Master Discusses Hot Topics:

In the past two weeks, the non-farm payroll and inflation data, while not yet alarming enough to raise concerns about inflation, have already cooled expectations for "recession" and "imminent interest rate cuts" by half.

Today's data from CME shows that the probability of a 25 basis point rate cut in November has risen to 84%, while the likelihood of no rate cut has decreased. Therefore, last night's market reaction was flat, as the basic expectations remained unchanged.

From a medium-term perspective, expectations for recession and rate cuts have both cooled. The market now seems to be lost, unable to find direction, waiting for a re-anchor. The most critical factor moving forward will be the trajectory after the rate cut: recession or rebound? The first rate cut is certainly important, but the subsequent pace will be key in determining whether the economy shows signs of improvement.

Currently, concerns about recession have been temporarily alleviated, and inflation slightly exceeded expectations but did not shake the probability of a rate cut in November. The risks are not significant, allowing for a moment of relief.

However, let’s not forget that the earnings season is approaching. Coupled with the uncertainty of the U.S. elections, the stock market may have to wait for earnings reports to signal whether it will show strong performance or weaken.

As for the crypto space, the most important factor remains liquidity! No matter how weak the fundamentals are, as long as liquidity is strong, there will always be some vitality.

Keep an eye on the U.S. dollar liquidity indicators, especially changes in bank reserves and fluctuations in USDC issuance, as these may also serve as observation indicators. After all, a pond without water won't allow fish to jump high!

Master Looks at Trends:

As soon as the CPI was released last night, there were discussions in the U.S. about prices rising slowly, so there is no rush to cut rates. As a result, Bitcoin reacted by dropping, briefly saying goodbye and falling below 60K.

Now, every time there is a drop, the trading volume is fierce, as if everyone is scrambling to jump off the train. But when it comes to a rebound, the trading volume quiets down, as if everyone is just watching the show.

So if buying pressure is weak, we might see a small rebound, followed by a continuation of the downward trend, sliding down further.

Overall, the current rebound strategy is like a temporary health boost in a game; it will be used up quickly, and then you need to run.

Resistance Levels Reference:

First Resistance Level: 60600

Second Resistance Level: 61300

The first resistance level is currently being tested. To see a larger increase, it must break through and stabilize. It's like playing basketball; you need to break through the opponent while keeping control of the ball, or else it will go out of bounds, and all that running will be in vain.

If the first resistance is successfully broken, we need to observe whether it can break through the downward trend line with momentum. If it can hold 60.6K and consolidate back and forth, the chances of a rebound will greatly increase.

After all, we are still in a bearish trend. If we reach the second resistance line without enough trading volume, it’s better to change strategies quickly rather than foolishly waiting for a rise; adjusting is safer.

Support Levels Reference:

First Support Level: 60000

Second Support Level: 59300

If it falls below 60K again, it will trigger a larger decline, resembling a downward "N-shaped" trend. At this point, 60K is like your safety rope; if you let it go, you can expect to be washed away by the tide!

Yesterday, the price already dipped to around 59K, like ice cream melting in front of you, with less and less to block it. The hope now is to hold the 60.4K level to expect a rebound. Otherwise, this wave of rebound might not have a chance.

Today's Trading Suggestions:

The current price level is a bit awkward, like standing on the threshold, neither going in nor retreating. Therefore, it is recommended not to rush into the market; wait for a pullback to the support line and see if a rebound can occur, or consider shorting when it reaches the resistance level.

After all, the reasons for the market to rise are as scarce as missing persons, and one cannot ignore the risks of a downturn while trading. In these times, caution is essential; don’t let the market teach you a lesson; not every strike is heroic.

Yesterday, the price of the coin dropped to around 58900, and the first target for long positions at 60100 has been achieved, securing a profit of 1100 points. Currently, the price has risen to around 60700, and friends still holding long positions can take a steady profit and exit.

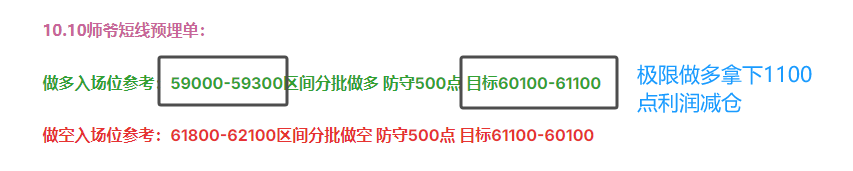

10.11 Master’s Short-term Pre-placed Orders:

Long Entry Reference: Buy in batches in the 59000-59300 range, with a stop loss of 500 points, target 60000-60600

Short Entry Reference: Sell in batches in the 61300-61600 range, with a stop loss of 500 points, target 60600-60000

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot contract trading techniques, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication, hoping to help you find what you want in the crypto space. Focused on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates of macro analysis articles, mainstream coins, and altcoin technical indicators analysis, as well as spot medium to long-term price prediction videos.

Friendly Reminder: This article is only written by the official public account (as shown above) of Master Chen; other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。