The best returns often occur in the early stages of emerging trends.

Author: Ignas | DeFi Research

Compiled by: Deep Tide TechFlow

I started to take an interest in Memecoins and even bought MOODENG. The fear of missing out drove me to take action. My default expectation was that the price might drop to zero, but I didn't want to miss the chance of it becoming the next Doge. I wanted to be part of a success story and join that optimistic community.

In fact, buying Memecoins satisfies a sense of belonging more than purchasing other utility tokens, becoming part of a story and joining a community that shares a "successful" optimistic sentiment.

You see, this optimism and bullish sentiment are hard to find in other areas of cryptocurrency.

Ethereum holders expect ETH to only rise 3 to 4 times in this cycle, and BTC may be similar. SOL might reach $1000. However, for tokens with low circulation and high fully diluted valuation (FDV), market sentiment is generally pessimistic.

This also goes against my own commitment not to participate in Memecoins trading. I wouldn't buy those coins that are heavily promoted in X dynamics, but I would try some that I believe have potential.

I changed my mind because my primary principle in the cryptocurrency space is to keep an open mind and try new things. Being an extremist myself is risky, but identifying and investing in extremist communities can yield huge returns.

Therefore, this blog post explores some new developments, with a particular focus on new methods of bringing tokens to market.

Identifying the latest token issuance trends may be the most profitable trade we can make. Memecoins are just one of those trends, and there are other trends emerging in this cycle.

A Brief History of Token Issuance

Viewing cryptocurrency as a hedge against the overproduction of fiat currency may be our biggest self-deception. While Bitcoin may be an exception, the "printing" methods of the entire crypto industry would make central banks envious. CoinGecko lists 14,741 cryptocurrencies, with thousands more that failed to survive long enough to make the list. With each cycle, issuing tokens becomes easier.

Here are some key token issuance trends you should know about, and how they change the game (if you've read my previous blog posts, you can skip this part).

Litecoin and the Early Altcoin Era (2011): Litecoin was one of the earliest altcoins, launched in 2011 as a fork of Bitcoin. Before Litecoin appeared, we generally thought Bitcoin was all there was to blockchain! However, Bitcoin's forks made us realize that we could create our own private currencies. During this period, a few Bitcoin forks and proof-of-work altcoins emerged, including Bitcoin Cash and Bitcoin SV. These forked tokens provided "free" tokens to Bitcoin holders during the fork process, creating profit opportunities.

The ICO Boom (2017): The ICO boom was driven by Ethereum's ERC20 standard, which made creating new tokens cheap and easy. No more need for proof-of-work (PoW) hardware! Thousands of tokens were launched, each accompanied by ambitious promises. ICOs often raised large amounts of money, but many projects failed to deliver on their promises, leading to massive losses during the 2018 market crash. This stage was a key period of speculative "printing," as teams issued tokens with minimal effort, ultimately leading to the market's collapse.

DeFi and Liquidity Mining (2020): The next innovation appeared during the DeFi summer of 2020, when liquidity mining and yield farming became very popular. Projects like Compound (COMP) and Susiswap introduced liquidity mining reward mechanisms, allowing users to earn governance tokens by participating in the protocol. This incentivized liquidity and user participation, but as new token issuances became excessive, demand could not keep up, ultimately leading to a market crash.

The Fair Distribution Era: This period was very brief. Yearn Finance's YFI token is a typical example of the "fair distribution" concept, where tokens were not issued through an ICO or presale but were directly distributed to users. Anyone could participate, and the initial mining rewards for YFI attracted widespread attention. However, people quickly realized that "fair distribution" was not truly fair. Pre-mining had already become common before marketing, and teams benefited little from genuine fair distribution, leading to inconsistent incentives.

NFTs and Ponzi Token Economics (2021): The NFT craze, represented by the Bored Ape Yacht Club, introduced a new way of "printing." The surge of NFT collectibles seemed to repeat the speculative token issuance that previously led to market crashes. As attention and capital gradually diluted, many new NFT projects ultimately faced collapse. NFTs are similar to meme coins, but with each series limited to a maximum of 10,000 NFTs and high prices, many were excluded, limiting the community's size.

Despite the different ways we issue "currencies," when the amount of "printing" exceeds the "hard currency" flowing into the market, a market crash is inevitable. We ultimately printed too many tokens to meet demand.

The Token Issuance Story of the 2023-2024 Bull Market Cycle

The first phase of the current bull market is marked by the rise and fall of the points-for-airdrop trend.

The points mechanism naturally evolved to address some issues with liquidity mining. By providing teams with more flexibility to execute token generation events (TGE) and attract capital into the protocol, it drove the growth of total locked value (TVL), thereby "proving" product-market fit. This also allowed teams to achieve higher valuations from venture capital firms.

Initially, when Jito and Jupiter generously rewarded users, this approach was significantly effective. However, as the rules of the points-for-airdrop game gradually became clear, the return on investment (ROI) from airdrops often turned negative.

Speculators tried to "farm" points, but the interest paid often exceeded the gains from airdrops. Additionally, the points system lacked the transparency of DeFi summer liquidity mining activities.

They made you believe that staking "DYM" or "TIA" could earn you multiple airdrops (which never materialized), leading to wealth.

However, the biggest issue leading to the decline of this trend was the issuance of tokens with low circulation and high fully diluted valuation (FDV). As total locked value (TVL) grew, the market perceived these protocols as more expensive, leading to tokens being issued at extremely high valuations, leaving little room for new buyers to profit.

We realized that high FDV is not a meme.

While the points mechanism has not completely disappeared, the decline in market sentiment and usage has become evident. For example, Eigenlayer decided not to proceed with the third-quarter airdrop but instead chose "programmatic incentives," which is essentially another term for liquidity mining.

Currently, most major protocols have entered the second, third, or fourth quarter of points mining, while enthusiasm for points mining in new protocols has waned. I used to share "best farms of the week" on this blog, but now it's hard to find attractive points opportunities in the market.

New protocols that missed the points craze must innovate in their token issuance models to attract users and create wealth. Here are some emerging token issuance models.

Public and Private Token Sales

ICOs are no longer popular, but their spirit remains.

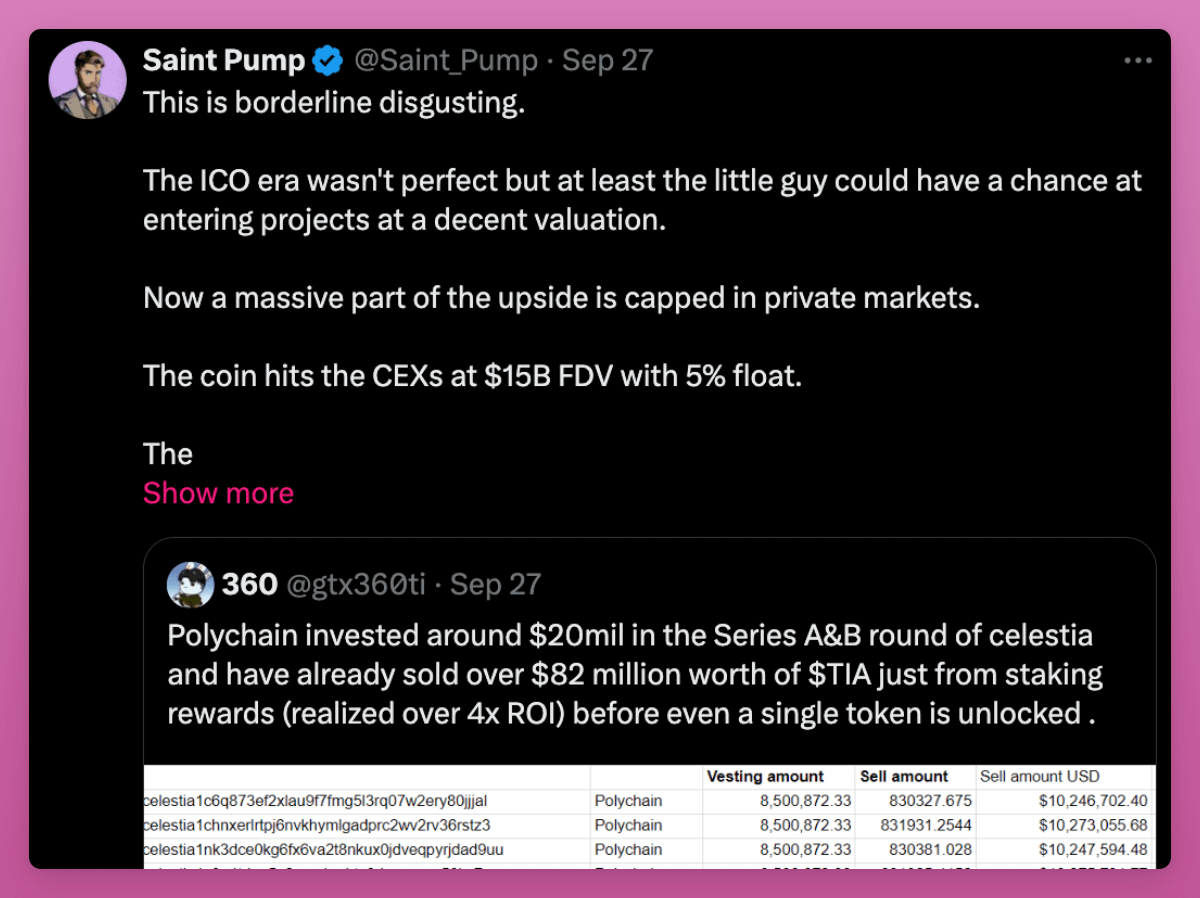

Perhaps the most influential cryptocurrency trader Cobie pointed out in his May blog post that a major issue in the current crypto market is that new token issuances have "privately captured" the upside, making it nearly impossible for ordinary investors to participate.

Most price discovery occurs in private financing rounds of venture capital, where investors buy in at low prices before tokens go public. Therefore, when these tokens enter the market, their valuations are inflated, and the fully diluted valuation (FDV) expands, leaving little profit margin for public investors. This situation favors insiders, while public buyers face high risks and low returns.

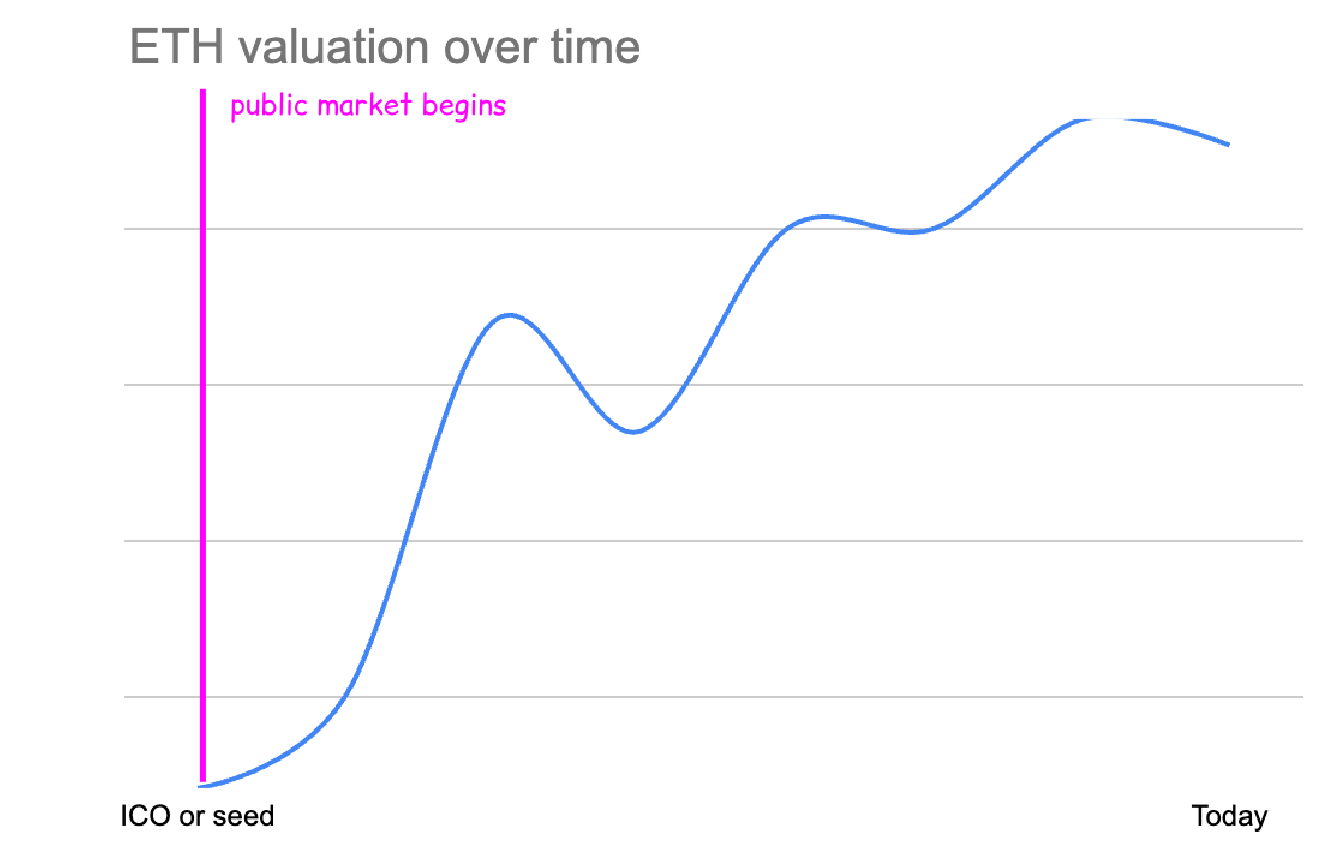

For example, the valuation of ETH during its seed round or ICO left buyers with significant upside potential.

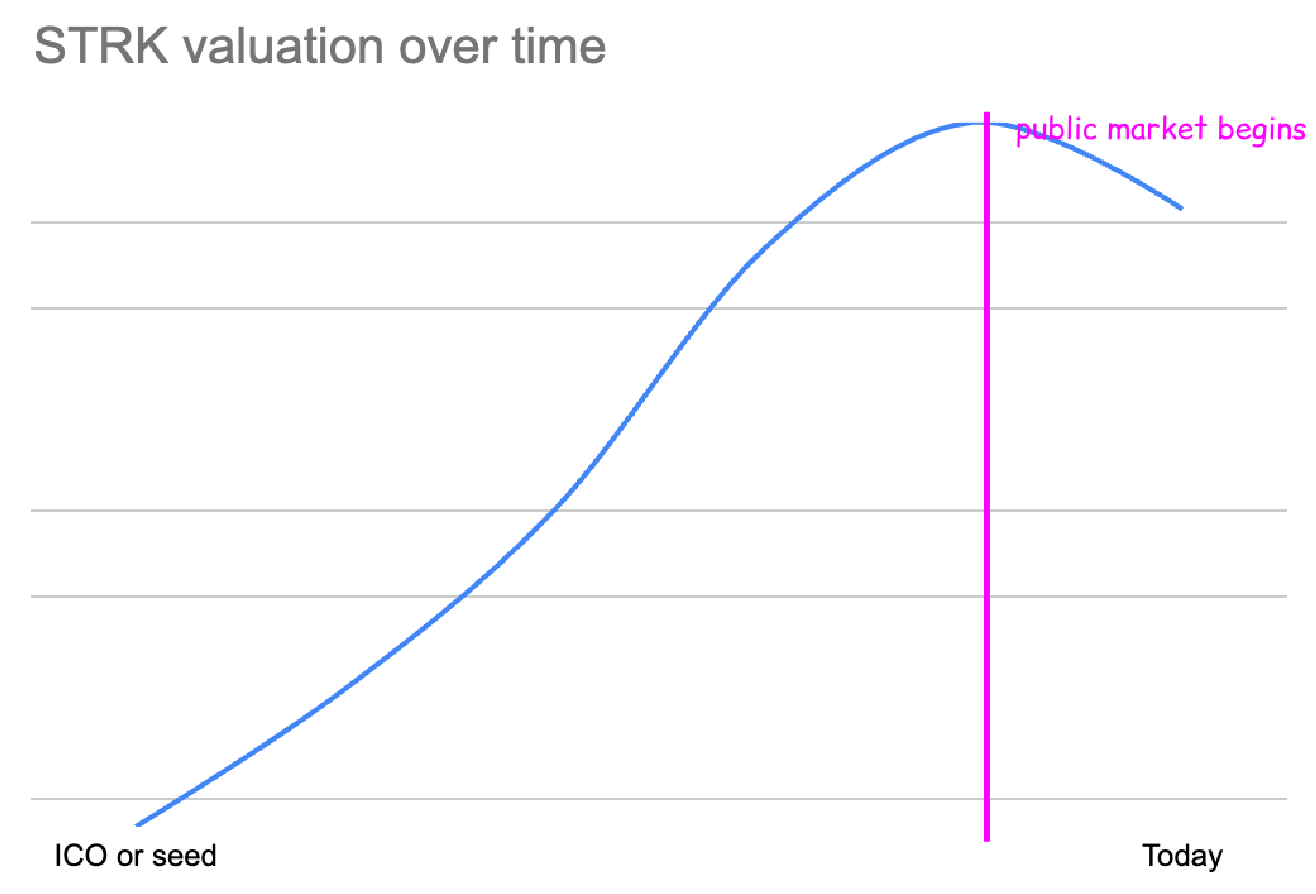

However, for tokens like STRK, EIGEN, or other low circulation, high FDV tokens in this cycle, the situation is different.

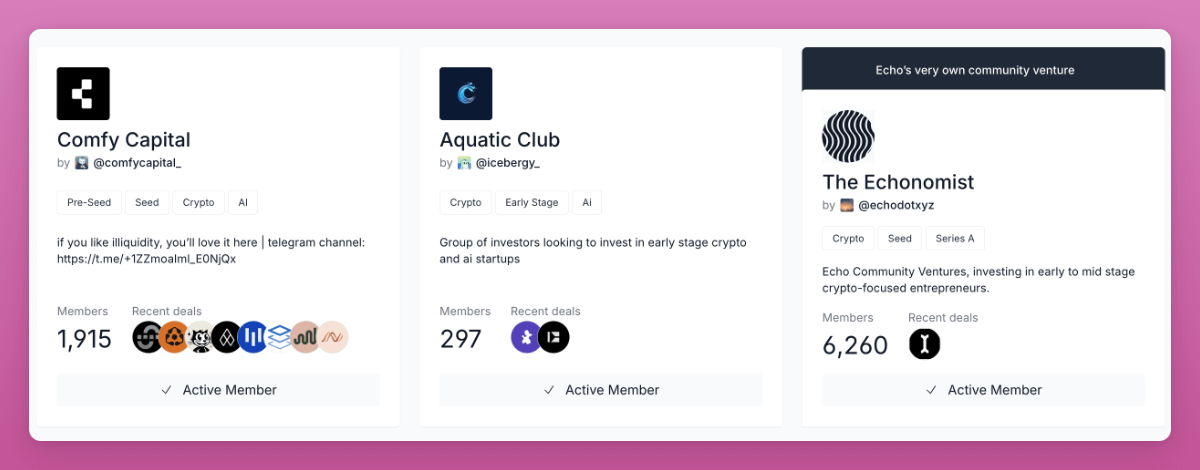

Thus, Cobie proposed a solution: the launch of the Echo platform for early-stage token investments. Here's how it works:

Group Leaders: "Experienced investors" (or Key Opinion Leaders, KOLs) create groups and share investment opportunities with members. Group members can choose to follow these leaders and invest under the same conditions.

On-chain Investment: All investments are made using USDC on Base L2.

Smart Contracts: Investments are legally managed by Echo through smart contracts, so lead investors do not have direct access to your funds. In token investments, only you can decide when to sell your own tokens.

For Founders: Founders looking for decentralized, community-driven funding can raise capital through Echo groups, avoiding the risks of centralized venture capital holdings and distributing equity or tokens to true on-chain native investors.

You need to complete KYC verification, connect your X or Farcaster account, fill out a questionnaire, and then join the group to view investment opportunities.

Their first major deal was the Initia project, which raised $2.5 million from at least 500 participants, with a valuation of $250 million, which is 28.57% lower than the $350 million valuation in the Series A round (according to The Block). The maximum investment amount was $5,000.

Echo participants were able to invest at a valuation lower than the Series A, which is very attractive. However, this model largely returns to the early ICO model of the past, where many people failed to participate.

Of course, I could create my own group and invite my followers to invest in early-stage protocol projects. Compared to VC rounds, these protocols can benefit from a larger community, but this does not solve many issues the projects face, such as larger capital injections, industry connections, strategic guidance, marketing and credibility, and long-term support.

Nevertheless, I believe projects can benefit from diversified funding channels: they can receive significant support from well-known venture capitalists while also building community through Echo, just like Initia did.

However, Echo is currently a relatively closed community, which is one of the reasons for its strong profitability: popular ICO platforms like Coinlist are also difficult to enter, and allocation amounts are usually small. If you have the opportunity to join, it might be worth a try.

“Sponsored Sales”

I have only participated in two rounds of KOL investments: Bubblemaps and Vertex.

Recently, I participated in a third: Infinex. I say "participated" because this is not a typical KOL investment. In a typical KOL investment, the project team contacts influencers and offers investment "opportunities" that are more favorable than venture capital. In exchange, KOLs need to post some tweets about the project on social media. It was precisely because Bubblemaps and Vertex did not have these promotional requirements that I was interested in them. But if I don't promote, what significance does it have as an investor?

Kain from Synthetix took a different approach in the Infinex token sale.

In addition to gamified yield farming activities, he also launched a Patron NFT sale. I received a private message from Kain informing me that I could choose one of the following three lock-up and valuation terms for investment: no lock-up, annual vesting, or a 1-year cliff plus a 2-year vesting period, with a 75% discount.

Infinex raised $65 million from 41,000 supporters!

In a podcast with Blockworks, Kain pointed out that the currently popular token distribution methods mainly rely on airdrops and private placements to qualified investors, which have their flaws.

He advocates for a fairer approach that allows everyone—whether venture capitalists, influencers, or ordinary investors—to have the same opportunity to purchase tokens at the same price.

"Everyone is at the same starting line. This is the fairest way you can do it, isn't it? If everyone follows the same rules and has as much information as possible, you can prevent those who are unaware from blindly investing out of fear of missing out." - Kain

Like Echo, Infinex draws inspiration from the ICO era and current trends, adapting them to the modern environment. While many participants are influential figures in crypto Twitter, this sale may exclude some large communities, but there are also different ways to qualify for the sale (such as point acquisition).

Unfortunately, this model may not apply to less well-known projects. However, if they offered a KOL sale option on their website without additional conditions, rather than requiring the signing of ambiguous SAFT contracts with unclear TGE timelines, I would definitely participate in more token sales.

There is now a new trend allowing anyone to participate in token sales.

Runes or other token models on Bitcoin.

For me, BTCfi is the most exciting innovation from 0 to 1 in this crypto cycle. I thoroughly enjoy minting Ordinal NFTs and playing with BRC20/Rune tokens.

I admit that the current infrastructure and user experience/user interface are not yet perfect, but they are gradually improving. Even so, ORDI (the first BRC20 token) was minted for free and reached a market cap of $1.8 billion, bringing substantial profits to early adopters. This is a success story we should pursue!

I have held it before but sold it too early.

BTCfi was one of the hottest topics, but interest waned shortly after the launch of the Runes protocol.

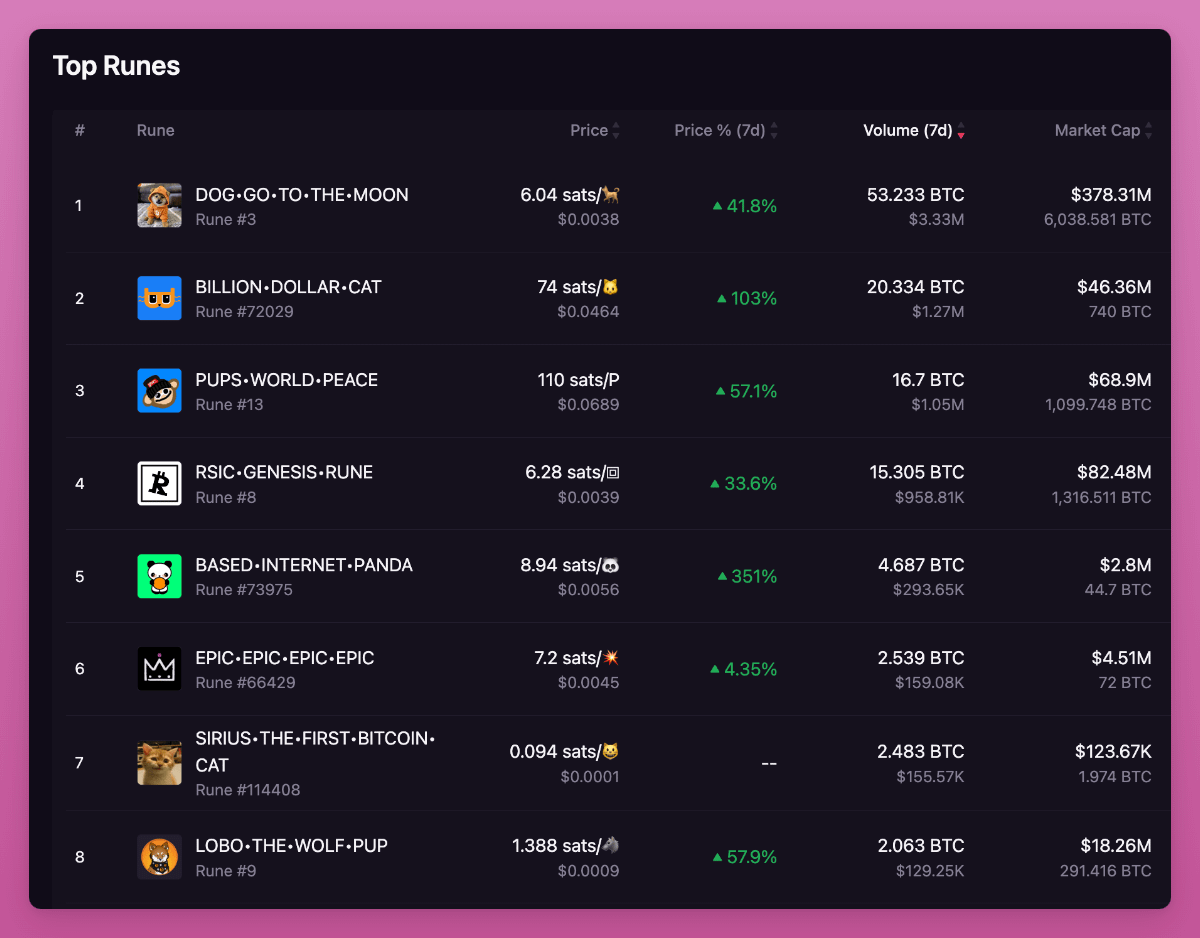

However, I still believe BTCfi can succeed: the infrastructure is continuously improving, and the community is very strong (mainly in Asia, so it is less mentioned in crypto Twitter). Prices are also recovering. You can take a look at the 7-day performance of the top 10 Runes.

The biggest innovation of BRC20 and Runes lies in their market issuance method.

Anyone can mint Rune tokens on the Bitcoin network by simply paying the transaction fee in Bitcoin. To try it out, you can visit Luminex and choose a token to mint. Alternatively, you can create your own Memecoin and choose a certain percentage for pre-mining, which will be publicly transparent for everyone.

I am optimistic about Runes because they address our dissatisfaction with venture capital rounds, pre-sales, low circulation tokens, and the lack of transparency in current Memecoin issuance. Runes represent the fairest token issuance model currently available.

Additionally, the lower Bitcoin transaction fees and slower transaction speeds set barriers to excessive token issuance and concentration in a few wallets, which is also a problem faced by other on-chain Memecoins.

I believe new catalysts are needed to spark a new FOMO wave. Currently, Fractals L2 is gaining attention, which may bring new heat to Runes. Runes can be minted on Bitcoin first and then bridged to Fractals (or other Bitcoin L2s), where they will gain smart contract functionality.

By the way, the mining method for Fractal's token FB is similar to BTC; you can participate in cloud mining by renting PoW machines. Due to high inflation, the price of FB has been declining.

Finally, new token standards on Bitcoin may become popular, perhaps bringing innovative token models through the OP_CAT upgrade. My point is that fairly issued tokens on Bitcoin have enormous speculative potential, making the BTCfi ecosystem worth close attention.

About the Ton Mini App "Tap Tap Game"

While I don't enjoy making money by tapping my phone screen, the "Tap to Earn" mini app launched by Ton and Telegram has attracted millions of users. Most of these users are not in the U.S., so many crypto Twitter users may miss this new trend.

In my previous article, we explored why South Asia is a unique crypto market.

We learned that for many people in third-world countries, "Tap to Earn" airdrops provide a new source of income amid economic challenges. This aligns more with the promise of blockchain to popularize cryptocurrency, making it accessible to everyone, not just allowing the wealthy to benefit from airdrop models.

However, after the frenzy of DOGS, Catizen, and Hamster, the next developments remain unclear. Currently, all tokens are declining, so the Ton mini app needs new catalysts to attract new speculative groups.

Being the first to notice changes in trends will yield the greatest rewards.

Memecoins

Memecoins are a tokenized community. Murad brilliantly articulates the value proposition of Memecoins in the video below, clearly explaining how, in the current market environment (such as venture capital unlocks, lack of transparency, regulatory issues, etc.), Memecoins outperform many utility tokens in certain aspects.

However, he only tells one side of the Memecoin story.

The screenshots he shows of Memecoins performing well overlook the fact that 99.5% of Memecoins will drop to zero within a day or two.

In contrast to his optimistic view, Memecoins are typically launched by internal groups that hold a large supply of pre-mined tokens and promote them through key opinion leaders (KOLs) who are compensated or given large allocations, preparing to sell once new buyers enter the market.

In reality, there is no true community; it is merely the illusion of a community being sold. This is why I stay away from Memecoins: finding genuine gems among a pile of low-quality projects is both chaotic and time-consuming. By constantly jumping from one Memecoin to another, your funds can quickly dwindle. In comparison, holding Bitcoin (BTC) may be a safer bet.

Nevertheless, Memecoins are where the most optimistic communities in the cryptocurrency space reside. This greed provides fertile ground for the emergence of true gems, like competitors such as Doge. This is why I haven't completely given up on Memecoins.

Additionally, platforms like Pumpdotfun in this cycle are preventing insider trading by introducing fairer launch mechanisms, using dynamic bonding curves to address initial liquidity issues, and reducing many security risks.

A good option might be to focus on Memecoin launchpad tokens like Ethervista or the upcoming Rush platform. I know the development team behind Rush, so it is unlikely to be a scam. However, be cautious: since its launch, the price of Ethervista tokens has been declining.

Repackaging + New Tokens

Old coins have become dull, and speculators are craving something new. If you can rebrand, create new token codes, and restart with new charts, that is the trend currently happening. I first mentioned this trend in June (see: Seven Emerging Trends in Crypto).

We have seen multiple brands rebranding, such as MATIC rebranding to Polygon and launching a new POL token, Orion rebranding to Lumia (from ORN to LUMIA token), Covalent (the DA protocol of the AI era) migrating from CQT to CXT token, and Connext rebranding to Everclear (introducing new token economics), among others.

One of the most interesting examples is Fantom migrating from $FTM to $S, and Arweave launching the AO protocol.

Arweave decided to launch a new token AO for the AO protocol instead of using the existing AR. This makes sense since AO is a different protocol, but interestingly, you can mine AO tokens just by holding AR in your wallet. It’s like printing money!

Unfortunately, the performance of these rebranded tokens has not been ideal, failing to bring much hope to this trend. Perhaps only Fantom's rebranding has started to gain attention, and even Polygon is facing difficulties in this cycle.

Nonetheless, it is still important to pay attention to those rebranding projects that can attract community interest. This indicates that the team is still active, has not given up on the protocol, and is continuing development.

Community/Social Tokens

I really got burned by FriendTech and 0xRacer.

This is one of the biggest mistakes I made in this cycle.

They had the opportunity to develop a consumer application that could attract a broader user base, but they chose the simple route of just making money.

Regardless, FT improved the user experience by popularizing the use of Privy and promoting social tokens, changing the industry.

In FT v1, social tokens were based on the personalities of key opinion leaders (KOLs), while in V2, the goal is to tokenize the entire community.

Like Memecoins, community tokens are centered around the community, providing an opportunity to join an exclusive club.

The most successful example is the DEGEN token, which recently listed on Coinbase and surged by 127%! Initially, it was airdropped as a community token to active Farcaster members. Personally, I earned about $40,000 by posting on Warpcaster.

The success of DEGEN lies in its community-driven launch and successful integration into Farcaster, thanks to the platform's openness. Tokens like DEGEN help solve the classic problem of social platforms: users don’t post because there aren’t enough users. By generously rewarding early users, other social applications can adopt similar strategies. Lens also conducted an airdrop.

My advice is to try out some new decentralized social applications, like Phaver (I posted a few times there and received a $250 airdrop).

However, the utility of these tokens in specific applications limits their widespread adoption. DEGEN has decided to launch its own L3 to expand, so keep an eye on the movements of other community tokens.

More excitingly, we may see the emergence of Farcaster, Lens, OpenSocial, and other SocialFi tokens.

What to Watch for in This Bull Market?

The best returns often occur in the early stages of emerging trends. Liquidity mining, point farming, fair launches, and NFT minting have already brought millions in profits to early participants. My task is to identify these new token minting trends and find ways to leverage them.

A good signal that a project has high potential is that the early stages often trigger community chaos, accompanied by love or hate. As long as people care, it’s worth paying attention to.

Look into how this token minting creates a flywheel effect: early users are rewarded, which incentivizes them to stay in the ecosystem. While this may seem like a Ponzi scheme, the most successful "money printing" mechanisms often share similar characteristics.

Remember to always keep an open mind. Try new things, and if you discover something interesting, please let me know!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。