Author: CGV

"In my opinion, Japan's current development status in the Web3 field is like the Japanese idiom '仏作って魂入れず' (hotoke tsukutte tamashii irezu), which means: creating a Buddha statue without infusing it with a soul. Although the Japanese government has done a lot of work in Web3 policy formulation and standard drafting, there are significant shortcomings in actual execution and key steps."

— Steve, Founding Partner of Japanese Crypto Fund CGV

As Steve, the founding partner of CGV, mentioned, although Japan has quickly embraced Web3 technology and launched relevant policy support, its deeply rooted conservative culture and cumbersome bureaucratic system have made the pace of innovation exceptionally slow.

This culture is deeply embedded in Japan's traditional concept of pursuing stability and avoiding risks, leading companies and government agencies to prefer stable paths rather than boldly trying new technologies. As a result, even though Japan rapidly adopts new technologies in the global tech wave, it often stumbles and progresses slowly when it comes to transforming these technologies into commercial applications.

I. Japan's Historical Lessons: The Reality of "New Technology Fever" and "Slow Transformation"

Meiji Restoration: Technology Introduction and Modernization Challenges

The Meiji Restoration (1868) was a key moment in Japan's modernization. Japan achieved a rapid start to national modernization by introducing Western military, industrial, and educational systems. However, during this process, Japan also faced significant challenges in absorbing and transforming technology. Although it learned advanced technologies from the West, internalizing these technologies into independent innovative capabilities took a long time.

For example, during the industrialization process, Japan introduced a large amount of railway technology from the UK and Germany, but due to a lack of local experience, the early construction of railways was plagued by frequent failures and high maintenance costs. It wasn't until the early 20th century that Japan gradually mastered railway technology, ultimately achieving localized technological innovation and improvement.

Post-WWII Technology Introduction: A Twisted Path from Imitation to Independent Innovation

After World War II, Japan achieved rapid development through its "economic miracle," with one of the keys to its success being the rapid introduction and application of external technologies. In the 1950s, Japan imported automotive and electronic technologies from the United States and became a global leader in these fields within just a few decades. However, this process was not smooth. In the early post-war period, most of Japan's automotive and electronic products imitated designs from Europe and the United States, lacking independent R&D capabilities. For instance, Toyota almost completely imitated the production lines of Ford and General Motors in the early post-war period, but Japanese companies continuously improved these technologies, ultimately achieving independent innovation in "lean production" and gradually establishing a leading position globally.

In the electronics industry, Sony is a typical case. Sony launched the first transistor radio in the early 1950s, although this technology initially came from Bell Labs in the United States. Sony successfully opened up the international market by improving the product's size and sound quality, becoming one of Japan's iconic companies for independent innovation. Through continuous imitation, improvement, and innovation, Japanese companies gradually transformed from technology followers to leaders, a process that took decades and significant resources.

The Lost Three Decades: Lack of Innovation and Gradual Loss of Competitiveness

The bursting of the economic bubble in the 1990s marked Japan's entry into the so-called "lost three decades." During this period, the Japanese economy fell into long-term stagnation, and its innovative capacity and global competitiveness gradually declined. Data shows that from 1990 to 2020, Japan's GDP growth rate remained low, while emerging economies like South Korea and China rapidly rose, surpassing Japan in many high-tech fields. For example, in 1995, Japan's semiconductor industry accounted for over 50% of the global market share, but by 2020, this proportion had dropped to less than 10%.

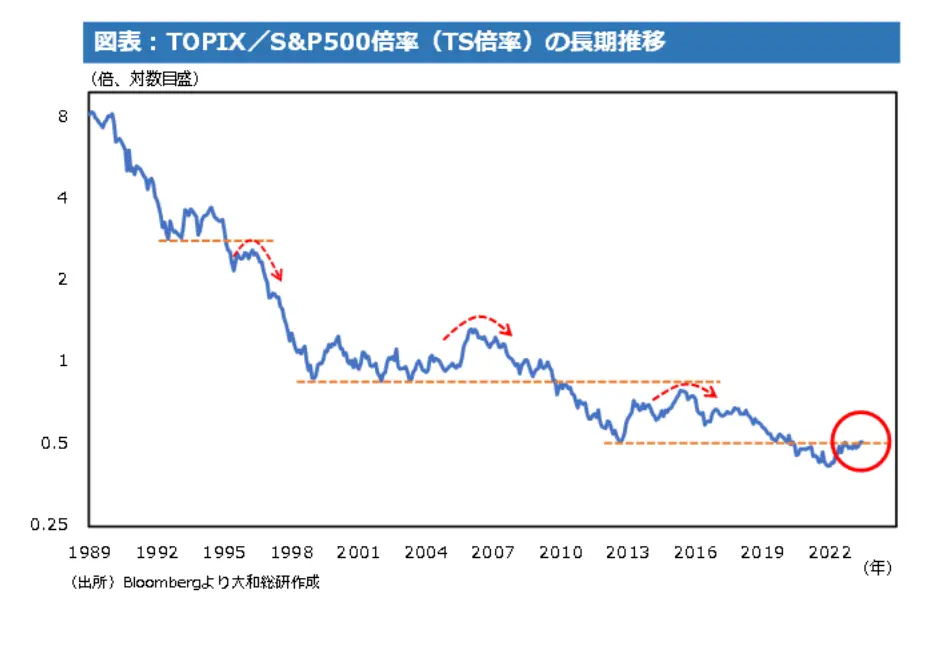

Historical data of the Tokyo Stock Price Index / U.S. S&P 500 Index multiple

(One of the indicators used to measure Japan's stock market position globally)

Data source: Daiwa Institute of Research

The reasons for this situation lie in the overly conservative approach of Japanese companies in the technology transformation and commercialization process, lacking a keen response to emerging markets and technologies. For instance, electronics giants like Panasonic and Toshiba failed to adjust their strategies in a timely manner in the face of the smartphone and new semiconductor technology wave, ultimately being surpassed by international competitors like Apple and Samsung. Meanwhile, Japan's bureaucratic system exacerbated this lack of innovation. Companies often spend years obtaining government support, approvals, and compliance permits, making many innovative projects appear sluggish in the face of market changes.

In the automotive industry, although Japan maintained a high level of competitiveness at the end of the 20th century, with the advent of the electric vehicle revolution, emerging companies like Tesla quickly occupied the market, while Japanese companies like Toyota and Nissan appeared slow to respond, only gradually introducing electric vehicle models in recent years. Data shows that in 2020, Japan's electric vehicle market share was only 1.1% of the global total, far below China's 44% and Europe's 28%. This slow transformation reflects the conservativeness of Japanese companies in the face of technological change, further exacerbating the loss of competitiveness during the "lost three decades."

In summary, Japan has historically achieved rapid starts by introducing external technologies, but transforming these technologies into independent innovative capabilities has faced multiple challenges from culture, systems, and markets. These lessons have profound implications for the current development of Web3—if Japan cannot quickly break free from conservative culture and bureaucratic constraints, it may miss another opportunity in the new round of technological revolution.

II. Current Status of Japan's Web3 Development: Quick Response, Slow Implementation?

Policy-Driven Quick Response and Underlying Strategy

In 2023, the Japanese government released the "Japan Web3 White Paper," which details Japan's development plans in the blockchain and digital asset fields, aiming to create an environment conducive to the development of Web3 technology through policy guidance and support. In 2024, the government further passed a bill allowing venture capital and investment funds to hold crypto assets. The introduction of these policies reflects Japan's strategic intent to leverage Web3 technology for economic digital transformation.

Additionally, the rollout of policies is also aimed at competing with other countries and regions, such as Singapore and South Korea, which have made significant progress in the blockchain and digital asset fields. Japan is trying to attract global Web3 companies and technical talent through these policies to prevent being marginalized in the new round of technological competition.

Participation of Mainstream Enterprises: Web3 Layout from SONY to SBI

Many large Japanese enterprises are also actively participating in the Web3 field. For example, Sony announced the establishment of a department focused on blockchain technology and NFTs, attempting to leverage its strong influence in the entertainment industry to combine digital assets with music, film, and other fields to explore new business models. In August 2024, Sony's subsidiary headquartered in Singapore, Sony Block Solution Labs Pte. Ltd, officially launched the Ethereum-based second-layer scaling system Soneium.

First batch of Web3 partners in the Soneium ecosystem

(Source: Soneium official website)

SBI Holdings (formerly the financial investment division of SoftBank Group) is one of the first financial institutions in Japan to enter the cryptocurrency field, with investments in various directions related to Web3, including blockchain payments and digital asset management. SBI Holdings has also partnered with Ripple to enhance the efficiency of financial services through a blockchain-based cross-border payment system. Additionally, SBI has established a dedicated blockchain investment fund aimed at investing in startups and projects to promote innovation in Japan's blockchain sector.

NTT Group is focusing on infrastructure development, planning to create high-performance communication networks that support Web3 applications to ensure that blockchain applications can have sufficient network bandwidth and stability in the future. In 2024, NTT also announced collaborations with several Web3 projects to explore how to apply blockchain technology to smart cities and Internet of Things (IoT) solutions.

Delayed Regulatory Execution: Complex Legal Framework and Compliance Challenges

Despite the Japanese government's active rollout of policies supporting Web3, the complex regulatory and legal framework poses significant challenges for many companies in implementing these technologies. For example, the Financial Instruments and Exchange Act and the Payment Services Act impose very strict regulatory requirements on crypto assets, requiring companies to comply with multiple regulations such as anti-money laundering (AML) and customer due diligence (KYC). The complexity of these regulations leads to companies spending substantial resources and time obtaining licenses and approvals.

According to data from 2024, over 70% of Web3 companies indicated that compliance costs are one of the main barriers to entering the market, with the average compliance expenditure for each company accounting for over 20% of total costs. This high compliance cost is a heavy burden, especially for resource-limited startups.

Moreover, listing new projects on Japanese exchanges also faces strict regulatory requirements. The Financial Services Agency (FSA) of Japan conducts very thorough reviews of projects for listing, requiring exchanges to conduct detailed examinations of each listed project. An industry survey indicated that the average time for domestic crypto exchanges in Japan to list new projects is about 9 to 12 months, while the same process in some other countries only takes 3 to 4 months.

Insufficient Innovation Capability: Talent Gap and International Competition

Japan has a significant shortage of talent in emerging fields like Web3, with a particularly noticeable gap compared to other countries. According to the 2023 LinkedIn Global Blockchain Talent Report, the number of professionals in the blockchain field in Japan is only 1/10 of that in the United States and less than 1/4 of that in South Korea. The lack of high-quality developers and technical experts has become a major bottleneck restricting the development of Japan's Web3 industry.

This talent shortage is a result of Japan's education system placing insufficient emphasis on emerging technologies. Although Japanese universities have strong teaching and research capabilities in traditional engineering disciplines, investment in educational resources for new technologies like blockchain and smart contracts is limited, and relevant course offerings are lagging behind. Additionally, the conservative nature of Japanese corporate culture makes it difficult for companies to cultivate innovative talent internally, with many young people lacking the courage to try and accept failure.

III. How to Break the Limitations of "仏作って魂入れず"?

Enhance Policy Execution: Simplify Procedures and Strengthen Department Coordination

To address the issue of delayed policy execution, the Japanese government needs to implement a series of specific measures to enhance the effectiveness of policy execution. First, it should simplify approval procedures and reduce unnecessary bureaucratic steps, especially by making flexible adjustments in the regulation of innovative technologies. For example, a dedicated fast-track approval green channel for Web3 could be established, providing expedited approval services for innovative projects related to blockchain and digital assets, thereby shortening the time it takes for companies to move from project initiation to implementation. Additionally, strengthening inter-departmental coordination and cooperation is crucial; the government could establish cross-departmental working groups specifically responsible for promoting the implementation of Web3 policies, ensuring smoother collaboration between different departments to reduce friction and delays in policy execution. At the same time, the Japanese government could learn from the successful experiences of regions like Singapore and Hong Kong by implementing a "regulatory sandbox" mechanism, allowing Web3 projects to pilot in a controlled environment, lowering compliance thresholds, and gradually improving regulatory measures.

Encouraging Bold Innovation in Enterprises: Tax Incentives and Government Funding

To encourage enterprises to boldly innovate in the Web3 field, the Japanese government needs to introduce a series of incentive measures. First, tax incentive policies could be implemented to encourage companies to increase their investment in R&D. For example, tax deductions for R&D expenses could be offered to companies investing in blockchain technology, reducing the innovation costs for enterprises. Additionally, a dedicated innovation fund could be established to provide financial support to small and medium-sized Web3 enterprises, helping to bridge the funding gap these companies face in their early development stages. Similar government funding programs have achieved significant success in the United States and South Korea, where government support and corporate collaboration have successfully nurtured multiple unicorn companies.

Strengthening International Cooperation: Choosing Suitable Partners and Models

International cooperation is crucial for Japan's breakthroughs in the Web3 field. To compensate for its shortcomings in blockchain technology, Japan needs to actively seek collaboration with other countries and enterprises. First, Japanese companies could establish strategic partnerships with enterprises in countries and regions that are leading in blockchain technology (such as the U.S. and China) to gain the latest industry knowledge and experience through technology exchange and project collaboration. For example, collaboration with regulatory agencies in Hong Kong could be pursued to jointly promote the implementation of regulatory sandbox projects, or partnerships with U.S. blockchain companies could be explored to innovate mechanisms for virtual asset user protection and cryptocurrency transaction monitoring.

Furthermore, strengthening cooperation with overseas universities and research institutions is also very important. Japanese universities could collaborate with top international institutions (such as Stanford University, UC Berkeley, and the Hong Kong University of Science and Technology) to conduct research on blockchain technology and jointly cultivate high-end talent, filling the domestic talent gap in the Web3 field.

Conclusion

Web3 technology offers Japan the possibility of achieving a "digital revival," but whether it can break free from the historical dilemma of "仏作って魂入れず" depends on the efficiency of policy execution, the strength of corporate innovation, and the attractiveness to global talent. If Japan remains trapped in conservative culture and a complex bureaucratic system, the Web3 industry may become another lost opportunity in a "lost thirty years."

In the global wave of Web3, Japan faces significant challenges and opportunities. Only by truly breaking free from the constraints of conservative culture and bureaucratic limitations, seizing the opportunities presented by technological change, can Japan avoid falling behind other countries on the path to digital revival and achieve long-term sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。