Life is like the weather; it can be predicted, but market trends often come as a surprise. I hope that investment friends can invest happily. Regardless of past profits or losses, we will face an unpredictable future, and the results of each new investment will not be influenced by previous performance. This is especially important for investors who have incurred losses. Some friends remain immersed in the joy of past profits or the pain of past losses during trading. While summarizing past experiences can help us improve our trading skills, staying stuck in past emotions can be extremely dangerous. We must remember that investing is not about seeking momentary pleasure, but about navigating through challenges for the long term.

The U.S. Bureau of Labor Statistics reported on October 10 that the Consumer Price Index (CPI) rose by 2.4% month-on-month in September, the lowest level since February 2021. Bitcoin and broader crypto assets are particularly sensitive to inflation indicators, as these indicators significantly impact the Federal Reserve's monetary policy decisions. The CPI data is expected to have a favorable impact on Bitcoin prices, as borrowing costs will decrease. Therefore, we anticipate a recovery in market flow after recent geopolitical tensions disrupted the financial landscape.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 10.11

Yesterday, Bitcoin and ETH both fell, with Bitcoin hitting a low around 59000. However, as of now, Bitcoin has rebounded, with the current price around 61200.

From a technical perspective, the bears experienced a strong rebound after touching below 60000. From last night's low of 59000, it has rebounded by 2000 points, which is quite good. However, from the daily and 4-hour charts, the current trend is still bearish. To restart a bullish trend, the price must reach at least above 63000. Therefore, in the short term, we can consider placing a short position around yesterday's high of 61200—61300, targeting 60000, with a stop loss at 61800.

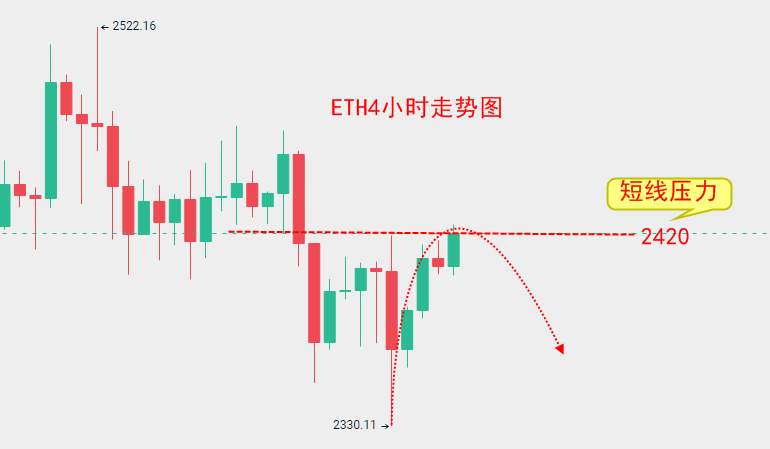

The same reasoning applies to ETH. To return to a bullish trend, it needs to stabilize above 2500. The current price is around 2420, which is also yesterday's high. In terms of operations, we can also place a short position, with a stop loss at 2470 and a target of 2350.

Now, let's talk about the macro perspective. We believe that in the coming months or years, Bitcoin still has room for growth, and prices above 100,000 cannot be ruled out. Friends holding spot positions need not worry; they can hold as a value investment. The market analysis we provide daily is aimed at short-term contracts. As we always say, contracts cannot withstand significant fluctuations, especially since they are leveraged, so please ensure to set stop losses when trading.

Specific Trading Suggestions (based on actual market prices)

Short position on Bitcoin around the current price of 61200, stop loss at 61800, take profit at 60000.

Short position on ETH around the current price of 2420, stop loss at 2470, take profit at 2350.

Before the market moves, any analysis can be correct and has its reasons, but no single trade can be absolutely accurate; there are always risks involved. Therefore, the premise for making money is to manage risk well. The market changes in real-time, and the strategy points are for reference only and should not be used as the basis for entry. Investing carries risks, and profits and losses are the investor's responsibility.

Many individual investors find it difficult to enter the trading world, often simply due to the lack of a guide. The questions you ponder may be easily resolved with a single insight from an experienced person. Daily real-time market analysis, along with guidance from our experience-sharing group, and evening practical trading guidance group, are available for real-time support. We also have irregular live broadcasts explaining real-time market conditions in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。