BTC Breaks Below $60,000

The relationship between Bitcoin (BTC) and the US dollar has always been a key topic in the cryptocurrency market. Recently, as the phenomenon of Bitcoin decoupling from the dollar re-emerges, discussions in the market about whether this trend is good or bad have intensified.

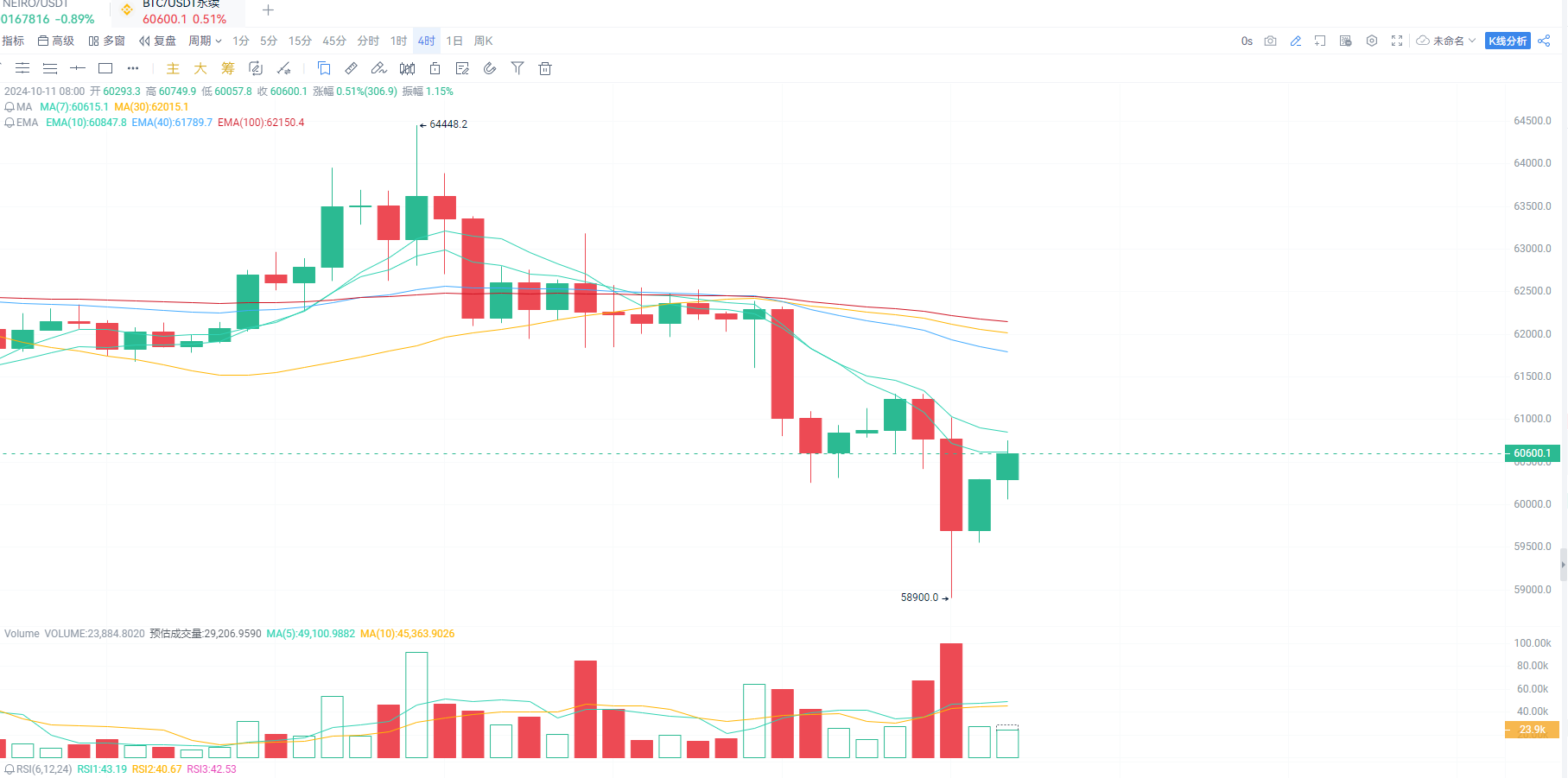

As of October 11, BTC fell about 4% during afternoon trading in the US, dropping to $59,000, the lowest level since the Federal Reserve unexpectedly cut interest rates by 50 basis points in mid-September. Other cryptocurrencies, such as Ethereum (ETH) and the broad cryptocurrency benchmark CoinDesk 20 index, also experienced declines, with Ethereum down 3.5%. Meanwhile, US stocks have generally shown an upward trend since the rate cut, indicating that BTC is once again decoupling from the stock market.

Image Source: AICoin

BTC Decoupling from US Stocks May Indicate a Maturing Crypto Market

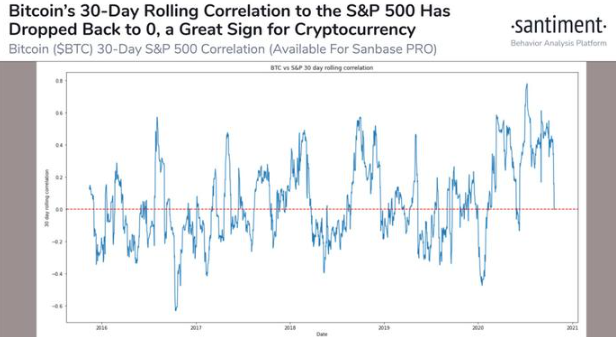

The decoupling of Bitcoin from the US dollar is not a new phenomenon. As early as 2020, after the correlation between Bitcoin and US stocks reached an all-time high, a decoupling trend began to emerge. Market data at that time showed that the correlation between Bitcoin and the S&P 500 index had dropped to zero.

Image Source: Internet

This trend indicates that Bitcoin, as a relatively independent digital asset, is no longer entirely influenced by the movements of the US dollar. Instead, its price fluctuations are increasingly affected by the global economic environment, geopolitical factors, and other macroeconomic indicators.

The short-term decline in Bitcoin's price may be attributed to oversupply and market selling pressure. The Bitcoin market has recently been impacted by oversupply, including the sale of seized Bitcoins by the German and US governments and the distribution of Mt. Gox tokens. These events have led to an increase in the supply of Bitcoin in the market, limiting its price appreciation potential. Additionally, Bitcoin miners are facing pressure on profitability due to the halving event and low prices, forcing them to sell some tokens to maintain operations. This has also created downward pressure on Bitcoin's price.

The decoupling of BTC from US stocks to some extent reflects the safe-haven attributes of cryptocurrencies. During economic downturns, some funds flow into Bitcoin to avoid the uncertainties of the traditional financial system, creating an independent market trend compared to the volatility of traditional financial markets.

Overall, the reasons for Bitcoin's decoupling from US stocks mainly include the imbalance of supply and demand in the market, Bitcoin's safe-haven attributes, the increasing maturity of the market, and the influence of macroeconomic policies. The decoupling phenomenon is seen as a positive sign of Bitcoin's market maturity and independence.

Multiple Institutions Remain Optimistic About the Crypto Market

Arthur Hayes, co-founder of BitMEX, analyzed the trend of the Federal Reserve's interest rate cuts and their impact on the economy. He believes that the Federal Reserve typically continues to cut rates in the face of high volatility until rates approach 0%. Rate cuts will promote bank credit growth, and the government will continue to borrow to gain public support.

10X Research also pointed out in its latest report that the issuance of stablecoins has surged, with an expected increase of nearly $10 billion in liquidity over the next few weeks, far exceeding the liquidity of Bitcoin ETFs. Recently, the inflow of Circle's stablecoin USDC reached 40%, indicating an increase in allocation by large market participants, possibly related to the revival of DeFi activities. So far this year, the total inflow of stablecoins has reached $35 billion, bringing the total value of circulating stablecoins to $160 billion.

The report also mentioned that after the July FOMC meeting, US bond yields fell significantly, with the 10-year Treasury yield dropping below 4.0%, triggering a revival of DeFi activities. Aave's lending platform saw monthly fees soar to $43 million in August. Although activity slowed in September, it may rebound after the Federal Reserve's rate cut.

MN Trading: Although I personally lost over 50%, I remain optimistic about altcoins. The trend of ETF fund inflows will continue, and Asia may provide momentum for the bull market.

Michaël van de Poppe, founder of MN Trading, stated: "There has been a significant inflow of funds into Ethereum and Bitcoin ETFs. I believe this trend will continue, as these two blue-chip assets are the best bets against the potential failure of the dollar. Meanwhile, China is pushing the market forward. Perhaps Asia will provide the momentum for the bull market."

Conclusion

Although BTC has fallen in recent days and has not followed the rise of US stocks, indicating a decoupling from the stock market, this actually signifies a maturing and independent crypto market. Multiple institutions remain optimistic about Bitcoin's performance in Q4 of this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。