The main innovation of the CryptoEconomic DVN Framework lies in providing core components for DVN through AVS, defining the staking assets and penalty mechanisms.

Author: YBB Capital Researcher Ac-Core

TL;DR

● The CryptoEconomic DVN Framework combines LayerZero's cross-chain messaging with EigenLayer's economic security and incentives;

● The DVN framework operates through a structured process, which is divided into three main stages: validation, veto, and punishment;

● LayerZero chooses to collaborate with EigenLayer to further deepen the decentralization of its DVN, accepting ETH, ZRO, and EIGEN as staking assets while also bringing new growth engines for both tokens;

● The CryptoEconomic DVN Framework may help enhance overall chain security in the future.

I. Understanding the Narrative Background: The Iterative Upgrades of EigenLayer and LayerZero

Image source: LayerZero Official

According to news on October 2, 2024, LayerZero Labs has partnered with Eigen Labs to launch the CryptoEconomic Decentralized Validation Network (DVN) framework, aimed at providing economic security for cross-chain messaging. Under this framework, developers can not only deploy their own DVN on EigenLayer but also enhance the security and reliability of cross-chain messaging by introducing incentive mechanisms.

In summary, the CryptoEconomic DVN framework combines LayerZero's cross-chain security mechanisms with EigenLayer's re-staking economic model for dual protection. Its core purpose is to leverage EigenLayer's economic model to provide higher security and incentives for the Decentralized Validation Network (DVN).

1.1 Phase One: The Cross-Chain Mechanism of CryptoEconomic DVN Lays the Foundation for LayerZero V2

LayerZero is not only about asset cross-chain but also a trustless cross-chain communication protocol that separates the ultimate trust layer through relayers and oracles, achieving cross-chain messaging via a super-light node mechanism.

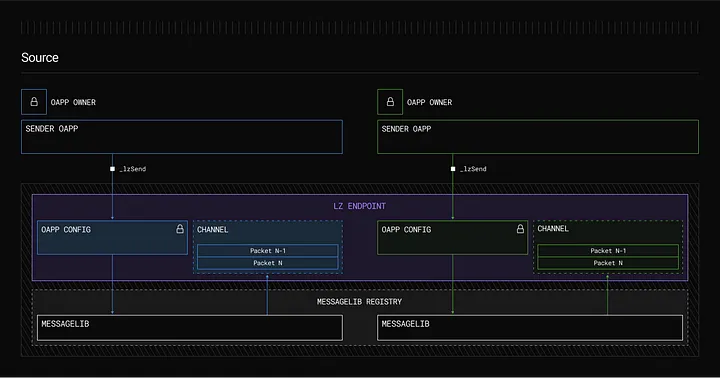

The core design of LayerZero V2 architecture can be divided into three categories: Protocol, Standards, and Infrastructure.

1. Protocol

The protocol part of LayerZero remains consistent across all supported blockchains and features immutability and permissionlessness, ensuring censorship resistance and long-term stability. This part consists of two main components:

● Endpoints: These are immutable and non-upgradable smart contracts on each blockchain, forming the core of the LayerZero protocol. Endpoints provide standardized interfaces for applications to manage security configurations and send/receive messages across chains. Due to the immutability of endpoints, once deployed, no entity can modify them;

● MessageLibs: Message libraries connect with endpoints and are responsible for validating and communicating cross-chain messages. Updates to each message library are additive and do not replace old versions, allowing developers to choose to use older message libraries even if the protocol needs upgrading, ensuring backward compatibility. This is similar to different versions of smart contracts on a blockchain, where users can select different versions as needed.

Image source: LayerZero Endpoint Description

2. Standards

The standards provided by LayerZero enable developers to build consistent applications and tokens across multiple blockchains, achieving cross-chain "unified semantics," meaning applications or tokens exhibit the same behavior across different blockchains. These standards help simplify the development process, ensuring consistency and scalability for cross-chain applications.

● Contract Standards: LayerZero provides standards such as OApp (Omnichain Application) and OFT (Omnichain Token), which extend existing smart contract standards (e.g., OFT is an extension of the ERC-20 standard), allowing developers to quickly create applications and tokens that can run on all LayerZero-supported blockchains;

● Message Packet Format: Used for transmitting data and commands between blockchains. Message packets contain elements to prevent replay attacks and misrouting (such as Nonce, source/target chain ID, unique identifiers) and include the actual commands or data to be executed on the target chain. This message format can adapt to various blockchain environments (including EVM and non-EVM chains, public and private chains), ensuring the accuracy and security of cross-chain information transmission;

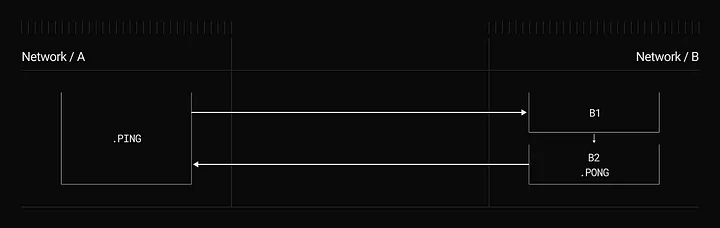

● Design Patterns: LayerZero provides a series of design patterns (such as AB, ABA, Composite AB), which offer developers basic building blocks for cross-chain applications, simplifying the process of developing complex cross-chain interactions. These patterns can help developers create a more streamlined and efficient user experience, such as completing token cross-chain bridging and swapping in a single transaction.

Image source: Composite ABA Design Pattern

3. Infrastructure

The infrastructure layer of LayerZero is fully permissionless and modular, allowing any entity to join the LayerZero network to validate and execute transactions. This design enables applications to choose different validation and execution methods based on their needs, achieving an optimal balance in terms of security, cost, and speed.

● Decentralized Validation Networks (DVNs): These networks validate cross-chain messages, and any entity capable of validating cross-chain data packets can join LayerZero as a DVN. This decentralized design allows applications to select suitable combinations of validators, avoiding being locked into a single validator network. Currently, there are over 15 DVNs participating in LayerZero, including zkLight clients provided by Google Cloud and Polyhedra;

● Executors: Any entity can run executors, responsible for ensuring the smooth execution of cross-chain messages on the target chain. Executors simplify the user experience, allowing users to pay gas fees only on the source chain without needing to perform additional operations on the target chain. Applications can choose one or more executors based on their needs, and they can even build their own executors or choose to manually execute cross-chain messages;

● Security Stack: Each application can configure a unique security stack based on its needs, including selecting DVNs, executors, and other security preferences. The security stack allows applications to choose how to validate cross-chain messages and make adjustments as necessary, providing a highly customizable security solution and avoiding being locked into a single security model.

To better understand the CryptoEconomic DVN Framework, here is additional information related to LayerZero V2 DVN:

Decentralized Validation Networks (DVNs) are used to validate messages transmitted between different blockchain networks. Each application built on LayerZero can customize its security stack by selecting DVNs. Key points include: 1. DVNs: These entities are responsible for validating cross-chain messages, ensuring their security and integrity. Developers can configure which DVNs to use as needed and set optional validation thresholds. 2. Openness: Anyone can create or develop a DVN, providing a variety of validation options. DVNs can include validators, signers, or utilize advanced technologies such as zero-knowledge proofs (ZKP) and intermediate chains. 3. Customizable Security: Applications can choose different DVNs based on their security needs, differing from the one-size-fits-all model of other protocols, allowing applications to adjust security settings as needed to reduce costs and risks. 4. DVN Combinations: Through "X of Y of N" configurations, applications can select multiple DVNs to validate messages. For example, a "1 of 3 of 5" configuration means that one specific DVN and two others selected from five DVNs are required.

Image source: The Position of DVN in the V2 Architecture

1.2 Phase Two: The Economic Security of CryptoEconomic DVN through EigenLayer

EigenLayer consists of a series of smart contracts that allow users to choose to "re-stake" their ETH or liquid staking tokens (LSTs) to guide new proof-of-stake (PoS) networks and services within the Ethereum ecosystem, earning additional staking rewards and providing security and decentralization attributes for other modular components and blockchain networks. In simple terms, its essence is selling the security of Ethereum. EigenLayer can be analyzed into five categories: native re-staking, LRT, AVS, large-scale Rollups, and committed applications.

1. Native Re-staking

It can input multiple commitments for validation simultaneously, measuring the economic bandwidth consumed by each commitment and ensuring that all commitments are solvent. Essentially, it is Ethereum's "elastic scaling of security" (ES2) that allows all AVS to be secure if they meet the conditions;

2. Liquidity Re-staking

LRT is a mechanism where liquid re-staking tokens (LRTs) are similar to liquid staking tokens (LSD) on Ethereum, serving as a tokenized representation of assets stored on EigenLayer, thereby unlocking previously locked liquidity;

3. AVS Economics

The core of EigenLayer, it is a collection of decentralized systems that can pair technology with a certain degree of decentralized trust architecture. The roadmap centered around AVS ensures that permissionless decentralized services can be integrated to build arbitrary applications and create different categories and customized AVS on EigenLayer;

4. Large-Scale Rollups

Most crypto application development is still constrained by block space. Without a corresponding cloud space concept, it will scale according to demand.

For example, EigenDA is a mechanism for infinitely scalable bandwidth, proposing various new use cases that were previously impossible: transforming the cloud into crypto;

5. Trustworthy Applications

The establishment of EigenLayer aims to maximize the number of commitments, with EigenLayer + Ethereum providing Ethereum-level diversity and verifiable commitments. For instance: 1. Maximizing the amplification effect through EigenDA; 2. Achieving diversity through open innovation in EigenLayer AVS; 3. Introducing off-chain verifiability into on-chain mechanisms to achieve verifiable computation.

II. Token Economic Empowerment, LayerZero x EigenLayer Collaboration, ZRO and EIGEN as Staking Assets

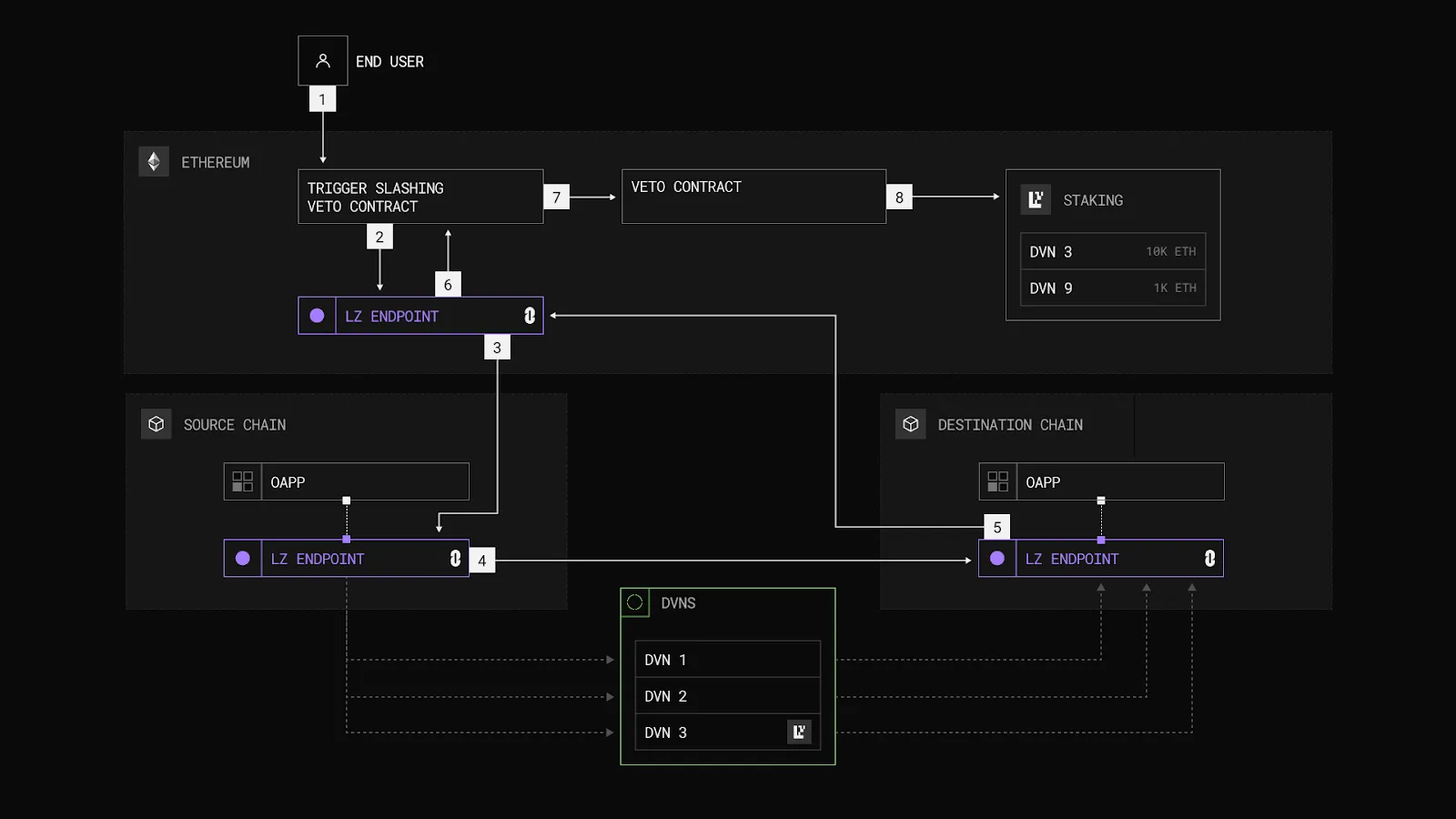

Image source: Explaining the processes of staking, validation, veto, and punishment

In short, the CryptoEconomic Decentralized Validation Networks (DVNs) enhance cross-chain security through the following three key ways:

Economic Security: DVNs introduce a penalty mechanism (Slashing), where the staked assets are penalized if the DVN exhibits malicious behavior or errors. This economic model ensures that DVNs have sufficient economic incentives to maintain correct behavior, as misconduct will lead to significant economic losses, thereby promoting accountability and security;

Security Defined by AVS: Each Active Validation Service (AVS) defines the types of assets that can be staked and their penalty conditions. This flexibility allows different types of DVNs (e.g., ZKP-based, Middlechain, or authority-proof DVNs) to enhance their security through additional staking guarantees, further increasing the economic deterrent against malicious behavior;

Permissionless Security: Anyone can contribute to the security of DVNs by staking assets, making the system more open and participatory. DVNs can choose any assets (such as ZRO, ETH, EIGEN) to support their network, broadening security options and enhancing decentralization.

The CryptoEconomic DVN framework is an open-source system designed to enhance the security of decentralized validation networks (DVNs) through an economic incentive mechanism tied to tokens, relying on LayerZero's DVN to validate messages and adding an extra layer of security. Specifically, it protects LayerZero's cross-chain messaging through four key mechanisms: Staking, Validation, Veto, and Punishment.

Staking: Validators (stakers) lock tokens such as ZRO, EIGEN, or ETH in the Active Validation Set (AVS) of the DVN as collateral. Staked funds incentivize validators to act honestly, as improper behavior may lead to the punishment (slashing) of the staked assets;

Validation: Users or applications can trigger a cross-chain round-trip message (Ethereum → Source Chain → Target Chain → Ethereum) to verify whether the hash recorded by the DVN matches the hash recorded on-chain. If they match, the process ends;

Veto: If a mismatch is found, a veto process is initiated, allowing token holders to vote on whether to punish (slash) the DVN's stake. This step prevents erroneous slashing due to non-malicious errors like blockchain reorganization, as reorganization may lead to packet mismatches, but the DVN may actually be honest;

Punishment: If the veto fails and confirms that the DVN has exhibited malicious behavior or validation errors, the staked assets of the DVN will be slashed.

The framework is divided into three stages:

● Stage 1: Validation – Messages are validated across multiple chains using independent DVNs to ensure fairness;

● Stage 2: Veto – If discrepancies are found, a veto contract is triggered, and token holders vote on whether to slash the DVN's stake;

● Stage 3: Punishment – If the veto fails, the staked assets of the DVN will be slashed due to malicious behavior or erroneous validation.

III. Perspectives on the CryptoEconomic DVN Framework

Today, the Ethereum infrastructure is becoming more complete, and a multi-chain landscape has been established, yet the security issues of communication between different chains remain a significant challenge. The main innovation of the CryptoEconomic DVN Framework lies in providing core components for DVN through AVS, defining the staking assets and penalty mechanisms. In the long run, it may contribute to the enhancement of overall chain security, but the uncertain impacts it brings are also common issues within the industry. Finding a balance between security and flexibility is a problem that needs to be addressed in the future.

Undoubtedly, the CryptoEconomic DVN Framework represents a mutually empowering collaboration between LayerZero Labs and Eigen Labs. From a technical perspective, it provides guarantees through staking, penalty mechanisms, validation, and veto mechanisms; but from an economic benefit perspective, it still represents a "nested" operation of PoS staking rewards.

LayerZero chooses to collaborate with EigenLayer to further deepen the decentralization of its DVN, accepting ETH, ZRO, and EIGEN as staking assets while also bringing new growth engines for both tokens. LayerZero provides technology, EigenLayer provides funding, and the collaboration rewards validators, encouraging honest behavior within this economic system.

Reference Articles:

(2) LayerZero x EigenLayer: The CryptoEconomic DVN Framework

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。