As market competition intensifies, exchanges that can quickly capture market trends and timely launch popular meme coins are becoming the preferred choice for investors.

When the crypto market falls into a liquidity crisis, meme projects, as natural reservoirs of traffic, have become a source of users for many crypto exchanges. Many exchanges are continuously releasing friendly measures targeting users in the meme sector to attract their participation.

According to data from CoinGecko, the current market size of the entire meme coin market is $53 billion, accounting for about 2.3% of the crypto market value. Among the top 200 cryptocurrencies by market capitalization, 19 are meme coins. This continuously expanding market share has transformed meme coins from "joke bets" into serious investment choices.

In the primary market, Pump.fun has created approximately 2.3 million meme coins since its launch in January 2024. Data shows that only 3% of users in the primary market can earn more than $1,000 in profit, and only 0.0028% of users have achieved $1 million in "To The Moon."

As market barometers, crypto builders and VCs are also highly focused on meme coins. Among them, the crypto fund Mechanism Capital has stated that it has completed its position in meme coins, and Pantera Capital partner Paul Veradittakit summarized in a post that "Meme coins are the Trojan horse of cryptocurrency." Notably, Zhu Su, co-founder of Three Arrows Capital, stated on social media that "institutional allocation to meme coins is likely to be the story of Q4"; Black Horse Venture and market maker DWF Ventures have also stated on the X platform that "Meme coins will become a new GTM strategy for many ecosystems and projects." A partner at DWF Labs has revealed, "We are in talks with some meme coin projects and are willing to deploy funds to promote their growth."

Clearly, for meme users in the crypto market, if they focus on the primary market, the "sinking investment" approach seems unpromising. The extensive personal effort spent on filtering and investing in coins does not yield high returns. Therefore, focusing on the secondary market and benefiting from the meme coin filtering mechanisms of exchanges to achieve stable returns has become the choice for many meme users.

Against this backdrop, many crypto exchanges have recognized the high traffic characteristics of the meme sector and have introduced favorable policies to compete for the attention of meme coin users. For example, some exchanges have expedited the listing review process for meme coins, provided higher liquidity support, and even attracted users by offering airdrop rewards and discounted fees.

As market competition intensifies, exchanges that can quickly capture market trends and timely launch popular meme coins are becoming the preferred choice for investors. This is not only to pursue significant short-term gains but also to gain an advantageous position in the early stages of the meme coin market. For secondary market users, whether an exchange has efficient project discovery capabilities and stable liquidity is a key factor determining their trading experience.

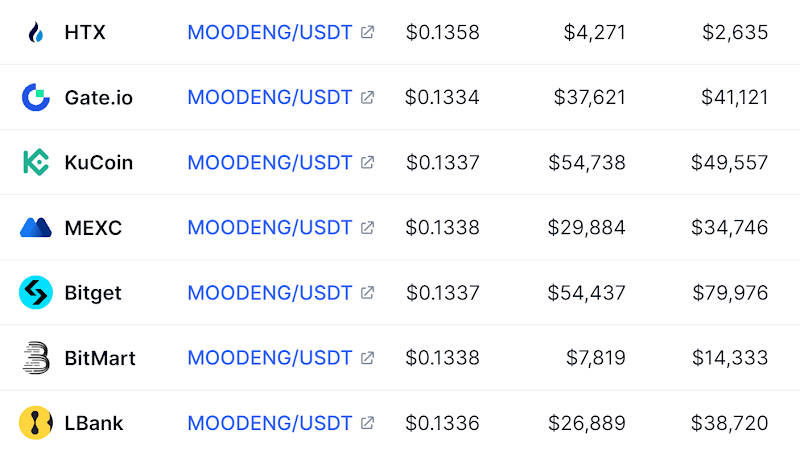

Taking the recently popular meme coin MOODENG as an example, according to data from CoinMarketCap, this coin has been listed on exchanges such as HTX, Gate.io, KuCoin, MEXC, Bitget, BitMart, and LBank. By reviewing the listing times and opening prices of each exchange, the following table can be derived (listing times are in chronological order).

From the table, it can be seen that LBank listed this coin relatively early. In fact, observing the K-line trends of MOODENG across various exchanges makes it easy to find that most exchanges that did not launch the coin first chose to "jump" the opening price, so for meme coin users, choosing an exchange that launches meme coins first can provide a significant cost advantage.

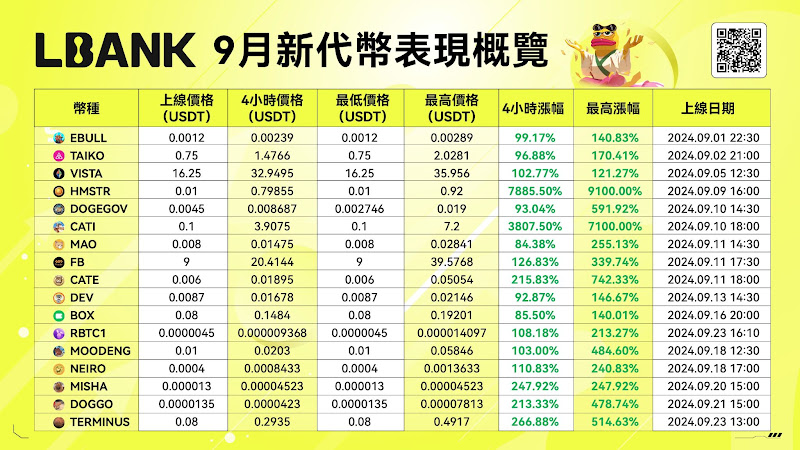

Taking LBank, which was the earliest to list MOODENG (data sourced from LBank's official social media), as an example, it listed 17 coins from September 1 to September 23, of which 14 were meme coins, showing impressive gains. Clearly, when the crypto market falls into a liquidity crisis, meme coins re-emerge as saviors, showcasing strong market performance.

Time, price increase, and liquidity have always been the most concerning factors for secondary market meme coin users. For meme coins, short-term price increases are key to attracting investors, and whether an exchange can list popular meme coins promptly has become an important indicator of its market competitiveness. Exchanges need to have the ability to quickly discover projects and conduct efficient reviews to ensure they can launch popular coins early, seizing market opportunities and providing users with the best trading timing.

Exchanges with keen project sensitivity and rapid response mechanisms can often bring significant investment returns to users in the early stages of meme coin listings, attracting a large number of investors. Additionally, strong liquidity assurance is also one of the important factors for users when choosing an exchange. Market depth and sufficient liquidity can ensure that users complete trades at better prices, avoiding losses due to market slippage.

With the popularity of meme coins, more and more exchanges are accelerating their layout in this sector, launching a series of liquidity assurance and project support measures to attract more users and project parties. This trend has driven the rapid expansion of the meme coin market and intensified competition among exchanges.

In this context, the market insight and technical advantages of exchanges have become key to attracting meme projects and users. As innovative meme projects continue to emerge, exchanges are not only facing challenges in technology and liquidity management but are also continuously adjusting strategies to expand their influence in the meme sector. In the future, as the meme coin market continues to develop, the relationship between exchanges and meme coin users is expected to become closer, with market activity and trading volume likely to continue to rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。