The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and refuse any market smoke screens.

Yesterday's short-term contract layout has reached the conditions for closing the net. Many friends who referred to Lao Cui's approach mainly focused on entry points and did not consider profit-taking or stop-loss points. Today, Lao Cui hopes everyone can correctly understand this. Short-term profits do not represent any central idea; the main focus is still on stability, so congratulations to everyone for achieving satisfactory profits. The low point yesterday reached the 2380 position, and today it can be considered a rebound directly pulling up to the 2470 position. This wave can be said to have a profit space of about 50 points. For those who entered the market following Lao Cui's article, Lao Cui does not seek anything in return after your profits; I just hope that when you incur losses in the future, you won't blame Lao Cui. Lao Cui did not want to provide exact entry points for everyone to try trading, as many users who went long recently have suffered too many losses. Therefore, in a moment of urgency, I provided a long position at 2400. For general contract users, it is advisable to set the profit-taking space around 50 points and not to aim too high.

A hero does not speak of past bravery; let’s directly enter today’s thematic analysis. From the perspective of rebound strength: we are currently in a process of rising and adjusting. It can be said that whether the 2400 level can hold will play a decisive role. As long as the 2400 position can hold, there is no need to think too much about the future; it will definitely contend for the 2500 level. Through the recent tug-of-war between bulls and bears, everyone psychologically believes they have a certain grasp of the market trend, and it is clear that the strength of the bulls is greater than that of the bears. A hundred-point upward space is basically within reach for Ethereum, and compared to the downward strength, the effect of bottom-fishing below is more obvious. Therefore, for contract users, the focus should be on going long. Although the previous analysis shows that we are currently in a short-term oscillating market, and this trend will continue without significant breakthroughs, Lao Cui still emphasizes not to easily enter short positions. Even if a short position can drop to around 2000, it cannot capture short profits.

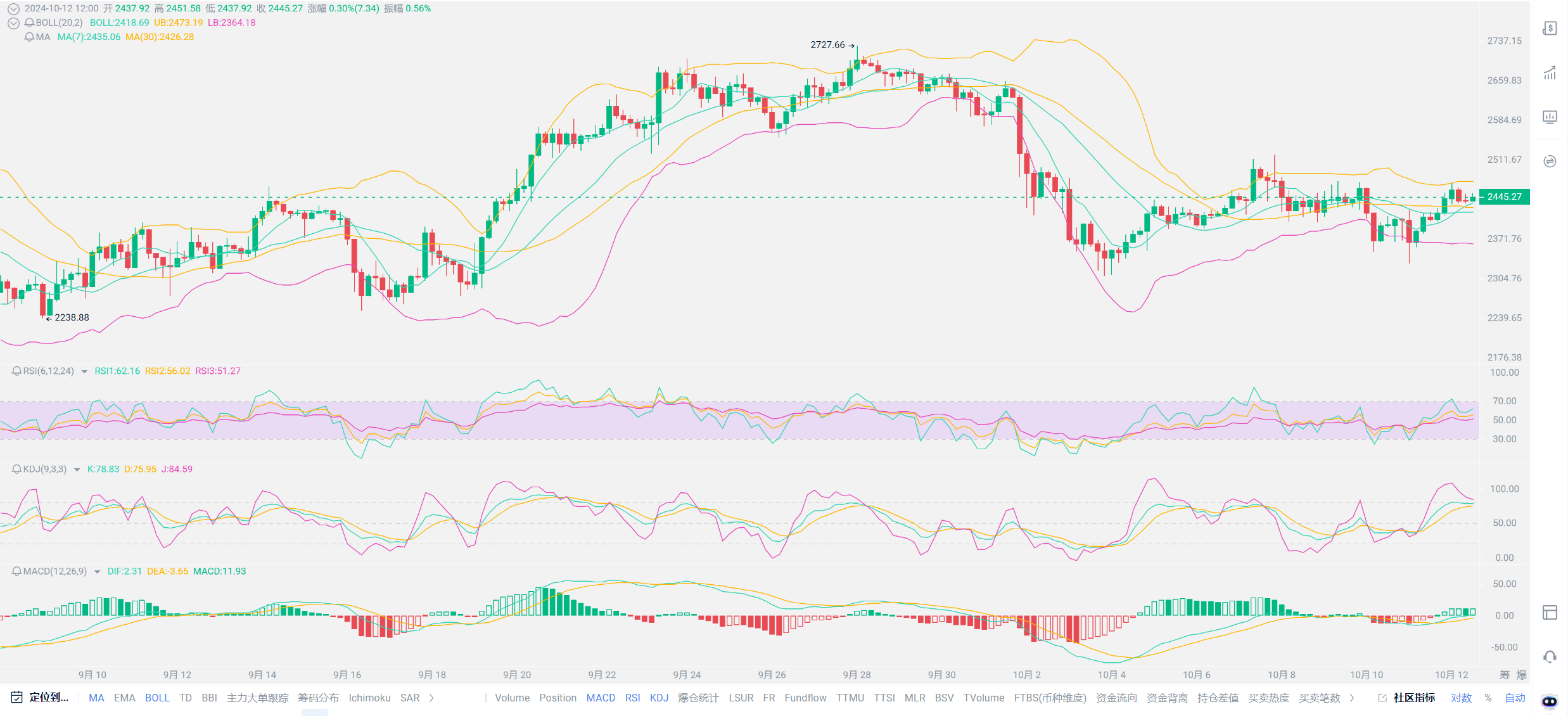

Because looking at the entire trend, the continuation of the bearish market will not last long, and the rebound speed below will be very fast, which means that once you chase a short position, you may be trapped. Such positions can easily rise above 3000, and it may take at least six months to get out. Let’s take a simple look at the four-hour chart: the seven-day moving average officially crossed the thirty-day moving average at eight o'clock this morning, indicating that the short-term strength has shown signs. The average price also clearly shows that the buying sentiment is higher than the selling sentiment. Combined with the direction of the Bollinger Bands, the three tracks are completely flat, and the price is running between the upper and middle tracks, with the upper track pressure located around 2475. A breakthrough would short-term aim for above 2500, and the next wave of breakthrough positions will directly target above 2500. The three tracks being flat indicates signs of consolidation, and in the short term, there will definitely be a downward adjustment trend. The values of RSI and KDJ three lines are slightly high, suggesting a possible overbought condition. The MACD formed a golden cross at 16:00 yesterday afternoon, indicating that this bullish trend seems to be nearly over. From a technical perspective, the downward space will not be too deep, and after the adjustment, there will still be upward breakout trends.

Looking at the entire Ethereum trend, the lowest point of the adjustment reached around 2329. Looking further ahead, the low point of the previous bearish market was 2308 on October 3, indicating that the depth of the adjustment is getting shallower. The entire market trend, viewed through T-lines, resembles the washout before a bull market, with depth fluctuating between 300-400 points. For the current trend, spot users need to have extraordinary patience. It can be said that as long as you withstand the depth of the downturn in these two waves, the subsequent explosion will definitely yield abundant rewards. For contract users wanting to enter the market, the key point still lies in the stability of the 2400 level. As long as today’s adjustment depth does not fall below 2400, you can try entering a long position. If you are unsure about the market trend, it is still best to ask Lao Cui first. Lao Cui has explained many trends and found that everyone does not have a clear idea of the criteria for judging stability. Many friends have been skeptical about whether a point is stable. Simply put, judging the stability of the 2400 level is very easy to understand. Even if there is a short-term drop below 2400, as long as it can recover this level within an hour, it already indicates that there is support at the 2400 position. With substantial market support, going long is the main theme.

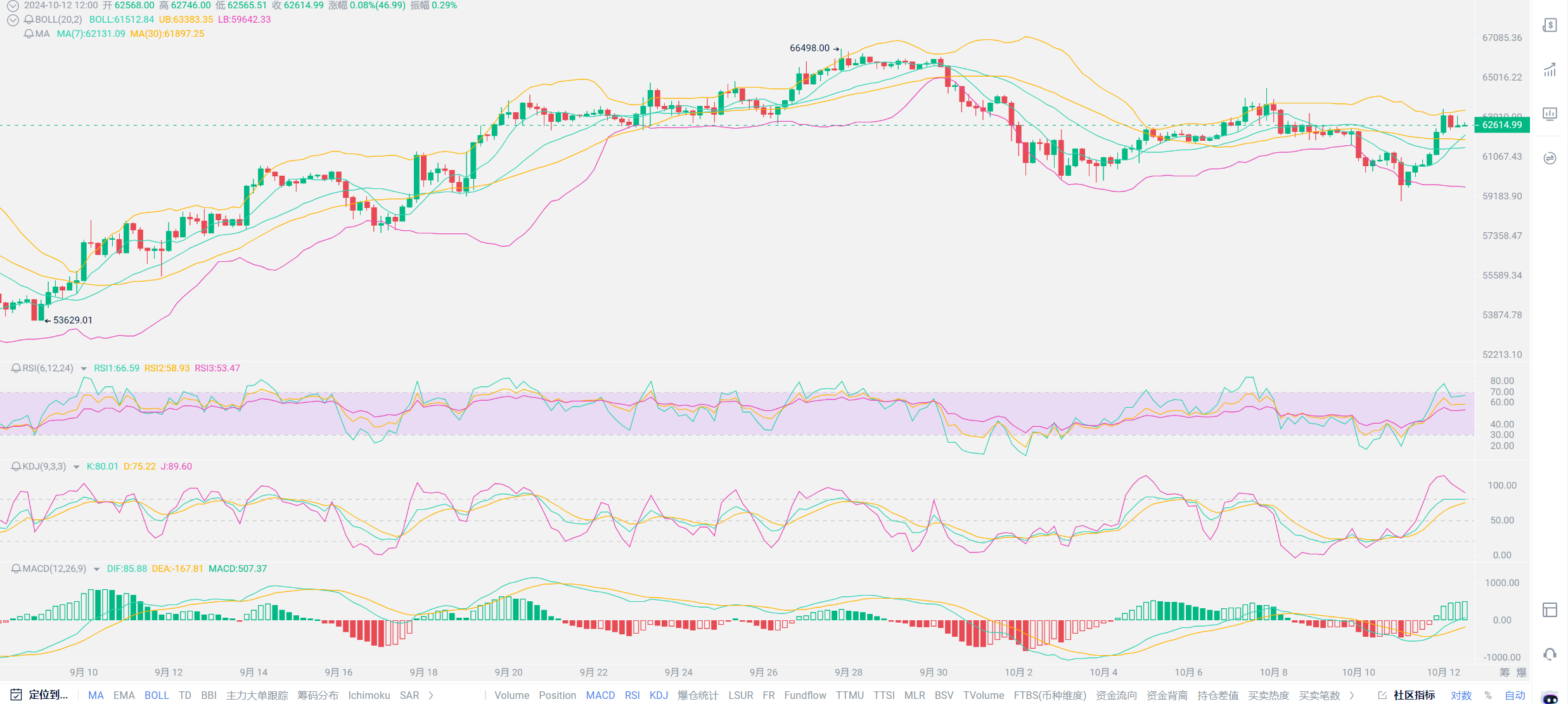

Lao Cui summarizes: The main factor for yesterday's growth still comes from the capital level, with over 250 million USDT flowing into the spot market, most of which flowed into BTC's ETF spot. It can be said that traditional capital has finally entered the crypto market, which is a good sign. At least it represents that traditional capital is beginning to take Bitcoin's spot seriously. With this beginning, it will guide other retail investors to return to the crypto market. Coupled with the recent slight downturn of Old A, there has been a return of retail investors and capital, indirectly indicating that the crypto market is still as we analyzed. Apart from the phenomenal trends, investment in the crypto market remains top-notch. As long as there are no war factors or political influences in the short term, even if there are violent increases in other financial markets like Old A, it will not significantly suppress the crypto market. Once other markets weaken, the crypto market will still be the gathering place for retail investors. This statement is to give confidence to spot users, and contract users are still the same; as long as you go long, you will profit. Long positions currently cannot be trapped. As for the entry points, they were just provided yesterday, and today’s observation still focuses on 2400. Users who do not understand the entry points can come and ask Lao Cui.

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。