Macroeconomic Factors Drive Downward, The Battle for Bitcoin's $60,000 Threshold!

If you're confused about whether the market will rise or fall in the coming days, you can take a look at this post.

The U.S. September unadjusted CPI year-on-year recorded 2.4%, marking the sixth consecutive month of decline, the lowest since February 2021, but higher than the market expectation of 2.3%. The market still has a slight bearish sentiment, but the issue isn't too significant.

After the data was released, Bitcoin started to decline continuously from around $61,200, breaking below the $59,000 mark at 2 AM. It then began to rebound, and the current price is above $60,000.

The non-farm payroll and inflation data from the past two weeks are not enough to generate substantial inflation concerns, but they have further suppressed the previously extreme recession narrative and interest rate cut expectations. The last non-farm payroll data is also approaching this, and today the CME raised the probability of a 25 basis point rate cut in November to 84%, while the probability of no rate cut has slightly decreased.

So, the aforementioned factors have little impact on the market because the expectations have not changed much.

Recently, there hasn't been much wealth effect, coupled with a decent performance in the A-shares market, leading to tight liquidity in the crypto space. Bitcoin rebounded from $52,000 to $64,000 and then corrected back to around $60,000.

Many altcoins are still priced at levels seen when Bitcoin was at $55,000, with some even hitting new lows. For example, the meme coin in the TON Telegram track, DOGS, has dropped 50% from its opening price, and HMSTR has fallen 70% from its opening price. Those who bought these coins at the opening or tried to bottom out during the process are now feeling the most pain.

From a medium-term perspective, both recession and interest rate cut expectations have cooled down.

The market is currently in a process of decoupling and re-anchoring, and whether there will be a recession after the rate cut is one of the most important anchors for the medium term.

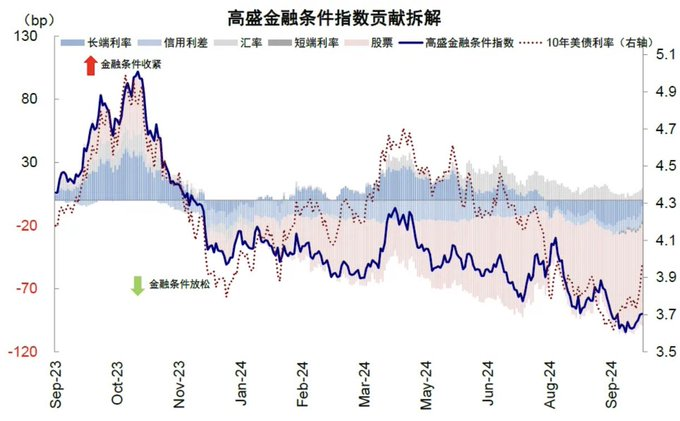

The subsequent pace of interest rate cuts is more important than the initial cut's magnitude. Of course, the initial significant rate cut leads to further easing of financial conditions, creating space for economic rebound.

From this perspective, recent recession concerns have been further alleviated, inflation has slightly exceeded expectations but has not changed the rate cut expectations for November, and there is currently no major risk.

However, the anxiety and uncertainty surrounding the elections, coupled with the onset of earnings season, suggest that for U.S. stocks, we may need to wait for clear signals from the earnings season (whether earnings remain strong or weaken) and then observe the election trends to identify a turning point.

As mentioned yesterday regarding the crypto market, the most important factor is not market expectations but liquidity (after all, weak fundamentals can only correlate with strong liquidity); without liquidity returning, it is hard to see improvement.

The most direct indicator of dollar liquidity is the change in bank reserves, and I believe the changes in USDC issuance can also be observed as an indicator.

Bearish but not shorting! Still optimistic about the future market!

I mainly analyze BTC, as BTC essentially represents all cryptocurrencies!

The decline over the past half month can still be viewed as a corrective phase after the rise. The larger trend remains intact, and it is a continuation structure, so just hold your positions; the significant resistance level is still between $64,000 and $65,000.

Regarding the market: Currently, BTC mainly needs to watch two positions, one around $61,400 and the other around $59,800:

① If it can hold above $61,400 today without a rapid pullback, then there is a high probability of an upward trend in the coming days, at least above $63,000.

② Conversely, if it falls below $59,800 without a quick rebound, then it will enter a downward trend early, potentially dropping below $57,000.

The support at $60,000 is currently effective, and there is a short-term need for a rebound from oversold conditions. The right-side movement at this position is quite important; if $60,000 is effectively broken, the previous rebound and double bottom confirmation will be retested, requiring a small structure to form again. However, if it stabilizes around $60,000, the previous upward structure remains valid.

ETH is correlated, and the bottom of the exchange rate still needs to be tested and confirmed.

As for altcoins, they are still largely correlated, and the recovery of funds will only appear after Bitcoin strengthens.

I still judge that the overall altcoin market has either completed or is in the process of building a bottom, and it is highly likely to gradually emerge from the bottom and start an upward trend.

In the crypto industry, if you want to seize the next bull market opportunity, you need to have a quality community where everyone can support each other and maintain insight. If you are alone, looking around and finding no one, it is actually very difficult to persist in this industry.

If you want to find support or have questions, feel free to join us — WeChat Official Account: You Bi Zhi Qing Nian

Thank you for reading! If you liked it, please give a thumbs up and follow us. See you next time!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。