Author: BlockBeats

Uniswap Labs has finally released another significant product development following V4 and UniswapX—Unichain. According to the official statement from Uniswap Labs, after years of building and expanding DeFi products, the Uni team has identified several areas in DeFi that need improvement. This Optimism superchain based on OP Stack aims to create the necessary conditions for advancing cross-chain DeFi and Ethereum's scalability roadmap, becoming a fast, decentralized "liquidity chain."

The Unichain testnet went live today, with the mainnet set to launch later this year. The Uniswap Foundation will provide funding and project support to help developers build on Unichain. Following the announcement, the price of UNI continued to rise, increasing by 15% in 24 hours and briefly surpassing $8. However, while many are surprised by "Uniswap making a chain," the most pressing question remains: Does it empower UNI?

Unichain Architecture & Interaction Overview

According to the Unichain official website and its white paper, Unichain is an L2 built on OP Stack, featuring two key innovations: verifiable block construction and the Unichain validation network.

The verifiable block construction mechanism is a collaboration between Uniswap and Flashbots, which splits each block into four "Flashblocks," achieving an effective block time of 200-250 milliseconds. Unichain will initially launch with a 1-second block time, quickly transitioning to a 250-millisecond block time. Additionally, Unichain can significantly improve market efficiency by increasing arbitrage frequency and reducing the value loss from MEV, all while minimizing transaction delays.

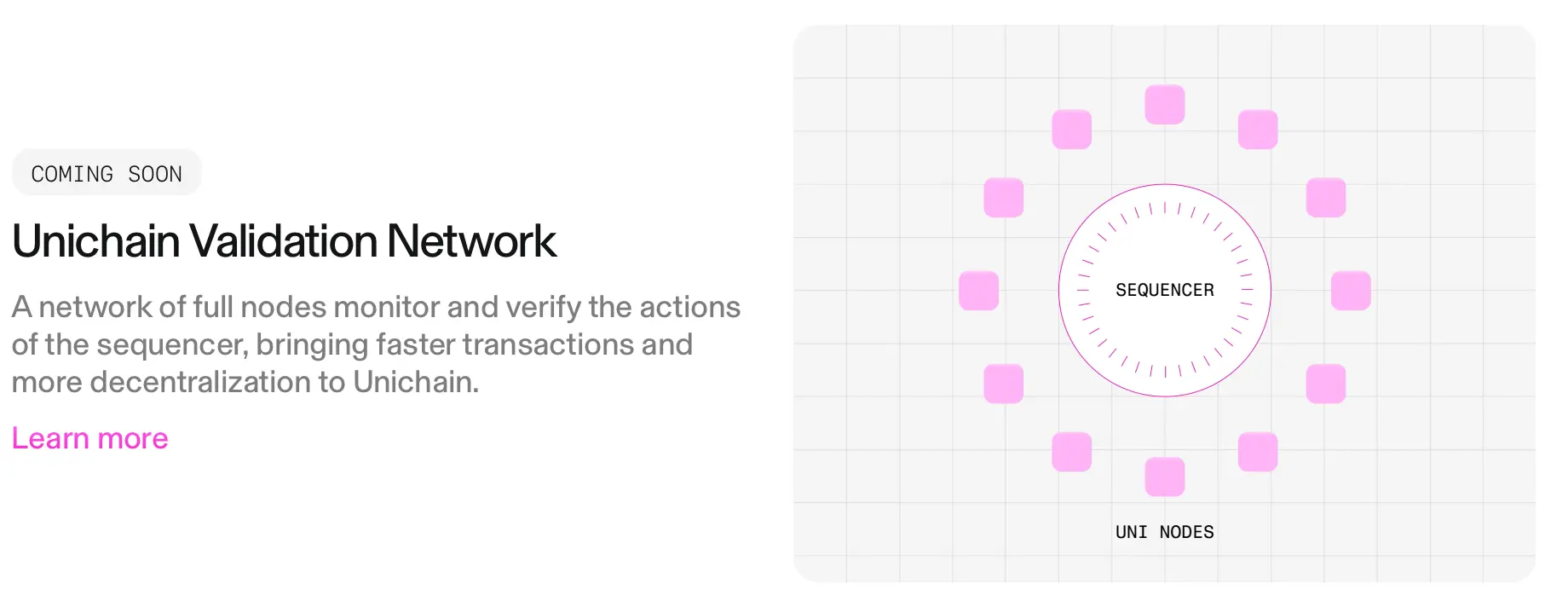

The Unichain validation network is a decentralized network of Unichain node operators designed to reduce certain key risks in the block sorting process, achieving faster economic finality for quicker settlement of cross-chain transactions and supporting potential future scalability.

Unichain is based on the OP Stack superchain environment, combined with the Intent Bridge, aimed at facilitating seamless liquidity flow across chains, providing users with fast, cheap, and broad access to liquidity. According to the official introduction, the development process of Unichain is entirely open-source, and its codebase is available for all OP Stack superchains.

Notably, Unichain can reduce users' transaction costs by approximately 95% in the short term. Although Unichain currently relies on a single sequencer to enhance efficiency, the team has implemented certain mechanism innovations on the mainstream L2 model by allowing full nodes to help verify blocks, thereby increasing Unichain's level of decentralization.

Currently, Unichain supports seamless transactions across dozens of chains, and users can add the Unichain Sepolia testnet to their existing Ethereum wallets. Here is some useful information:

Chain ID: 1301

RPC URL: https://sepolia.unichain.org

Currency Symbol: ETH

Block Explorer: https://sepolia.uniscan.xyz/

Tools to claim testnet ETH include:

- Alchemy, where you can claim testnet ETH once every 24 hours using an Alchemy account;

- QuickNode, where you can claim testnet ETH every 12 hours;

- Superchain, where you can claim 0.05 testnet ETH every 24 hours or verify your on-chain identity for more tokens;

- thirdweb, where you can claim testnet ETH every 12 hours.

Has UNI Finally Been Empowered?

Returning to the most concerning question: Has UNI been empowered on Unichain? The answer is yes, but not ideally.

UNI does have practical use cases within Unichain. As mentioned earlier, to enhance Unichain's level of decentralization, the Uniswap team has designed a validator network and uses UNI as the staking token. Node operators must stake UNI on the Ethereum mainnet to become validators in the UVN (Unichain Validator Network). The amount of staked tokens not only determines the validator's influence but also represents their commitment to participating in network maintenance.

The Unichain network divides time into fixed-length periods, and at the beginning of each period, the network takes a snapshot of the current staked balance, which serves as the basis for reward calculations. At the start of each period, the network calculates the value of each staked token and allocates rewards accordingly.

Participants can increase a validator's staking weight through staking and voting, thereby improving their chances of becoming an active validator. Active validators are those with the highest staking weight, eligible to publish proofs and earn special compensation during the period.

Active validators need to run a monitored Reth Unichain node online, responsible for proposing and validating blocks. Validators must sign the block hash and publish it to the UVN service smart contract at the end of each period as proof of their work's validity. The service smart contract verifies these proofs and immediately distributes rewards based on the validators' equity weight.

If a validator fails to publish valid proofs during the period, they will not receive rewards, and any unallocated rewards will be transferred to the next period.

Thus, compared to the previously useless "mascot token," the UNI token has indeed gained some empowerment and demand pressure with Unichain. However, compared to the recently popular direct dividend model in the market, the "chain empowerment" approach feels more like a tease for investors. Additionally, regarding staking rewards, further observation from the community is needed.

What Has Uniswap Labs Done in the Past Year?

As the leader in DEX, Uniswap's every move is closely watched by the entire industry. Before announcing the launch of Unichain, the market was clearly focused on a few major events from Uniswap: the release of version V4, the regulatory actions from agencies like the SEC and CFTC, and most importantly, how changes to the fee mechanism would empower UNI token holders.

In February of this year, the Uniswap Foundation announced that the release of V4 is tentatively scheduled for the third quarter of 2024. Meanwhile, Uniswap has been busy updating and iterating existing products. On March 12, Uniswap successfully launched a non-custodial, zero-cost limit order feature on its web app. On April 7, Uniswap announced that the web version had launched UniswapX, providing users with MEV protection, gasless transactions, and no-cost transactions even if they fail. This also included launching a web plugin wallet and domain services.

In terms of regulation, in April, the SEC issued a warning to Uniswap Labs, planning to take enforcement action against it. In September, the CFTC also issued a command to Uniswap Labs, accusing it of offering illegal digital asset derivatives trading.

On February 23, the Uniswap Foundation announced it would release a proposal to "activate Uniswap protocol governance," which would proportionally distribute any protocol fees to UNI token holders who have staked and delegated their voting rights. Following this news, the price of UNI token surged, rising overnight from $7 to around $12. However, the fee switch remained off until May, and there were even reports that the Uniswap Foundation announced a delay in starting the fee mechanism vote due to pressure from a certain VC firm.

This time, does Uniswap aim to solidify its liquidity moat through its own chain, bringing hope to UNI token holders?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。