Original Title: [Next-Gen Layer 1 Tokenomics: Three Pillars for the Token Flywheel]

Written by: Eren, Four Pillars

Translated by: Tia, Techub News

The Shift in Layer 1 Tokenomics

Recently, projects that have gained significant attention and investment (such as Berachain, Monad, Story Protocol, Initia, and Movement) share a commonality: they are all Layer 1. These projects have chosen to develop their own L1 solutions rather than building Layer 2 on Ethereum. Typically, they construct their own ecosystems by leveraging their unique features and economic models. Each project also has its own mission, with some focusing on high-performance EVMs and others optimizing Rollup execution environments. In summary, they are all committed to proposing new L1 solutions.

Which of these projects will become the next generation of L1 and achieve sustainable growth? While the importance of technical strength and community engagement cannot be overlooked, tokenomics plays a crucial role in the development of L1. Therefore, this article will focus on assessing the robustness of various L1 tokenomics.

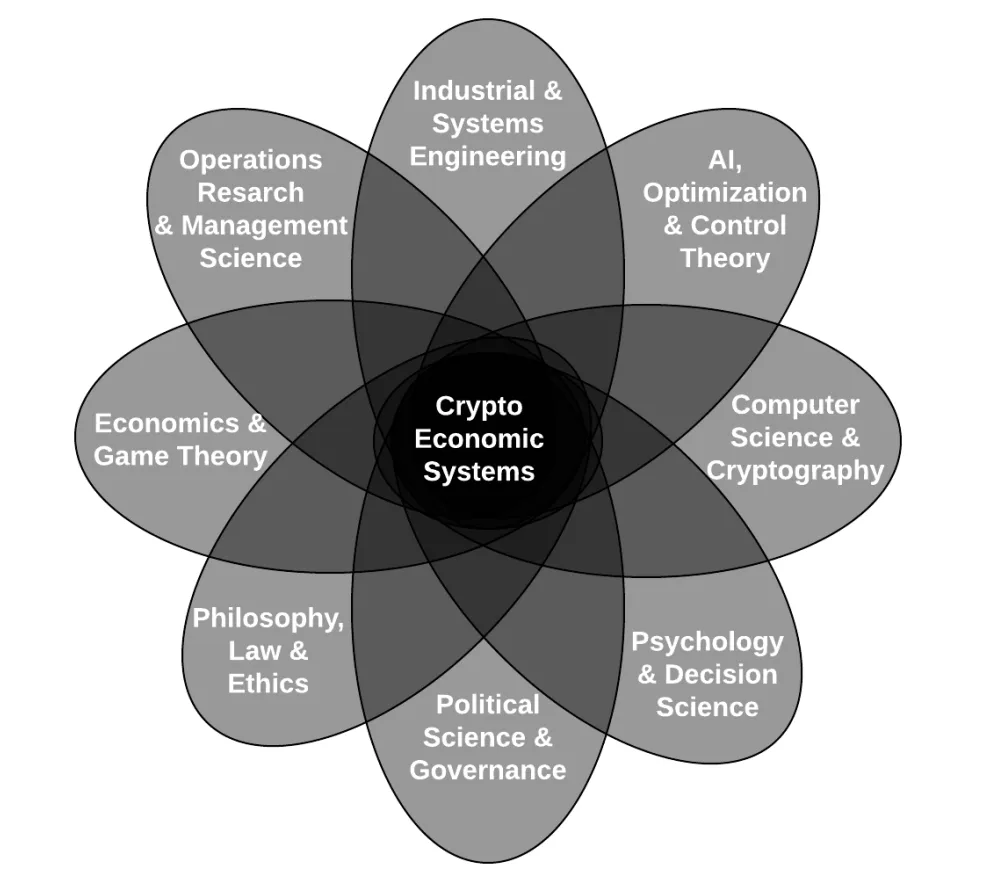

Source: Foundation of Cryptoeconomic Systems

The operation of L1 is very similar to that of a nation. L1 acts as the country, ecosystem protocols constitute local economies, and users or communities act as participating entities. In this framework, tokens organically link various economic units together, serving both as economic incentives and as reserve currencies.

In this context, what role does tokenomics play in the L1 "nation"? Tokenomics is an economic system that incentivizes network participants to actively engage and ensures the network operates smoothly. At the same time, it needs to regulate the supply and demand of tokens to maintain stable value.

Thus, the design of tokenomics reflects the economic system of a nation. Just as countries consider geographical conditions, industrial structures, political systems, and cultures to design their economic systems, L1 tokenomics must reflect technological architecture, Dapp ecosystems, governance, and community characteristics.

However, many L1 blockchains that emerged during the ICO boom from 2017 to 2019 adopted uniform tokenomics, overlooking the uniqueness of different networks. This led to the emergence of “billion-dollar zombie blockchains”. While these blockchains maintain high valuations, they fail to deliver actual value.

Today, tokenomics has begun to grow complex. It not only requires monitoring the supply and demand of tokens at the network level but also needs to introduce tokenomics optimized for technological architecture while considering the distribution of interests among different roles in the network (such as validators, protocols, and users). This article will use Berachain, Initia, and Injective as examples to introduce three dimensions that address the limitations of existing tokenomics and promote sustainable design.

Defects of the Token Flywheel and the Three Pillars to Solve These Issues

2.1 Basic Overview of Tokens and Tokenomics

The Role of Layer 1 Tokens

"Why do we need tokens?" While tokens are effective tools, this question is difficult to answer. However, for L1, issuing tokens is reasonable because tokens are needed to reward validators. The native tokens of L1 have three main functions:

Reserve Currency: Users pay network fees with native tokens when using block space. When L2 uses the main chain as a DA (data availability) layer, native tokens can also serve as storage costs.

Incentive Tool: Honest validators who verify the legitimacy of transactions will receive native tokens as block rewards. Additionally, L1s with "Unified Liquidity" features will provide native tokens as rewards to encourage liquidity provision.

Unit of Value: The native tokens issued by L1 directly or indirectly reflect the value created by L1. Market participants trade L1 tokens like Ethereum based on their assessments of Ethereum's business performance and market position.

The Role of Layer 1 Tokenomics

While tokens have specific roles, the function of tokenomics that controls token flow is entirely different. The term "tokenomics" is often narrowly defined as the destruction mechanisms used to adjust supply or token distribution methods (maximum supply, distribution ratios, unlocking schedules, etc.). However, for our discussion, tokenomics encompasses not only destruction mechanisms and distribution methods but also the incentive systems that coordinate participant interests, token utility, and revenue distribution models—essentially the entire economic system based on tokens.

In this context, the fundamental role of tokenomics is to create a system that incentivizes participants to engage in desired behaviors, ensuring the smooth operation of the L1 network. Specifically, it designs reward structures to encourage behaviors that benefit the network, such as enhancing security or providing liquidity. For this reward system to be effective, the rewards must hold sufficient value and be meaningful to contributors. Therefore, tokenomics must also include mechanisms to regulate token supply and demand to maintain reward value.

2.2 The Circular Growth Structure Created by Tokenomics: The Token Flywheel is the Endgame

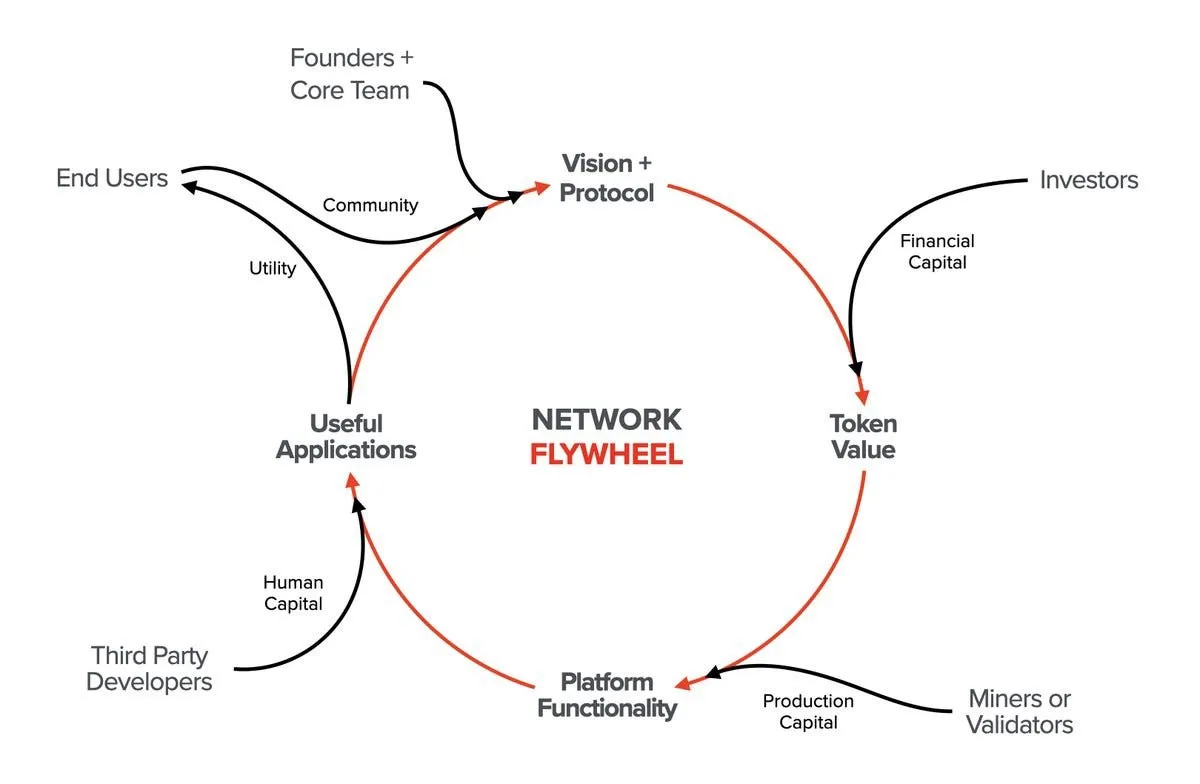

Source: X(@alive_eth)

Well-designed tokenomics has the potential to create a flywheel effect, where value circulates to promote organic growth of the network. This model assumes that interactions between validators (responsible for blockchain security), developers (creating applications), and users (forming communities) create a circular growth structure. Through "network effects," economies of scale are achieved, accelerating network growth. Let’s trace the flywheel process from the bottom up:

After the core team presents a new vision to the market, initial capital completes the basic infrastructure of the L1 network and generates token value (in private or public markets).

As token value is generated, validators contribute to guiding the supply side of the network in exchange for token rewards. For example, validators earn block rewards by verifying transactions, providing security and functionality to the network.

Once the L1 network establishes stable functionality and security, developers join and build useful applications on the network.

These applications provide real value to end users, driving demand for tokens. In this process, a community forms around users, becoming supporters of the L1 network.

As the network becomes more active, the community grows larger, and demand for tokens increases, with tokens serving as both reserve currency for network fees and units of value reflecting network value. Thus, market demand for tokens rises.

As token demand increases, validators have stronger incentives to support the security and functionality of the network → this improves network security and development environment, encouraging developers to build more useful applications, providing more value to users → token demand rises → incentives are strengthened → network security and functionality improve → application development → community becomes more active → Flywheel

Once this flywheel starts turning, the L1 network gains the momentum for self-sustaining growth. The network no longer needs to be driven solely by the core team; instead, growth accelerates automatically through token incentives. This flywheel maximizes the potential of tokenomics and is often seen as the ultimate goal that all tokenomics should strive for.

2.3 The Token Flywheel is a Meme

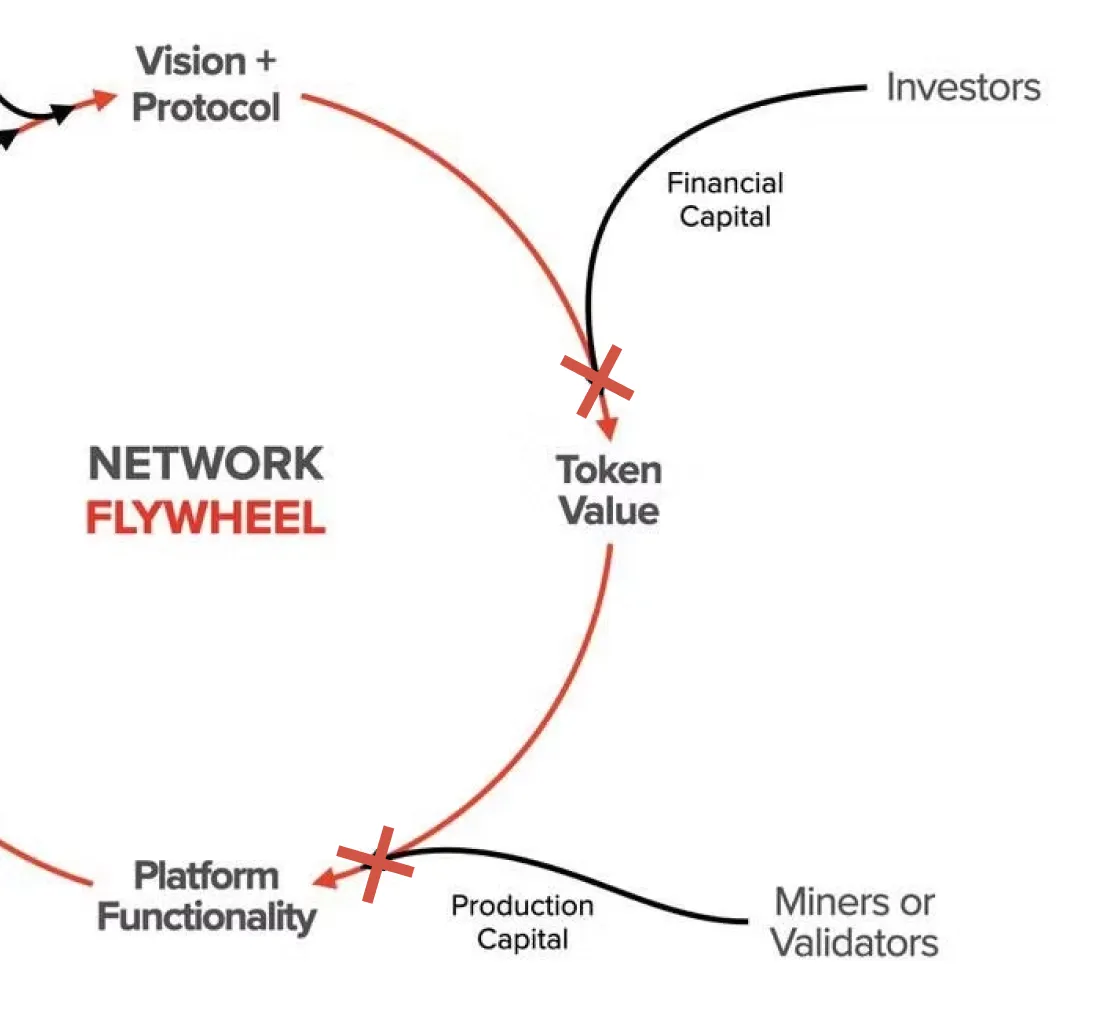

Source: X(@alive_eth)

The flywheel model assumes certain facts when creating a circular growth structure. It assumes that as network activity increases, token demand will also grow, providing a basis for strengthening incentives for ecosystem contributors. It also assumes that enhanced incentives will prompt validators to contribute to the ecosystem in any way, thereby creating an environment for more useful applications. We need to question these seemingly obvious assumptions. Many existing L1 networks seem to struggle with creating sustainable tokenomics, often lacking key elements in three areas:

- Are the incentives for all participants truly aligned?

L1 networks involve various types of participants with different interests within the ecosystem. If the structure combining these complex interests with growth collapses, the flywheel will stop turning. In particular, we should question whether validators will necessarily contribute to the ecosystem in other ways when token demand increases and their interests are strengthened, as suggested by the flywheel model above.

The interests of validators are not unrelated to the development of the ecosystem. Their block rewards are given in the form of L1's native tokens, so an increase in token demand and value is beneficial to them. Additionally, as the application ecosystem attracts users and generates more transactions, network congestion may increase, which could enhance validators' incentives. Most L1 networks (such as Ethereum's PoS network) adopt a gas fee mechanism, meaning that the more congested the network, the higher the fees validators receive.

However, at the network level, there is no direct mechanism requiring validators to contribute to the ecosystem, which weakens the relationship between validators and the protocol or users. The lack of a direct link between strengthening validator incentives and activating the ecosystem means there is little motivation for ecosystem contributions. Conversely, when individual stakers cannot obtain substantial returns, users or protocols have no clear methods or incentives to contribute to economic security. The low governance participation rate across all L1 ecosystems indicates that individual users lack a clear motivation to contribute to network consensus. In other words, the interests of validators are not directly connected to those of other ecosystem participants.

- Does increased network activity lead to increased token demand?

It is difficult to assert that as applications emerge and users join, increased network activity will necessarily lead to increased token demand. Without an inherent structure or with only a weak structure linking network activity to native token demand, network activity and token demand may not align. As will be discussed in detail later, Ethereum is currently experiencing such a situation: L2 activity is increasing, but the factors driving demand for ETH are very low. Like Ethereum, every blockchain network has its unique technological architecture. Therefore, tokenomics should reflect this architecture well.

- How do tokens capture value?

While similar to the previous question, we can rephrase it: how do tokens acquire value? Let’s assume the flywheel unfolds ideally, with token demand increasing as the network activates. Does this necessarily lead to an increase in token value? Clearly, an increase in token demand does not automatically mean an increase in token value. Setting aside market speculation (independent of fundamental ecosystem growth), simple calculations indicate that token demand must exceed the newly created token supply for value to increase. Therefore, mechanisms that increase token demand or reduce supply during network activation should lie between the two. This point is sometimes overlooked or fails to function effectively, preventing the feedback loop of network activation → token demand → token value increase.

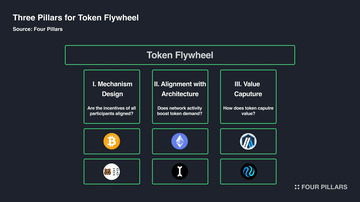

2.4 The Three Pillars to Correct the Token Flywheel

To summarize what has been discussed so far, L1 tokens serve as the reserve currency of the network, an incentive tool to encourage contributions, and a unit of value reflecting the value created by the network. L1 can construct tokenomics as an economic system to coordinate the interests of ecosystem participants and ensure the active operation of the network through tokens and incentive mechanisms. Well-designed tokenomics has the potential to promote self-sustaining network growth through the value created by token incentives within the network.

However, the idealized token flywheel often diverges from the phenomena observed in actual L1 networks. This is because positive feedback loops fail to operate effectively in inducing participant behavior or connecting value. Specifically, this is due to insufficient consideration of whether the incentives for all participants are truly aligned, whether network activity leads to increased token demand, and whether value accumulates in the tokens.

These limitations often lead existing L1 networks to lose the sustainability of their tokenomics in many cases. Therefore, in determining the direction that next-generation L1 tokenomics should take, we need to examine these previous limitations more closely by specifying them. To this end, let’s transform the questions regarding the token flywheel into key points for L1 tokenomics design: I. Mechanism Design, II. Consistency with Architecture, III. Value Capture. In the next section, we will continue to discuss the limitations and reasons exhibited by existing tokenomics through case studies while clarifying the above key points.

I. Are the incentive mechanisms for all participants truly aligned? → Mechanism Design

II. Does increased network activity lead to increased token demand? → Consistency with Architecture

III. How do tokens capture value? → Value Capture

Lessons from the Millennium Era L1

Given the complexity of tokenomics, relying on a single factor to judge a tokenomics case may lead to a one-sided interpretation of phenomena. However, as one method of seeking sustainable tokenomics, attempting to define the limitations encountered by existing cases and drawing lessons may be a good approach. Let’s examine 1) the limitations Bitcoin faces in mechanism design, 2) the coordination issues between architecture and tokenomics revealed by Ethereum, and 3) the structural limitations of the Arbitrum token in failing to capture value from the network, to substantiate the three pillars of tokenomics that support the flywheel.

3.1 Pillar One — Mechanism Design: Bitcoin

Bitcoin is one of the most innovative inventions since the birth of blockchain and has become an important asset in traditional financial markets. However, there is a significant gap between the expected functions of Bitcoin at its inception and its current role. As the role of Bitcoin as an asset has evolved, the initial incentive mechanism design no longer aligns with its current function, leading to concerns about a lack of incentives to maintain Bitcoin's security in the future. This reality is reshaping Bitcoin's development roadmap. Let’s take a closer look at the Bitcoin case, focusing on mechanism design, which can be summarized as "how much reward to provide, how to provide the reward, and what behavior to induce from participants."

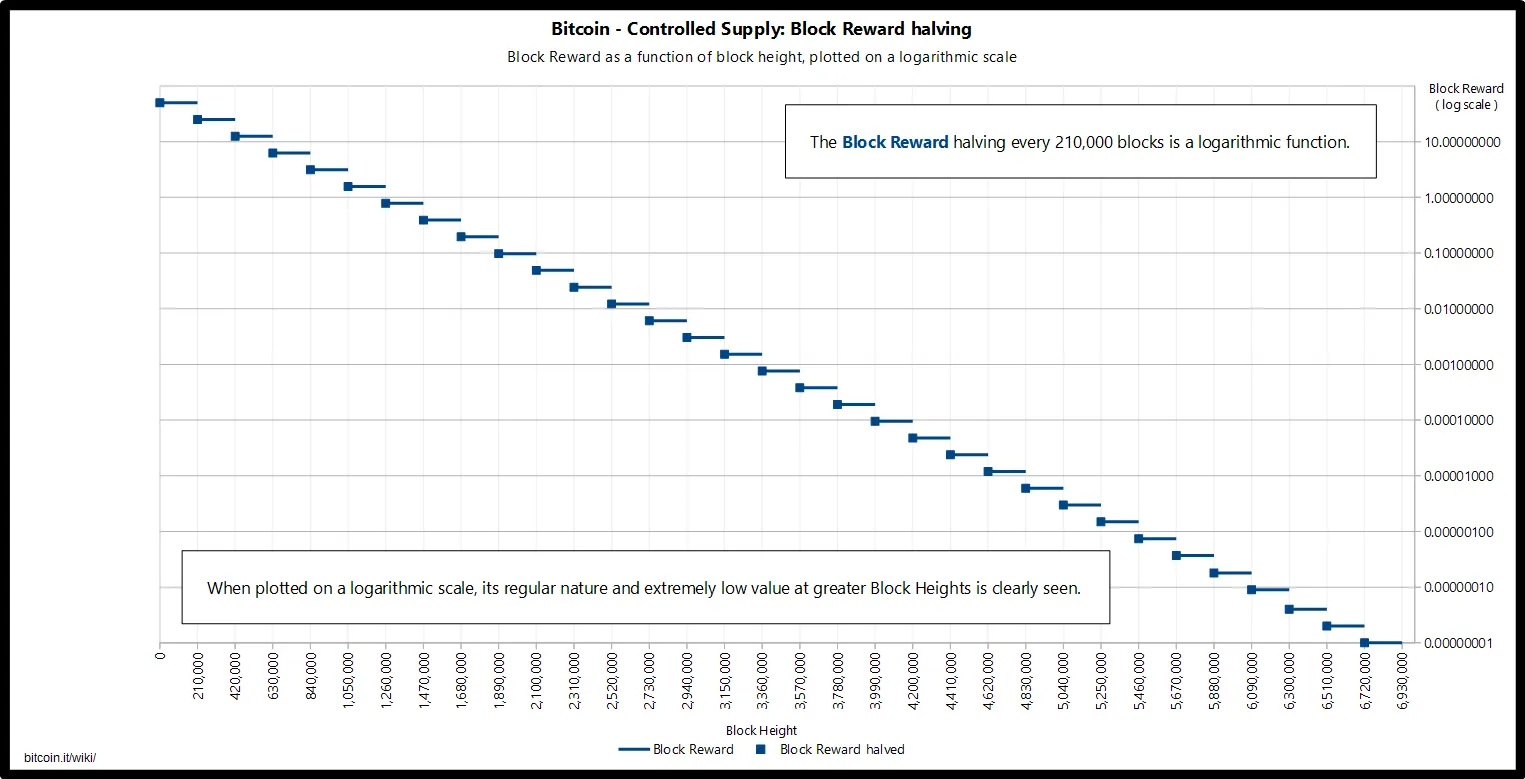

Bitcoin Tokenomics: The Premise of Halving

To summarize Bitcoin's mechanism, it combines network security with node incentives by rewarding mining nodes that generate valid blocks and adhere to the PoW (Proof of Work) consensus algorithm rules. Nodes participating in the network compete to compute hash values, consuming computational power to earn block rewards for adding valid blocks to the longest chain. For malicious nodes attacking the network, they need to control more than half of the computational power dedicated to PoW. This is practically difficult, and even if achieved, attackers would lose motivation as the attack would lower Bitcoin's value, causing them to incur losses. Through this dynamic, Bitcoin achieves Byzantine Fault Tolerance (BFT), operating as a decentralized currency system through node consensus without requiring third-party trust.

Source: Bitcoin Wiki

Thus, the block rewards earned by mining nodes are crucial for maintaining Bitcoin's decentralization and security, as they incentivize nodes to act honestly and actively participate in the proof-of-work process. However, a close examination of Bitcoin's reward mechanism reveals that to limit inflation, block rewards are halved approximately every four years, eventually stopping altogether. Therefore, miners will increasingly rely on transaction fees rather than inflationary block rewards.

The design of this halving reward mechanism is based on the assumption that Bitcoin will ultimately serve as a payment currency, with transaction fees completely replacing mining rewards. Contrary to the current perception of "store of value" (SoV), Bitcoin was born to replace centralized electronic payment systems. However, it is well-known that Bitcoin faces scalability issues as a payment currency, while solutions like USDC or USDT are already sufficient to replace payment currencies.

In response, some have suggested that Bitcoin needs to modify its strategy, summarizing the solutions for Bitcoin mining incentives as follows. One scenario is that as Bitcoin's supply becomes increasingly limited, its scarcity will naturally increase, potentially resolving this issue. Ultimately, as Bitcoin evolves into a true store of value, its value may rise significantly, providing sufficient incentives for block generation even without mining rewards. Another solution is to develop Bitcoin into a programmable asset and network through initiatives like BTCFi or Bitcoin L2. This approach aims to make Bitcoin a more productive asset rather than "lazy digital gold," thereby increasing transaction fees generated within the Bitcoin network.

Bitcoin Highlights the Importance of Mechanism Design

While discussions about Bitcoin's scalability continue, the potential absence of future miner incentives, contrary to the initial tokenomics design, raises critical questions about Bitcoin's sustainability. If mining rewards eventually cease, no one will expend computational power to gain block generation rights, which could lead to Bitcoin transactions no longer being recorded on the blockchain. Consequently, the market has set a new mission to gradually increase transaction fees, making Bitcoin a more productive asset to replace mining rewards. This has become an important task, driving an influx of developers and the expansion of the Bitcoin ecosystem.

The Bitcoin case emphasizes the importance of mechanism design in tokenomics—"how much reward to provide, how to provide the reward, and what behavior to induce from participants." Here, mechanism design refers to the method of setting contexts and incentives so that tokenomics participants take actions to maximize their returns. Mechanism design is also known as "reverse game theory." Game theory predicts how individuals will make strategic decisions to take actions that align with their best interests, while reverse game theory designs optimal mechanisms that allow self-interested individuals to collectively achieve any goal. In other words, it ensures that validators responsible for network security, protocols, and users pursue maximum benefits when participating in the ecosystem, achieving smooth operation and sustainable growth of the L1 network.

3.2 Pillar Two — Consistency with Architecture: Ethereum

Architectural fit can be defined as whether the technological architecture of a blockchain is compatible with the economic model that supports it. L1 networks adopt different structures in their technological architecture, from consensus algorithms to transaction computation structures and the existence of L2. For example, L1 networks with specific goals, such as the Monad blockchain aiming for high-performance EVM networks through parallel transaction processing, or the Story network focusing on IP tokenization, require unique technological architectures. But is merely adjusting the architecture sufficient? As the architecture changes, the types of participants in the network and their interests also change, necessitating the optimization of the economic model to match the architecture. From this perspective, we can examine whether the architecture and tokenomics are consistent, and the challenges Ethereum has recently faced regarding the sustainability of its tokenomics provide a case study for considering this topic from multiple angles.

Ethereum Tokenomics: Layer 2 Parasitizing Ethereum

Ethereum, with its rich liquidity and developer community, has built the largest ecosystem among all blockchain networks. However, recently, Ethereum has faced concerns regarding its economic model, where the value of L2 does not accrue to the Ethereum main chain and ETH. This issue stems from the significant reduction in DA (data availability) fees paid by L2 when sorting transaction data to Ethereum after the EIP-4844 update. This has led to a corresponding decrease in demand for ETH as a gas token. In other words, as the fees paid to Ethereum by L2 decrease, Ethereum's revenue diminishes, while the fundamental demand factors for ETH disappear, leading to the perception that "L2 economically parasitizes Ethereum."

To explore the background in more detail, Ethereum distinguishes gas fees into base fees determined by network congestion and priority fees set arbitrarily by users. The priority fees serve as rewards for validators, while the base fees are burned. Therefore, when the total base fees generated in Ethereum exceed the amount of newly issued block rewards, sufficient ETH is burned, keeping the total supply of ETH in a deflationary state. The fact that the absolute number of ETH in circulation continues to decrease has been recognized by the market, supporting the fundamental demand for ETH as an asset.

However, Ethereum's long-term roadmap is centered around L2, which has facilitated the EIP-4844 update to lower sorting costs and improve L2 scalability. Since this update, the situation has changed. The significant increase in L2 transactions and unique active addresses indicates that end users can now use L2 applications with lower network fees as alternatives to Ethereum. On the other hand, Ethereum has structurally gained a "disadvantage" compared to L2. Although L2 has been activated, the average gas fees on Ethereum have dropped to 1 Gwei, resulting in an inflationary state for ETH supply. This is why people criticize L2 for economically parasitizing Ethereum.

Ethereum's Proof-of-Stake Architecture and Economic Model Need Coordination

Ethereum continuously upgrades its architecture through L2 to compensate for the shortcomings of the main chain's scalability. This raises the question: Given that Ethereum's scalability has significantly improved and L2 activity has indeed increased, has Ethereum effectively achieved its goals? Ethereum has announced a rollup-centric roadmap aimed at creating a highly scalable blockchain environment while maintaining sufficient decentralization. Therefore, the reduction in L2 operational costs and the increased convenience for end users since EIP-4844 may align with Ethereum's architectural upgrade goals.

However, the Ethereum case illustrates that even when viewed as a transitional phase towards a rollup-centric roadmap, problems arise when the technological architecture and economic model are inconsistent. While L1 has improved its architecture to fulfill its mission, usability and activity have correspondingly increased, the connection between the value generated from this activity and the economic model has been broken. The link between L2's scalability and Ethereum's economic benefits has been lost. Proposals like EIP-7762, which increases the blob fees paid by L2, indicate that L2 scalability may regress, suggesting that Ethereum has encountered a situation where the growth curves of architecture and economic model are inconsistent.

This indicates that tokenomics cannot be considered separately from the architecture built on Layer 1. If Layer 1 has a clear problem to solve and a mission to accomplish, its technological architecture will be constructed as a methodology. Subsequently, the tokenomics design optimized for that architecture should follow suit. This issue is more likely to arise in modular blockchains, where there is a risk of economic fragmentation. Beyond Ethereum, the Cosmos IBC ecosystem has also spawned various application chains based on its unique technological architecture, but it maintains a fragmented ecosystem without a single value chain linking application chains into a unified economic system. In other words, if unique interests form among ecosystem participants during the architectural development process, an optimized economic model is also needed.

3.3 Pillar Three — Value Capture: Arbitrum

Value capture refers to the mechanism by which tokens capture value from the network. Even if the network becomes highly active, a mechanism that directly adjusts token supply and demand is needed to increase the fundamental demand for tokens. The lack of connection between Arbitrum and ARB illustrates the importance of value capture mechanisms well.

Arbitrum Tokenomics: L2 Tokens as Meme Tokens

Arbitrum is currently the most active among all L2 networks, with approximately 700 protocols in its ecosystem generating about 5 million transactions weekly according to data. However, despite its high network activity, ARB faces criticism for being indistinguishable from meme tokens, lacking utility beyond governance functions. It lacks fundamental demand factors recognized by the market. Although various market variables complexly influence token prices, making price fluctuations difficult to explain simply, the token mechanism that creates a long-term willingness to buy or hold tokens plays a crucial role in market participants' assessments of token value. In fact, ARB's price has not escaped a downward trend, having fallen 66% since the beginning of the year, with data from IntoTheBlock showing that 95% of existing ARB holders are at a loss.

In response, Arbitrum DAO recently passed a proposal to introduce staking functionality for ARB. The core of this proposal is to allow governance rights to be delegated through ARB token staking and to strengthen the staking reward system. First, staking ARB will enable earning interest from various revenue sources (such as sorting fees, MEV fees, and validator fees). Additionally, by introducing liquid staking, ARB depositors can interoperate stARB with other DeFi protocols while maintaining their staking status.

This update to the tokenomics will produce various expected effects. The Arbitrum DAO treasury has accumulated ETH worth $45 million, but less than 10% of ARB in circulation is available for governance. Therefore, strengthening the motivation for governance delegation through ARB staking provides an opportunity to enhance governance security. Another important role is to encourage token holders to be willing to hold ARB long-term.

The Importance of Value Capture Mechanisms Highlighted by Arbitrum

Value capture involves accumulating network value in the form of tokens by distributing the revenue generated by the network to ecosystem contributors or directly or indirectly adjusting token supply. Value capture is important not only for L2 or DeFi protocols (as illustrated by the Arbitrum case) but also for L1 tokenomics. Particularly for L1 native tokens, they can serve as incentives for ecosystem participants to engage in beneficial actions for the network; tokens must be viewed as rewards with appropriate value to expect participants to make sufficient contributions.

The method of capturing value through tokens is achieved by mechanisms that combine network demand with the dynamics of token supply and demand. For example, if network revenue is used to purchase tokens from the market and burn them, the absolute number of tokens supplied to the market will decrease. Alternatively, there is a method of directly redistributing the revenue generated by the network to stakers. This value capture mechanism can create fundamental demand factors for tokens or adjust the number of tokens in circulation in the market, forming a virtuous cycle. This cycle can lead to L1 activation, resulting in an increase in token value, thereby strengthening incentives for contributions and further increasing L1 activity.

Next-Generation Layer 1 for Sustainable Tokenomics

Thus, through the study of existing tokenomics cases, we have been able to clarify the three key points for creating a token flywheel. Of course, it will take a long time for Bitcoin's block rewards to completely disappear, so it is still far from certain. Ethereum and Arbitrum are engaged in intense discussions to address current issues, leaving room for future improvements. Nevertheless, the problems encountered by existing tokenomics have already accumulated valuable lessons. When there is a lack of incentives for ecosystem contributions, inconsistencies between economic models and technological architectures, or when network activity fails to translate into token value growth, tokenomics risks losing sustainability.

However, meeting all these criteria is not as easy as it sounds. The common solutions proposed by Berachain, Initia, and Injective involve directly participating at the network level, adjusting the interests of participants, or designing tokenomics that fit the technological architecture. Alternatively, they attempt to adjust token supply and demand through unique mechanisms to overcome the limitations shown earlier. This strategy of deeply engaging in tokenomics at the network level has the potential to effectively supplement the missing flywheel in existing tokenomics. From here, let’s see how Berachain addresses the issue through its complex PoL mechanism design, how Initia plans to economically connect decentralized Rollup ecosystems through VIP, and why Injective can maintain its token in a deflationary state over the long term.

Mechanism Design: Berachain, Proof of Liquidity

Mechanism design involves creating a system where L1 participants contribute to the active operation and sustainable growth of L1 while pursuing their maximum interests. Focusing on this area, Berachain has newly proposed PoL (Proof of Liquidity) as a consensus algorithm, addressing the issue of misaligned interests by closely intertwining the interests of ecosystem participants with the reward system.

Overview of Berachain

Berachain is an EVM-compatible Layer 1 built using BeaconKit, which is developed by modifying the Cosmos SDK. Similar to Ethereum's beacon chain structure, Berachain uses BeaconKit to separate the execution layer and consensus layer, employing ComtBFT as the consensus layer and EVM as the execution layer, ensuring high compatibility with the EVM execution environment. With its solid technical strength, Berachain has been long-term building its community and development environment, starting from the NFT project Bong Bears. Therefore, although it is still in the testnet phase, various protocols have joined, showing high community engagement.

Berachain Tokenomics

What makes Berachain unique is PoL, which adjusts the interests of participants at the network level. PoL is a consensus algorithm specifically designed to stably ensure liquidity and security while strengthening the role of validators in the ecosystem. It focuses on mechanism design, where each ecosystem participant prioritizes their own interests while promoting network growth in an interdependent relationship. Let’s take a look at how Berachain aligns the individual interests of 1) users, 2) validators, and 3) protocols at a single growth intersection.

First, Berachain has three tokens: BERA, BGT, and HONEY. Each token plays a different role in the operation of PoL. BERA serves as the gas token for network fees, BGT (Bera Governance Token) is used as a reward for providing liquidity and as a governance token to determine reward ratios. HONEY is Berachain's native stablecoin, pegged 1:1 to USDC. While Berachain has this triple tokenomics, we will now focus on BERA and BGT to simplify our discussion of the PoL participant structure. To understand Berachain's mechanism design, we need to pay more attention to the special functions of BGT.

BGT is a token that can serve as a reward for providing liquidity to whitelisted liquidity pools (whitelist reward treasury), as determined by governance. BGT is provided in a non-tradable state bound to the account, and while BGT received as a reward can be exchanged 1:1 for BERA, the reverse exchange (BERA → BGT) is not possible. Therefore, providing liquidity is the only way to obtain BGT.

The supply of BGT is determined by validators voting on how much BGT issuance is allocated to which liquidity pool. Users who obtain BGT have two options: one is to exchange BGT for BERA for liquidation, and the other is to delegate it to validators for additional rewards. Here, the additional rewards refer to bribes flowing from the protocol through validators to users, which we will elaborate on later.

The reason Berachain separates the gas token and governance token into BERA and BGT is to ensure liquidity and security within the ecosystem. In L1 networks using a single token, staking tokens to enhance PoS security limits the number of tokens available for liquidity in the ecosystem. Therefore, by allowing BGT to be obtained solely through providing liquidity for security, Berachain aims to address the inconsistency between network liquidity and security. Additionally, by allowing validators to allocate the issuance rate of BGT, it strengthens the structure of aligned interests among ecosystem participants by increasing the interdependence between validators, protocols, and users.

Now that we understand the basic principles of PoL and the roles of BERA and BGT, let’s see how ecosystem participants interact under this mechanism design. Following the flow of BGT, liquidity, and bribes from (1) to (6), we can understand how ecosystem participants interact under certain interests.

User ↔ Protocol

(1) Liquidity: Users deposit liquidity into the whitelisted liquidity pool of their choice. The protocol utilizes the liquidity from this pool to provide a smooth trading environment for protocol users.

(2) BGT + LP Rewards: When users provide liquidity to the whitelisted pool, the protocol rewards them with BGT rewards and liquidity provision rewards for their deposits. Here, the protocol needs to ensure the issuance rate of BGT is as high as possible to encourage users to choose its liquidity pool.

Protocol ↔ Validators

(3) Bribes: Validators have governance rights to determine the BGT issuance rate for liquidity pools. Therefore, the protocol offers bribes to validators to vote in favor of their liquidity pools.

(4) BGT Issuance Voting: Unlike other L1s, Berachain's validators do not directly receive L1 tokens as network validation rewards based on inflation rates. Instead, they receive incentives for network validation through bribes provided by the protocol (excluding any priority fees that may occur irregularly). Therefore, to obtain sufficient bribes from the protocol, they need to acquire more BGT to gain stronger governance rights.

Validators ↔ Users

(5) Bribes: Validators gain stronger governance rights by obtaining BGT delegated by users through liquidity provision. To do this, they need to return the bribes received from the protocol to users or provide separate incentives to increase the amount of delegated BGT.

(6) Delegating BGT: Users delegate BGT to validators in exchange for bribes received from the validators.

Token Economic Direction Proposed by Berachain's Mechanism Design

In summary, Berachain aims to ensure liquidity and security in the ecosystem through PoL and addresses the issue of fragmented interests among validators. Berachain goes beyond the existing approach of using a single token as a base currency serving all roles by distinguishing between BERA for liquidity and BGT for governance, resolving the trade-off between liquidity and security. By constructing a system where validators receive rewards through bribes and are empowered to determine the issuance of BGT, it strengthens the interdependence between validators, protocols, and users.

Of course, as the complexity of the mechanism increases, the learning difficulty for end users will also rise, so whether the PoL-centered interactions can proceed smoothly after the mainnet launch remains to be seen. However, Berachain's tokenomics is quite mature in mechanism design, addressing the issue of discontinuity in the flywheel caused by misaligned participant incentives, pointing to an important direction for L1 tokenomics.

Alignment with Architecture: INITIA, VIP

Initia aims to address the inconsistency between architecture and economic models that arises when the architecture needs to remain aligned with the network. Initia focuses on the fragmentation issues faced by the existing Rollup ecosystem. According to its mission of "Interwoven Rollup," it aims to establish an ecosystem where L2 Minitias are distributed around Initia while being closely connected in terms of economy and security. As part of this work, it attempts to connect the fragmented Rollup ecosystem economy through its unique tokenomics, VIP.

Overview of Initia

Initia is a Layer 1 based on Cosmos, supported by MoveVM, and serves as the settlement layer for Layer 2 Rollups known as Minitia. Initia (L1) and Minitia (L2) are interconnected in terms of economy and security, forming a comprehensive ecosystem called Omnitia. Therefore, various functions of Initia are created to strengthen the connection with Minitia L2. For example, in terms of security, if fraud occurs internally within Minitia, Initia's validator nodes will intervene with Celestia to resolve disputes, thereby reconstructing the last valid state. In terms of liquidity, it operates a liquidity center called Enshrined Liquidity at the L1 network level, which Minitia can use to achieve smooth flow and exchange of assets between Minitias through the routing function of Enshrined Liquidity.

Initia Tokenomics

The design focus of Initia is on the interconnection with Minitia L2, so it has designed a mechanism called VIP (Value Incentive Program) for economic connection with Minitia. VIP aims to make INIT, the base currency of the Initia ecosystem, an important component of all L2s. By using INIT to connect Initia and Minitia, it continuously creates use cases for INIT. The VIP process can be roughly divided into three parts: 1) Allocation, 2) Distribution, and 3) Unlocking.

1) Allocation

First, 10% of the initial supply of INIT is allocated as VIP funds. These funds are distributed every two weeks to Minitias and users eligible for VIP rewards. Here, VIP rewards are allocated based on two pools in a separate state: the balance pool and the weight pool. The balance pool rewards are distributed to Minitias in proportion to the amount of INIT held by Minitias. On the other hand, the weight pool rewards are allocated to Minitias based on the weights set by measurement voting in L1 governance. In other words, L1 stakers determine how much reward is allocated to each Minitia through measurement voting. Therefore, the balance pool encourages Minitias to hold more INIT and create use cases for INIT in their applications, while the weight pool creates use cases for the INIT token through measurement voting and encourages validators, users, or bribing protocols (such as Votium or Hidden Hand) to actively participate in L1 governance.

2) Distribution

The rewards allocated to Minitias are provided in the form of esINIT (escrowed INIT), which is non-transferable in its initial state. The recipients of esINIT allocated to Minitias are divided into operators and users. Here, operators refer to the project teams operating Minitias. Project teams that receive operator rewards can use esINIT in various ways. They can use it as a development fund to supplement Minitia, redistribute it to active users within Minitia, or stake it in Initia L1 for self-voting in future epochs.

On the other hand, esINIT distributed as user rewards is directly provided to users based on their VIP scores. VIP scores are calculated based on various KPIs set by Minitia, aimed at encouraging users to interact within Minitia. For example, by setting standards for VIP scores (such as the number of transactions generated by users through Minitia within a specific period, transaction volume, or lending scale), Minitia can incentivize users to perform specific actions.

3) Unlocking

As mentioned above, when rewards are allocated to users based on VIP scores, esINIT will be provided as a non-transferable escrow token. Therefore, users need to go through an unlocking process to liquidate the esINIT received as rewards. At this point, users can choose one of two actions to maximize their benefits. One is to maintain their VIP scores over multiple epochs to unlock esINIT as liquid INIT. During this period of maintaining VIP scores, users can accumulate additional points within Minitia, which has the advantage of incentivizing users to retain their holdings from Minitia's perspective. Another way to utilize esINIT is to use it as liquidity pairs deposited into Enshrined Liquidity to earn deposit rewards.

Token Economic Direction Proposed by Initia VIP

In summary, VIP is the tokenomics of Initia, aimed at economically connecting L1 and L2 and creating sustained demand for INIT. In the 1) allocation process, it aims to increase the use cases for INIT and encourage governance participation by providing facilities such as balance pools and weight pools with different allocation methods, thereby activating the ecosystem. In the 2) distribution process, it allows Minitia to incentivize specific user behaviors through VIP scores, thus coordinating the interests of Minitia and users. The 3) unlocking process serves as a mechanism to incentivize users to retain or directly contribute to the Initia ecosystem by providing liquidity.

Through this process, Initia aims to prevent economic fragmentation within the Minitia ecosystem while creating multifaceted use cases for INIT and generating fundamental demand factors for the base token. As modular blockchain infrastructure becomes increasingly prevalent, economic fragmentation within ecosystems is seen as a long-standing issue that must be weighed against the benefits of modular development environments. In this regard, the VIP proposed by Initia provides a meaningful direction for the design of tokenomics in future modular ecosystems.

4.3 Value Acquisition: Injective, Destruction Auctions

Unlike Berachain and Initia, which have not yet launched their mainnets, Injective has been well-known in the market since 2018. However, until recently, it has continuously improved its tokenomics through updates such as INJ 3.0 and Altaris, building a unique deflationary tokenomics through its destruction mechanism. Therefore, discussing L1 tokenomics from the perspective of value acquisition, I believe this is a noteworthy use case and would like to introduce it in this section.

Injective Overview

Injective is an L1 built on the Cosmos SDK and a custom consensus mechanism based on TendermintBFT, optimized for financial applications ranging from spot trading to perpetual futures trading or RWA. As an L1 built for finance, it provides a high-performance blockchain environment with over 25,000 TPS to handle high-frequency trading and utilizes on-chain order matching models such as FBA (Frequent Batch Auctions) to prevent MEV and achieve capital-efficient trading. Additionally, Injective offers plug-and-play modules as part of its development resources. In particular, using the exchange module, it can easily handle processes such as order book operations, trade execution, and order matching, and leverage Injective's built-in shared liquidity to build a financial services environment without the need to attract separate liquidity.

Injective-style Tokenomics

Injective is known for its tokenomics, which achieves deflation through destruction auctions aimed at reducing the circulating supply of INJ in the market. The process of destruction auctions is as follows: when assets generate revenue from Injective applications and flow into the auction fund, these assets will be auctioned off, and people can bid using INJ. After the auction is completed, the winning bidder will exchange the INJ used for bidding for tokens in the auction fund, and the INJ used for bidding will be destroyed, thus removing that amount of INJ from the total token supply. Injective conducts such auctions weekly, as of October 2024, a total of 6,231,217 INJ (approximately $142,000,000) has been auctioned for destruction.

Delving into the destruction auction process, it is conducted through an auction module that handles bidding, winner determination, and INJ destruction, as well as the exchange module. First, the assets in the auction fund are collected through three avenues. One is that a portion of the revenue from applications using the exchange module is transferred to the auction fund. Another is that applications not using the exchange module can transfer a nominal amount or a certain percentage of fees to the auction fund. Finally, individual users can independently donate to the auction fund.

The assets accumulated in this auction fund are primarily in the form of USDT, USDC, or INJ, and anyone can participate in the auction of this fund using INJ. Auction participants have the opportunity to acquire assets from the fund at a slightly discounted price, for example, winning a $100 auction fund with INJ worth $95, naturally generating bidding competition. Finally, the winning bidder will exchange their INJ used for bidding for tokens in the auction fund, and the INJ used for bidding will be destroyed.

Token Economic Direction Proposed by Injective's Destruction Auctions

Injective's destruction auctions accumulate bidding fees generated by the exchange module, thereby creating a structure where the amount of INJ destroyed increases with the trading volume of the exchange module. Therefore, as Injective's trading activity increases, the circulating supply of tokens in the market decreases, allowing the tokens to acquire value from the network. Thus, Injective combines ecosystem growth with token value enhancement through its destruction mechanism and seems likely to continue strengthening its growth-driven token destruction mechanism in the future.

While most blockchains have mechanisms to destroy a certain percentage of network fees, few L1 networks can intuitively adjust token supply like Injective. In particular, since most blockchains, except for Bitcoin and Ethereum (mainnet), are developed with low gas fees in mind, token destruction mechanisms based on network fees are limited when large-scale destruction occurs. Injective is also committed to achieving near-zero transaction fees, with an average fee of $0.0003 per transaction. In this context, the destruction auctions that can conduct large-scale destruction while maintaining low gas fees align with the user environment that future L1 networks aim to develop, making Injective particularly noteworthy in this regard.

Looking Ahead: Why We Should Focus on Next-Generation Layer 1 Tokenomics

5.1 What is the Ideal Layer 1?

So far, we have examined the limitations faced by existing tokenomics and the cases for improving tokenomics, identifying potential directions for next-generation tokenomics. Notably, Berachain, Initia, and Injective exhibit a common trend: they are enhancing their tokenomics through unique mechanisms implemented at the network level. Each project is building tokenomics to leverage its advantages in mechanism design, alignment with architecture, and value acquisition.

Therefore, we conclude what constitutes the ideal tokenomics for L1. Is there an absolute framework for tokenomics to drive the token flywheel? To answer this question, we view tokenomics as an integrated system that includes not only discussions related to tokens but also the missions that L1 aims to solve, its technical architecture, and the behavioral patterns of ecosystem participants. The key insight derived from this process is that tokenomics itself is merely an idea. The value of tokenomics is reflected in the actual interactions between the various elements that constitute the L1 network and its participants.

Thus, we need to shift our perspective from "What is the ideal tokenomics?" to "What is the ideal L1, and what role does tokenomics play within it?" From this perspective, I believe a highly promising L1 is an ecosystem where the mission, architecture, protocols, and tokenomics are organically linked with consistent logic and generate synergies.

A clear mission

Technical architecture faithfully reflecting the mission

An ecosystem filled with protocols and applications aimed at optimizing the network development environment or architecture, which can be described as "only possible on xxx Chain"

Therefore, providing differentiated value to users

This list does not mention tokenomics, but that does not mean tokenomics exists independently; rather, tokenomics should serve as a lubricant to ensure the smooth operation of the gears of architecture and protocols. Diagnosing the L1 networks we examined today with this framework leads to the following conclusions:

5.2 Overview of Berachain, Initia, and Injective

Berachain has designed a unique consensus algorithm called PoL to create an EVM-compatible L1 network that converts liquidity into security and has developed its own framework compatible with EVM, such as Polaris. In addition, several projects are emerging, such as Infrared, which liquidates non-tradable assets BGT, Smilee Finance which hedges impermanent loss to offset the risks of PoL that must focus on liquidity supply, and Yeet Bonds, which allows protocols to autonomously ensure liquidity through bond products, minimizing resources spent on liquidity guidance (liquidity mining, bribing) and achieving self-voting to autonomously ensure the emission of BGT. When these components are combined with PoL (which is both the purpose and means of Berachain) and the triple tokenomics of BERA, BGT, and HONEY, we can expect to build a unique ecosystem where validators, protocols, and users can create synergies and grow together.

Initia is an L1 network built for "Interwoven Rollup," aimed at addressing the fragmentation issues of modular blockchains. To this end, it has constructed various architectures to strengthen the connection between Initia and Minitia, from the Minitia framework Opinit Stack that builds Rollups based on Initia, to Enshrined Liquidity for protecting Minitia's liquidity, and the shared security framework OSS (Omnitia Shared Security) for Minitia's fraud proofs. Based on Initia's architecture, Minitia, specifically designed for modular infrastructure, is emerging, including Tucana (an intent-based DEX that integrates liquidity from modular networks) and Milkyway (aimed at providing re-staking services based on Initia). Here, the VIP tokenomics has the potential to create a virtuous circular economy, where Minitia accumulates the value created in Initia, which in turn increases the activity of Minitia.

Injective has a technical architecture optimized for financial application development, faithfully reflecting its goal of being "a blockchain built for finance." It is based on a high-performance blockchain environment capable of handling high-frequency trading, supporting plug-and-play modules for financial application development, ranging from exchange modules that provide shared order books and shared liquidity to auction, oracle, insurance, and RWA modules. Injective has various financial applications and products developed using these different modules. I believe that the on-chain order book exchange Helix, which provides a trading environment comparable to CEX, and the use of Injective's built-in RWA oracle for launching a tokenized index for BlackRock's BUIDL fund exemplifies what is "only possible on Injective." Here, Injective's tokenomics, specifically the destruction auctions, plays a role in coordinating ecosystem growth with the enhancement of token economic value, facilitating the launch of more killer applications.

It is evident that these projects possess the conditions for the components of L1 networks and tokenomics to generate synergies and grow together. Of course, since Berachain and Initia have not yet officially launched, it is necessary to closely observe the interactions that will occur within the ecosystem over the long term. In particular, both chains are preparing quite complex tokenomics. Therefore, careful consideration from various angles is needed to effectively reduce the high learning curve that users will face and ensure that the tokenomics can be executed as expected in practical implementation.

At the same time, Injective's tokenomics especially needs to activate the application ecosystem as the most critical prerequisite. Currently, Injective averages 2-3 million transactions per day, with a cumulative trading volume of $39.2 billion, indicating high activity and maintaining a stable INJ consumption rate. Looking ahead, the activation of financial products and applications that actively utilize the unique features of the financial professional chain (such as the BUIDL index or the 2024ELECTION perpetual market) will continue to play a key role in maintaining the inherent unique deflationary model of Injective's tokenomics.

5.3 Fundamentals are Key, and Tokenomics is the Fundamental

Is the crypto industry still a "narrative game" without substantial content? Looking at the recent crypto industry, the atmosphere seems quite different. With the RWA market led by large institutions such as BlackRock and Franklin Templeton reaching a scale of $12 billion, the influx of traditional institutions is accelerating, and market participants are not only focused on short-term narratives but also on the actual cash profitability and yield distribution mechanisms of protocols like Uniswap or Aave. Given this situation, fundamentals are becoming an increasingly important topic in the crypto industry.

As fundamentals become more important, tokenomics is undoubtedly the core criterion for assessing the fundamentals of L1 networks. Based on our discussion in this article, we can diagnose the fundamentals of tokenomics by examining whether network activity is sufficient to trigger token demand, whether ecosystem participants are actively interacting around the token to gain their own benefits, and whether these interactions converge into network growth. Furthermore, whether this tokenomics exists not only as an idea but also synergizes with the various components of the network may become an increasingly important framework for judging the fundamental value of L1 in the future.

In this context, the reason why Berachain, Initia, and Injective introduced today are worth paying attention to is that they attempt to overcome the limitations of existing models by directly implementing tokenomics at the network level. Injective maintains a unique tokenomics in enhancing token value through its deflationary mechanism, while Berachain's PoL and Initia's VIP provide a blueprint for L1 tokenomics in unprecedented ways. Considering the reality that many past L1 projects remain "zombie chains," I believe the token flywheel has been almost stagnant. On the other hand, whether these new approaches truly establish sustainable ecosystems and achieve the ultimate goal of the flywheel will be an important focus in determining the next phase of L1 tokenomics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。