In the past few months, Bitcoin (BTC/USD) has risen almost in sync with U.S. tech stocks, but due to oversupply and insufficient demand, the correlation between Bitcoin and U.S. tech stocks is weakening. Manuel Villegas, a next-generation research analyst at Julius Baer, stated, "The oversupply of tokens is expected to enter centralized exchanges in the coming days, which may put pressure on Bitcoin prices. Oversupply has been a major factor affecting confidence."

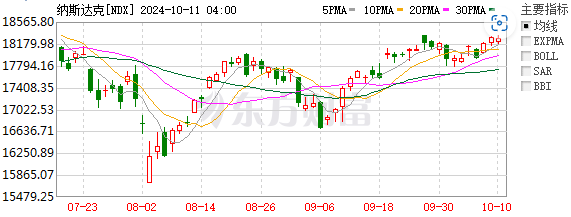

Recent data shows that the 90-day correlation coefficient between Bitcoin and the Nasdaq index has dropped to 0.21. This coefficient has fallen by more than 50% in two months. As of October 10, Bitcoin's price has decreased by 14.83% from its July peak, while the Nasdaq index has shown almost no overall change and even experienced some gains. The chart indicates that especially when U.S. stocks rise, BTC has not followed suit, but when U.S. stocks decline, BTC often follows the downward trend.

Data Source: AICoin

Data Source: Eastmoney

Bitcoin has previously been viewed as "digital gold" or a safe-haven asset, with investors seeking to hedge against traditional market risks. However, its high volatility often leads to simultaneous declines during periods of increased economic uncertainty. Recently, there have been signs of a rebound in the Chinese stock market, primarily due to a series of favorable policies introduced by China and the low prices of assets, attracting many foreign investors.

The renowned institution Goldman Sachs believes that despite the strong rebound in the Chinese stock market, there is still potential for further increases: Chinese assets are estimated to have a 15% to 20% rise potential. The strong performance of the Chinese stock market has attracted funds that were originally invested in the cryptocurrency market. This shift of funds may be temporary, but it explains part of why Bitcoin has not followed the upward trend of U.S. stocks.

Meanwhile, the cryptocurrency market remains sluggish, with different countries having varying degrees of regulation on Bitcoin. The U.S. has a relatively lenient regulatory stance on Bitcoin, while China has taken a strict prohibitive approach, including banning initial coin offerings (ICOs) and the operation of cryptocurrency exchanges, as well as a complete ban on cryptocurrency trading and mining activities. This greatly limits the ability of foreign capital to profit from trading Bitcoin in China.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。