The A-shares have rebounded strongly, prompting many investors in the cryptocurrency market to reassess their investment strategies. Some KOLs have publicly suggested shifting funds from the cryptocurrency market to the A-share market. Where is the cryptocurrency market headed?

A-shares Warm Up Strongly, Opening Surge

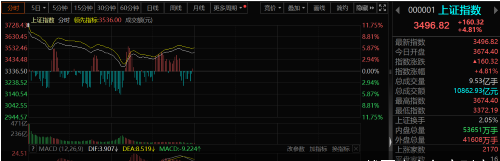

On October 8, the three major stock indices opened significantly higher, each rising over 10%, with the Shanghai Composite Index opening above 3600 points. Although the gains narrowed afterward, by the time of the midday close, the Shanghai Composite Index still rose by 4.81%. This performance not only met the market's high expectations but also reflected investors' confidence in the outlook for the Chinese economy, with the trading volume surpassing one trillion yuan in just 20 minutes, setting a record for the fastest transaction volume to exceed one trillion.

Image source: Internet

The Logic Behind A-share Rise, Caution Needed in Investing in A-shares

After the National Day holiday, the A-share market experienced a surge, mainly due to a series of economic stimulus policies introduced by the government. These policies include fiscal measures, credit easing, and support for the capital market, which quickly boosted market sentiment. International capital, such as large institutions like BlackRock, has also reassessed the potential of the Chinese market, upgrading the rating of A-shares from "neutral" to "overweight." However, for investors in the cryptocurrency market, whether to follow this trend requires careful judgment.

Zhao Junpeng, a senior figure in the securities industry in Jiangmen, pointed out that the current market reversal combines favorable timing, location, and human factors. From a macro perspective, the U.S. officially entered a rate-cutting cycle on September 18, marking a turning point for global capital activities. The rate-cutting cycle has led to a gradual outflow of funds from the U.S. into undervalued markets, creating appreciation expectations for domestic assets. On the policy front, after the U.S. rate cut, a series of easing policies were introduced domestically, especially measures targeting the real economy and financial markets, injecting vitality into the market. The central bank established new monetary policy tools to support the stock market, allowing financial institutions to facilitate loans through financial swaps. This policy significantly enhanced institutions' ability to access funds and increase stock holdings, becoming an important force driving the rise of the A-share market.

"October 8 was the first trading day after the holiday, and the domestic A-shares opened with widespread limit-ups. Some market funds chose to take profits and observe, while others opted to adjust their portfolios. At the same time, relevant departments announced strict investigations into credit speculation in stocks to cool the market, leading to a high opening but a decline afterward. However, the underlying logic of this bull market is the appreciation of RMB assets and the liquidity provided to the stock market by policies, so the future remains promising, but it will not be a 'crazy bull' because a 'crazy bull' is not conducive to the stable development of the capital market and the revaluation of Chinese assets," Zhao Junpeng said.

Although the current rise in A-shares benefits from policy support, the fundamentals of A-shares have not fundamentally changed. Historically, A-shares have experienced multiple "policy bull markets," but often the market quickly retreated after the effects of the policies weakened.

Are A-shares "Sucking Blood" from Cryptocurrencies?

The strong performance of A-shares has led some funds to flow from the cryptocurrency market into the A-share market. Due to the high volatility of the A-share market and policy support, investors may seek higher returns in the short term. This flow of funds is considered temporary, and as the A-share market stabilizes, funds may flow back into the cryptocurrency market.

The unique appeal of the cryptocurrency market: Although A-shares have attracted some funds from the cryptocurrency market in the short term, the cryptocurrency market still offers high risk, high returns, and a decentralized global investment philosophy. This characteristic has a lasting appeal for speculative funds, and due to the difficulties in entering and exiting the cryptocurrency market, the speed of fund withdrawal is relatively slow.

Continuous advancement of technological innovation: In the face of global economic uncertainty, the cryptocurrency market remains an important battleground for technological innovation. The application of blockchain technology is expanding across multiple industries, and the development of DeFi, NFTs, DAOs, and other fields brings new opportunities to the market. The rise of Layer 2 solutions and emerging public chains has improved market infrastructure, laying the foundation for large-scale applications in the future.

Conclusion

The bullish trend in A-shares has attracted a significant inflow of funds, including from investors in the cryptocurrency market. However, for long-term participants in the cryptocurrency market, whether to follow this trend into A-shares requires calm consideration. Although the cryptocurrency market is highly volatile in the short term, its potential for technological innovation and globalization remains substantial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。