The market capitalization of ETH is approximately $290 billion, which has surpassed that of any bank in the world.

Written by: Tom Carreras, Benjamin Schiller

Translated by: BitpushNews Mary Liu

For many investors, the performance of the spot Ethereum (ETH) exchange-traded fund (ETF) has been disappointing.

While the spot Bitcoin ETF has processed nearly $19 billion in inflows over the past 10 months, the Ethereum ETF that started trading in July has failed to generate the same level of interest.

Worse still, Grayscale's ETHE, which existed as an Ethereum trust before converting to an ETF, has faced significant redemptions, and the demand for other similar funds has not offset these redemptions.

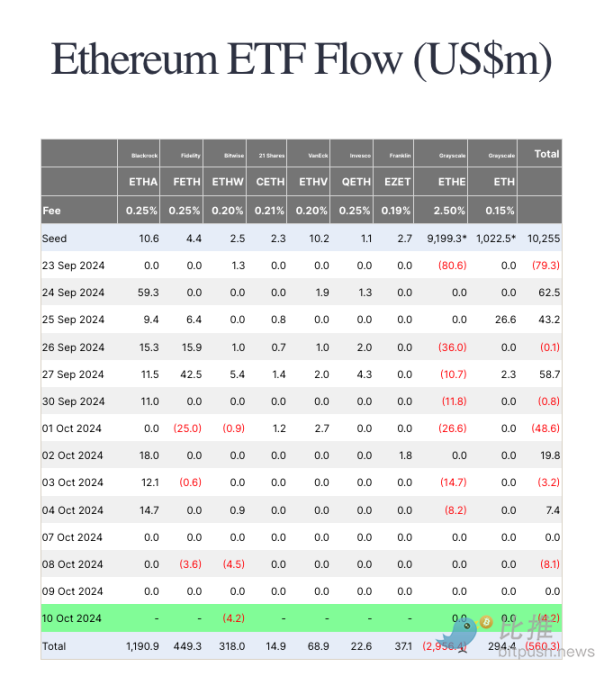

This means that since its launch, the net outflow from the spot Ethereum ETF has reached $556 million. According to data from Farside, just this week, the net outflow from these products has reached $8 million.

So, why has the performance of the Ethereum ETF been so different? There may be several reasons.

Background of Fund Inflows

First, it is important to note that the performance of the Ether ETF is not ideal compared to the Bitcoin ETF. Bitcoin products have broken so many records that they can be considered the most successful ETF of all time.

For example, the ETFs issued by BlackRock and Fidelity, IBIT and FBTC, raised $4.2 billion and $3.5 billion respectively within the first 30 days of listing, breaking the record set by another BlackRock fund, Climate Conscious, which raised $2.2 billion in its first month (August 2023).

Nate Geraci, president of The ETF Store, stated that while the Ethereum ETF has not "made a splash," three of its funds still rank among the top 25 performing ETFs this year.

BlackRock's ETHE, Fidelity's FBTC, and Bitwise's ETHW have absorbed nearly $1 billion, $367 million, and $239 million in assets respectively—quite impressive for funds that have been established for just two and a half months.

Geraci told CoinDesk: "In terms of inflows, the spot Ether ETF can never challenge the spot Bitcoin ETF."

"If you look at the underlying spot market, you'll find that Ethereum's market cap is about a quarter of Bitcoin's market cap. This should reasonably represent the long-term demand for the spot Ether ETF relative to the spot Bitcoin ETF."

The problem is that the significant outflows from Grayscale's ETHE overshadow the performance of these funds.

ETHE was established as a trust in 2017, and due to regulatory reasons, its initial design did not allow investors to redeem their ETF shares—funds were trapped in the product. This situation changed on July 23, when Grayscale received approval to convert its trust into a formal ETF.

At the time of conversion, ETHE had approximately $1 billion in assets, and although some of these assets were transferred by Grayscale to another fund—the Ethereum Mini ETF—ETHE has suffered nearly $3 billion in outflows.

Notably, Grayscale's Bitcoin ETF – GBTC – has also experienced the same situation, processing over $20 billion in outflows since its conversion in January. However, the strong performance of BlackRock and Fidelity's spot Bitcoin ETFs has been enough to offset the losses from GBTC.

Lack of Staking Yields

One significant difference between Bitcoin and Ethereum is that investors can stake Ethereum—essentially locking it in the Ethereum network to earn yields paid in Ethereum.

However, the current form of the Ethereum ETF does not allow investors to participate in staking. Therefore, holding Ethereum through an ETF means missing out on that yield (currently around 3.5%) and paying the issuer a management fee ranging from 0.15% to 2.5%.

While some traditional investors may not mind giving up yields for the convenience and security of an ETF, it makes sense for native cryptocurrency investors to seek alternative ways to hold Ethereum.

Adam Morgan McCarthy, an analyst at crypto data company Kaiko Research, told CoinDesk: "If you are a competent fund manager with a basic understanding of the crypto market and are managing someone else's money, why would you buy an Ethereum ETF now?"

McCarthy said: "You can pay to gain exposure to ETH (the underlying asset is held at Coinbase), or you can buy the underlying asset yourself and stake it with the same provider to earn some yield."

Marketing Dilemma

Another obstacle facing the Ethereum ETF is that some investors may find it difficult to understand the core use cases of Ethereum, as it attempts to lead in multiple different areas of cryptocurrency.

Bitcoin has a hard cap on its issuance: the total supply of Bitcoin will never exceed 21 million. This makes it relatively easy for investors to view it as "digital gold" and a potential hedge against inflation.

Explaining why a decentralized, open-source smart contract platform is important—more importantly, why the value of ETH continues to increase—is another matter.

Bloomberg Industry Research ETF analyst Eric Balchunas wrote in May: "One of the challenges the Ethereum ETF faces in breaking into the 60/40 baby boomer world is distilling its purpose/value into something easily understandable."

McCarthy agrees, telling CoinDesk: "The concept of ETH is more complex than other cryptocurrencies and is less suited to be easily explained in a single sentence."

As a result, the crypto index fund Bitwise recently launched an educational advertising campaign emphasizing the technological advantages of Ethereum, which is necessary.

Zach Pandl, head of research at Grayscale, told CoinDesk: "As investors learn more about stablecoins, decentralized finance, tokenization, prediction markets, and many other applications powered by Ethereum, they will enthusiastically embrace these two technologies and the Ethereum ETP listed in the U.S."

Poor Value Proposition

In fact, the performance of ETH itself this year has not been great compared to BTC.

The second-largest cryptocurrency by market capitalization has only risen 4% since January 1, while BTC has risen 42% and continues to hover near its historical high from 2021.

Brian Rudick, head of research at crypto trading firm GSR, told CoinDesk: "One factor in the success of the Bitcoin ETF is the investors' risk appetite and fear of missing out, which is still primarily driven by retail investors, and this is further fueled by BTC rising 65% at the time of the ETF launch and subsequently rising 33%."

Rudick added: "Since the ETF launch, the price of ETH has fallen 30%, which has greatly dampened retail enthusiasm for buying these funds, and the perception of Ethereum is mediocre, with some viewing it as being between Bitcoin (the best monetary asset) and Solana (the best high-performance smart contract blockchain)."

Unattractive Valuation

Finally, traditional investors may not find ETH's valuation attractive at these levels.

ETH's market capitalization is approximately $290 billion, which has surpassed that of any bank in the world, second only to JPMorgan and Bank of America, which have market capitalizations of $608 billion and $311 billion, respectively.

While this may seem like a comparison of apples to oranges, Quinn Thompson, founder of crypto hedge fund Lekker Capital, told CoinDesk that ETH's valuation is also high compared to tech stocks.

Quinn Thompson wrote in September that ETH's valuation "is now worse compared to other assets because no valuation framework can justify its price. Either the price must come down, or a new universally accepted asset valuation framework needs to be formed."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。