Original Author: Thor Hartvigsen, Thlither, hyphin

Original Compilation: LlamaC

(Portfolio: DAYBREAKER, Illustrator for Tomo: eth Foundation)

"Recommendation: Polymarket, as a successful case in the crypto field, offers significant advantages compared to centralized platforms. This article explores how Domer, as a top trader on Polymarket, achieves trading success through his experiences in prediction games, stock trading, and event trading, along with his unique insights into trading psychology and market forecasting."

Introduction

Polymarket has become one of the most prominent success stories in the cryptocurrency space this year, attracting tens of thousands of daily active users and generating hundreds of millions of dollars in trading volume each month. As the largest blockchain-driven prediction market, it has clear advantages over centralized alternatives, proving that cryptocurrency can bring about real innovation.

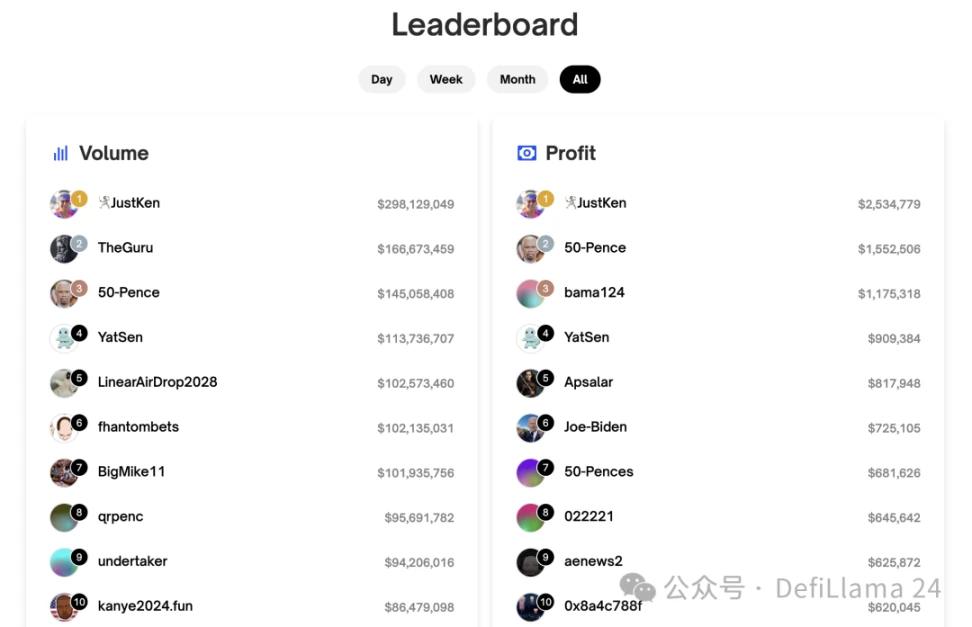

Last week, the On Chain Times team had the privilege of speaking with Domer, who is also known as "JustKen" on the Polymarket leaderboard. Domer is the top trader on the Polymarket platform in terms of trading volume and profitability. He has participated in trading over 5,000 markets, with a total trading volume approaching $300 million, and has unique insights into the prediction market and election forecasting.

In the interview, Domer discussed his professional background, prediction market trading framework, trading psychology, and more.

Chat with Domer

How did you start making political predictions? What made you decide to become a full-time political trader?

I accidentally became an online poker player. I started playing online poker in the mid-2000s, which was the golden age of online poker, and it was relatively easy for a young person to make money (before the U.S. government shut it down). After graduating from college, I didn't stick with my job for long and decided to play poker full-time. I randomly clicked around on a website and discovered that there were other things to trade besides sports. This led me to start trading movie box office numbers (again, before the U.S. government shut that down), and then I quickly entered the political realm through a site called Intrade (before the U.S. government shut down Intrade). I have always had an affinity for politics, so I had a lot of fun trying to predict various details during the 2008 campaign. I made a lot of "big" (relatively speaking) profits in 2008, and after that, I quit poker to focus on trading these things. The prediction market is basically a slow-motion poker game where you can beat your opponents through more research. Plus, these are all topics in the news, or at least things you care about a bit.

Let me expand on this answer further. From a broader perspective, I come from two different backgrounds: one as a poker player and the other as a stock trader. Ultimately, I transitioned from both fields for different reasons: poker has a lot of variance, while stock trading has unclear and sometimes long time horizons.

In poker, you can play perfectly and still lose money. You can actually play optimally for many, many hours and still lose. The fluctuations in money can be stressful, and to be honest, it's quite foolish. Emotionally, poker can oscillate between extreme boredom and extreme risk.

Then when it comes to stocks, you might be completely correct in your judgment of a company, but it may take years to see that judgment validated. I’ll illustrate with a simple example: my first "trade" in stocks was in the early 2000s when I discovered that McDonald's owned almost all the land where its restaurants were located, and that land was rapidly appreciating during the real estate bubble. They had a real estate empire that should add more value to their stock price. At least, it was worth a few percentage points, maybe more. But "Wall Street" didn't really realize this until years after I bought in. So you can be right about some aspect of a company to the point of turning blue in the face, but that doesn't mean it will make you any money in the stock market. The unpredictability of the market in the short term can be foolish and nonsensical.

Ultimately, I enjoy looking for edges and I enjoy trading, and the prediction market is the best and most interesting way I've found to do that. As for the U.S. government, they basically forced me to leave the country (temporarily), but it seems their regulatory policies may be coming to an end, as they are losing in court regarding prediction markets. Hope is in the air.

You are the most profitable trader on Polymarket ever. Have you noticed that people disproportionately mimic your trades? Do they reverse your trades? Seek to be your allies or competitors?

For copy trading, the answer is yes, but then again, it's also no. I place a lot of orders and lose a lot of orders. My risk tolerance is high, and I have ample capital. So many people will copy my trades and then give up after losing once. At this stage of my career, I think I might have lost slightly more orders than I’ve won, but I make more money when I win. This puzzle is left for you to ponder.

Regarding teammates - I receive a lot of selfish "advice." I have a core group of people I trust and talk to. To most people, I might seem like I'm just sitting alone trading, but in reality, I almost constantly discuss my event trading orders with others for feedback. I'm smart, but not always, and I'm definitely not the smartest person, so it's important to talk to smart people and get reality checks. Making a career out of event trading is a very ronin-like existence. But you also need to talk to other ronins; otherwise, your career won't last long. Haha.

In your post about the transferability of EIGEN, you mentioned that you were buying at 20 cents because you believed the chances of success were close to 50/50. Can you elaborate on how you came to that conclusion? Was it purely a qualitative judgment, or did you consider other more specific data in your mental calculations?

I think event trading can be a process. They often start from intuition. I often make a lot of small intuitive trades. But when you turn to larger trades, you need to rely on much more than intuition; sometimes you don't have much time to do that, so in that case, I was researching the situation CZ would face. I spoke with some experts. Based on my research, I thought he would be released in early October. But usually, you are researching unprecedented situations. CZ is the richest person ever to have been imprisoned anywhere in the world (I think). You can't completely use the case of Jimmy Walnuts scamming his local laundromat for $500 as a reference to predict what a $50 billion person will encounter in the criminal justice system. So it's a very imprecise science. He ended up going to prison about a week earlier than I expected, so he was a few days ahead of EIGEN, and I lost that event trading contract. But even in losing, it was an extraordinary trade.

For large positions, liquidity can be both an opportunity and a constraint. Does market liquidity on Polymarket affect your trading decisions? If so, how? Have you ever encountered situations where liquidity limited your ability to enter or exit positions?

Liquidity is interesting; I think I don't think about it too much anymore unless in certain specific situations.

As for exiting - if there is a slippage ratio for a trade, I wouldn't care about liquidity for a small, intuitive bet. For a large, well-researched trade, I wouldn't care whether I wanted to exit, so I wouldn't care about liquidity. This might apply to situations where I am making medium-sized trades where I think I might have an edge but am not entirely sure, and if liquidity is low, I might hesitate to overcommit. If new information comes in, you might get stuck in a low-liquidity market. The answer is "it depends."

As for entering a position - I think everyone wishes for unlimited liquidity to enter a position, haha. Yes, limited liquidity is almost a challenge for every trade I want to make. However, I will say that high liquidity can be a bad thing if you end up trading more than you intended because you can. So be wary of the temptation of high market liquidity to overcommit. I might have overcommitted because of high liquidity; I might be wrong about that.

It seems you make hundreds or even thousands of trades every day. What is the ratio of automation to manual operation in your trading?

"No one believes me, but it's all manual. I have a lot of orders on my account, so most of my trades are my orders being matched rather than me manually entering new trades."

You trade across a wide range of prediction categories, from politics to macroeconomics. Have you found that certain types of markets are more predictable or profitable than others? How do your strategies differ across different categories?

That's a good question. I should think about it more. I do have a vague sense of my areas of expertise.

But overall, I like to pay attention to the world, so I enjoy placing bets on a wide variety of events. I also like markets about new things I'm not familiar with. Because if I'm not familiar, it's likely that almost everyone else isn't either. So we all start from very little knowledge, trying to see who can figure it out best. It's a bit like a combination of competition and puzzle-solving.

To slightly digress, regarding people's "familiarity" with things, I find that sometimes super experts in a field are actually not very good at predicting the things they specialize in. This is because they overestimate their expertise.

As the largest trader by volume on Polymarket, you have unique insights into what drives trading activity. With less than 6 weeks until the U.S. presidential election, Polymarket will face two new pressures: 1) they need to securely settle over $1 billion in trading volume, and 2) they need to establish a new dominant market after the election market ends. How do you view these two challenges? As we move toward this moment, what will you be looking for from Polymarket?

I don't really see settlement as a source of pressure. Polymarket has settled tens of thousands of markets, totaling billions of dollars. The U.S. election market will be very large and could be very controversial, but ultimately someone will be sworn in as the next president, and I don't think the mechanism for resolution itself is a source of pressure (if no one is sworn in and a civil war occurs, then the world might have bigger problems to worry about than Polymarket's settlement). By the way, if you're worried about settlement, you can always sell your winning shares to someone like me for $0.999!

As for the next big market, the U.S. presidential election has always been the largest market on prediction markets to date. It is one of the largest team competitive events in the world, with hundreds of millions (billions?) of people at least loosely supporting a winner, even if they cannot vote for them. Therefore, you certainly cannot replicate the trading volume of this scale with a single market.

But there is no doubt that prediction markets are experiencing explosive growth overall. I remember the first "big" market after I joined Polymarket in early 2021. It was the ship stuck in the Suez Canal. It blocked a channel of world trade. Almost everyone in the world knew or was following this story. Everyone on the site was placing orders like crazy. Reports were written about this market on Polymarket. Total trading volume? Not even $500,000. If the same situation happened today, the trading volume for the same market would easily exceed $50 million, if not more.

To put it metaphorically, back in 2021, Polymarket was like a small sandbox with just a few kids playing. Now it has turned into a large beach with thousands of people. In a few more years, it might become an island with numerous beaches.

There will always be emerging interesting markets, with elections happening all over the world, and you know what? The campaign for 2028 will start immediately after the next president is inaugurated. I’ve heard that Vance will be a popular candidate for the Republican Party.

What advice do you have for a trader who has dabbled in stocks/options/cryptocurrency trading but has never traded binary event contracts? How would you explain your Polymarket strategy to someone just starting out?

First, give it a try. Deposit $10 or $100, or any amount you want to deposit. The worst-case scenario is that you have fun or get excited and then lose it all. If that’s the worst outcome, it’s not too bad, haha.

The second point I want to make is that you don’t have to feel pressured to predict any market or trade any single thing. Just because everyone is trading the presidential election doesn’t mean you need to participate. There are hundreds of markets on the site covering various topics. Find some areas where you think you might have an edge. Try to look for advantages. If you find one, great, place your order! If not, that’s okay; you don’t have to do anything, just keep looking around for other opportunities.

Didn’t see anything you liked but have an interesting idea for an order? Join our Discord group and propose the market you want.

In terms of strategy, I suggest you follow this general guideline when placing orders: place orders based on your advantages. If you haven’t found an advantage, don’t place an order unless you are intentionally placing a bet for entertainment (like betting on a game you are watching). If you find an advantage but are unsure if it’s really useful, place a smaller bet. If you think you’ve found a significant advantage, place a larger bet. This may sound simple or even a bit silly, but it’s a powerful and important concept. Many people place too many orders without an advantage.

I really enjoyed reading your X posts about the Venezuelan presidential election. They taught me a lot about what was happening, but as an event contract trader, what did it teach you? Did it change the way you handle markets that seem likely to be controversial?

On Polymarket, almost all markets can settle without any controversy. Absolutely over 99.5% of markets can complete settlement without issues or only minor controversies.

But some rare controversies are highly contentious. Controversies are tricky. They can be both interesting and foolish, both engaging and stressful. New users should avoid them like the plague unless they are masochists or know what they are getting into. I have experienced failures and victories in controversies, but I remember the clarity of failures to be about 100 times that of victories.

In the case of Venezuela, the opposition candidate likely won the election, but the ruling president manipulated the results and claimed victory. I suspect this situation occurs at least semi-regularly around the world, where the ruling party manipulates "elections," making voting meaningless. If that were all, the ruling party would be directly marked as the winner on Polymarket. But this time it became very interesting because the opposition anticipated electoral fraud and made tremendous efforts to prove they won the election, recruiting thousands of volunteers and preserving "evidence" of vote counts. They actually proved they won the election. The ruling party was caught off guard and quickly created a spreadsheet of "real" results but messed it up, exposing that the numbers they just presented were impossible and fabricated. Ultimately, UMA made a very controversial ruling, stating that the evidence was sufficient to indicate the opposition won, even though the ruling dictator was unlikely to let them take office (we shall see; loose negotiations are ongoing). If it weren’t for the extremely strong chain of evidence and the obviously forged spreadsheet, this dictator might have won on Polymarket.

Regarding how I handle controversies, unfortunately, due to my investment in many markets, I have to get involved. But after being hurt by UMA multiple times (I mainly criticize them for not caring at all about what they are doing, and those who don’t care usually don’t put in any effort), I try to strictly limit the time I spend on arguments. There is a group of users on Polymarket who are specifically trying to persuade UMA during controversies, involving a lot of networking and backdoor dealings. All of this is very undignified, absurd, and even close to fraud, but I won’t discuss that for now. However, keep this in mind when I later answer questions about tokens.

What are your thoughts on non-blockchain platforms like Kalshi or PredictIt? Have you used them, or is most of your trading volume on Polymarket? Do you often look for arbitrage opportunities between the same events across different markets?

I have used Kalshi and PredictIt in the past and would recommend them! But I don’t use them much now because Polymarket has grown so large that it has become an adventure platform I am fully invested in.

I often look for arbitrage opportunities, but many people are doing the same, and these opportunities may disappear quickly nowadays.

You have to be careful with arbitrage and ensure there are no very subtle and fine differences between markets; otherwise, theoretically, you could lose on both platforms.

Prediction markets like Polymarket are becoming increasingly popular, especially in predicting major political and economic events. Looking ahead, how do you think these markets will evolve? Do you think they could become influential enough to actually shape real-world outcomes rather than just predict them?

I think these markets will become a class of important financial contracts that are widely cited and referenced to the point that they become commonplace and ordinary.

One of the largest markets on Polymarket, but not getting much attention, is the actions of the Federal Reserve. These markets currently trade in the tens of millions of dollars because they are both unpredictable and very important. Financial markets already have a similar "prediction market" that is frequently cited—the CME (and its FedWatch chart). You will see these numbers in financial networks and news articles. You hear less about (but this will change) predictions from sites like Polymarket and Kalshi. Traders on these markets are more accurate than those on the CME. Yes, amateurs are more accurate than professionals. In predictions, accuracy is key, so you will see media citations evolve over time to reflect this.

As for influencing real-world events, I think this is more of a philosophical question. Personally, coming from a poker background, one principle of poker is "don’t tap the glass." If there is a bad player at the table, a fish, you don’t let him know he’s a fish, or he might change his behavior (like leaving or learning more). In this sense, I do not advocate trying to influence events to solve market problems. I believe there should be a wall between the two. As for the philosophical question of whether it is feasible to not influence world events, I don’t know. The tail might start wagging the dog.

What is your current favorite overlooked PM contract, and why? Which new market needs to be launched as soon as possible?

Well, if there is an overlooked contract, I might try to quietly buy as many shares as possible, so I won’t share that information anyway (and there is indeed such a market right now!). But I will give you a roundabout answer:

I think people have become accustomed to the assumption that the U.S. election will be close, and I believe a savvy trader might find an opportunity to bet against the traditional view of "the election will be very close!" If Trump or Kamala wins by an unexpectedly large margin, they could reap substantial profits. This is a realistically possible outcome, even if it doesn’t seem so from media reports.

There has been ongoing debate about whether projects really need to launch their own tokens, even though token generation events (TGEs) clearly have lucrative potential. In your view, would a native token improve the user experience on Polymarket? What would become easier? What would become more difficult?

This might offend some people, but I am not a supporter of cryptocurrency. At least not right now. I feel that most of cryptocurrency is just potential and has not truly leveraged blockchain/ledger technology. Unfortunately, many cryptocurrencies are vehicles for speculation, scams, hacks, and people trying to make quick money. I have interacted with two people who went to prison for ridiculous cryptocurrency crimes. I roughly keep an eye on airdrops (because these are popular markets on Polymarket!), but it’s ridiculous how unclear many projects are about why they should issue tokens. I won’t name names!

Against the backdrop of my skepticism towards cryptocurrency and airdrops, I want to say that I strongly support a Polymarket token. This is not because I have a bias! Let me explain.

I believe the potential of cryptocurrency, in my view, is embodied in forms like Polymarket. This is the largest prediction market ever, built through smart contracts, with every transaction on-chain. Your money isn’t sent to some company; it exists in a wallet you control. The determination of outcomes is decentralized (well, mostly; I’ll talk about that later). All of this is a big deal, and in my view, Polymarket is a huge innovation in multiple ways. I might be biased, but I think it is the first killer app built on blockchain.

If someone asks me whether they should get into cryptocurrency, I might counter with "which part of cryptocurrency?" and "…are you sure?" But if someone asks me whether they should participate in Polymarket, I would answer, "Yes, I’ll help you get started!"

Therefore, the benefit of establishing a token for this is that this prediction market has thousands of markets that need to be resolved. As I discussed earlier, 95% of the resolutions are straightforward, but sometimes they can be perplexing and difficult. Token holders with vested interests in Polymarket's success should be the ones deciding on ambiguous market resolutions. Currently, UMA votes on controversies, but I believe their interests are somewhat aligned with Polymarket, though not completely. If the interests are not fully aligned, then the voters themselves may lose interest. This is indeed the case. It is disappointing that they lack interest. The ownership of tokens by UMA is somewhat centralized, so you will find that a small number of people decide many of these controversies. This undermines what could have been a fully decentralized exchange. A token that could help smooth the controversy resolution process would address many issues. If Polymarket is a killer app, then the killer feature needed is the handling of the controversy resolution process.

I see you listed a book by Kahneman in your recommended reading list - heuristics, risk/loss aversion psychology, and dual-system thinking all play important roles in gambling. How do you think Kahneman would view Polymarket? Which of his teachings often come to mind for you?

I think about the biases that Kahneman and Tversky wrote about every day, and that is no exaggeration. Their findings are simple—somewhat obvious in certain ways—but also very profound. Some of the things I ponder include: price anchoring effect, endowment effect, loss aversion, availability bias. There are many others. If you want to be a top trader or a top performer in any field, you should have a deeper understanding of the biases that try to control your brain.

Daniel Kahneman would appreciate Polymarket. He is an advocate for prediction markets.

Lastly, I want to say that overcoming biases is difficult, and you must remain vigilant to prevent losing money as a result. I like to say (and believe) that making money in prediction markets is easy. The future is unpredictable, but it’s not that unpredictable. You can easily find markets that can make money. But the truly difficult part of prediction markets is avoiding losing large amounts of money on foolish things. Because while making money in prediction markets is easy, losing money is even easier. Reading the works of Kahneman and Tversky, and trying to avoid some traps, is essential because many foolish trades are only considered foolish by traders in hindsight. This is not necessarily hindsight bias!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。