Although writing about the hot topics of July in October may seem outdated, in the long run, the entire Web3 industry is shifting towards off-chain and real consumption scenarios. PayFi is the latest attempt by the crypto industry to move into real-world applications.

Written by: Zuo Ye

The Non-Trading Nature of Cryptocurrency: A Melody for Exploring Web3's Path

Compared to the fragmented landscape of Ethereum, the Solana ecosystem is smaller but more agile. After the collapse of FTX, Solana has risen from the ashes, relying on high performance, strong marketing, and various hardware products to successfully make a comeback.

Specifically, high performance refers to the Firedancer upgrade, strong marketing is represented by Meme Season, and hardware includes various Web3 phones. However, these are not enough. The PayFi concept proposed by Solana Foundation Chair Lily Liu has also become a hot topic. Although discussing July's hot topics in October may seem outdated, in the long run, the entire Web3 industry is shifting towards off-chain and real consumption scenarios.

"In a time long ago, you had me, and I had you."

This article is not a song for Solana but a melody for exploring the path of Web3.

The Unresolved Dilemma of Crypto Wallets: The Prelude to PayFi

Before presenting Lily Liu's definition of PayFi, let's first discuss Web3 wallets. From 2022 to 2023, with the rise of smart contract wallets, account abstraction (AA), and the traffic anxiety of exchanges, various Web3 wallets have entered a second peak period following the "dog coin" era of 2017-2021.

From the perspective of exchanges, wallets are the main entry point for users to interact with the blockchain, and subsequent traffic will flow in and out from there, even having the potential to replace CEXs. Furthermore, in the increasingly heated competition among Ethereum L2s, multi-chain wallets will undoubtedly be the main battlefield for aggregating liquidity.

However, the wallet ecosystem in 2024 is not particularly impressive. OKX's built-in Web3 wallet is already a standout, but in many cases, it has not become an independent product. One important reason is that Web3 wallets have traffic but lack a closed-loop transaction mechanism; they cannot solve the profitability issue. If users want to pay fees, they will simply open desktop products, as it is more beneficial to avoid an extra fee.

From a more "path-dependent" perspective, the problem with crypto wallets lies in their excessive pursuit of transaction characteristics. Note that this does not conflict with the aforementioned profitability issue. The core product feature of crypto wallets is to provide users with richer on-chain transaction characteristics, from accessing more chains to having a more competitive dApp recommendation mechanism.

Moreover, users' funds are not like those in Alipay; they are not stored within crypto wallets. The non-custodial mechanism provides peace of mind but does not earn users' loyalty. In short, crypto wallets have no relevance to Web2 wallets; they neither manage money nor provide financial services.

All these factors make it impossible for crypto wallets to establish a closed-loop payment system like PayPal or WeChat/Alipay. From a broader commercial perspective, Web3 wallets only have users and lack support from the merchant side. If dApps are considered merchants, then there are only a small number of on-chain merchants.

However, wallets do have a large amount of traffic, and the gains or losses from DeFi on-chain can indeed be converted into off-chain consumption possibilities. However, losses are also possible, depending on whether it is ETH-based, stablecoin-based, or fiat-based.

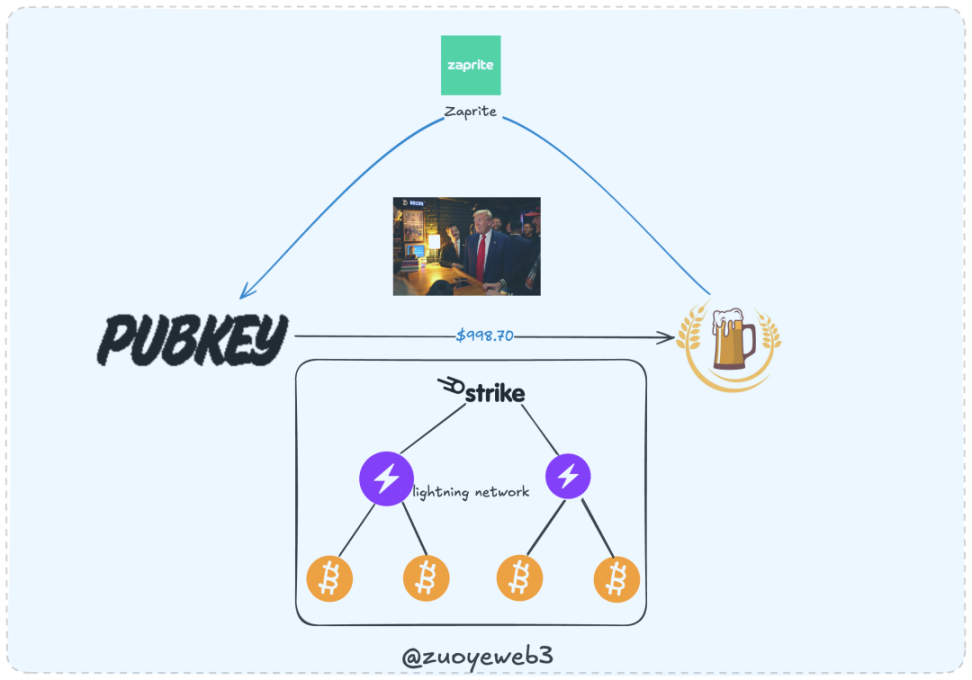

A normal payment system requires support from both the merchant and user sides, but this is precisely the current industry's shortcoming. To illustrate this issue, we can refer to the prominent entrepreneur Chuan Bao. On September 19, 2024, Chuan Bao visited the PubKey bar in New York and bought a $998 beer for his supporters, using Strike to initiate the payment, while the merchant used Zaprite to receive the payment.

In this case, the merchant and Chuan Bao are not using the same payment system, which would be hard to imagine in the Web2 era. It is akin to Chuan Bao paying with Alipay while the merchant receives payment via WeChat. However, in Web3, this makes sense because both parties are using the Bitcoin network as the settlement layer. Here’s a breakdown of the workflow:

- Chuan Bao initiates a payment request using Strike, which calls the Lightning Network to start the payment process. After confirmation through the Bitcoin network, the transaction is initiated.

- The merchant PubKey uses Zaprite to receive payment, and Zaprite uses the Lightning Network to confirm the payment status. After confirmation through the Bitcoin network, the transaction is completed.

In this process, Zaprite only has a subscription fee of $25; aside from that, the merchant only needs to deduct miner processing fees, and the rest is their income. For comparison, Visa/MasterCard/AE typically charge around 1.95%-2% in fees, while the average miner processing fee for Bitcoin is around $1.46, and accepting Bitcoin incurs no fees at all.

Continuing this line of thought, Web2 Payments generally follow a logic similar to Chuan Bao buying beer, but there are many intermediary steps, which is a drawback of Web2. The opportunity for Web3 Payments and PayFi lies within this.

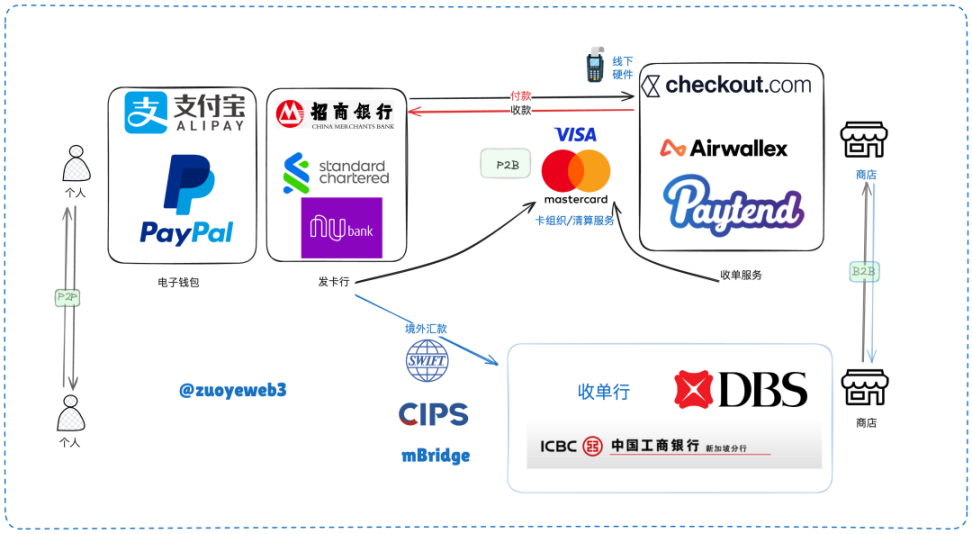

To replace concepts and products, the electronic wallets we commonly use, such as Alipay, WeChat Pay, and PayPal, are aimed at the consumer side (C-end), while the corresponding systems are the merchant acquiring systems on the business side (B-end). As long as a funding clearing network similar to the Lightning Network is established, the simplest P2B (person-to-business) interaction system can be built. Generally, the intermediary clearing network requires card organizations and payment protocols to work together.

In the above diagram, the Web2 payment system can be divided into P2P transactions between individuals, P2B and B2B transactions between individuals and businesses, as well as payment behaviors between merchants. Interbank transactions can also occur through systems like SWIFT or CIPS, or through cross-border CBDC transaction systems like mBridge.

However, it is important to note that the act of payment strictly occurs between individuals and businesses, as well as between businesses. We include P2P and interbank transactions here for the sake of comparison with Web3 payment behaviors, because in Web3, the primary payment scenarios are actually between individuals. For example, Bitcoin is a peer-to-peer electronic cash payment system.

If we refer to Web2's payment system, then Web3's payment system is actually very simple. Of course, this theoretical simplicity does not mask the fragmentation of the ecosystem. A notable characteristic is that traditional payment systems have many banks but few card organizations, thus possessing strong network effects. In contrast, Web3 has many public chains/L2s, but the main assets are only stablecoins, with only a few products like USDT/USDC.

Even with the most optimistic estimates, there are only about 30,000 merchants worldwide that support Bitcoin. Although some major brands, including Starbucks, are included, their acceptance still cannot be compared to traditional card organizations or electronic wallets.

Merchants accepting Binance Pay/Solana Pay are more concentrated among online merchants, such as Travala and other travel OTA platforms. There is still a significant distance to go before expanding to the scale of card organizations with hundreds of millions of merchants.

We will elaborate on the content of payment systems in the following sections, and now it is time to introduce the concept of PayFi.

The PayFi Stack: The Intersection of DeFi, RWA, and Payments

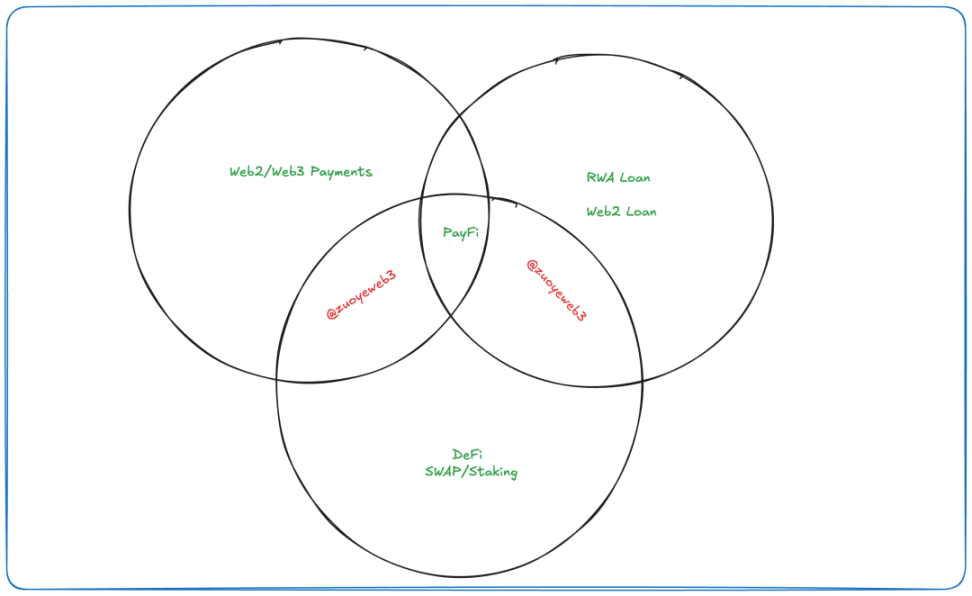

The reason for discussing Payments before introducing PayFi is that the differences between the two are significant. Overall, PayFi resembles DeFi + stablecoins + payment systems and is not closely related to Web2 Payments, as mentioned earlier.

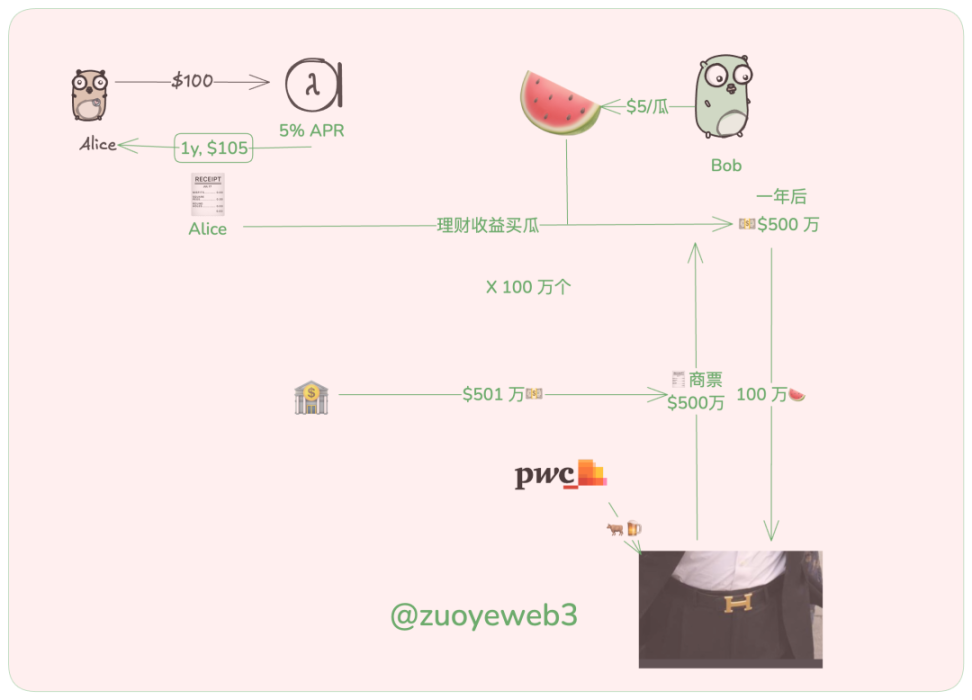

Let’s start with Lily Liu's explanation: PayFi utilizes the time value of money (TVM). For example, earning profits from funds in DeFi is an application of TVM. However, this may require time, such as staking tokens to earn rewards, which usually involves a lock-up period. But as long as there are tokens, there is potential for appreciation. In past operations, after obtaining profits, they could be reinvested in DeFi, creating a cycle of continuously seeking profit opportunities.

Now, this portion of profits can be directed elsewhere, such as using expected earnings for current consumption. For example:

- Alice invests 100 USDC in a financial product with an annual percentage rate (APR) of 5%, and after one year, she will receive $105 in principal and interest.

- Bob, who runs a watermelon stand, allows Alice to use her financial proof to buy a $5 watermelon to sell more.

This example is very simple, so simple that it cannot withstand scrutiny. For instance, how do Alice and Bob ensure the smooth execution of the contract? What if Alice's financial income decreases? However, without considering these issues, Alice can eat watermelon without incurring costs, and Bob receives a $5 receivable.

A year later, a bull market arrives, and Bob receives many $5 payments, preparing to supply large enterprises. After some selection, he sees that Evergrande is looking for watermelon sellers, and he places an order for $5 million. Bob is very happy, but Evergrande gives him a commercial bill. Having had experience with Alice, Bob happily accepts the commercial bill, and both parties agree to exchange it for cash in a year; if not, Bob can take the house as collateral.

However, after six months, Bob is ready to enter the stock market, and at this point, he needs to cash in the commercial bill. After a rating from PwC, the Evergrande commercial bill is rated as AAA quality asset, making it highly sought after by banks, non-financial institutions, and even individuals. Everyone is scrambling for it because Evergrande's real estate has a quality guarantee and significant appreciation potential.

Bob successfully sells the commercial bill at an excess price of $5.01 million. The bank receives the commercial bill, Evergrande gets a free ride, and Bob enjoys the stock market dividends. Everyone has a bright future. (Generally, cashing in a commercial bill requires a discount and handling fees; this is just to illustrate the workflow. Before Evergrande's collapse, the commercial bill was already trading at about 87.5% of its face value.)

Another layer of meaning for TVM is the monetization of non-circulating assets, where even non-circulating assets themselves can be considered currency or its equivalents. This has some similarities with the logic of re-staking, which can be further explored in the article Triangular Debt or Mild Inflation: An Alternative Perspective on Restaking.

In the context of Web3, the monetization of non-circulating assets can only occur through DeFi. Therefore, PayFi is a natural extension of DeFi, merely extracting some liquidity from the on-chain Lego to improve off-chain living.

The relationship between PayFi and Payments lies in the fact that payments are the simplest and most convenient way to satisfy the need for funds to go off-chain. PayFi and RWA intersect, but traditional RWA emphasizes "on-chain" more, such as the so-called tokenization process, which requires securities, gold, or real estate to be tokenized to enable on-chain circulation. Many familiar consortium chains in China do this, such as blockchain electronic invoices or Gongxinbao.

It is difficult to say that PayFi is a subset of RWA; a significant portion of PayFi's activities occur "off-chain." Whether there are on-chain components is not the focus of the PayFi concept; rather, its activities require interaction with off-chain elements.

However, there is no need to get too caught up in this. Many concepts in Web3 lack large-scale products and user bases, often revolving around speculation and token sales. Roughly categorizing products related to PayFi/Payments and RWA can be done in the following chronological order:

- Old Era: Ripple, BTC (Lightning Network, BTCFi, WBTC), Stellar

- 2022 RWA Concept Triad: Ondo/Centrifuge/Goldfinch

- New Era - 2024 PayFi: Huma (already established, gaining traction in 2024), Arf

From the historical development of the aforementioned products, it is reasonable to say that PayFi is a continuation of RWA. The traditional narrative, especially the business model of lending on-chain funds to off-chain entities, is indeed the PayFi of 2024, while in 2022, they were all referred to as RWA.

One could even boldly argue that the lending within RWA, similar to Ripple's cross-border settlement, combined with off-chain consumption of stablecoins, constitutes several aspects of current PayFi. At its core, these are the only elements involved.

It can be said that the construction of Web3 hardware and software is based on the material and ideological foundations of Web2, and Web3 PayFi is no different. Its similarities with Payments actually outweigh the differences, and lending products are more about the flow of funds. If off-chain products can generate more returns, then these returns can also be used for payment activities.

Being misunderstood is the fate of the expressor. Whether Lily Liu agrees with this interpretation, I do not know, but I believe that only by laying it out this way can the logic flow smoothly. As long as on-chain earnings are used for off-chain consumption scenarios, it aligns with the PayFi concept. Therefore, the market's focus moving forward will be on Web3 Payments, RWA Loans, and stablecoins, which can often be integrated into a cyclical process.

For example, RWA corporate loans are priced in U, individuals enter the RWA on-chain lending pool through DeFi protocols, and after evaluation, the RWA lending protocol provides loans to real enterprises. After recovering accounts receivable, LPs receive a share of the profits from the protocol, and funds are withdrawn using a Mastercard U card, perfectly closing the loop as the merchant supports Binance Pay.

History belongs to the pioneers, not the summarizers. How PayFi is defined is not important; what matters urgently is to explore real returns beyond the internal competition of DeFi chains. The demand from billions of people off-chain will bring more abundant liquidity and higher leveraged valuation support to on-chain activities. Those who can successfully navigate this will define the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。