Original Author: BitMEX

Brief Overview

The cryptocurrency market has performed modestly this week, and it seems that the "October Bull Market" has yet to arrive.

This week, despite the U.S. stock market hitting new highs, the prices of major cryptocurrencies remained largely flat. The meme coin sector saw a significant recovery, with POPCAT leading the way. Uniswap also performed well after launching its Unichain Layer 2 network solution, indicating a positive market reaction to technological advancements in the DeFi space.

In our trading analysis section, we will delve into the Unichain announcement and analyze its potential impact on the $UNI price target.

Data Overview

Top Performing Coins

$POPCAT (+22.1%): Cat coin surpasses Dogecoin

$UNI (+16.1%): Uniswap launches Unichain - the most significant announcement in 3.5 years

$WIF (+11.9%): $WIF shows signs of a breakout

Underperforming Coins:

$W (-11.2%): Last week's biggest winner turns into this week's biggest loser

$ENA (-9.1%): $ENA has continued to decline since the airdrop received two weeks ago

$BONK (-8.8%): $BONK has fallen out of favor in the new cat meme coin scene

News Briefs

Macroeconomic:

ETH ETF weekly outflow: -$12.3 million (Source)

BTC ETF weekly inflow: +$139.5 million (Source)

U.S. job growth exceeds expectations; unemployment rate drops to 4.1% (Source)

Last month's CPI inflation was higher than expected - but still at a 3.5-year low (Source)

HBO's Satoshi Reveal show received a lukewarm response, and the crypto market reacted mildly (Source)

Trump declines Fox News invitation, will not participate in the second presidential debate with Harris (Source)

Thailand's Securities and Exchange Commission new draft allows mutual funds and private funds to invest in digital assets (Source)

Projects

Crypto.com confirms receipt of a Wells Notice from the SEC and has filed a lawsuit against the SEC (Source)

Uniswap launches Layer 2 network Unichain (Source)

Swell Network: Users can now check their eligibility for SWELL token claims (Source)

Puffer Finance will start its airdrop on October 15, continuing until January 15 (Source)

Telegram CEO posts to celebrate his 40th birthday, stating he will share related experiences in the coming days (Source)

Stripe launches "Pay with Cryptocurrency" feature in the U.S., supporting stablecoins including USDC and USDP (Source)

HBO lists seven reasons Peter Todd could be Satoshi, despite his denial (Source)

Google has integrated ENS, allowing users to search for .eth domain names and view balances (Source)

Grayscale launches Aave fund (Source)

Jupiter mobile app is now live on iOS, with the Android version coming soon (Source)

Trading Insights

Note: The following content does not constitute financial advice. This is a compilation of market news, and we always encourage you to conduct your own research before executing any trades. The following content does not intend to express any guaranteed returns, and BitMEX is not responsible for your trading performance falling short of expectations.

In-Depth Look at Unichain

On Thursday, Uniswap announced the launch of Unichain and $UNI staking, marking a significant milestone for the project. Let’s take a closer look at this technology and its potential impact on the UNI price.

Unichain is an L2 built on the OP Stack, designed to address key challenges in DeFi and blockchain scalability. This new layer 2 solution introduces cutting-edge features aimed at improving market efficiency, mitigating maximum extractable value (MEV) risks, and facilitating seamless cross-chain interactions. Some key highlights of Unichain include:

1. Efficient Block Building:

Unichain introduces verifiable block building developed in collaboration with Flashbots, ensuring transparency in block construction. This is achieved by breaking each block into four "flashblocks," resulting in faster block times (200-250 milliseconds) while also mitigating MEV-related risks.

It separates the roles of block ordering and block building, making block order transparent and trustless, and utilizes Trusted Execution Environments (TEEs) to enhance security.

2. Flashblocks:

Flashblocks can reduce latency and the adverse selection risk faced by liquidity providers. This provides a low-latency trading experience for AMMs and other DeFi applications, which is crucial for them.

Flashblocks ensure that transactions are processed faster and more efficiently, allowing DeFi platforms to operate optimally without exposing users to MEV risks such as sandwich attacks.

3. Trustless Transaction Rollback Protection:

- By simulating transactions in a TEE environment, Unichain can detect and remove transactions that would roll back, ensuring that users do not pay for failed transactions, thereby improving user experience and reducing friction.

4. Unichain Validation Network (UVN):

The $UNI token gains additional utility by serving as the staking token for the UVN.

Unichain's decentralized validation network reduces reliance on a single sequencer, which can avoid risks such as block equivalence or invalid block proposals. Validators participate in block validation by staking UNI tokens, ensuring faster economic finality and cross-chain settlement.

The network aims to validate blocks more quickly, helping to streamline cross-chain liquidity.

5. Integration with OP Superchain:

- Unichain is built on the superchain, enabling seamless liquidity movement and interoperability across rollups on the OP Stack. This makes cross-chain interactions faster and cheaper, addressing the issue of liquidity fragmentation.

How High Can $UNI Go?

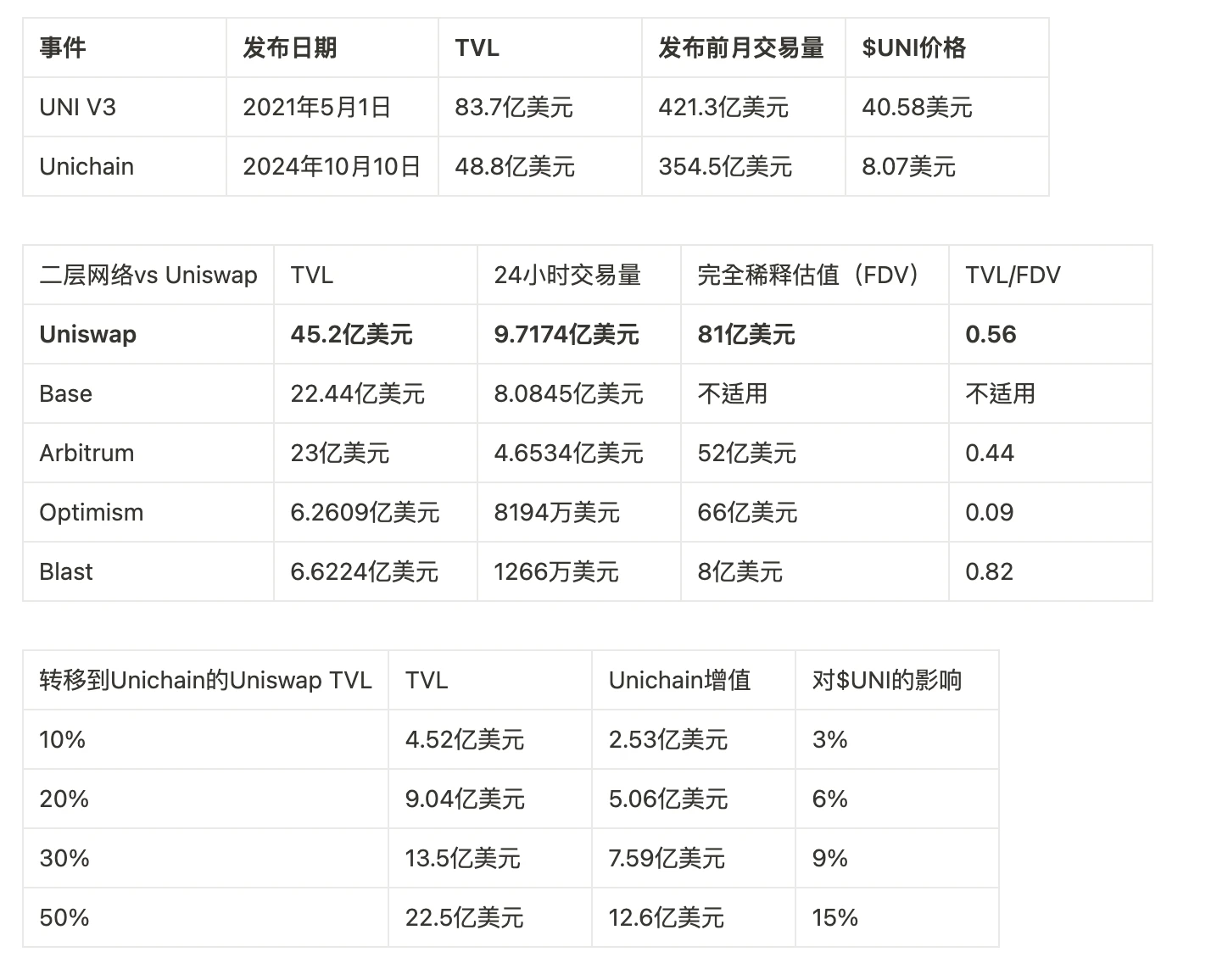

It has been three years since Uniswap last upgraded to UNI V3. During the launch of UNI V3, the price of $UNI briefly peaked at around $42 shortly after the announcement. However, there is a significant disparity between this price and the market valuation.

To assess the potential price growth of $UNI now, we examined what would happen if UNI could transfer a significant portion of its current Total Value Locked (TVL) and trading volume to the L2 solution. We compared this scenario with existing L2 networks to estimate UNI's potential additional "L2 valuation":

Conclusion

Overall, Uniswap is a crucial cornerstone of the DeFi ecosystem, as the scale of the application itself is several times larger than the largest rollups in the cryptocurrency space. If Unichain successfully migrates over 30% of its current TVL from other chains to its own chain, the price impact could be significant. However, if only about 10% of the TVL/trading volume migrates, considering it is already an $8 billion token, the impact of Unichain on the price of $UNI may be limited.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。