Original | Odaily Planet Daily (@OdailyChina_)

_

Since the emergence of Uniswap, which heralded the era of DeFi, to Compound igniting the DeFi Summer mining frenzy in 2020, and then Pendle introducing a discount mechanism from traditional finance to realize future earnings in advance within the DeFi world, further enhancing asset liquidity. The DeFi space periodically sees innovative mechanisms that align with the current market stage, prompting a slew of products to imitate (or nest).

The development of Pendle has benefited from the explosive growth of LSD, and the demand for lending protocols based on LST as collateral is bound to expand continuously, especially in the stablecoin sector.

Lista DAO, which Odaily Planet Daily has recently focused on, was born out of such demand. Following the Binance Megadrop, Lista DAO has also entered a new phase. This article will explore how Lista DAO releases asset liquidity and achieves higher and more stable returns from stablecoins to liquidity mining and then to composite yield products from the perspective of CDP protocols.

Overview of CDP Protocols

CDP stands for Collateralized Debt Position, a lending mechanism in DeFi that allows users to borrow stablecoins or other cryptocurrencies by collateralizing crypto assets.

In 2023, with the development of liquid staking and re-staking tracks, LSDFi protocols have become a market hotspot. This has enriched the CDP system, with protocols beginning to allow users to use LST assets as collateral to generate stablecoins, further improving the capital utilization efficiency of the CDP system, with Lista DAO being one of them.

What Common Problems Exist in Mainstream CDP Protocols?

Although DeFi and stablecoins have developed over decades, the "impossible trinity of stablecoins" remains a persistent cloud over the DeFi industry, meaning that price stability, decentralization, and capital efficiency cannot be achieved simultaneously.

For example, MakerDAO (now renamed Sky) is the pioneer of CDP and holds an absolute leadership position in CDP. However, to ensure the stability of DAI, the protocol allows the use of centralized stablecoins like USDC to generate DAI, sacrificing a degree of token decentralization.

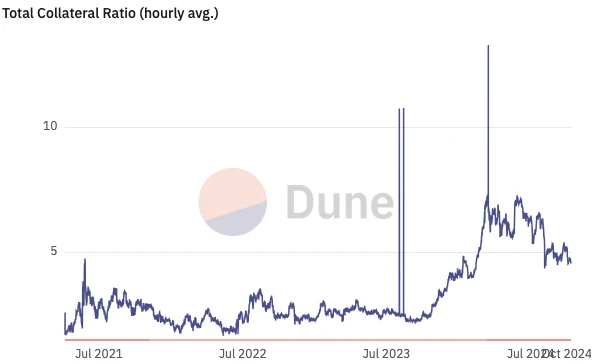

Liquity's LUSD is a stablecoin that uses ETH as the sole collateral, ranking third in CDP protocols. While LUSD guarantees decentralization with a minimum collateralization ratio of 110%, users often proactively increase their collateralization ratio to avoid liquidation. According to Dune data, LUSD's collateralization ratio has remained above 250% for a long time, recently rising to 460%, meaning that for every 1 LUSD in circulation, there must be $4.6 worth of ETH collateral backing it. Such a high collateralization ratio severely reduces LUSD's capital efficiency.

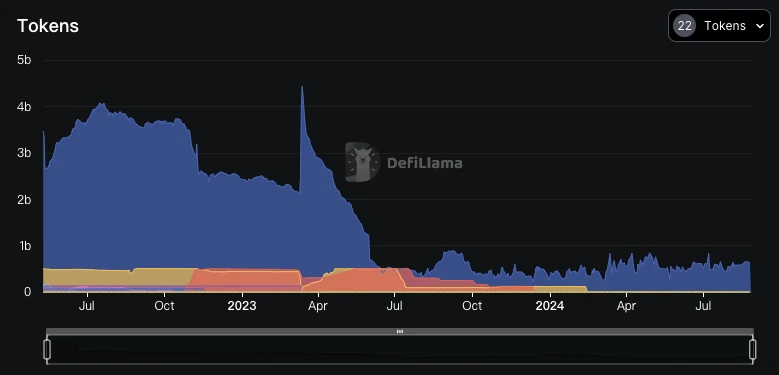

USDe, launched by Ethena Labs, is a highly popular stablecoin this year and has become the fifth-largest stablecoin by market cap. Although USDe has achieved 100% capital efficiency and good decentralization through innovative yield strategies, its over-reliance on upward markets raises concerns about its price stability. USDe has undergone several stress tests this year, with its supply continuously decreasing since July, now falling below 2.5 billion.

The Combination of LSDFi and CDP Protocols is Becoming a Trend

To address the above issues, the combination of CDP protocols with LSDFi to issue stablecoins has become a new solution. For instance, Sky has increased the share of stETH collateral to replace USDC; Liquity v2 will support LST as collateral to unlock liquidity potential; Ethena Labs chose stETH as its main holding position from the start… However, their solutions are either still in their infancy (like Sky and Liquity v2) or, like USDe, have not fully resolved the issues.

So, is there currently a CDP protocol in the market that is already mature and incorporates the advantages of liquid staking? The answer is Lista DAO, which will be introduced next.

Overview and Advantages of Lista DAO

Next, we will briefly introduce the business of Lista DAO and analyze its developmental advantages compared to current mainstream CDP protocols.

Protocol Introduction

Lista DAO, originally known as Helio Protocol, was established in 2022, when the project issued the over-collateralized stablecoin HAY. In July 2023, Helio merged with liquid staking provider Synclub to form a new LSDFi Foundation and was renamed Lista DAO.

Lista DAO is an LSDFi project that combines liquid staking and CDP systems, operating on the BNB chain. Users can stake BNB to obtain liquid staking certificates slisBNB and earn POS income, while also borrowing stablecoin lisUSD through over-collateralizing classic decentralized collateral like ETH and BNB, as well as collateral like slisBNB, wstETH, and solvBTC.

As of now, Lista DAO has a total TVL of up to $420 million, ranking fourth on the BSC chain. Among them, the value of collateral exceeds $187 million, and the value of liquid staking assets is approximately $233 million.

Advantage 1: Multiple Measures to Enhance BNB Asset Efficiency and Returns

- DeFi BNB: Combining On-chain Staking and New Listing Returns

As a protocol that issues stablecoins through a CDP system, Lista DAO naturally faces the "impossible trinity of stablecoins." Lista DAO's innovative solution is that it not only allows users to fully increase their capital utilization through CDP but also combines liquid staking and additional liquidity from DEX liquidity providers (LP) through DeFi BNB, enhancing the overall capital efficiency of the system.

slisBNB is the liquid staking certificate of the Lista DAO platform, inherently containing the rewards from node staking. Users can enjoy slisBNB rewards while also participating in new listings, making it far more liquid and profitable than placing BNB in a CEX's fixed-term financial products.

This approach allows users to achieve multiple income goals without the cumbersome recharge/withdrawal operations, thus improving capital efficiency, reducing processes, saving time, and lowering costs through reduced losses.

To incentivize users, Lista DAO also offers high point rewards for DeFi BNB, which can lead to future airdrops, forming a "triple mining" effect that accelerates product adoption.

- BNB.xyz: Optimizing the Utility of CeFi BNB and DeFi BNB

Additionally, to further enhance the capital utility and returns of users' BNB, Lista DAO has participated in building a one-stop on-chain staking platform BNB.xyz, designed specifically for CeFi BNB and DeFi BNB users, with core contributors including PancakeSwap and BNB Chain.

BNB.xyz went live on September 3rd, serving as a one-stop center for staking, simplifying the path and operational processes for users to search for and compare optimal staking solutions within the BNB ecosystem, while also providing innovative staking solutions that optimize the utility of CeFi BNB and DeFi BNB, bringing the most direct and valuable income to all BNB users.

BNB.xyz is still in its early development stage, and in the official plan, it will collaborate with a broader ecosystem of platforms (such as binance.com or Binance Web 3 wallet) to explore more staking solutions and options for BNB users, maximizing asset efficiency and profits.

- clisBNB: Balancing BNB Lending and New Listing Rights

To further enhance BNB asset efficiency and expand user returns, Lista DAO recently launched a product that allows users to engage in both collateralized lending and on-chain new listings simultaneously—clisBNB. When users over-collateralize BNB to borrow the stablecoin lisUSD, they will also receive a lending limit of clisBNB.

Although clisBNB differs from the liquid staking certificate slisBNB of the Lista DAO platform by only one letter, there are significant differences. clisBNB is pegged 1:1 to the value of BNB but can only participate in new listings and cannot be traded or transferred. When the lisUSD is repaid and BNB is withdrawn, clisBNB will also be automatically burned.

Therefore, clisBNB is essentially an "ancillary product" generated from borrowing lisUSD, aimed at further releasing the liquidity of BNB for users, allowing them to earn new listing rewards while participating in lending.

In addition to Launchpool rewards, the earnings from clisBNB also include lisUSD earnings (LP pool 10%~15%; it can also be used for recursive lending, with returns exceeding 30%), Lista airdrop rewards, and Lista token emission rewards.

Advantage 2: Fusion Development of LSDFi + CDP

slisBNB is the native yield and liquid staking token of BNB built by ListaDAO, and it is a key asset in LSDFi within ListaDAO. Currently, the number of BNB staked in slisBNB has exceeded 413,000. slisBNB has the following threefold earnings:

The appreciation of slisBNB is consistent with the APY of BNB. Users who liquid stake BNB into slisBNB can passively earn BNB staking rewards;

Earn additional LP rewards on DeFi platforms. Users can provide liquidity for slisBNB in liquidity pools such as PancakeSwap and Thena Finance, earning trading and LP fees;

Receive Binance Launchpool rewards. On August 13, Lista DAO officially announced that slisBNB would support reward calculations in Binance Launchpool, and users only need to hold slisBNB in their Web3 MPC wallets to qualify. Currently, slisBNB is the only LST that can participate in new listings in Binance Launchpool.

In addition to the above threefold earnings, Lista DAO also supports over-collateralizing slisBNB to borrow stablecoin lisUSD, with a minimum collateralization ratio of 150%. This allows users to leverage their positions by minting stablecoins through the CDP method while retaining exposure to liquid staking rewards, maximizing the capital efficiency of BNB. Of course, the liquidity of the stablecoin lisUSD is also crucial in this process, and Lista DAO also supports staking mining using lisUSD.

By integrating the LSDFi + CDP system, slisBNB brings users multiple earning models while also increasing exposure to risk assets, leveraging user assets through the CDP system.

According to official documentation, slisBNB will also integrate with the universal staking layer Karak in the future, enabling it to gain re-staking capabilities. This feature will not only expand the utility of slisBNB but also further release slisBNB liquidity and more LSDFi gameplay.

Advantage 3: Utilizing the veToken Model to Unlock Token and Governance Potential

- Rich Governance Token Rewards

The veToken model was initially introduced by Curve Finance, aiming to incentivize token holders to participate in protocol governance and development, ensuring their interests align with the long-term success of the protocol. In this model, users can lock their protocol tokens for a period and receive "veToken." During this time, they can use veToken to gain governance rights and various rewards. The longer the lock-up period, the more veToken they receive, which means greater voting power and higher rewards.

LISTA is the protocol token of Lista DAO, which underwent TGE on June 20 this year. Users can currently lock it up and mint veLISTA.

veLISTA can only be obtained through minting and is non-transferable, with a maximum lock-up period of 52 weeks. The lock-up reward is equal to the number of weeks locked; for example, locking 1 LISTA for 52 weeks will yield 52 veLISTA. If the user does not complete the 52-week lock-up, they can choose to extend it to 52 weeks, and they can also withdraw LISTA before the lock-up period ends, but they will need to pay an early unlock fee, calculated as "early unlock fee = (total locked amount * unlock weeks) / 52."

To incentivize users to lock up, veLISTA holders can also receive a portion of the LISTA protocol's income, which mainly comes from early unlock fees for veLISTA, lisUSD borrowing fees, ETH withdrawal fees, and LST rewards and operational commission fees. veLISTA holders will receive these rewards in the form of LISTA, WBETH, slisBNB, BNB, and lisUSD tokens.

- Improved DAO Governance

In terms of governance, since the concept of DAO emerged in 2020, countless DAOs have appeared in the DeFi space (such as Uniswap and Aave), but most of them are inadequate and vague in aspects like voting, dividends, and token buybacks.

Lista DAO also plans to transform into a decentralized autonomous organization, gradually transferring governance rights to veLISTA holders. However, unlike most DeFi DAO organizations, Lista DAO has sought to ensure that DAO governance is transparent and complete from the outset:

Immediately after the token release, DAO governance will commence, with all core parameters requiring community proposals and votes, aiming to decentralize power as much as possible;

A dividend mechanism will be activated from day one, with all profits distributed to the community after necessary costs are deducted;

An auto-compound feature will be introduced, allowing users to increase their earnings with a single click.

veLISTA holders have voting rights within the Lista governance system, covering areas such as modifying fee rates (withdrawal fees, veLISTA early unlock fees), adding or removing collateral, increasing and decreasing collateralization ratios and debt limits, and the distribution ratio of protocol fee dividends for veLISTA holders. However, currently, only the core team of Lista DAO can submit proposals.

Locking LISTA not only binds the interests of token holders with Lista DAO, thereby reducing selling pressure in the secondary market, but also grants the community voting rights in governance, allowing token holders to maintain their interests to some extent.

The circulating supply of the LISTA token is 181 million, with the number of locked LISTA tokens currently at 53.73 million, resulting in a lock-up rate of 14%.

Advantage 4: Leading Token Model

In addition to the above innovations and advantages, Lista DAO is also very advanced in the circulation of its tokens, characterized by low market capitalization and high circulation, showing good potential.

- Circulation Analysis

Lista DAO's native token LISTA is a BEP-20 token with a total supply of 1,000,000,000 tokens, distributed as follows:

Binance Megadrop: 100,000,000 LISTA, accounting for 10% of the total supply;

Airdrop: 100,000,000 LISTA, accounting for 10% of the total supply;

Investors and Advisors: 190,000,000 LISTA, accounting for 19% of the total supply;

Team: 35,000,000 LISTA, accounting for 3.5% of the total supply;

Community: 400,000,000 LISTA, accounting for 40% of the total supply;

DAO Treasury: 80,000,000 LISTA, accounting for 8% of the total supply;

Ecosystem: 95,000,000 LISTA, accounting for 9.5% of the total supply.

On the day of LISTA's release on June 20, the initial circulating supply of tokens was 230,000,000 (23% of the total token supply). The unlocking situation is as follows:

100% of the 10% LISTA token supply allocated to Binance Megadrop was unlocked;

8.5% of the 10% LISTA token supply allocated to airdrops was unlocked;

3.5% of the 9.5% LISTA token supply allocated to ecosystem development was unlocked;

1% of the 19% LISTA token supply allocated to investors and advisors was unlocked.

The majority of LISTA tokens are allocated to the community (40%) and ecosystem development (9.5%), while the proportion held by the project team and investors is relatively low, at 3.5% and 19%, respectively. This distribution method demonstrates the project's emphasis on the community, helping to avoid the risk of a single entity holding too many tokens and reducing the possibility of market manipulation.

- Unlocking Analysis

According to official documentation, in addition to the initial unlocking on the release day, the unlocking plan for LISTA is as follows:

The remaining 15% in the airdrop, which is 1.5% of the total LISTA token supply, was unlocked at the end of September;

The remaining 18% for investors and advisors will be locked for one year until June 2025. Starting from June 2025, this portion will be linearly unlocked quarterly over the next two years until March 2027;

The token supply allocated to the Lista DAO team (3.50%) will be locked for one year until June 2025, with the first unlocking occurring in June 2025. From June 2025, the 3.50% token supply allocated to the Lista DAO team will be linearly vested and unlocked quarterly over the next five years until March 2029;

The community incentive LISTA tokens will start unlocking in July, with the unlocking amount continuing to be released at a decreasing rate of 1/√2 per year, lasting 20 years until June 2044. Since Lista DAO is still in a transitional phase, the current unlocking amount is set at 312,500 LISTA per week, lower than the expected monthly unlocking amount of 9,772,651 LISTA;

The token supply allocated to the Lista DAO treasury (8.00%) will be locked for three months until September 2024, with the first unlocking occurring in September 2024. From September 2024, the 8% token supply allocated to the Lista DAO treasury will be linearly vested and unlocked quarterly over the next four years (until June 2028);

The remaining 6% of the token supply allocated to the ecosystem will be unlocked quarterly over the next five years until June 2029.

The unlocking plan for LISTA is designed to be relatively robust. On the day of release, only 23% of the tokens were unlocked, while the majority of the remaining tokens will be gradually unlocked over time. This long-term unlocking arrangement helps prevent the risk of a large short-term sell-off in the market, contributing to the stability of the token price.

At the same time, both the Lista DAO treasury and the development of the ecosystem have dedicated token allocations, and the unlocking of these tokens is also relatively slow, ensuring that funds can be used for the long-term development of the project and community building.

In summary, the token model of Lista DAO is designed to be advanced and reasonable. Through a strict unlocking plan and a community-oriented distribution model, it reduces the risk of large-scale token sell-offs by the project team and VCs, enhancing investors' confidence in the long-term development of the project. Therefore, this makes LISTA a promising investment target.

Summary

This article first briefly explains the concept of the CDP protocol, and as the market for liquid staking and re-staking continues to expand, the demand for lending protocols using LST as collateral is also growing. To address the "impossible trinity of stablecoins," mainstream CDP protocols are innovating to varying degrees, using LST as collateral to generate stablecoins in hopes of improving capital efficiency, although current solutions are not perfect.

Next, we introduced Lista DAO, which operates on BNB and Ethereum and is a relatively ideal combination of LSD and CDP protocols. Lista DAO not only enhances the capital efficiency of stablecoins but also provides rich earning models and leverage options for the LSD token slisBNB. Coupled with the rewards and governance rights granted to users by LISTA and veLISTA tokens, as well as its leading token model, it is believed that it will have strong growth potential in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。