Explore the significant leap of Uniswap and its impact on the future of DeFi.

Written by: Jack Inabinet, Senior Analyst at Bankless

Translated by: xiaozou, Jinse Finance

Unichain has been launched and is poised to become a liquidity hub for cryptocurrencies soon. Built on the OP Stack, Unichain will support the highly anticipated UNI fee switch through staking features, while also reducing transaction wait times and addressing the fragmentation challenges posed by Ethereum's rollup-centric roadmap.

This was shared by Uniswap founder Hayden Adams and Optimism contributor Karl Floersch when discussing Uniswap's next steps and their vision for achieving interoperable Ethereum with Bankless.

Crypto supporters have long speculated about the role specific application L2s can play in the Ethereum scaling battle without compromising decentralization. With the launch of Unichain, the time has finally come to test the performance of general-purpose applications in isolated execution environments.

In this article, we will explore the significant leap of Uniswap and its impact on the future of DeFi.

1. Introduction to Unichain

Uniswap is the backbone of Ethereum's DeFi applications, and Unichain is the latest version of this important token exchange protocol. The goal of Uniswap developers is to replicate the seamless user experience of a monolithic blockchain, creating a true liquidity hub in the crypto space.

Like Optimism and Base, Unichain will be a permissionless EVM-compatible general rollup, built on the OP Stack for Uniswap deployment.

While the freshly launched Unichain testnet is a low-spec proof of concept, the mainnet is planned to go live later this year. This network intends to leverage a trusted execution environment (TEE) secured by UNI validators, who provide fast pre-confirmations and earn network fees for their services, while reducing user transaction wait times by four times, from 1 second to 200-250 milliseconds, and supporting the long-awaited UNI fee switch feature!

While Ethereum's decentralized-first design philosophy is commendable, it is undeniable that offloading execution tasks to L2s by distributing assets and protocols across isolated blockchains complicates the user experience. For Ethereum to achieve mass adoption, it must address the fragmentation issues brought about by its rollup-centric roadmap that supports L2 interoperability.

Efforts to transform L2 interoperability go far beyond the scope of Unichain's construction, requiring the adoption of new interoperability standards across Ethereum, such as unified cross-chain transaction execution EIPs and interface improvements for wallet chain switching and asset balance displays.

Swaps from alternative networks supported by Unichain still require time-consuming bridging transactions, but the proposed OP Stack native interoperability promises to reduce bridging wait times and transaction costs within the OP Stack.

2. Advantages of Superchain

Since Unichain adopts the OP Stack standard, any "Superchain" rollup built on this framework can easily implement the aforementioned technical improvements, positively impacting the broader OP ecosystem by reducing transition wait times and enabling functional native token staking.

Interoperability between rollups under shared standards is the easiest to achieve. Although a series of competing rollup frameworks on Ethereum has led to today's technical heterogeneity of rollups, the potential synergies generated by developing on the most popular stack naturally promote a winner-takes-all scenario.

Once advanced rollup features like shared ordering and native interoperability become available, the advantages of building within a unified stack will become very apparent. This means that any L2 deployers wishing to leverage their own L2 liquidity hub must consider Uniswap's decision to build on the OP Stack during the rollup stack selection process.

As many OP Stack chains allocate a portion of sequencer revenue to the retroactive public goods fund (RPGF) projects, increased ecosystem activity will translate into more funds available for creating and promoting standards consistent with Optimism.

If Unichain's ambition to become the liquidity hub for cryptocurrencies can truly be realized, this experiment will position the Optimism OP Stack as the ace rollup framework, while clearly demonstrating the rationale behind Ethereum's rollup-centric roadmap.

3. Impact on the Future of DeFi

Imagine Unichain becoming the liquidity center of Ethereum, where free market dynamics dictate that most on-chain swaps are automatically routed through this network, as its deep liquidity will reduce slippage and provide optimal trade execution.

If Unichain can replicate the success of the Uniswap exchange at the network level, then this chain will also become a hub for high-performance DeFi applications, where high-level players like institutional market makers can reap significant benefits from the shortest transaction wait times and best execution prices.

Nevertheless, even with OP Stack native interoperability, trading on a unified crypto network has always been faster and cheaper, meaning Unichain must have the deepest liquidity and best execution prices for a given trading pair to be considered a viable exchange solution.

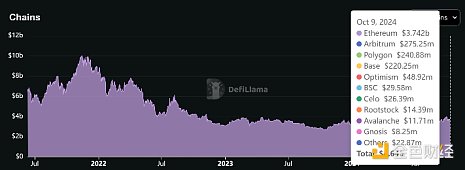

Despite L2s processing 22 times more transactions than Ethereum, our analysis shows that up to 80% of Uniswap's TVL is still stored in its Ethereum smart contracts. While Uniswap can freely deploy Unichain, this does not mean liquidity providers will migrate as well.

The discussion about a Uniswap application chain has been ongoing for a long time, and many in the Ethereum community express deep skepticism about the feasibility of this model. Now that Uniswap's grand vision for Unichain has been made public, we will soon see who is right.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。