Following Chris's sharing, let's delve into Plume's more practical and feasible implementation ideas for RWAfi.

Author: Deep Tide TechFlow

Throughout this cycle, the market seems to have diverged into two distinctly different directions:

On one side, led by MEME, there is a focus on concepts without practical application, creating a speculative frenzy;

On the other side, the RWA track serves as a model, advocating for large-scale adoption and seeking a closer connection between the real world and the crypto world.

Indeed, RWA is one of the fastest-growing segments in the market this year. According to the report "RWA: A Safe Haven for On-Chain Yields?" published by Binance Research in September:

The total on-chain RWA has reached $12 billion, not including the $175 billion stablecoin market. Meanwhile, institutions and traditional finance are increasingly participating in RWA.

We know that RWA aims to bring real-world assets on-chain, so why go on-chain? The answer is clear: to leverage the power of decentralization to facilitate more efficient and transparent transactions, achieving more attractive yields. This is precisely why the concept of RWAfi has emerged.

Although the demand for RWAfi is very clear, achieving it is not easy due to challenges such as technical barriers, regulatory issues, and general applicability in the RWA track: How to support a more diverse range of assets on-chain? How to give tokenized assets greater utility? And how to promote a deeper integration of RWA assets with DeFi?

In the face of this series of questions, we had an in-depth conversation with Chris Yin, the founder and CEO of Plume Network.

As the first modular RWAfi blockchain tailored specifically for RWA, Plume aims to simplify the complex process of deploying RWA projects by embedding compliance and asset tokenization directly into the protocol layer, and relying on its thriving DeFi applications to achieve RWAfi composability, providing a platform for RWA investors to interact.

When discussing "why RWAfi needs a dedicated blockchain," Chris stated:

Our value lies in bridging the traditional finance (TradFi) world and the decentralized finance (DeFi) ecosystem, providing RWAfi tools that are both easy to use and meet institutional standards.

Regarding the impressive achievement of attracting over 3.26 million users and generating 129 million interactions within just one month of launching the Plume testnet, Chris shared more plans:

We are about to launch the mainnet, with the TGE following closely. The mainnet will support institutional-level tokenization, RWAfi applications, and cross-chain integration, becoming a comprehensive solution for RWAfi.

In this issue, let’s follow Chris's sharing and explore Plume's more practical and feasible implementation ideas for RWAfi.

Born for RWAfi: The Necessity and Customization of Plume's "Dedicated Chain"

Plume Network is stepping into a new era of blockchain technology in the realm of real-world assets (RWA).

Deep Tide TechFlow: It’s a pleasure to have the opportunity for an in-depth conversation with you. Could you briefly introduce yourself and share the motivation behind founding Plume Network?

Chris:

Hello everyone, I am Chris Yin, the founder and CEO of Plume Network. I am glad to have this opportunity to engage in a deep conversation with you all.

I have always been fascinated by the intersection of technology and finance, being both an operator and an investor. Throughout my career, I have experienced the ups and downs of entrepreneurship. After working at Beluga and investing in several startups, I realized that real-world assets (RWAs) have tremendous potential but lack the infrastructure to integrate them with decentralized finance (DeFi), which is why Plume is the first RWAfi blockchain that combines RWA and DeFi.

Fortunately, this realization aligned with the ideas of our co-founder and CBO Teddy, who accumulated rich industry experience and resources while working at Coinbase and BNB Chain. Coupled with my experience building products at companies like Rainforest QA and Coupa, it led us to establish Plume Network.

Our goal is to build a modular blockchain that allows institutions to tokenize assets while ensuring compliance and scalability, thus filling a market gap.

Deep Tide TechFlow: Plume is a blockchain network designed specifically to promote the development of RWA. Why does RWAfi need a dedicated blockchain? What value does Plume bring to the market?

Chris:

RWA requires a unique approach to develop its RWAfi ecosystem because RWA assets must comply with real-world laws and regulatory frameworks. Through my experience in the enterprise software field, I understand how to handle institutional-level data and assets, which is why RWA needs a dedicated blockchain.

Plume provides a secure and compliant infrastructure for institutions while also catering to the needs of crypto-native users. Our value lies in bridging the traditional finance (TradFi) world and the decentralized finance (DeFi) ecosystem, providing RWAfi tools that are both easy to use and meet institutional standards.

Deep Tide TechFlow: How does Plume's customization around RWA help participants enter the market?

Chris:

Plume's mission is to simplify and innovate the on-chain introduction of RWA.

We integrate compliance, custody, and tokenization services, lowering the barriers to entry, allowing both institutional investors and ordinary users to easily participate in the RWA ecosystem.

For institutions, this means they can easily bring assets like real estate and bonds onto the blockchain without worrying about complex regulatory issues; for ordinary users, Plume allows these tokenized assets to be used in DeFi applications, enhancing the liquidity and ease of trading RWA assets.

Deep Tide TechFlow: Can you outline Plume's ecosystem and future focus areas?

Chris:

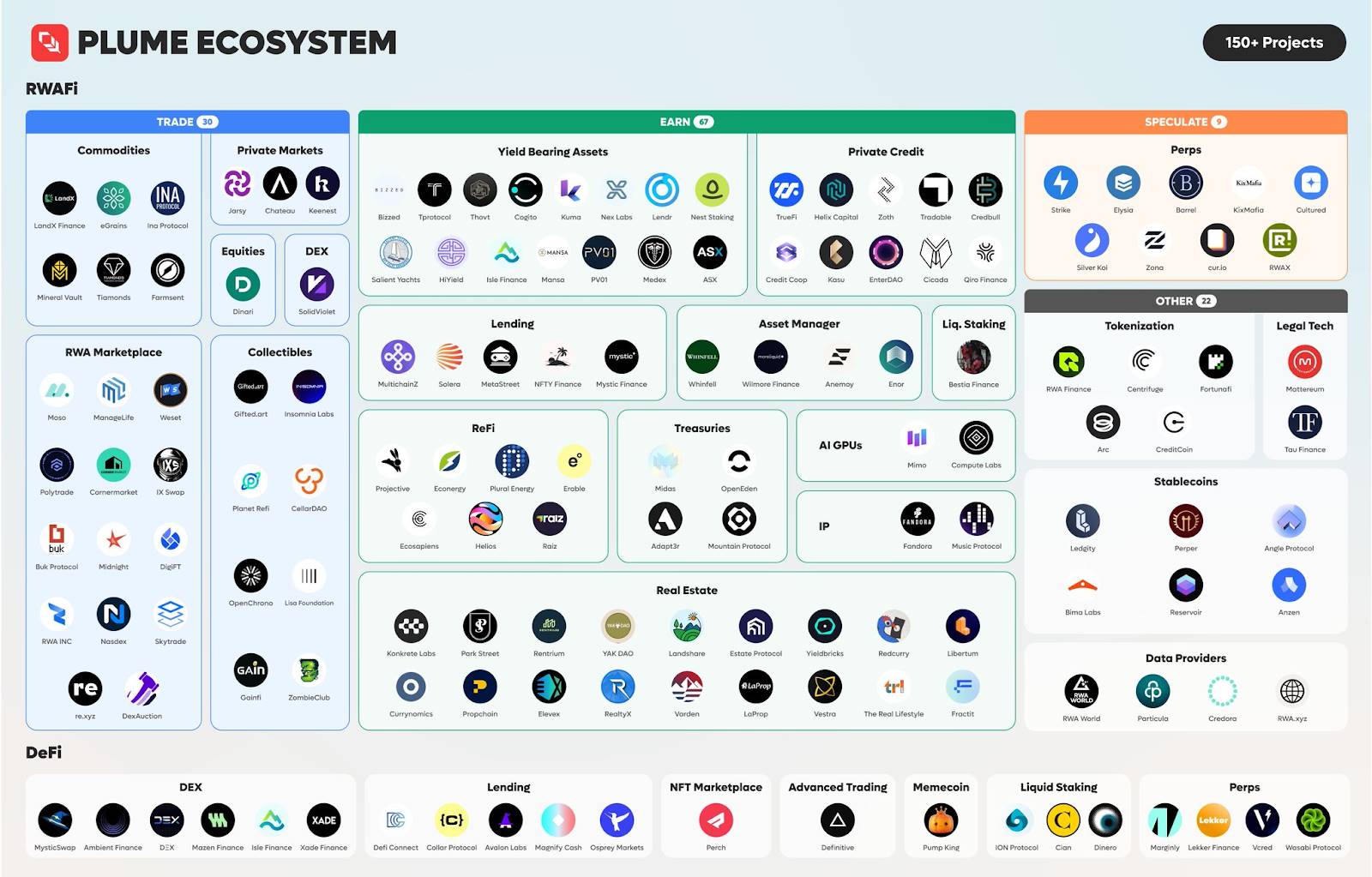

We have expanded the concept of RWA to include collectibles and alternative assets, opening new opportunities for investors. Currently, Plume supports over 170 projects, covering a variety of use cases from tokenized bonds and real estate to collectibles.

Our future focus will be on deepening integration in the RWAfi space and expanding our Data Highway to bring real-world data on-chain.

Focusing on RWAfi, Making RWA Efficiently Liquid

Plume's core focus is on RWAfi: bringing real-world assets into the crypto space.

Deep Tide TechFlow: Recently, Plume successfully joined the Tokenized Asset Coalition (TAC). What is the Tokenized Asset Coalition (TAC), and what is Plume's goal in joining?

Chris:

TAC brings together a group of forward-thinking companies dedicated to driving innovation in the tokenization of RWA.

Through TAC, we can collaborate with industry leaders like a16z, Coinbase, Circle, BlackRock, etc., to accelerate the adoption of RWAfi and promote a deeper integration of real-world assets with the RWAfi ecosystem.

Deep Tide TechFlow: How can ordinary users participate in RWA, and what attracts them to Plume?

Chris:

Through RWAfi, ordinary users can gain stable real-world yields and diversify their investment portfolios. Plume not only tokenizes these assets but also allows them to be used in the RWAfi ecosystem, enabling users to easily trade and lend these assets.

Our goal is to ensure that all participants can seamlessly enter the RWA ecosystem.

Deep Tide TechFlow: With RWAfi as the core development philosophy, what challenges has Plume faced in implementing RWAfi, and how has it turned these challenges into advantages?

Chris:

One of the biggest challenges in implementing RWAfi is the complexity of compliance and regulation.

We have built compliance and custody functions into the Plume network, meeting the strict requirements of institutions while maintaining flexibility for RWAfi applications. This dual model sets us apart in the market.

Deep Tide TechFlow: Can you provide a specific case from the ecosystem to help readers better understand the specific advantages of RWAfi in attracting user participation in Plume?

Chris:

A typical example is our work on the tokenization of real estate assets.

By tokenizing real estate assets into fractional tokens, we enable more investors to enter the real estate market with smaller capital, while these tokenized assets can also be used as collateral in RWAfi lending protocols, providing users with liquidity and flexibility.

The Arrival of the Interest Rate Cut Cycle: Plume's RWA Layout

In the changing economic cycle, how does Plume strategically position itself?

Deep Tide TechFlow: How do you view the upcoming interest rate cut cycle market trends, and how will Plume respond?

Chris:

Interest rate cuts typically lead to increased market liquidity, which is beneficial for RWA, especially in an environment where investors seek stable yields.

Plume will seize this trend by providing tokenized assets that offer real-world yields, ensuring that RWA becomes a viable alternative to traditional bonds or savings accounts.

Deep Tide TechFlow: Does Plume have more customized strategies and business expansion considerations for the Asian and Chinese-speaking markets?

Chris:

Asia, particularly China, is one of our key growth markets. We have established our team in the region and built partnerships here, especially with local traditional finance and government institutions.

We will focus on providing local asset RWA solutions to meet local regulatory requirements and user preferences.

Success of the Testnet, Mainnet and Token TGE Coming Soon

Plume Network has achieved great success with its testnet and is now preparing for the next significant milestone.

Deep Tide TechFlow: What factors drove the success of the Plume testnet?

Chris:

Key factors for the success of the testnet include our modular design of technology, strong community engagement, and deep integration with other DeFi protocols in the RWAfi ecosystem.

Deep Tide TechFlow: Can you share more information about the mainnet launch and TGE?

Chris:

We are about to launch the mainnet, with the TGE following closely. The mainnet will support institutional-level tokenization, RWAfi applications, and cross-chain integration, becoming a comprehensive solution for RWAfi.

Deep Tide TechFlow: How can ordinary users and developers better interact with Plume Network?

Chris:

For users, the best way to participate in Plume right now is to explore our deployed RWAfi ecosystem projects through our testnet. Once the mainnet is live, we will have staking reward activities, trading activities, and collectible activities for users.

For developers, we provide a comprehensive SDK and API to support them in building RWAfi solutions on Plume's modular architecture or integrating with existing DeFi protocols. Everyone can look forward to the launch date of our mainnet.

Deep Tide TechFlow: What are Plume's main directions and roadmap for next year?

Chris:

In the coming year, Plume will focus on expanding our ecosystem, deeply integrating DeFi protocols, and developing the Data Highway to enhance the interaction between real-world data and blockchain.

We will also launch corresponding products for users on different platforms, such as a Mini App for Telegram. Additionally, we plan to introduce more tokenized assets, with a focus on alternative assets and collectibles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。