According to Foresight News statistics, from September 24, 2024, to October 11, 2024, there were a total of 34 investment and financing events in the cryptocurrency market, including 16 in tools and infrastructure, 2 in the DeFi sector, 4 in asset management, 5 in blockchain games and NFTs, and 7 in the Web3 sector. The total disclosed investment amount is approximately $280 million.

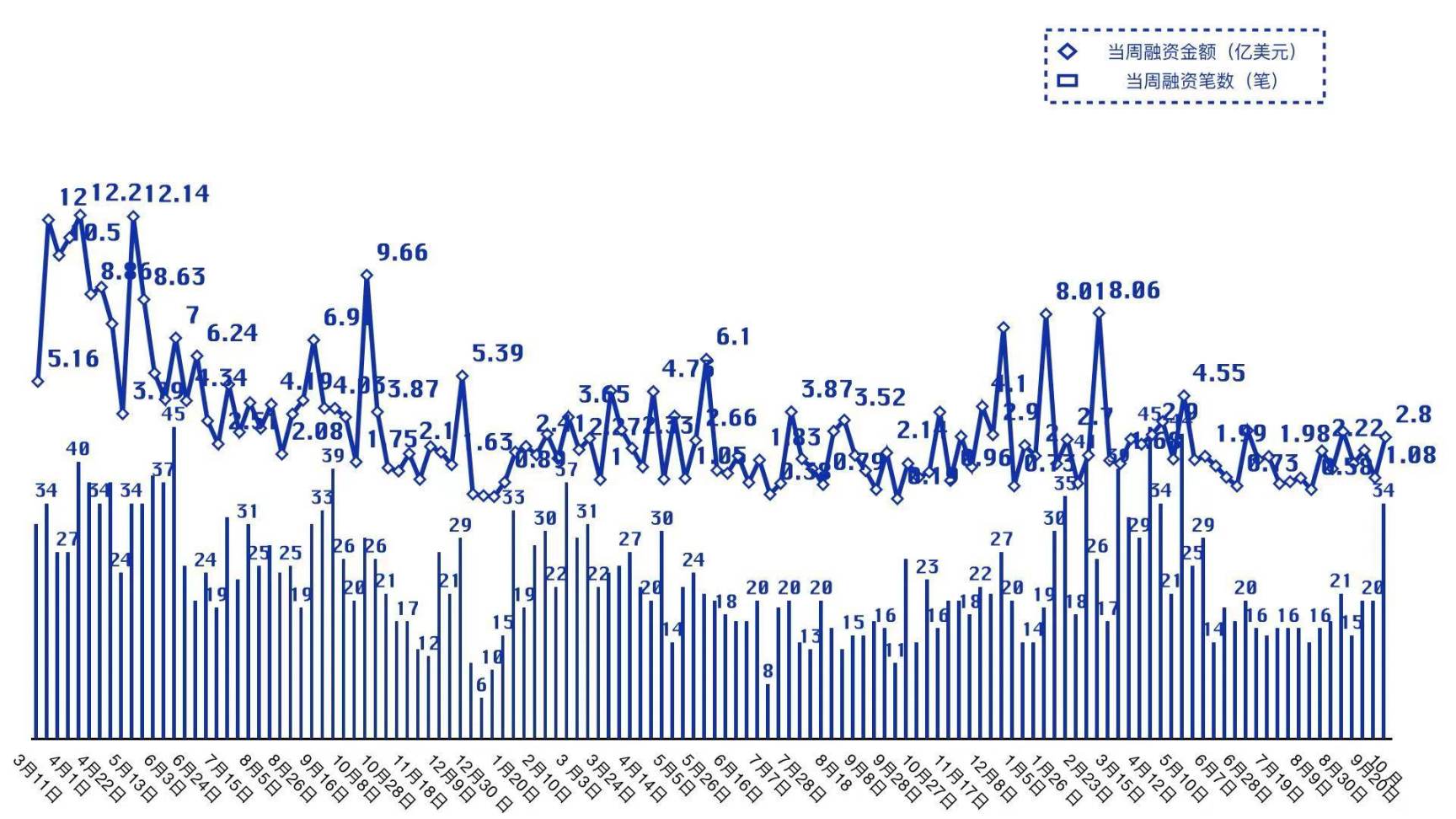

Weekly summary of disclosed financing amounts and number of financing events:

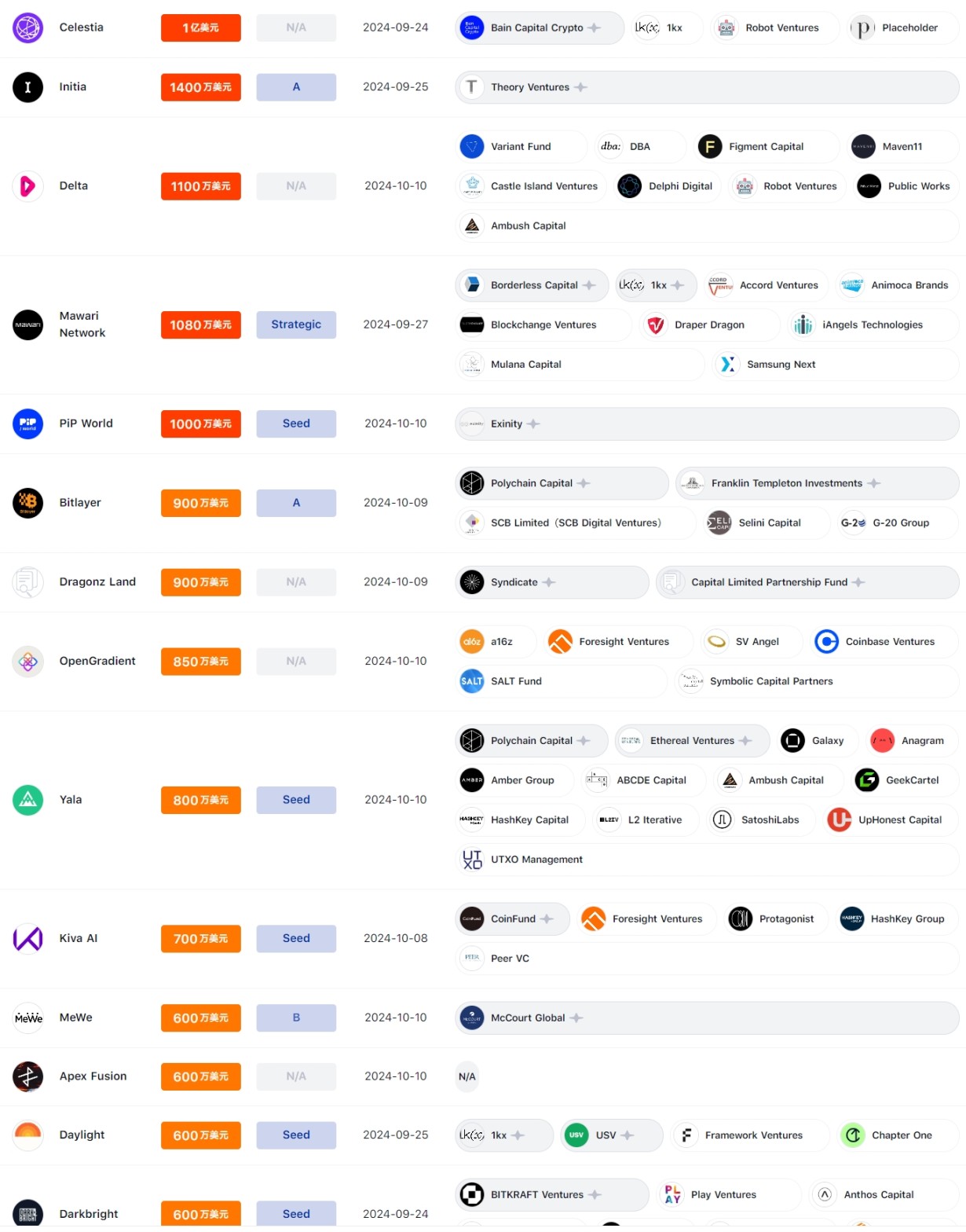

This week's investment and financing projects sorted by financing amount are shown in the following chart:

From September 24, 2024, to October 11, 2024, there was one financing event exceeding $100 million, with the Celestia Foundation completing a $100 million financing round led by Bain Capital Crypto. This week, there were a total of 6 financing events in the tens of millions of dollars, including the Web3 game ecosystem PiP World completing a $10 million seed round; the permissionless network delta completing $11 million in financing; the metaverse platform SecondLive completing $12 million in financing, led by Crypto.com; Mind Network completing $10 million in Pre-A financing, with participation from Animoca Brands; the DePIN network Mawari Network completing $10.8 million in strategic financing, led by Anfield LTD; and Initia completing $14 million in Series A financing, led by Theory Ventures.

In the segmented investment and financing tracks, this week saw a strong performance in the Web3, tools, and infrastructure sectors, while DeFi remained relatively sluggish.

On the institutional side, active institutions this week included Bain Capital Crypto, Crypto.com, and Animoca Brands, primarily focusing on the tools and infrastructure sector.

Tools and Infrastructure

Celestia Foundation completes $100 million financing

Celestia is a modular blockchain.

Decentralized cloud computing platform Swan Chain completes multi-million dollar new financing round

Swan Chain's mainnet was launched in early July, currently boasting over 150 ecosystem partners and more than 100 AI applications. The project plans to launch the SWAN token in the second half of this year to further enhance its ecosystem and incentive mechanisms.

DePIN network Mawari Network completes $10.8 million strategic financing

Mawari Network is a decentralized content delivery platform under Mawari.

Initia completes $2.5 million community round financing through Echo platform

Initia announced on the X platform that it completed $2.5 million in community round financing through the Echo platform in less than two hours. Echo is an angel investment platform created by crypto trader Cobie (Ser Shokunin).

Mind Network completes $10 million Pre-A financing

Mind Network is a fully homomorphic encryption (FHE) infrastructure layer.

ZAR completes angel round financing

ZA is a digital wallet.

Decentralized AI training network Nodepay completes new financing round

Nodepay allows users to utilize unused internet bandwidth for AI training and convert contributions into digital assets, thereby promoting the development of AI technology. Its platform claims to ensure data source privacy through blockchain technology.

Kiva AI completes $7 million seed round financing

Kiva AI is a startup focused on developing AI applications for specific domains.

Bitlayer completes $9 million Series A extension financing

Bitlayer proposed and implemented OpVM, a Bitcoin L1 verification solution that combines fraud proofs (BitVM) and validity proofs (based on OP_CAT).

Semantic Layer completes $3 million seed round financing

Semantic Layer will introduce application-specific sorting (ASS) to DApps.

AI and DePin solution PinGo Lab completes seed round financing

PinGo is an AI and DePin solution on the TON network, aimed at addressing the fragmentation and underutilization of idle computing resources, providing the computational foundation for building AI models.

Privacy social network MeWe completes $6 million Series B financing

MeWe focuses on user empowerment, offering a range of features that allow users to create groups, interact, and control their data flow.

OpenGradient completes $8.5 million financing

OpenGradient aims to accelerate the development of open-source AI by democratizing model ownership, simplifying AI deployment, and ensuring the widespread adoption of cutting-edge AI technologies.

Decentralized data storage solution Botanika completes $1.5 million angel round financing

Botanika aims to build a decentralized data storage network using AI-driven sharding, transmission, data regeneration algorithms, and B1 hardware nodes.

Bitcoin ecosystem oracle APRO Oracle completes $3 million seed round financing

APRO Oracle has launched a variety of oracle product matrices, including support for Bitcoin L1, Bitcoin L2, Ordinals, Runes Protocol, LST/LRT, Lightning Network, RGB/RGB++, EVM-compatible chains, Ton, and more.

Initia completes $14 million Series A financing, led by Theory Ventures

Initia is a Layer1 blockchain built on the Cosmos SDK.

DeFi

Movement ecosystem DeFi project Meridian completes $4 million seed round financing

Meridian is currently running on the Movement testnet and plans to launch alongside its mainnet.

Yala completes $8 million seed round financing

Yala is a Bitcoin liquidity protocol and stablecoin issuer.

Asset Management

Crypto front-end hosting solution EarthFast completes $1.4 million Pre-Seed round financing

EarthFast enables projects to easily build and host decentralized applications, providing a scalable, secure, and high-performance alternative to traditional cloud platforms. EarthFast was initially launched in 2022 as a community project under the name Armada Network, with its first product being a front-end hosting solution that allows projects to transfer the responsibility of website updates and deployments to DAOs, governance contracts, or other on-chain entities.

Round Coin Technology completes $7.8 million A1 round financing

Round Coin Technology will test its Hong Kong dollar stablecoin operation plan in the Monetary Authority's sandbox. Additionally, another subsidiary of Round Coin Technology, Round Coin Wallet Technology Co., Ltd., has obtained a Stored Value Facility (SVF) license issued by the Monetary Authority and will officially operate by the end of 2023.

French fintech company Kriptown completes €4.2 million Series A financing

Kriptown will provide asset management companies and individual investors with opportunities to purchase shares in small and medium-sized enterprises and offer liquidity through an all-day secondary market.

Tradias completes Series A financing and obtains securities trading bank license

Tradias is a German cryptocurrency market maker.

NFT and Blockchain Games

SecondLive completes $12 million financing

SecondLive is a metaverse platform.

Web3 game ecosystem PiP World completes $10 million seed round financing

PiP World aims to create a crypto version of Duolingo, with its game ecosystem including a AAA strategy management simulator game PiP Trader for building trading portfolios, a Telegram click-to-earn game PiP World's Gold Rush, a gamified application PiP Academy that simplifies financial concepts, and a stock simulator StockRise.

Web3 game studio Dragonz Lab completes $9 million financing

Dragonz Land is a collectible card game where players can buy, collect, merge, and evolve NFT cards, which can be used on mobile devices and desktops via Telegram.

Moonray Studio raises $8.25 million through two rounds of financing

Moonray Studio is a Web3 multiplayer battle arena game development studio that enhances the gaming experience through asset ownership, customizable NFTs, and token rewards using blockchain technology. The new funds are intended for launching a mobile version of the Autobattler game in the first quarter of next year.

Web3 game developer Darkbright Studios completes $6 million seed round financing

Darkbright's first life simulation game "Smolbound" has entered internal testing and is planned for launch next year on the Layer2 blockchain Treasure, where all user-generated content in "Smolbound" can be NFTs.

Web3

Web3 rewards information aggregation solution Daylight completes $6 million seed round financing

Daylight is a Web3 rewards information aggregation solution.

AminoChain completes $5 million seed round financing

AminoChain is building an L2 blockchain protocol connecting enterprise medical institutions, with the first application built on AminoChain being a biological sample marketplace that allows researchers to query and license samples through a biological sample library network. Patients can track their sample usage, learn from new insights generated from the samples, and earn money when these samples are sold.

MeshMap completes $4 million financing

MeshMap is a decentralized 3D mapping project.

Full-stack decentralized development tool developer Layer completes $6 million financing

Layer utilizes Web Assembly, allowing developers to write applications in languages like Rust that can run anywhere—even on iPhones. Layer's upcoming product, "Layer SDK," enables developers to build new layers on top of Ethereum, running full-stack blockchain applications, including smart contracts, consensus mechanisms, UI, and verifiable off-chain services.

Synnax completes new round of strategic financing

Synnax is a decentralized credit rating platform aimed at building a decentralized, transparent credit market and optimizing the credit rating industry through predictive analytics obtained from decentralized data sources.

Base ecosystem token launch platform Trendies completes $1.75 million Pre-Seed round financing

Trendies is a launch platform designed for token holders, allowing them to earn rewards by creating memes, liking popular content, and staking tokens.

Permissionless network delta completes $11 million financing

Delta aims to create a network system with global state sharing, providing developers with a balanced solution for sovereignty and interoperability through the separation of execution and data availability.

Other

VanEck launches $30 million venture capital fund to support crypto and AI

Asset management company VanEck has launched a $30 million venture capital fund, VanEck Ventures, to support the development of the crypto and AI industries. The fund will invest in early-stage crypto and AI startups, with plans to make 25 to 35 investments, ranging from $500,000 to $1 million each.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。