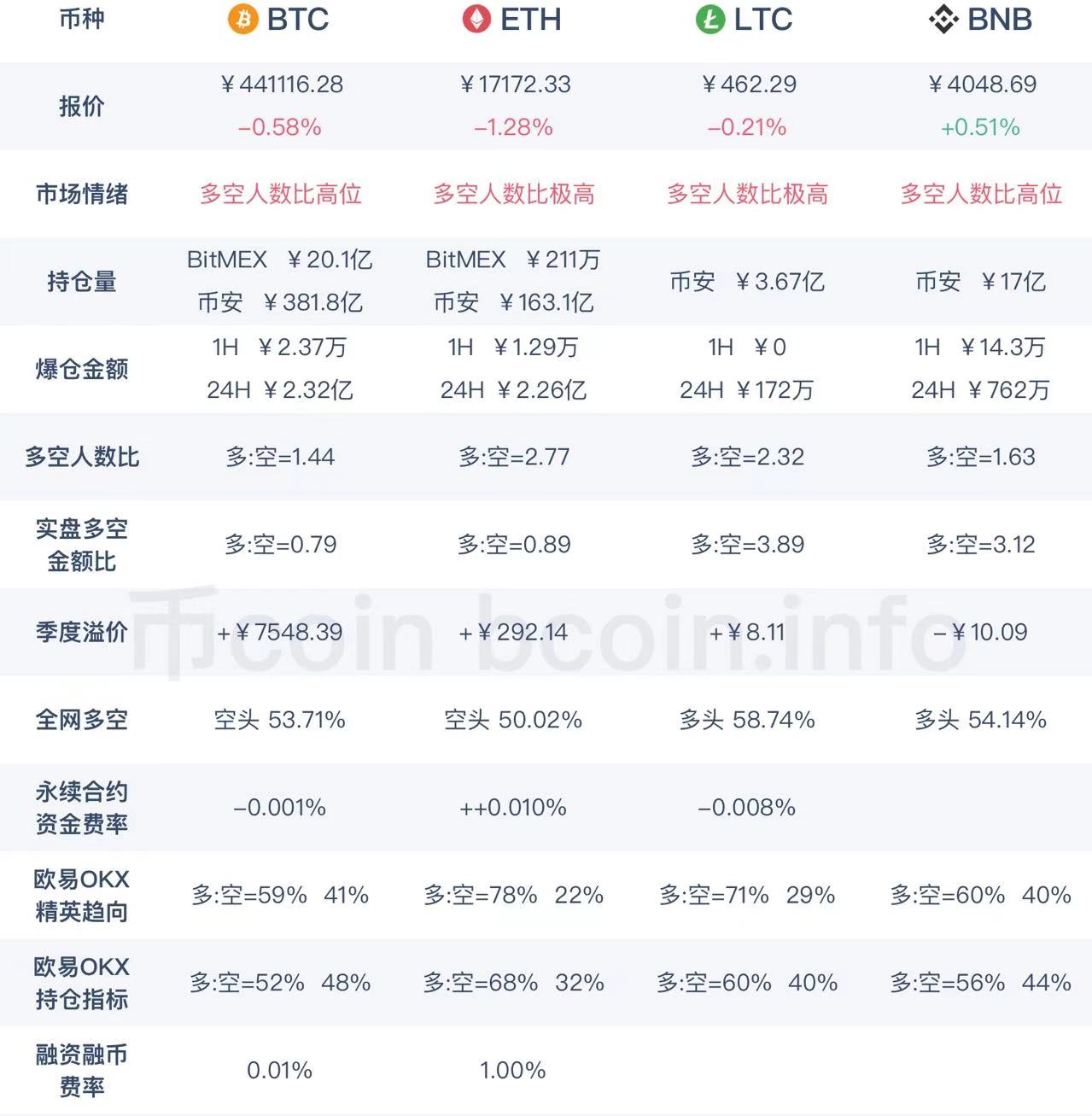

BTC had a small bullish wave last night, gaining 1500 points! Today's overall chart structure continues the upward trend, so as long as it doesn't break the four-hour bottom of 62200, we can continue to look up to 63500-64100. The short-term focus range is 625-63500. The overall naked K changes are indicated in the chart, so a straightforward oscillation upward allows for gradual long positions to take profit. If it breaks downward, I will look at whether 61500 can hold; if not, then consider a new bullish upward trend at 585. The upper short position can be seen at 64500; if it breaks, then look at the extreme target of 68. 😄 I mainly use naked K and channels for layout, rarely using MA Bollinger Bands due to their strong lagging nature. If anyone wants to see them, please leave a message, and I can include them next time. Please note that this article has lagging characteristics and is mainly for reference. You can follow the WeChat public account for daily updates 🔍【Looking Towards Money】

Resistance Level: 64100-65500

BTC Support Level: 61000

ETH also entered long positions last night, but although the overall structure of ETH is also a naked K upward trend, it has not yet exited and remains relatively weak. Patience is required. The short-term range to focus on is 2420-2520, with a hundred-point range. If it breaks through the four-hour high, we can see 2590-2674. If it breaks downward, pay attention to 2330-2250. Remember that different cycles require different strategies. Other than that, there’s no harm done. Thank you all for recognizing my personal suggestions, which are for reference only. If you want to follow my trades, feel free to leave a message and join the community! When others are greedy, I am fearful; when others are fearful, I am greedy. Remember, if you don’t understand something, you can leave a message for communication, or you can communicate under the same name across the internet! Be mindful of risks! Please like, watch, and share this article three times.

ETH Resistance Level: 2590

ETH Support Level: 2450

Macroeconomic Overview: The three major U.S. stock indices closed lower, and U.S. Treasury yields rose.

The three major U.S. stock indices all closed lower, with the S&P 500 index down 0.96% at 5695.94 points; the Dow Jones index down 0.94% at 41954.24 points; and the Nasdaq index down 1.18% at 17923.90 points. The benchmark 10-year U.S. Treasury yield is at 4.03%, while the 2-year U.S. Treasury yield, which is most sensitive to Federal Reserve policy rates, is at 3.99%.

The U.S. 2-year/10-year Treasury yield curve has turned negative for the first time since the Federal Reserve cut rates by 50 basis points on September 18. Traders expect the Federal Reserve to cut rates by less than 50 basis points for the rest of the year.

Summary

In the coming months, Bitcoin may continue to face challenges from market volatility and macroeconomic policies. As investor interest in DOGE rises, it may drive its price further up. The market's interpretation of Federal Reserve policies will be key, especially the pace and magnitude of rate cuts, which will directly affect the performance of risk assets.

Additionally, as the U.S. presidential election approaches, political meme tokens may see a surge in popularity, attracting more investor attention. Overall, the recovery of the altcoin market and the popularity of meme tokens may provide new opportunities for investors, but the sustainability and stability of the market still need to be observed.

Personal Introduction

Graduated from Nanjing University with a degree in finance, previously worked as a risk management expert and private wealth advisor at Shanghai Yimeng Securities.

Invested in BTC for the first time in 2015, focusing on the cryptocurrency space for nine years, navigating multiple bull and bear cycles.

Integrating deep financial expertise and sufficient industry experience into practical applications.

Helping students quickly master trading skills and improve trading systems.

Trading Style: Skilled in building structured thinking, creating financial trading courses, and naked K strategies.

For business inquiries, search for the same name on WeChat public account 【Looking Towards Money】

Join the group for learning

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Search for the same name on WeChat public account 【Looking Towards Money】

Also, please help me like + watch + share three times 👌😂 The links and advertisements below do not belong to me; please be cautious in identifying them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。