The unexpected rise in the inflation rate in the U.S. in September and the subsequent regulatory actions have dealt a double blow to the cryptocurrency market. The inflation rate increased by 0.2%, exceeding expectations, raising concerns in the market about the Federal Reserve possibly pausing interest rate cuts. Atlanta Fed President Raphael Bostic's statements further exacerbated market unease. Additionally, the U.S. Securities and Exchange Commission (SEC) lawsuits against Crypto.com and Cumberland DRW, along with crackdowns on market manipulation, have further intensified market volatility. Bitcoin's price fell by about 4%, retreating to $59,000, while other cryptocurrencies also performed poorly.

Reasons for the Bitcoin Market Slump

CPI rise hits interest rate cut expectations, cryptocurrency falls in response

Latest data shows that the U.S. September CPI year-on-year increase was 2.4%, a slight decline from August but higher than the market expectation of 2.3%. This is the smallest year-on-year increase since February 2021. Bostic mentioned in an interview that the volatility of economic indicators suggests the Fed should pause interest rate cuts in November to patiently wait and observe the development of the data. The market's expectations for continued interest rate cuts by the Fed in November have been dampened.

The release of inflation data had an immediate impact on the cryptocurrency market. Bitcoin fell by about 4% during afternoon trading in the U.S., dropping to $59,000, the lowest level since the Fed's unexpected 50 basis point rate cut in mid-September.

Image source: Internet

Cryptocurrency Capital Outflow

There has been a noticeable withdrawal of funds from cryptocurrency ETFs. Recently, Crypto.com received a Wells notice from the SEC and filed a lawsuit to defend itself. Coupled with large trading firms like Jump Trading selling off cryptocurrencies in large quantities, market tension has intensified, especially in products like Grayscale's Ethereum Trust, where investors are withdrawing funds. This trend reflects a growing skepticism about the rapid recovery of cryptocurrency values, adding additional downward pressure on prices.

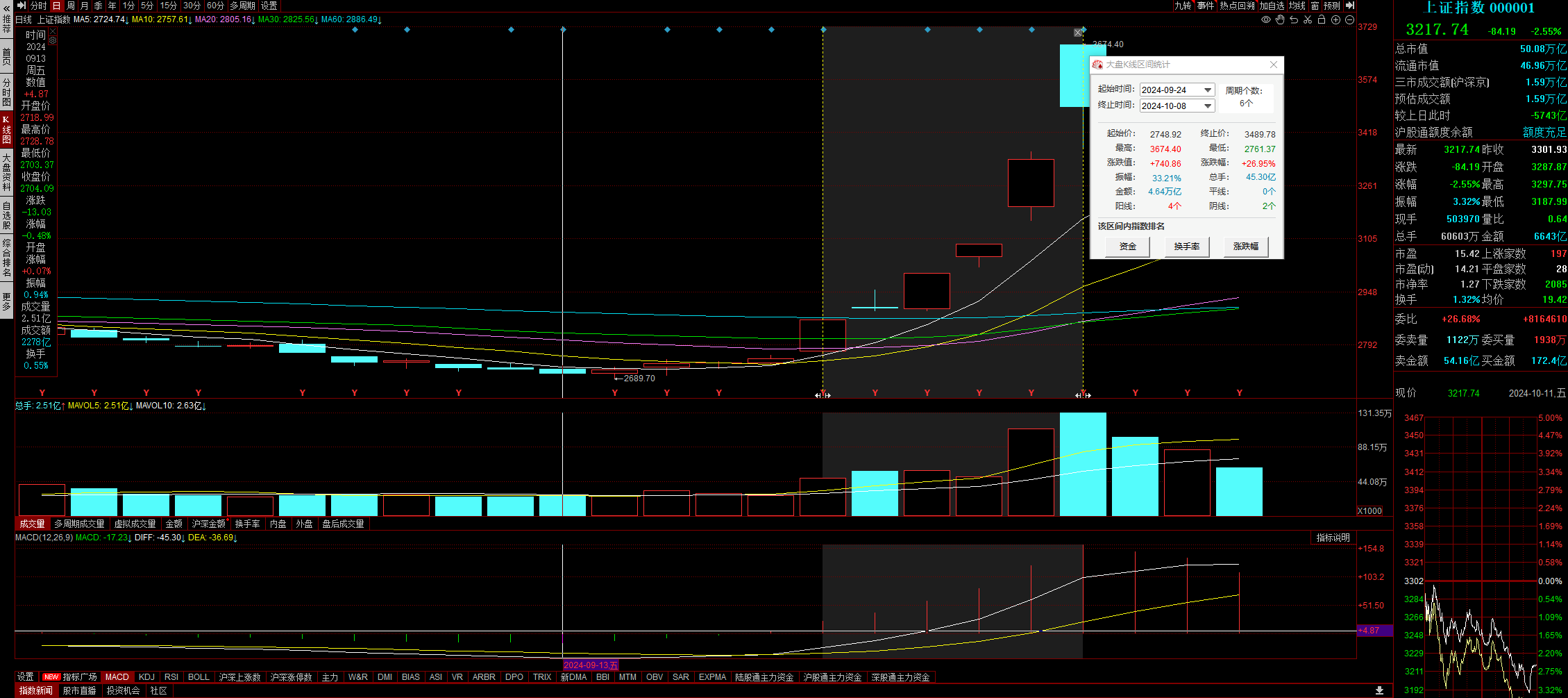

Furthermore, after the Fed's interest rate cut, the Chinese stock market surged under a series of favorable policy stimuli, achieving a 2,700-point reversal with a remarkable 27% increase in just six trading days. Given that Chinese assets have long hovered around 3,000 points, it is not hard to imagine whether there has been a transfer of funds from Bitcoin investors.

Image source: Tonghuashun

Macroeconomic Impact

After the release of the September non-farm data, some institutions pointed out that the weak U.S. non-farm employment data, combined with the expectation of a dollar interest rate cut and a yen interest rate hike, has led to a reduction in market liquidity, which in turn affects the inflow of funds into the cryptocurrency market, resulting in price declines. Additionally, the unexpected rise in the U.S. inflation rate in September has heightened market concerns about the Fed possibly pausing interest rate cuts, increasing the risk associated with Bitcoin assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。