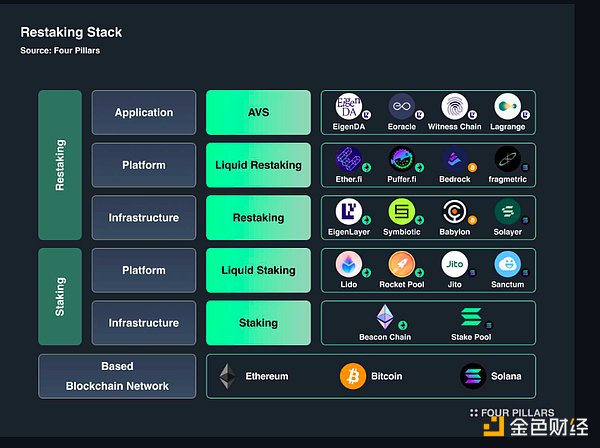

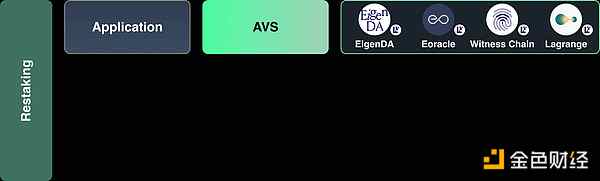

The main components of the re-staking stack and their representative projects.

Written by: Ingeun, Four Pillars

Translated by: Golden Finance, Shan Oppa

Key Points

- Re-staking is a mechanism that allows users to reuse staked assets to provide additional security for multiple blockchain networks or applications. This approach enables users to recover their existing staked assets, enhancing scalability and liquidity while also earning additional rewards.

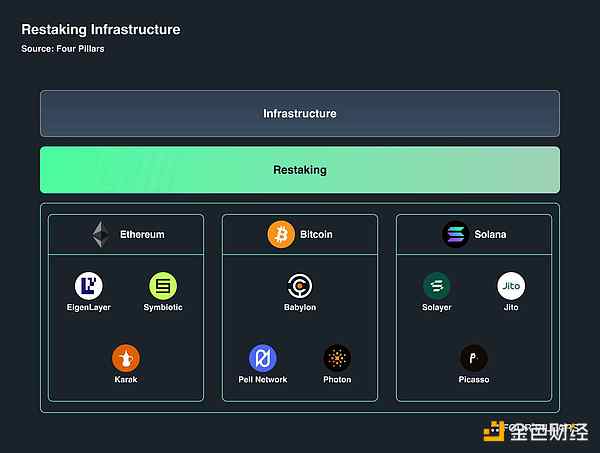

- The re-staking stack is a conceptual framework that systematically categorizes the main components of the re-staking ecosystem, including blockchain-based networks, staking infrastructure, staking platforms, re-staking infrastructure, re-staking platforms, and re-staking applications.

- Re-staking infrastructure provides the technical foundation for implementing re-staking, allowing the use of staked assets to secure other protocols or networks. Notable projects in this field include EigenLayer on Ethereum, Babylon on Bitcoin, and Solayer on Solana. These projects focus on ensuring liquidity, enhancing security, and providing network scalability.

- Re-staking redefines blockchain security and is rapidly evolving into an ecosystem. Its ability to enhance scalability and liquidity through economic security makes it highly attractive, although concerns about the risks and profitability of re-staking models remain.

- The next article in this series will explore re-staking platforms and applications, which are crucial for the potential large-scale adoption of the re-staking ecosystem.

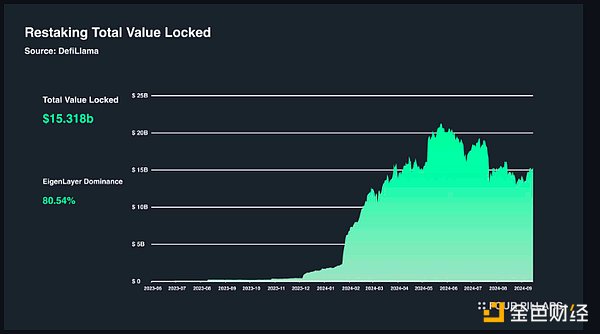

As of September 28, 2024, the total locked value (TVL) in the re-staking ecosystem led by EigenLayer is approximately $15.3 billion. This figure surpasses the $13 billion TVL held by the crypto lending platform Aave and accounts for more than half of the leading Ethereum liquid staking platform Lido's TVL ($26.48 billion). This highlights the remarkable growth of the re-staking ecosystem.

Given this, you may wonder what has attracted the interest of cryptocurrency holders and driven this growth. To answer this question, this series of articles is divided into two parts, aiming to explain what re-staking is, from which perspective to view the expanding re-staking ecosystem, and the interesting projects within it.

This series first outlines what re-staking is, then defines the re-staking stack centered around robust re-staking infrastructure, and explores the projects categorized under re-staking infrastructure and their unique characteristics.

1. Introduction to Re-staking

1.1 Before Re-staking

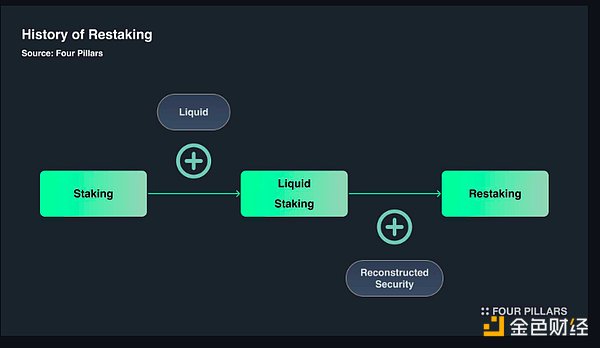

When Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) with the much-anticipated upgrade known as The Merge, many ETH holders staked their ETH to support the network's stability and earn staking rewards. This process led to the emergence of various staking services and platforms.

The first demand was for staking pools. The minimum requirement of 32 ETH for staking posed a significant challenge for smaller Ethereum holders. To address this issue, staking pools were developed, allowing those with less than 32 ETH to participate in Ethereum staking.

The next issue was related to liquidity. When ETH is staked, the assets are locked in smart contracts, leading to reduced liquidity. In the initial phase of the PoS transition, staked ETH could not even be withdrawn, effectively meaning that the liquidity of staked ETH was close to zero. To solve this problem, services like Lido and Rocket Pool issued liquid staking tokens (LSTs). LSTs are pegged to the value of staked ETH, allowing stakers to use them as proxies for their staked ETH in other DeFi services. Essentially, LSTs enable users to regain some liquidity for their staked assets.

After ensuring liquidity through LSTs, new opportunities for utilizing these tokens also emerged. However, LSTs were primarily confined to the Ethereum DeFi ecosystem and were not used to secure extended networks built on Ethereum (such as L2). This posed new challenges to Ethereum's security model, such as:

- Scalability issues: Ethereum's transaction processing capacity is limited, meaning that during periods of high demand, the network can become congested, leading to significant increases in transaction fees. This makes it difficult for dApps and DeFi platforms to accommodate large numbers of users. Layer 2 (L2) solutions emerged to address this issue, but they require their own security and validation mechanisms.

- Need for additional security: Ethereum's basic security mechanism operates at the protocol level and relies on participants staking ETH to maintain network security. However, Ethereum's built-in security is not always sufficient to meet the specific security needs of various L2s and applications, necessitating an additional layer of security for each application.

- Liquidity constraints: While Ethereum's adoption of PoS activated the staking mechanism, a key issue remains: staked assets are only used for network security. For example, staked ETH cannot be used for other useful functions or applications. This limits liquidity and restricts network participants' ability to explore additional revenue opportunities.

These challenges highlight the need for a new security mechanism suitable for the current state of Ethereum and PoS blockchains.

1.2 The Rise of Re-staking

The demand for new security methods ultimately led to the concept of re-staking.

"Re-staking is the latest answer to the core security issues of cryptocurrency: how to use economic games to protect decentralized computing systems."

— Sam Kessler, CoinDesk

As described in the quote, re-staking leverages principles of financial engineering to enhance blockchain security through economic security.

Before delving into re-staking, it is essential to understand how PoS blockchains maintain security. Many blockchains, including Ethereum, have adopted PoS, where a common attack method is for adversaries to accumulate enough staked assets to influence the network. The cost of invading a blockchain typically correlates with the total value staked in the network, which can serve as a deterrent.

Re-staking further advances this concept, aiming to apply economic security more broadly. Significant funds have already been invested in major protocols like Ethereum. Re-staking reuses these funds to provide enhanced security and functionality at the L2 or application level. With the added security benefits, re-stakers can earn greater returns than through traditional staking alone. Thus, re-staking can address the challenges mentioned above:

- Scalability: Re-staking allows L2 solutions and other applications to leverage the security of the primary blockchain's staked resources. This enables L2 solutions to maintain a higher level of security without building independent mechanisms, instead utilizing the staked capital from the mainnet.

- Enhanced security: Re-staking allows the staked resources of the primary blockchain to be used not only to secure the mainnet but also to validate and protect application-level functionalities. This creates a more robust and comprehensive security framework.

- Increased liquidity: Re-staking is designed to allow staked mainnet assets to be reused for other purposes. For example, staked assets can be used for validation tasks across different networks or applications, thereby increasing the overall liquidity and utility of the security ecosystem while providing additional rewards for participants.

In summary, re-staking emerged to address the limitations of PoS mainnets like Ethereum, aiming to enable these networks to support more participants while providing enhanced security and liquidity.

One notable early implementation of the re-staking concept is Inter-Chain Security (ICS). Cosmos operates an ecosystem where multiple independent blockchains interact through the concept of cross-chain. However, each chain must maintain its own security, which brings a burden. ICS addresses this issue by allowing blockchains within the Cosmos ecosystem to share security resources.

Validators of the Cosmos Hub are responsible for securing the network, and new or smaller chains can leverage this security without establishing their own validator networks. This approach reduces security costs and facilitates the easier launch of new blockchain projects within the Cosmos ecosystem. However, challenges such as increased infrastructure costs, limited utility of native tokens, and high profitability demands from consumer chains have restricted the overall success of ICS.

Nevertheless, these efforts paved the way for EigenLayer in the Ethereum ecosystem, which has now become a leader in the re-staking industry. Therefore, to thoroughly understand re-staking, studying EigenLayer, which is deeply rooted in the Ethereum ecosystem, is an excellent starting point. Let’s take a deeper look at EigenLayer and the re-staking ecosystem.

1.3 An Example Through EigenLayer

1.3.1 From Fragmented Security to Reconstructed Security

How does re-staking fundamentally provide stronger security and liquidity?

"If I have seen further, it is by standing on the shoulders of giants."

— Isaac Newton

Isaac Newton's quote acknowledges the contributions of past scientists to his achievements. More broadly, this statement suggests that "leveraging existing resources is often a wise choice."

Currently, many blockchain services rely on large L1 networks, utilizing their ecosystems, trust, and security resources. However, choosing a less mature network or attempting to independently become a major player can be risky, as these projects may fail before fully realizing their potential.

To illustrate this with EigenLayer, let’s consider the scenario depicted in the following diagram.

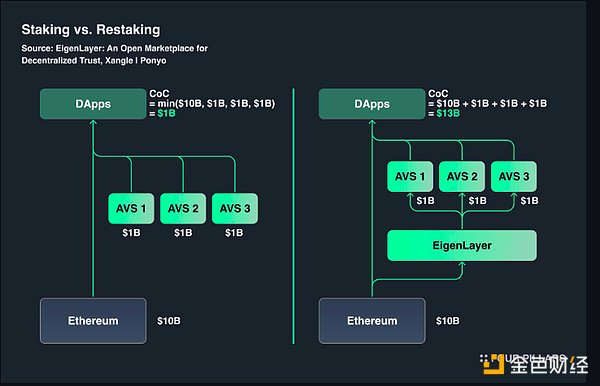

The two ecosystems in the diagram each have $13 billion in staked capital. On the left, Ethereum and Actively Validated Services (AVS, a middleware network service) are not interconnected, while on the right, Ethereum and AVS are interconnected through EigenLayer.

Left Ecosystem: Here, Ethereum and AVS are not directly connected, so while value can be transferred between networks via bridges, this is unrelated to shared security. Therefore, Ethereum and AVS cannot share economic security, leading to security fragmentation. Attackers may target the network with the lowest staked capital. This results in security fragmentation, where the cost of corruption (CoC) aligns with the minimum required amount. This situation creates a competitive environment between services rather than synergy, potentially undermining Ethereum's economic security.

The Correct Ecosystem: What If Ethereum and AVS Were Interconnected? EigenLayer answers this question by integrating Ethereum and AVS through the concept of re-staking, merging fragmented security into a reconstructed form. This integration has two benefits: AVS services can share the capital of the Ethereum network rather than compete for it, and all AVS services can fully leverage the shared economic security. This effectively creates an environment where these "giants" come together, allowing them to see further together.

1.3.2 Pillars of Re-staking (Feat. EigenLayer)

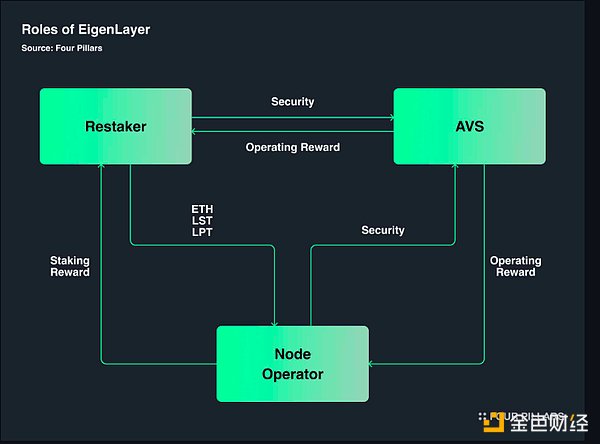

Through this explanation, we can understand that AVS services can inherit the economic security of Ethereum, thereby achieving significant security at a lower cost. However, this complex financial ecosystem relies on various roles to operate smoothly. Let’s delve into these roles:

- Actively Validated Services (AVS): AVS are services that require a decentralized validation system, such as DA layers, sidechains, or oracle networks. AVS relies on node operators to maintain network security by reliably running nodes. AVS employs two mechanisms: slashing (confiscating part or all of the staked amount due to underperformance) and rewards (incentives for successful operations). AVS can utilize re-staked ETH to leverage Ethereum's security without building a separate trust network.

- Re-stakers: Re-stakers are entities that re-stake native ETH or LST staked on the Ethereum beacon chain. If re-stakers are uncertain about choosing a specific AVS or seeking additional rewards, they can delegate their re-staked capital to node operators. In this case, re-stakers delegate their capital to nodes operated by node operators and receive re-staking rewards from them.

- Node Operators: Node operators receive delegated re-staking funds from re-stakers and operate nodes to perform the validation tasks required by AVS. Node operators use the re-staked funds to establish and run nodes with enhanced security. They play a crucial role in maintaining the reliability and security of AVS and receive re-staking and node operation rewards in return.

1.3.3 Merging into One

EigenLayer integrates these roles into an open market structure, allowing each role to operate freely based on economic principles.

In this setup, re-holders delegate their assets (such as ETH, LST, or LPT) to node operators, who then use their nodes to protect AVS services and earn rewards. At the same time, AVS pays operational rewards to node operators in recognition of their security contributions, ensuring network security and trust.

1.3.4 Strengthening the Re-staking Ecosystem

EigenLayer is a typical example of re-staking, providing a comprehensive understanding of the concept. Most emerging re-staking services strictly adhere to the core principles of re-staking, making EigenLayer an effective reference for understanding re-staking models.

With EigenLayer as a pioneer, the re-staking ecosystem is continuously expanding. This growth is not just in scale; the ecosystem is becoming increasingly nuanced, with more specific roles and classifications emerging. This gives us a deeper understanding of the expanding ecosystem. In the next chapter, we will closely examine the re-staking stack and explore the projects within each category.

2. The Re-staking Stack

As the re-staking ecosystem is still actively developing, clearly delineating each category may be challenging. However, as the ecosystem matures and stabilizes, it will facilitate the development of more advanced projects. Utilizing existing data and my perspective, I will introduce a framework for categorizing the re-staking ecosystem—the re-staking stack.

2.1 Blockchain-Based Networks

The blockchain-based network layer is the foundation for staking or re-staking, characterized by blockchains that have their own native tokens and security mechanisms. PoS-based blockchains like Ethereum and Solana provide a stable and efficient environment for staking and re-staking due to their large TVL. Although Bitcoin is not PoS-based, its dominance in blockchain capital drives ongoing efforts to incorporate its economic security into re-staking.

- Ethereum: Ethereum is the primary re-staking blockchain network, playing a key role in the ecosystem. With its PoS system and smart contract capabilities, Ethereum offers users the opportunity to participate in various re-staking activities using their native ETH through platforms like EigenLayer.

- Bitcoin: Bitcoin employs a PoW mechanism and lacks the native staking capabilities unique to PoS blockchains. Nevertheless, due to its global adoption and strong security, initiatives like Babylon aim to integrate significant capital from Bitcoin into the re-staking ecosystem, leveraging its economic security to support other blockchains. Projects like Babylon allow the use of Bitcoin's capital without wrapping or bridging, enabling Bitcoin staking directly from its blockchain.

- Solana: Solana is known for its high performance and low transaction costs, providing a favorable environment for staking, DeFi, NFTs, and re-staking. As Solana's staking infrastructure continues to evolve, platforms like Solayer are emerging, aiming to establish a prominent position for Solana in the re-staking ecosystem by offering unique re-staking models tailored to Solana's advantages.

2.2 Staking Infrastructure

The staking infrastructure layer includes systems that allow participants to stake their native tokens, thereby contributing to the security and efficiency of blockchain networks. This infrastructure is central to PoS consensus mechanisms, enabling decentralized processes for block validation and generation. Participants stake their assets to become validators, helping to maintain network stability and earn rewards. Additionally, staking infrastructure monitors validator behavior, enhancing security by slashing penalties for misconduct.

- Beacon Chain: The beacon chain plays a crucial role in the Ethereum network that has transitioned to PoS, enhancing scalability, security, and energy efficiency. Unlike the previous PoW-based Ethereum, the beacon chain operates around validators staking native ETH. It selects validators and manages the process of proposing and validating blocks. This shift reduces the high energy consumption associated with PoW mining while maintaining the network's decentralization and improving efficiency. Furthermore, the beacon chain supervises users participating as validators by locking up staked native ETH and monitors whether validators correctly validate blocks. If validators misbehave, they face penalties through a process called slashing, which involves confiscating their staked ETH.

- Staking Pools: Solana's staking pools enhance network security and simplify the process for users to participate in staking. They aggregate smaller SOL stakes, allowing users to collectively support a single validator. Through this process, users delegating their stakes to validators earn rewards as these validators create blocks or validate transactions. Staking pools also improve network stability by allocating staked SOL to reliable validators.

2.3 Staking Platforms

The staking platform layer includes various services that enable users to contribute to the security and operation of blockchain networks while maintaining the liquidity of their assets. These platforms play a critical role in PoS blockchains by providing simple services that allow users to stake native tokens and earn rewards. In addition to locking up assets, staking platforms also offer liquid staking, which tokenizes staked assets, allowing users to utilize these assets in DeFi services. This structure enables users to maintain liquidity while participating in network operations and maximizing rewards. Through these features, staking platforms simplify the user experience, making it easier for more users to participate in staking.

- Lido: Lido is one of the most popular liquid staking platforms in the Ethereum ecosystem, allowing users to stake their native ETH and receive stETH as a reward. This liquid token maintains the value of staked ETH, enabling users to earn additional rewards through other DeFi services. Subsequently, Lido's focus on Ethereum has expanded to support networks like Polygon's PoS network.

- Rocket Pool: Rocket Pool is a community-owned decentralized staking platform for Ethereum, compatible with native ETH staking. The platform was initially conceived in 2016 and launched in 2021, aiming to provide solutions for users who lack the technical ability to run nodes or the financial means to meet the 32 ETH requirement. Rocket Pool is committed to building a liquid and reliable platform that allows users to leverage their staked assets across various services.

- Jito: Jito is a liquid staking platform for Solana that offers users MEV (Maximum Extractable Value) rewards. Users can stake their native SOL through Jito's staking pool and receive JitoSOL tokens, which maintain liquidity while accumulating staking and MEV rewards. Jito aims to optimize returns for users holding JitoSOL, contributing to the richness of the Solana DeFi ecosystem.

- Sanctum: Sanctum leverages Solana's speed and low fees to provide enhanced security as a staking platform through an open-source and multi-signature framework. It allows users to utilize staked SOL in DeFi services. By integrating the liquidity of various LST pools, it addresses the issue of liquidity fragmentation, enabling users to access richer liquidity pools. Notably, through the Infinity Pool, users can deposit LST or SOL, receive INF tokens, and simplify staking and liquidity provision. Additionally, Sanctum runs a rewards program called Wonderland, which encourages user engagement by providing points and rewards for completing specific tasks or using the platform.

2.4 Re-staking Infrastructure

The re-staking infrastructure layer is crucial for enhancing the economic security of blockchain networks, providing scalability and flexibility. It enables users to reuse staked assets to secure multiple networks or applications, offering re-stakers opportunities to participate in various services while maximizing returns. Applications built on this infrastructure can leverage re-staked assets to protect a more robust security framework and expand their functionalities.

The re-staking infrastructure also supports re-staking platforms and applications, allowing them to create customized staking and security models. This enhances the scalability and interoperability of the entire blockchain ecosystem, positioning re-staking as a key technology for maintaining decentralized networks.

Here are some examples, with more details about re-staking infrastructure provided in Chapter 3.

- EigenLayer: EigenLayer is a re-staking infrastructure built on Ethereum that allows users to re-stake their native ETH or LST to secure other applications and earn additional rewards. By reusing staked ETH across various services, EigenLayer reduces the capital requirements for participation while significantly enhancing the credibility of individual services.

- Symbiotic: Symbiotic is a re-staking infrastructure that provides an open and accessible shared security model for decentralized networks. It enables builders to create custom staking and re-staking systems with modular scalability and decentralized operator rewards and slashing mechanisms, thereby providing enhanced economic stability for the network.

- Babylon: Babylon connects Bitcoin's robust economic security with other blockchains, such as Cosmos, aiming to strengthen security and facilitate cross-chain interoperability. Babylon's integration allows networks connected through it to leverage Bitcoin's verified security for safer transactions. It utilizes Bitcoin's hash power to enhance certainty and provides a set of protocols for securely sharing Bitcoin's security with other networks.

- Solayer: Solayer is built on the Solana network, leveraging economic security to scale application chains, providing application developers with custom block space and efficient transaction alignment. It utilizes re-staked SOL and LST to maintain network security while enhancing specific network functionalities, aiming to support scalable application development.

2.5 Re-staking Platforms

The re-staking platform layer includes platforms that provide additional liquidity or combine re-staked assets with other DeFi services, enabling users to maximize their returns. These platforms often issue Liquid Re-staking Tokens (LRT) to further enhance the liquidity of re-staked assets. They also promote user participation in re-staking through flexible management models and reward systems, contributing to the stability and decentralization of the re-staking ecosystem.

- Ether.fi: Ether.fi is a decentralized re-staking platform that allows users to directly control their re-staking keys. It provides a service marketplace for node operators and re-stakers to interact. The platform issues eETH as a liquid staking token and seeks to decentralize the Ethereum network through a multi-step re-staking process and node service configuration.

- Puffer.fi: Puffer.fi is a decentralized native liquid re-staking platform based on EigenLayer. It allows anyone holding less than 32 ETH to stake their native Ethereum tokens, maximizing returns through integration with EigenLayer. Puffer.fi offers high capital efficiency, providing liquidity and PoS rewards through its pufETH token. Re-stakers can achieve stable returns without complex DeFi strategies, while Puffer.fi's security mechanisms ensure asset safety.

- Bedrock: Bedrock has developed a liquidity re-staking platform in collaboration with RockX, supporting multiple asset types. It provides additional rewards by re-staking assets such as wBTC, ETH, and IOTX. For example, uniBTC re-stakes BTC for the security of the Ethereum network, while uniETH similarly re-stakes ETH, maximizing rewards through EigenLayer. Bedrock adopts a capped token structure to prevent total issuance growth, aiming to increase token value over time.

- Fragmetric: Fragmetric is a liquidity re-staking platform within the Solana ecosystem that leverages Solana's token expansion capabilities to address reward distribution and slashing rate issues. Its fragSOL token sets a new standard for re-staking on Solana, providing a platform structure that simultaneously enhances security and profitability.

2.6 Re-staking Applications

The re-staking application layer includes decentralized services and applications that use re-staked assets to enhance the security and functionality of existing blockchain infrastructure. These applications leverage re-staking to ensure economic security while focusing on providing specific functionalities, such as data availability storage, oracles, physical infrastructure verification, and cross-chain interoperability.

By allowing validators on Ethereum and other blockchain networks to re-stake assets across multiple services, re-staking applications can lower capital costs while improving security and scalability. They also ensure data integrity and security through decentralized processes, applying economic incentives and penalties to ensure reliability. These applications enhance the scalability and efficiency of blockchain systems and facilitate interoperability between different services.

- EigenDA: EigenDA is a highly scalable data availability (DA) storage solution for Ethereum rollups, integrated with EigenLayer. EigenLayer requires operators to stake collateral to participate, penalizing those who fail to store and verify data correctly. This incentivizes decentralized and secure data storage, with EigenDA's scalability and security enhanced through EigenLayer's re-staking mechanism.

- Eoracle: Eoracle is an oracle service within the EigenLayer ecosystem that utilizes re-staked ETH and Ethereum validators to provide data verification. Eoracle aims to create a decentralized competitive market for data providers and users, automating data verification and enabling smart contracts to integrate external data sources.

- Witness Chain: Witness Chain supports the development of new products and services for various applications and decentralized physical infrastructure networks (DePIN). It uses the DePIN Coordination Layer (DCL) module to convert physical attributes into verifiable digital proofs. Within the EigenLayer ecosystem, EigenLayer operators run DePIN Challenger Clients to ensure their verification processes have a reliable environment.

- Lagrange: Lagrange is the first zero-knowledge AVS on EigenLayer. Its national committee is a decentralized network of nodes that uses zero-knowledge technology to provide security for cross-chain interoperability. Lagrange's ZK MapReduce solution supports efficient cross-chain operations while maintaining security and scalability. It strengthens cross-chain messaging and rollup integration, leveraging EigenLayer's economic security to enhance performance.

Through an overview of the re-staking stack and project examples, we see that as the re-staking ecosystem matures, it becomes more structured, providing a deeper understanding. How can we take a closer look at these emerging categories? In this series, we will first focus on re-staking infrastructure, with other components introduced in the next section.

3. The Ecosystem of Re-staking Infrastructure

The re-staking infrastructure is a foundational framework that supports the reuse of staked assets across different networks and protocols to enhance network security and maximize utility. As the concept of re-staking gains popularity, major blockchain networks like Ethereum, Bitcoin, and Solana have developed infrastructures suited to their unique characteristics. In this section, we will explore the reasons for the emergence and development of re-staking infrastructure in each network, the advantages and challenges they face, and the impact of various projects on re-staking infrastructure.

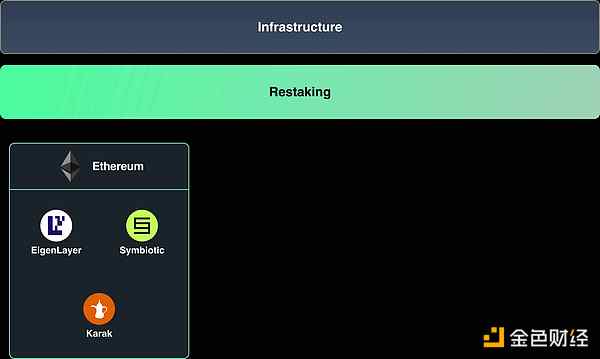

3.1 Ethereum

During "The Merge" upgrade, Ethereum transitioned from PoW to PoS, laying the groundwork for the development of re-staking infrastructure. Ethereum's PoS model relies on staked assets to ensure network security, but the ability to repurpose these assets for other protocols has significantly increased interest in re-staking.

Ethereum's primary focus is scalability, which it has been achieving through L2 solutions. However, as Ethereum founder Vitalik Buterin pointed out, this approach has led to security fragmentation, ultimately undermining Ethereum's security model. EigenLayer has become the first solution to address this issue through economic security, allowing staked Ethereum assets to be used for other protocols to enhance security and scalability.

EigenLayer provides re-staking services for Ethereum assets across different protocols while maintaining fundamental security and leveraging a large operator network to achieve stable economic security. It supports native ETH re-staking and plans to expand to LST and ERC-20 tokens, offering potential solutions to Ethereum's scalability challenges.

The concept of re-staking is spreading within the Ethereum ecosystem, with other projects also working to address Ethereum's limitations. For example, Symbiotic enhances Ethereum's security by integrating with other DeFi services. In collaboration with Ethena Labs, Symbiotic supports a wide range of asset re-staking, including LSTs like wstETH, as well as assets like sUSDe and ENA. This allows users to provide additional security resources through re-staking, improving Ethereum's PoS security. Additionally, Symbiotic issues ERC-20 tokens like LRT to provide a flexible reward structure, allowing for the effective use of re-staked assets across various protocols.

Another re-staking infrastructure, Karak, aims to address the structural inefficiencies of Ethereum that pose challenges to re-staking operations. Karak offers multi-chain support, allowing users to deposit assets across chains such as Arbitrum, Mantle, and Binance Smart Chain. It supports re-staking of ERC-20 tokens, stablecoins, and LST in a multi-chain environment. Karak uses its own L2 chain to store assets, maximizing scalability while maintaining security.

3.2 Bitcoin

As a PoW-based network, Bitcoin's characteristics differ from those of PoS-based networks, where staked assets are directly related to security. However, Bitcoin's dominance in market capitalization has led to the development of re-staking concepts that leverage Bitcoin's economic security to generate additional income in other blockchains. Projects like Babylon, Pell Network, and Photon integrate Bitcoin's security into their ecosystems in various ways, enhancing their scalability.

Bitcoin's PoW system is one of the most secure systems in the world, making it a valuable asset for re-staking infrastructure. Babylon utilizes Bitcoin's staking and re-staking capabilities to enhance the security of other PoS blockchains. It converts Bitcoin's economic value into economic security, providing protection for other blockchains. It operates its own PoS chain using the Cosmos SDK, supporting non-custodial staking and re-staking directly from the Bitcoin blockchain without third-party trust.

Bitcoin also faces challenges related to liquidity and additional income opportunities. The establishment of Pell Network aims to provide liquidity and income opportunities for Bitcoin holders, integrating Bitcoin into the DeFi ecosystem through cross-chain technology for additional yield.

The most significant limitation of Bitcoin is the lack of native smart contract support. While PoW provides strong security, its design makes internal programming through smart contracts difficult. Photon addresses this issue by extending Bitcoin's ability to execute smart contracts without altering its core structure, implementing staking and re-staking directly on the Bitcoin mainnet. This ensures that all staking and re-staking related processes are verified on the Bitcoin mainnet while providing flexible staking options and maintaining Bitcoin's high security.

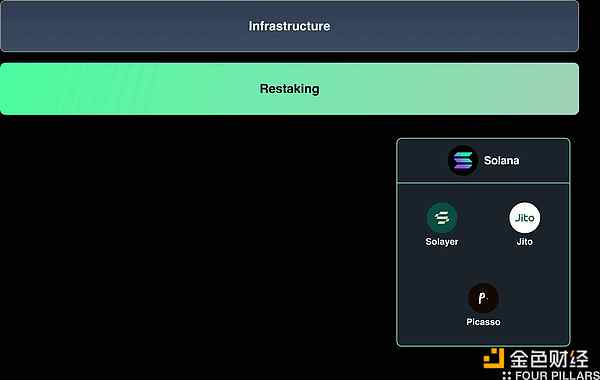

3.3 Solana

Solana is known for its high transaction throughput and low fees, making it an ideal environment for the development of re-staking infrastructure. Several projects within the Solana ecosystem have adopted re-staking models to maximize these advantages.

The rapid growth of Solana directly benefits validators, but fairly distributing economic gains across the broader Solana ecosystem has been a challenge. Solayer addresses this issue by providing re-staking infrastructure focused on economic security and execution, offering a framework for staking native SOL and LST to support application-specific networks. It also allows users to reuse their staked assets on other protocols to maximize returns.

Drawing inspiration from Ethereum's re-staking infrastructure (such as EigenLayer), Solayer adopts a similar approach to facilitate users while customizing its re-staking model based on Solana's unique attributes. This ultimately aims to drive the development of the Solana ecosystem.

Jito has gained recognition for its role in Solana's staking infrastructure and is currently working to extend its influence into the re-staking domain. Jito is building its re-staking services on top of its existing Solana infrastructure, generating significant interest from users due to its potential scalability and reliability. Jito's vision is to leverage SPL-based assets through re-staking solutions and optimize MEV during the block creation process. This enhances security while providing more earning opportunities for re-stakers.

Picasso complements Solana's scalability by building a cross-chain expansion framework and re-staking mechanism. Picasso not only develops a re-staking layer for Solana but also for the Cosmos ecosystem, introducing an expanded concept that allows users to re-stake assets across multiple PoS networks. It aims to bring the previously Ethereum-limited re-staking ecosystem into the Solana and Inter-Blockchain Communication (IBC) ecosystems, providing tailored re-staking services with a grand vision.

3.4 The Increasing Complexity of Re-staking Infrastructure

In this way, re-staking infrastructure projects on networks like Ethereum, Bitcoin, and Solana have developed by leveraging the strengths and weaknesses of their respective ecosystems. These projects demonstrate the potential for re-staking infrastructure to play a significant role in the future blockchain ecosystem as their networks evolve.

Projects like Eigenlayer, Symbiotic, and Karak have made significant contributions to addressing Ethereum's scalability issues and enhancing its security. Meanwhile, projects like Babylon, Pell Network, and Photon utilize Bitcoin's security in various ways to further develop the concept of re-staking. Additionally, projects like Solayer, Jito, and Picasso leverage Solana's unique characteristics to facilitate re-staking more effectively, positively impacting network scalability.

4. Looking Ahead — A New Form of Network Security Based on Financial Engineering

In this series, we explored the fundamentals of re-staking, defined the re-staking stack, and examined the ecosystem of re-staking infrastructure. Just like the growth of L2 solutions, re-staking infrastructure is developing around core blockchain networks and continuously striving to enhance its functionalities. As the scale of the re-staking ecosystem continues to expand (as represented by its growing TVL), an independent ecosystem is forming.

A significant factor in the growth of re-staking is its reliance on financial engineering rather than purely technical characteristics. Unlike traditional staking infrastructure, re-staking infrastructure is more flexible and can accommodate a broader range of asset types. However, this flexibility brings new economic structures and risks that differ from traditional blockchain operations.

One major risk is that re-staking is essentially a derivative financial asset rather than a core financial asset. Some view re-staking as a promising investment opportunity and a new advancement in crypto security, while others see it as a re-staking model with overly generous returns and higher risks. Furthermore, the re-staking infrastructure has yet to undergo extreme market tests, such as the pressures of a "crypto winter," raising concerns about its potential stability.

If this stability cannot be validated, re-staking may face criticism due to the inherent risks of its re-staking model. Additionally, the ecosystem has not yet expanded to the scale necessary to establish the economies of scale required for sustainable business models, which remains a challenge.

Nevertheless, it is undeniable that the rapid growth of the re-staking ecosystem, particularly the re-staking infrastructure, is occurring. The ecosystem's structure is becoming increasingly refined, supporting this momentum. As the ecosystem develops, concerns about profitability may be addressed, ultimately positioning re-staking infrastructure as a key player in cryptocurrency and blockchain security.

The classification and definition of the ecosystem indicate that it is ready to enter the next stage of development. The emergence of the Restaking Stack reflects significant progress made by various projects in developing narratives and products.

Now that the re-staking infrastructure is well-established, the focus will shift to re-staking platforms and applications, which will determine the success or failure of the large-scale adoption of the re-staking ecosystem. Therefore, the next installment of this series will delve into re-staking platforms and applications, exploring their potential to drive widespread adoption of the ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。