Original | Odaily Planet Daily (@OdailyChina)

Author | Fu Ruo He (@vincent31515173)

Today, another large-scale theft occurred in the crypto world. The security platform Scam Sniffer posted on X, stating that someone lost 15,079 fwDETH, worth about 35 million dollars, after signing a "permit" phishing signature. The hacker then sold the stolen funds on the market, swapping DETH for ETH. Due to insufficient depth in the DETH pool, only 14,079 DETH was exchanged for 2,288 ETH, which still led to the decoupling of DETH. CoinGecko data shows that DETH once dropped to 91.58 USDT, a decline of over 90%, and has now risen to 1135 USDT, but it still has not escaped the decoupling state.

According to Lookonchain monitoring, the address that lost 36 million dollars in fwDETH due to a phishing attack is suspected to be related to Continue Capital.

Just an hour later, Continue Capital co-founder Lin Xiaohong posted on X, saying, "I accidentally exposed that I haven't exited the circle, and passively made a charitable headline." In addition, Lin Xiaohong disclosed the details of the theft in his social circle, stating, "Recently, my Gmail has been frequently attacked by hackers, often popping up fake dialog boxes. Although I refused, it seems impossible to stop. Worse, hackers impersonated Google customer service and called, claiming someone was trying to access my account and asking for identity confirmation."

According to Lin Xiaohong, it is not clear how the theft occurred, but it is evident that the methods of online fraud are becoming increasingly sophisticated.

It is reported that this phishing attack was conducted by hackers using Permit signatures. Contracts that support Permit can authorize through offline signatures, bypassing Approve and without paying gas fees. Once authorized, third parties gain corresponding control and can transfer the user-authorized assets at any time.

Subsequently, Duo Exchange's official response stated, "We have noticed recent phishing attacks targeting some whales on Duo. Over 10,000 DETH were sold on AMM, leading to the decoupling of DETH prices. DETH is designed to always be redeemable for 'opened' ETH at a 1:1 ratio on Duo. The Duo protocol itself is secure and continues to operate as expected. We are closely monitoring the situation and working with affected parties."

The overall process of this theft incident is as described above, but what truly concerns the community is whether it can bottom out DETH. To this end, Odaily Planet Daily has collected key points from Duo Exchange's official documents and social media discussions to explore the chances and risks of bottoming out.

Does decoupling mean a bottoming opportunity? But bottoming out comes with anxiety

In most theft incidents that lead to a stablecoin or wrapped token decoupling, some investors in the market adopt bottoming arbitrage strategies to gain short-term profits, such as the previous Luna and the recent VUSD. After this DETH decoupling, although some users still participated in bottoming out, the discussions on social media have made bottoming investors anxious.

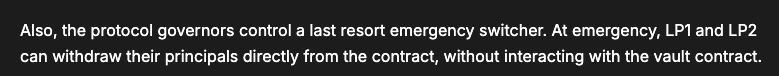

The main reason is that, according to the Duo Exchange official document, the protocol managers control the final emergency switch. In emergencies, LP1 and LP2 can withdraw their principal directly from the contract without interacting with the vault contract.

In simple terms, when issues arise with the protocol, the officials can use a "backdoor" to withdraw the ETH principal previously deposited by users, thereby avoiding risks. This viewpoint has caused panic in the market, leading some bottoming users to regret their actions.

However, fundamentally, this incident involved a large holder being stolen, while the protocol continues to operate normally, which does not meet the conditions for the aforementioned emergency situation.

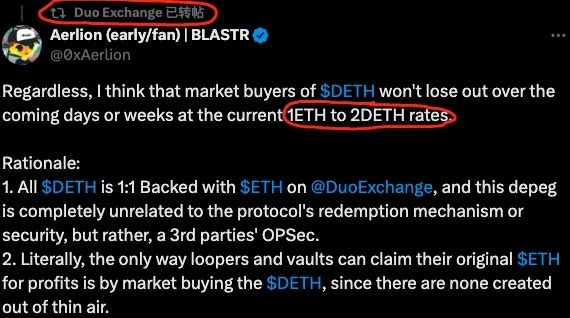

Moreover, according to the official response, it emphasizes that "DETH is always redeemable for 'opened' ETH at a 1:1 ratio on Duo." According to the official retweet of @OxAerlion's content, "With the current exchange rate of 1 ETH to 2 DETH, market buyers of DETH will not suffer losses in the coming days or weeks." This may also hint at the possibility of profit from bottoming out.

Below, we also summarize the pros and cons of bottoming out DETH based on protocol documents and community discussions for everyone's reference.

Favorable factors:

Potential arbitrage opportunity: The current exchange ratio of DETH to ETH is 2:1, significantly lower than its historical average, providing arbitrage opportunities for bottoming investors. There are views in the market that as the market gradually recovers, investors may achieve up to 40% immediate returns. This means that if market conditions improve, bottoming investors can realize profits at a lower cost.

1:1 supported security: DETH is 1:1 backed by ETH on Duo Exchange. This indicates that as long as the protocol itself is secure, the DETH held by bottoming investors still has value. The current decoupling situation is unrelated to the protocol's redemption mechanism but is due to third-party security issues. Therefore, theoretically, the long-term value of DETH remains supported.

Market demand and liquidity: Bottoming investors can drive up demand and increase liquidity by purchasing DETH in the market. As more investors wish to redeem their DETH, market liquidity may strengthen, thereby pushing up prices. Additionally, bottoming investors may find other users in the market willing to purchase their held DETH at a discount.

Adverse factors:

Hacker risk and market uncertainty: Recent hacker attacks directly led to a sharp drop in DETH prices, exposing bottoming investors to additional risks. Despite the arbitrage opportunities, if the project party chooses to snapshot and compensate large holders for their losses, the $DETH held by bottoming investors may quickly depreciate, resulting in losses.

Redemption restrictions and liquidity issues: According to the protocol, users who have not deposited ETH on DUO cannot redeem DETH at a 1:1 ratio. This means that bottoming investors face restrictions when redeeming and need to rely on other existing investors to trade. This redemption restriction increases the difficulty of liquidity and trading, potentially leading to longer waiting times for bottoming investors during the market recovery process.

Bad debt risk and market pressure: Lending protocols like Orbit Lending may face a large amount of bad debt, putting pressure on market recovery. Since these protocols have been exploited by arbitrageurs, market liquidity and confidence have been affected, potentially leading to further depreciation of DETH.

Psychological factors and market sentiment: In the current market's low sentiment, investor confidence in DETH may be affected. If the market is generally pessimistic, bottoming investors may face difficulties in liquidating their holdings even if they hold DETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。