Introduction

Arthur from Defiance Capital and several other notable figures are hinting at a potential revival of DeFi. Recently, analyst @tradetheflow_shared a compelling argument outlining the reasons why a DeFi 2.0 rebound may be imminent. Here is a brief overview of the key driving factors he emphasized:

- DeFi has significantly evolved, bringing better scalability, improved security, and innovative use cases such as RWA (real-world asset) tokenization and on-chain credit products.

- The total value locked (TVL) has nearly tripled since October 2023, with trading volume on decentralized exchanges (DEX) continuing to grow compared to centralized exchanges.

- Major players like BlackRock and PayPal are entering the market through tokenized funds and stablecoins, indicating increased mainstream acceptance.

- Recent interest rate cuts have enhanced liquidity, making DeFi yields more attractive compared to traditional investments.

- DeFi is now more mature and secure, ready for the next wave of growth.

In the broader economic environment, Jerome Powell's 50 basis point rate cut may mark a turning point. The M2 money supply is rising again, and Bitcoin is following past cycle trends, suggesting a potential parabolic bull market may be starting.

Some warn that aggressive rate cuts often signal an economic recession, and ongoing geopolitical tensions remain a concern. While these risks are real, we maintain a positive outlook today. This rebound feels different, as if it is preparing for a unique surge that may surprise many.

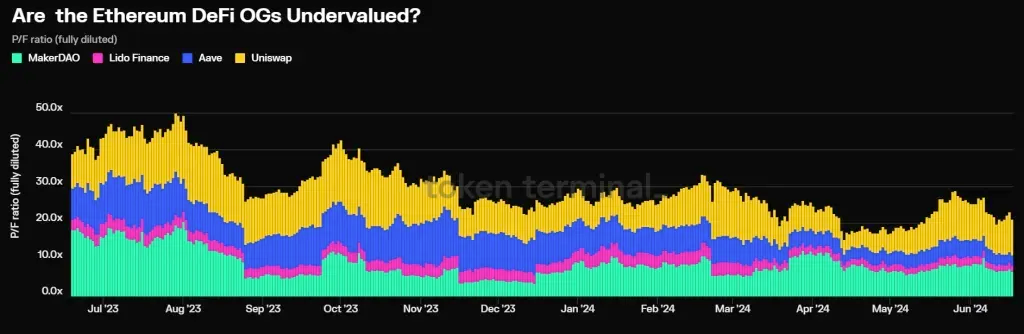

Given that we have experienced a prolonged bear market, it is reasonable to assume that DeFi valuations are suppressed, suggesting that this sector may be undervalued. In this article, we will closely examine AAVE's position and assess its potential role in a strong DeFi recovery.

Aave: Ready to Explode?

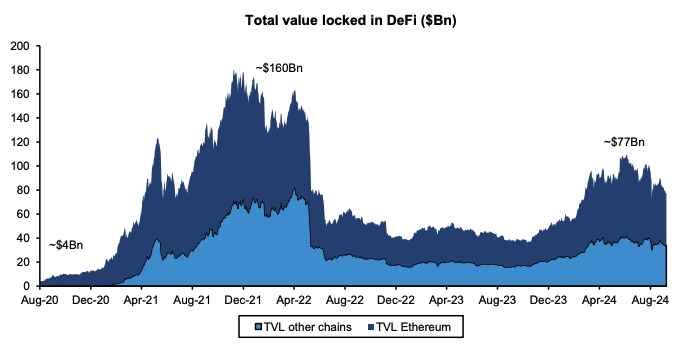

DeFi's TVL has rebounded significantly from its 2022 lows, more than doubling to $77 billion. However, despite this recovery, the current TVL is still 50% lower than the peak of approximately $154 billion in 2021. This indicates that while interest in the sector is increasing, DeFi valuations remain far below the highs of the last bull market.

Source: Bernstein

1. Market Leadership and Activity

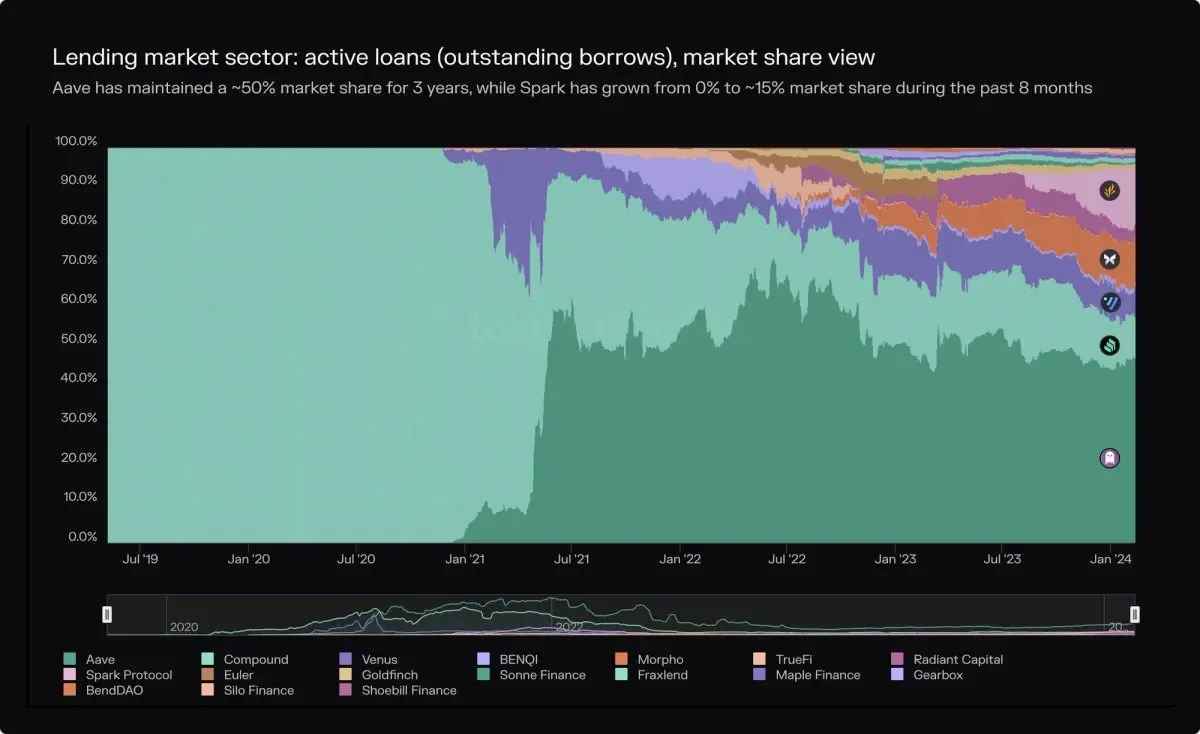

Aave is one of the leaders in the DeFi space, allowing users to lend and borrow cryptocurrencies without intermediaries. Originally launched as ETHLend in 2017 and rebranded to Aave in 2018, the platform gained momentum during the DeFi boom of 2020 and has captured over 50%plus of the DeFi lending market over the past three years. Its success is driven by continuous upgrades and the introduction of new products, such as the GHO stablecoin, and the $400 million “Safety Module” that enhances security. The "buy and distribute" program further supports long-term token growth by creating stable buying pressure.

Source: Token Terminal

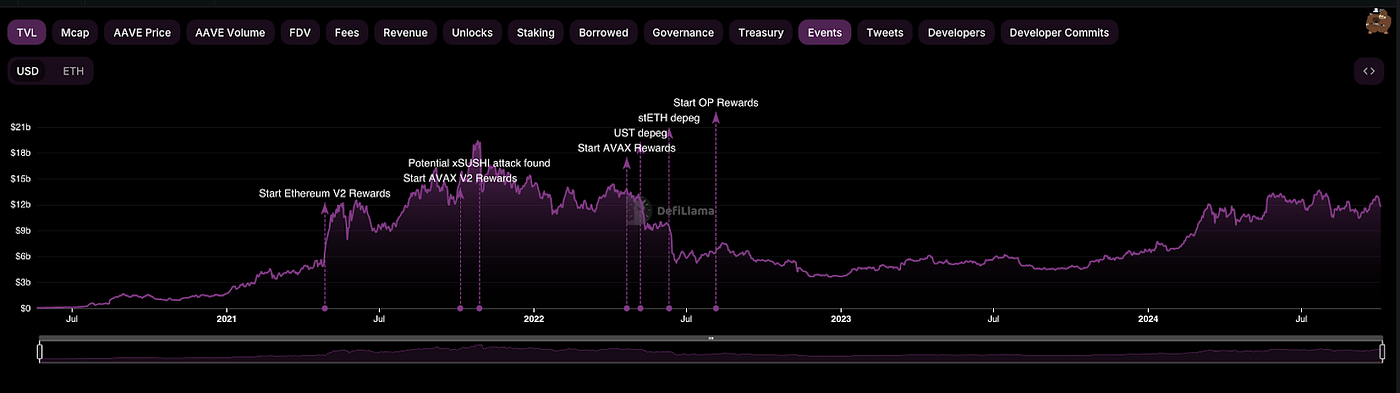

In 2024, Aave's TVL reached $13 billion, indicating strong user adoption and increasing confidence in the platform. The launch of the GHO stablecoin has also added to its revenue streams, while recent expansion to non-EVM chains like Aptos has broadened its market reach.

Source: DeFiLlama

Source: X

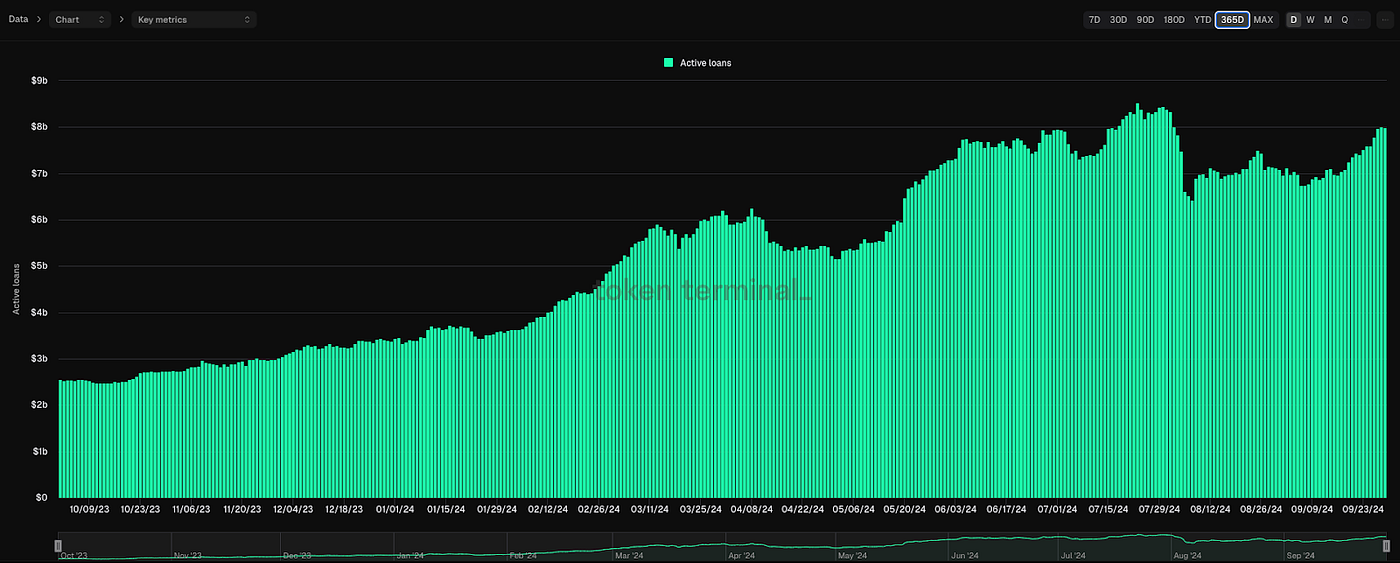

Aave's active loans have also seen an increase recently. As of the latest update, Aave's active loans amount to $7.4 billion, a significant growth that solidifies its dominance in the DeFi lending market. This growth is attributed to recent adjustments in its tokenomics, which have reduced inflationary pressure on AAVE tokens and redirected revenue to stablecoin stakers, making the protocol more attractive to lenders.

2. Undervaluation and Accumulation Potential

Despite Aave's dominant position, Aave and other DeFi projects still appear undervalued. A few months ago, Michael Nadeau explained that Aave's price-to-fee (P/F) ratio is 2.8 times, with an annual revenue of $240 million. Given that 93% of its tokens are already in circulation, Aave may face less selling pressure compared to other projects, potentially leading to a rebound after a 2.5-year consolidation period. Recent breakthroughs suggest that Aave may be in the early stages of a new upward trend, making it an attractive asset for long-term accumulation. This technical trend, combined with its solid fundamentals, supports the argument for its potential price recovery, especially as DeFi projects regain attention.

Source: @MichaelNadeau

Source: TradingView

3. Institutional Interest

Institutional Interest Recently, institutional interest in Aave has been primarily driven by the launch of Aave Arc, a permissioned DeFi product designed for regulated financial institutions. Currently, the platform is accessible to over 30 whitelisted companies, including CoinShares, Wintermute, and Galaxy Digital. By providing a compliant environment for lending digital assets, Aave Arc aims to bridge the gap between traditional finance and DeFi, offering high-yield opportunities while meeting regulatory standards.

Additionally, Bernstein has officially added Aave to its digital asset portfolio, replacing GMX and Synthetix. As potential U.S. rate cuts approach, lower traditional rates will reduce yields offered by dollar money market funds, making DeFi's high yields comparatively more attractive, thereby increasing demand.

The launch of ETH ETFs this year may also bring significant capital inflows to DeFi, with Aave likely to be a major beneficiary due to its strong presence in the Ethereum lending market, attracting new capital from institutional investors.

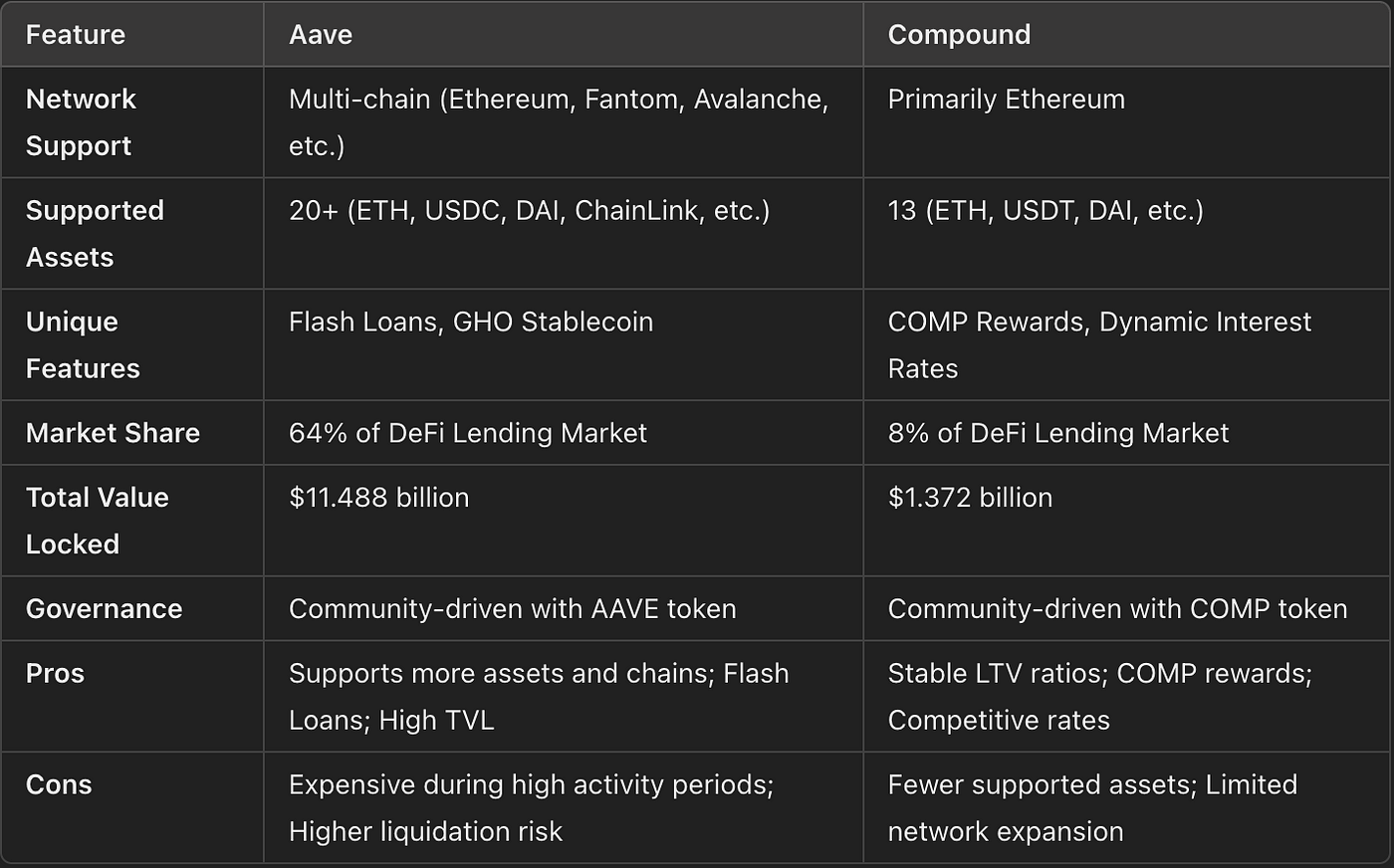

4. Competitive Advantage

Compared to competitors like Compound, Aave stands out with its multi-chain capabilities and broader asset support. While Compound primarily operates on Ethereum, Aave also has a presence on networks like Polygon, Avalanche, and Fantom, offering wider coverage, lower fees, and faster transaction speeds, making it more attractive to users.

In addition, Aave supports a wider range of collateral types, from traditional cryptocurrencies to tokenized assets and staking derivatives. This diversified offering, along with features like flash loans and the GHO stablecoin, has helped Aave capture a larger share of the DeFi market and maintain its dominance in the lending space.

5. Upcoming Catalysts

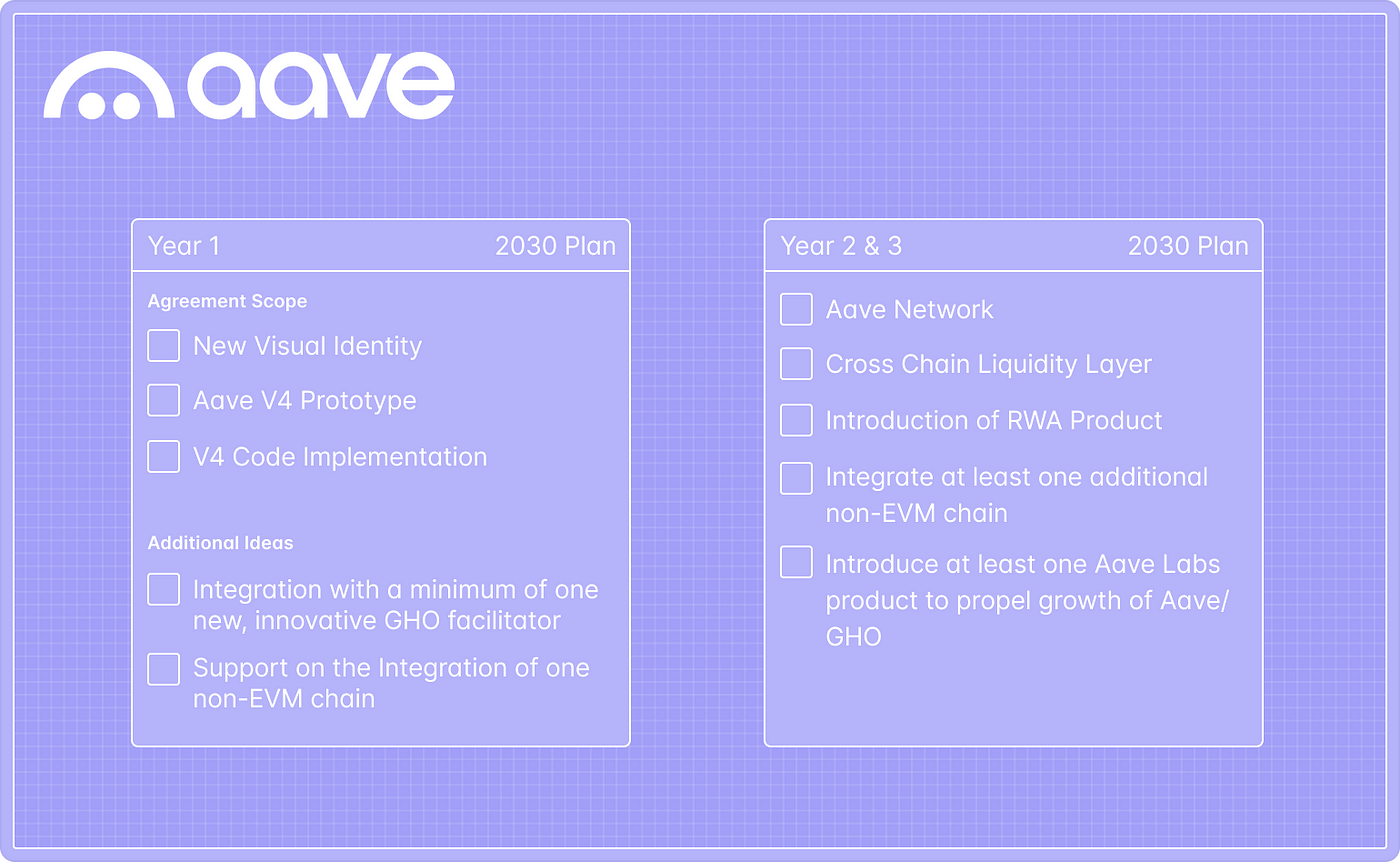

The upcoming catalyst Aave 2030 is a strategic proposal from Aave Labs aimed at expanding the protocol beyond Ethereum and introducing new features in the coming years. Key objectives include:

- Multi-chain Expansion: Aave aims to support non-EVM chains and expand its presence, building a network-agnostic cross-chain DeFi platform. This will allow users to access Aave's services across different blockchain ecosystems, enhancing liquidity and increasing user adoption.

- Aave V4 Upgrade: Introduction of real-world asset integration, higher capital efficiency, and improved governance tools. By integrating real-world assets with its native stablecoin GHO, Aave aims to diversify its collateral base, providing more stability for its lending services. This initiative could attract more users and institutions, especially those seeking safer, real-world-based financial products.

- Proactive Funding Model: Unlike previous retrospective funding models, Aave proposes a proactive budgeting model for its 2030 plan, setting clear allocations and goals in advance. The initial budget includes 15 million GHO and 25,000 stkAAVE for research, development, and security audits.

Source: AAVE

Aave's overall goal is to establish a sustainable, cross-chain, compliant DeFi ecosystem by 2030 that can adapt to changing market dynamics and serve as core infrastructure for retail and institutional users.

Bullish Fundamental Factors

- Aave controls 67% of the DeFi lending market, managing $7.4 billion in active loans, positioning it favorably for growth in DeFi lending.

- Aave is active across multiple blockchains (Arbitrum, Avalanche, Base, BNB Chain, Fantom, Optimism, and Polygon) and plans to expand to chains like Aptos, attracting more users and liquidity.

- Aave's GHO stablecoin is gaining traction, increasing platform revenue and making its income more diversified and stable.

- Aave Arc is designed for institutional investors, allowing them to participate in DeFi in a compliant manner, helping Aave attract significant inflows from traditional finance.

- The potential launch of ETH ETFs and interest rate cuts may attract more capital into DeFi, providing Aave with a significant opportunity to boost its TVL.

Bearish Fundamental Factors

- Aave holds a large share of the DeFi lending market, but this high concentration means that any technical issues, smart contract vulnerabilities, or regulatory actions against Aave could have a disproportionately large impact on the entire industry.

- Although the growth of GHO is encouraging, a slowdown in its adoption or increased attractiveness of competitors' stablecoins could harm Aave's revenue and weaken its competitive edge in DeFi.

- A global economic recession would reduce the inflow of funds into risk assets (such as cryptocurrencies) and limit lending activity on DeFi platforms, decreasing platform revenue and TVL.

- Escalating geopolitical risks could increase uncertainty and market volatility, making investors reluctant to engage in DeFi.

- While the threat of restrictive regulations currently seems less urgent, it remains a potential concern if less crypto-friendly governments or candidates come to power globally. Stricter regulations on stablecoins, lending protocols, or DeFi activities could undermine confidence and reduce activity on platforms like Aave, particularly in key markets like the U.S. and the EU. Close attention to upcoming elections and policy shifts is crucial for assessing this risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。