Mr. Coin in the Crypto Circle: Bitcoin (BTC) Market Analysis Reference for 10.11

From the daily chart perspective, the price has closed in the red for four consecutive days, and the key support at 60,000 has been broken. Fortunately, the price has not further deepened; it is currently showing a slight rebound, testing the 60,000 level where it faces resistance. There is significant pressure above, and if it cannot break and stabilize above the 60,000 line, there is a risk of further downward movement. The current trend is maintaining a corrective fluctuation, and the daily EMA240 has not been broken, so the price cannot experience a significant decline. Therefore, Mr. Coin advises all crypto friends not to blindly chase short positions.

On the short-term hourly chart, the price has retreated from a high and formed short-term support near 60,000, but it has not effectively rebounded. The MACD is currently in the bearish zone, with both the fast and slow lines being negative and diverging downwards. The market is relatively quiet, with both bulls and bears in slight consolidation. However, the resistance above is slowly descending. If a strong rebound cannot be achieved, the price is expected to remain under pressure and retreat to the daily support. In terms of operations, it is recommended to focus on short positions during rebounds.

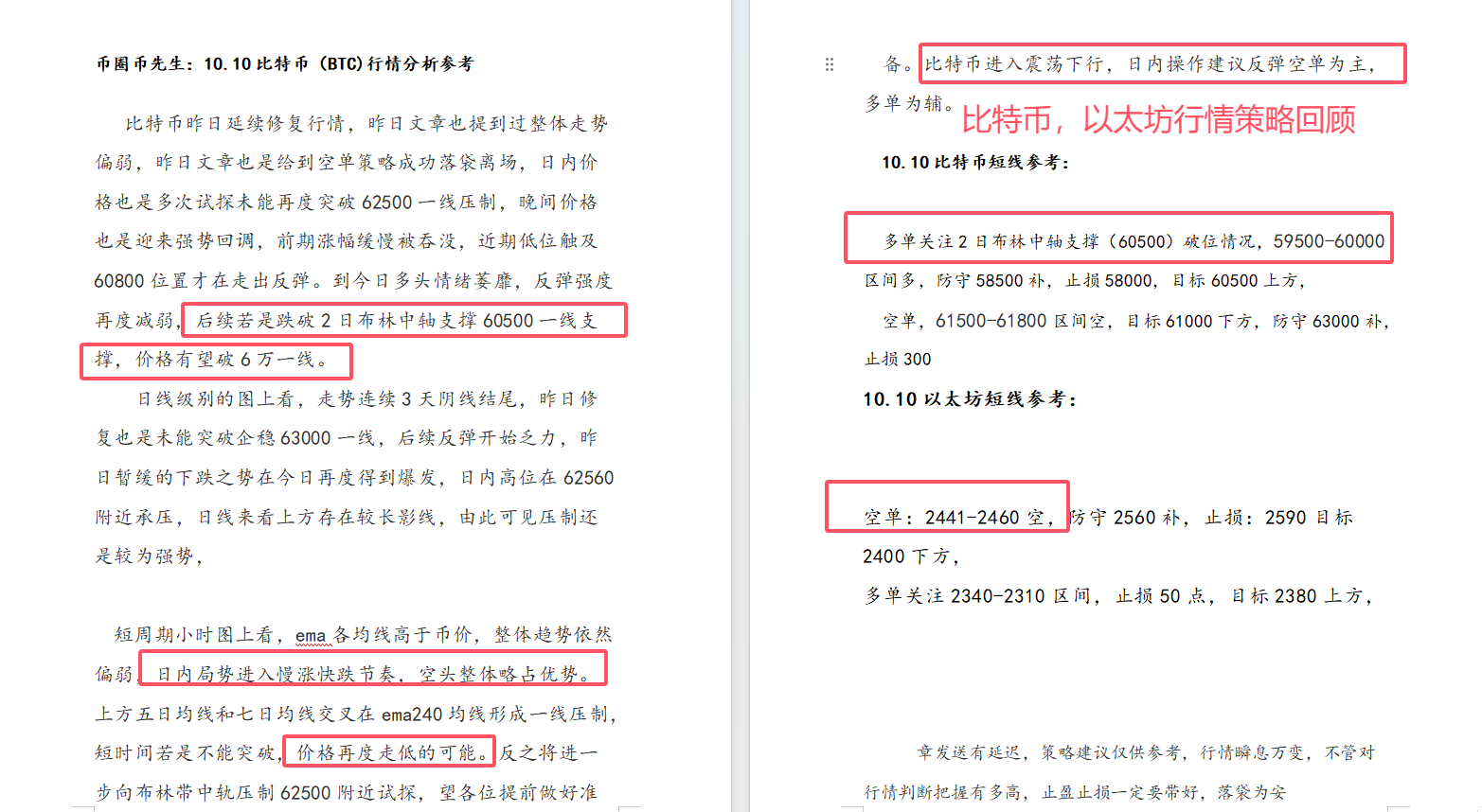

Short-term Reference for Bitcoin on 10.11:

For more real-time trading strategies, online technical learning, and exit strategies, you can follow the mentor's public account (Mr. Coin in the Crypto Circle) for addition methods: the first ten each day can receive free exit strategies.

For long positions, pay attention to the daily EMA240 moving average (58,650) break situation, long in the 57,000-57,300 range, with a stop loss at 56,000 and a target above 68,500.

For short positions, short in the 60,900-61,400 range, with a target below 59,300, and a stop loss at 61,500.

Short-term Reference for Ethereum on 10.11:

For short positions: short in the 2,421-2,460 range, with a stop loss at 2,530 and a target below 2,360.

For long positions, pay attention to the 2,240-2,210 range, with a stop loss of 50 points and a target above 2,280.

There may be delays in sending messages; strategy suggestions are for reference only. The market changes rapidly, and regardless of how confident you are in your market judgment, always set take-profit and stop-loss levels to secure your gains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。