In the current trend of mini-games on Telegram, numerous GameFi projects like Notcoin, Catizen, and Hamster Kombat have emerged, created through WeChat mini-game models or other low-cost methods. These GameFi projects based on the TON ecosystem have successfully attracted a large number of users and traffic in a short time, but they primarily rely on token expectations and airdrop rewards to "squeeze" market liquidity. With the end of token airdrops, the actual number of people profiting from these projects through Tap to Earn is only a minority, leading to a rapid decline in community enthusiasm and a significant drop in user retention, ultimately turning these projects into fleeting short-term phenomena.

Over time, project teams, in pursuit of short-term traffic, have overly relied on airdrop expectations and token rewards while neglecting the refinement of the games themselves. The GameFi market will inevitably fall into a vicious cycle of "bad money driving out good." In fact, truly successful games require not only careful crafting by the project but also the time and asset accumulation from users.

So, what type of GameFi projects represent the future development direction of the Web3 gaming industry? Below, Odaily Planet Daily will analyze data from the Web2 gaming industry to help find the answer.

High-End Players Focus on SLG Games as the Key to Breaking the Current Web3 Gaming Dilemma

SLG Games: High Market Share and Strong Player Spending Power

SLG (Simulation Game) is a type of game that emphasizes strategic planning and resource management, particularly excelling in the mobile gaming market. SLG is often referred to as "4x strategy games" (explore, expand, exploit, exterminate) and is popular among players worldwide.

According to traditional mobile gaming market reports, SLG has become one of the highest-grossing mobile game categories globally. In 2023, the global revenue scale of SLG games reached $8 billion, with annual downloads nearing 700 million, maintaining a rapid growth rate of 23.5%. This game category has shown outstanding market share performance, attracting numerous publishers to continuously release new titles over the past two years. In 2023, SLG mobile games accounted for over 52.1% of downloads in the strategy game category, remaining a favorite among players.

SLG Games Maintain a Rapid Growth Rate of 23.5% in 2023

In terms of player spending power, the average revenue per user (ARPU) for SLG games is $11, with top players spending up to $1 million annually, far exceeding other game types, making them one of the strongest paying player groups. SLG games also have a longer lifecycle, typically lasting 6 to 8 years, with top products like Clash of Clans operating for nearly 10 years and accumulating in-game purchase revenue of nearly $10 billion, demonstrating their long-term revenue potential and market competitiveness.

SLG Games Naturally Align with Web3 Games' Strong Economic Utility and High Social Attributes

The high spending power and complex economic systems of SLG games create a natural alignment with Web3 games. SLG game design focuses more on numerical calculations and strategic thinking rather than competition itself, which aligns with the Web3 market's high expectations for financial attribute games. Compared to other game types like FPS (first-person shooter), SLG has a more complex ecosystem, where the supply and demand relationships do not rely on a single scenario, and its consumption and output models are more diversified. Currently, the user base of Web3 games often possesses a certain level of spending power; if high-quality SLG games are introduced to Web3, their complex economic systems will increase player interactions, leading players to continuously invest costs in pursuit of higher returns. This mechanism helps avoid the economic collapse or death spiral caused by simple "mining and selling" models, making the game economy more stable and sustainable.

The strong social attributes of SLG games are more suitable for the social networks of Web3 games. SLG games emphasize social attributes, leading to the formation of various gaming guilds that provide platforms for cooperation and interaction among players. In Web3 games, players often actively communicate with community members to formulate and optimize efficient gold mining strategies, even organizing guilds, showcasing their inherent high social attributes. If high-quality SLG games are introduced to Web3, the complexity of their economic systems will lead to more frequent discussions among community members, deeper exchanges of cooperation and strategy, greatly enhancing player engagement and retention rates.

SLG games encompass a multi-layered player ecosystem, a trait that is further enhanced in Web3 games. In SLG games, various types of players coexist, including top spenders, "casual players," and guild strategists, forming an interdependent ecosystem. If high-quality SLG games are introduced to Web3, their complex economic systems will allow player roles to be differentiated not only by the amount of funds but also by guilds further refining members' responsibilities based on strategic needs to optimize resource allocation and maximize gold mining profits.

Thus, it is clear that SLG games are undoubtedly a direction that Web3 game teams should focus on exploring and developing. However, due to the inherent complexity of SLG game production and the difficulty of acquiring users, there are currently very few game teams in the Web3 space willing to attempt this category, and even those that do often go unnoticed due to insufficient quality.

So, in such a fiercely competitive environment, what kind of game team possesses both the determination to produce high-quality games and the ability to attract existing Web3 and even Web2 players? Recently, we have noticed that Xterio may become the key to breaking through GameFi, driving a revolutionary transformation in the next generation of GameFi.

Xterio: A Platform and Publisher Betting on SLG, Building a Prosperous Web3 Game World

Project Overview

Xterio is a Web3 platform and publisher that integrates free games and online games, along with self-developed and third-party games currently in development. Its team members come from top gaming studios such as FunPlus, Electronic Arts, Zynga, Activision Blizzard, Krafton, Jam City, and NetEase, gathering many experienced game producers.

Xterio not only continues to build and expand its gaming community but also provides developers with a broad and active player base, closely linking players with the right games. This close interaction not only promotes the testing and exposure of innovative products but also accelerates game development. Additionally, Xterio helps cooperative games gain liquidity by launching a unified trading market and resource cooperation platform, avoiding the dispersion of user liquidity while simplifying repetitive market development work, thus improving overall operational efficiency. Currently, there are over 70 GameFi projects on the Xterio platform, including several self-developed games, venture capital games, and cooperative games.

Image Source: Xterio Official Website

Perfect Integration of Traditional and Chain Games: Xterio SLG Opens a New Chapter for Million-Dollar Spending

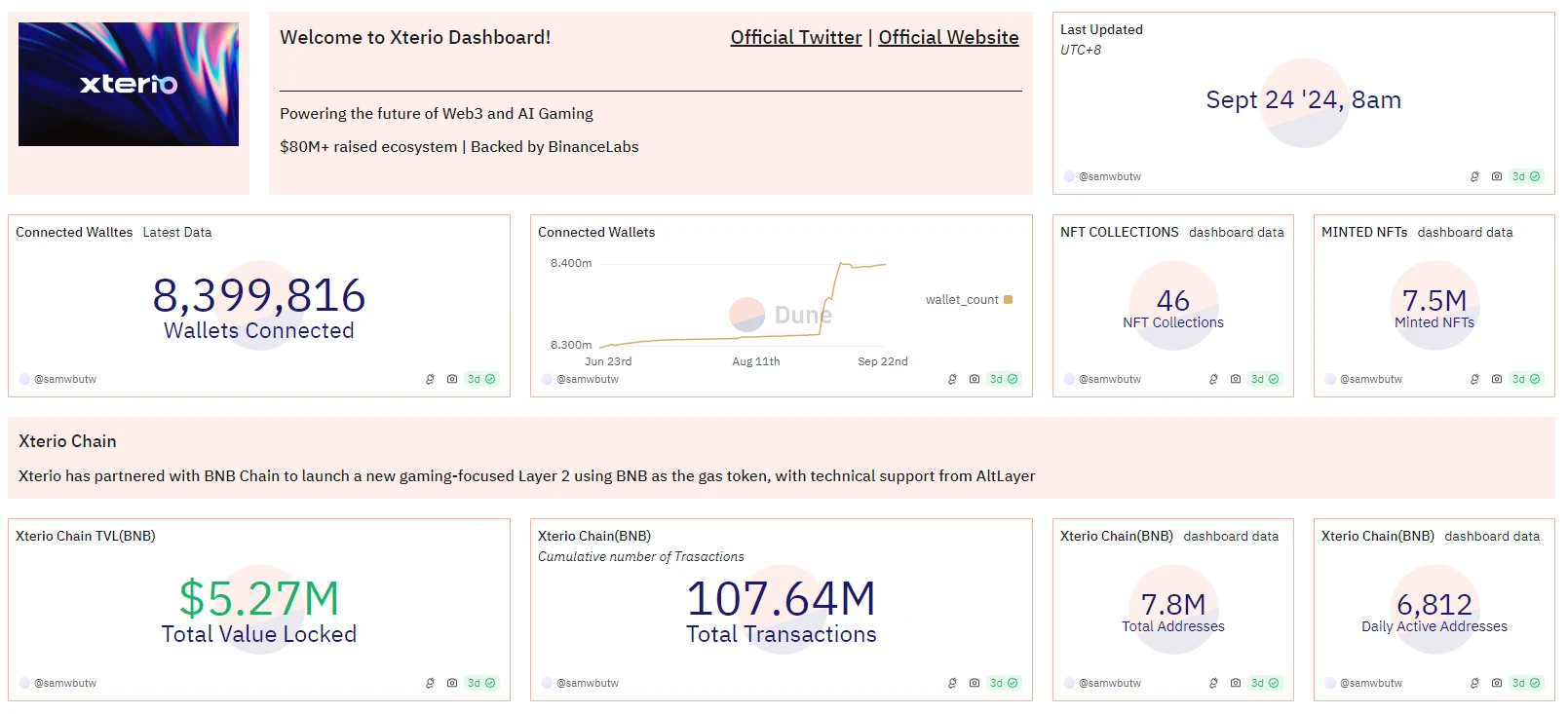

At the end of April this year, Xterio announced a partnership with BNB Chain to bring its games to a game-focused Layer 2 new chain. According to Dune data, as of September 24, the number of addresses on the Xterio ecosystem chain is nearly 8.4 million, with over 108 million total transactions, establishing a solid on-chain community foundation for its games.

Whether it is the experienced professional team or the active and rich on-chain data, Xterio's outstanding performance is mainly attributed to the little-known founder Michael Tong's extensive background in venture capital and the gaming industry. Michael served as a director and COO at NetEase since 2003, leveraging his keen insights to discover the billion-dollar blue ocean in the gaming market, expanding NetEase's online gaming business, and accurately seizing the opportunities for SLG games overseas during market development, propelling FunPlus to become a leader in the SLG gaming field (FunPlus is a global leader in mobile game development and publishing, known for its high-quality mobile games). Therefore, Xterio's establishment in the Web3 space and its bet on SLG games have unique strategic advantages.

On one hand, the Xterio team can accurately reach the core gaming user base. With their rich past experience, they have accumulated a wealth of data on user profiles and tags, allowing Xterio to implement more precise and efficient user acquisition strategies in both Web2 and Web3, effectively controlling costs and enhancing marketing effectiveness.

On the other hand, the Xterio team has achieved significant success in the Web3 gaming market. In the current crypto cycle, over 70% of the multiple game projects invested by Xterio have established a foothold in mainstream markets such as Asia and Europe and America, gaining a large user base. These projects not only have competitive advantages in the gaming market but also occupy a place in the trading market, further consolidating Xterio's market position.

Recently, the SLG game Age of Dino, incubated by Xterio, has sparked heated discussions in major gaming communities during its public testing phase, and its outstanding data performance may point to a new direction for the development of Web3 games.

Age of Dino May Fire the "First Shot" in the Second Half of Web3 Gaming

Age of Dino (referred to as AOD) is a large-scale multiplayer online strategy game that incorporates elements of SLG (Simulation Game) and RPG (Role-Playing Game). The current game content includes feeding dinosaurs, resource collection, adventures, and base building. Players will engage in battles against AI-controlled opponents and mutated dinosaur armies, continuously expanding their territory and acquiring resources. AOD is one of the few chain games that supports multi-terminal and cross-platform connectivity, currently available on iOS, Android, and PC, and has also launched a Telegram mini-program version to achieve comprehensive player coverage.

AOD Game Interface

It is worth mentioning that AOD's development studio, GamePhilos Studio, announced the completion of an $8 million seed round financing in September 2023, led by Xterio, Animoca Ventures, and SevenX Ventures, with participation from Hashkey Capital, Sanctor Capital, Game7, Bas1s, GSR Markets, and GSG Ventures.

AOD Token Economic Model

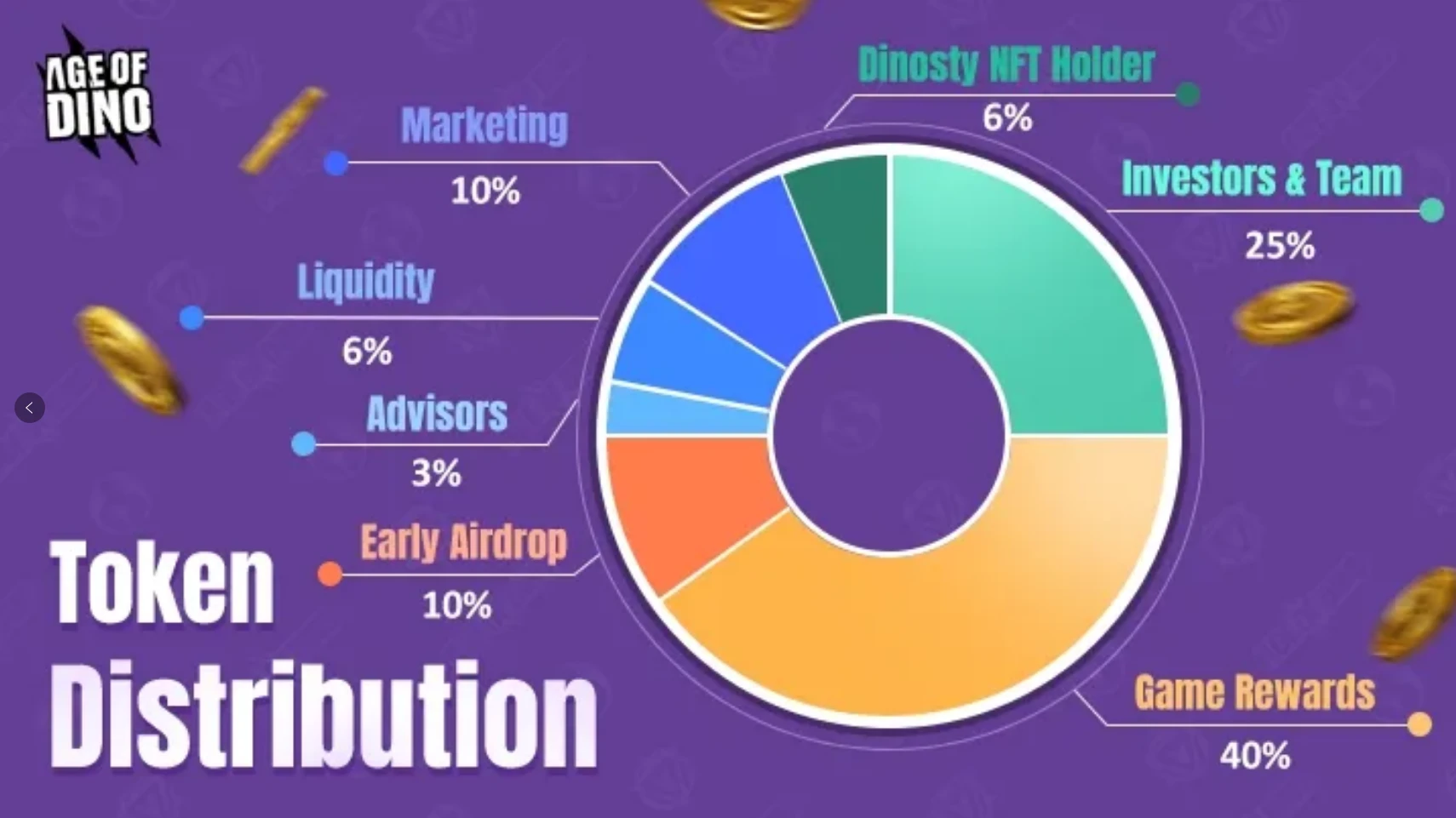

On the evening of October 10, Age of Dino announced its ecological token economic model, with $AOD serving as the foundation for in-game transactions and blockchain-related activities, enabling various practical functions from management and ranking to in-game purchases and player-to-player trading. According to official information, the total supply of $AOD is 200,000,000 tokens, with a strategic allocation plan to ensure game growth, community participation, and long-term sustainability. The specific allocation ratios are as follows:

Investors and Team: 50,000,000 $AOD, accounting for 25% of the total supply, will be locked for 6 months after the Token Generation Event (TGE) and then released linearly over the next 24 months. This portion of tokens is used to incentivize the development team and key stakeholders to continue developing and improving the game;

Game Rewards: 80,000,000 $AOD, accounting for 40% of the total supply, will be gradually released over 48 months after the TGE. This portion of tokens is used for the "play to earn" aspect of the game, ensuring that players' time and effort are rewarded;

Early Airdrop: 20,000,000 $AOD, accounting for 10% of the total supply, will be fully unlocked at the TGE. This portion of tokens is used to reward early contributors and supporters of AOD, including early bird players and participants in the Telegram mini-game;

Advisors: 6,000,000 $AOD, accounting for 3% of the total supply, will be locked for 6 months after the TGE and then released linearly over the next 24 months. This portion of tokens is used to reward advisors who provide strategic guidance, technical expertise, and industry connections for AOD's development;

Liquidity: 12,000,000 $AOD, accounting for 6% of the total supply, will be fully unlocked at the TGE. This portion of tokens is used to establish initial liquidity for decentralized exchanges (DEX) and centralized exchanges (CEX);

Marketing: 20,000,000 $AOD, accounting for 10% of the total supply, will be locked for 6 months after the TGE and then released linearly over the next 24 months. This portion of tokens is used for marketing activities, partnerships, influencer collaborations, and promotions to increase AOD's visibility and attract new players;

Dinosty NFT Holders: 12,000,000 $AOD, accounting for 6% of the total supply, will unlock 50% at the TGE, with the remaining portion released linearly over 12 months. This portion of tokens is reserved for Dinosty NFT holders, providing additional rewards for holding and using these high-value assets in the game, encouraging players to engage more deeply with the ecosystem.

It is noteworthy that to maintain the long-term value of $AOD, the team has decided to implement several plans to achieve token deflation, including:

A portion of $AOD spent by players in the game will be burned;

Players need to burn a certain amount of $AOD to participate in high-reward exclusive events;

Players need to burn a certain amount of $AOD to create rare NFTs, upgrade dinosaurs, and other game assets;

The team will regularly hold $AOD token burning events based on revenue or community-driven initiatives.

Low-Key Efforts, Impressive Data

In the first week of AOD's public testing, several core data points performed excellently, particularly in terms of strong spending power and high gameplay engagement, attracting widespread attention from various communities.

The game achieved over $300,000 in revenue during its first week, including in-game purchases and on-chain income. Notably, unlike other leading SLG games where about 40% of revenue comes from skins, all skins in AOD are user-generated. The team promises to genuinely transfer ownership of the game's core assets to users, thus not issuing additional skins to boost revenue. Furthermore, AOD's ARPU (Average Revenue Per User) is as high as $110, a figure that is not only 300% higher than similar Web3 games but also outperforms many traditional SLG games, fully demonstrating the game's ability to attract high-value users. Additionally, within a few weeks of launch, AOD's revenue has shown that Web2 fiat currency top-ups and Web3 players' on-chain top-ups are evenly matched, a rare phenomenon.

The high-quality game content and innovative design of AOD have attracted player guilds from multiple countries, who spontaneously form teams within the game and establish solid alliances between guilds to achieve better results. The high level of collaboration among players is vividly reflected in the game, especially during the last round of the research institute competition, where nearly 10,000 players were online simultaneously, collaborating for 8 hours to compete for the king position on the server. Notably, during the guild wars, a single user topped up over $20,000 in the game store, an action that is very rare in Web3 games. This high level of participation and competitive enthusiasm further demonstrates the game's strong social attributes and deep engagement.

Screenshots from the Research Institute Competition

AOD does not forcibly insert "unnecessary" on-chain interactions during gameplay; instead, it utilizes "transactions" to more naturally connect Web2 and Web3 users, allowing users to have different choices.

Xterio SLG Builds a New Web3 Game Ecosystem

It is evident that the combination of SLG games and Web3 addresses the current pain point of weak payment attributes in GameFi development while further enhancing the social attributes of GameFi. Unlike the vast majority of Web3 game projects, Xterio, which has secured $55 million in funding, continues to persistently build during the bear market, continuously investing resources over the past two years to develop and produce high-quality SLG games. This ongoing effort and pursuit of quality reflect Xterio's long-term vision and commitment to the player community.

It is worth mentioning that Age of Dino recently launched a limited-time Telegram mini-game, Dino Museum, providing players with an additional way to acquire rare game resources.

With its continued investment in SLG games, emphasis on the player community, and significant market share potential, Xterio, the company that has incubated many high-quality games like AOD, may lead the development of the second half of Web3 games, firing the "first shot" and truly driving the entire industry forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。