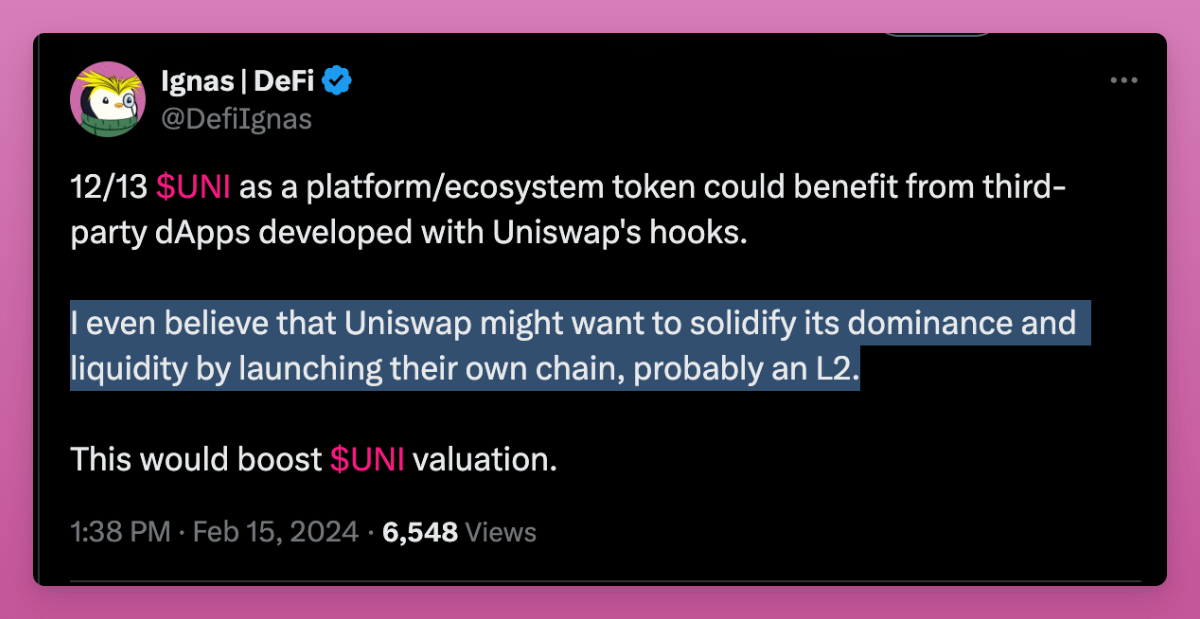

The Uni L2 launch isn't too surprising as Uniswap aims to be a platform, not just a dApp.

The first step was announcing Uniswap V4 with "hooks."

Think of them as "plugins" or "extensions" that allow for the execution of customized code during key events within a pool like:

• on-chain limit orders

• autocompound LP fees

• KYC

The "hooks" are like bringing App Store to the iPhone.

Like Apple no longer needed to develop iPhone apps themselves, devs can build on top of Uniswap.

Now, the L2 further solidifies their dominance and liquidity.

This is bullish for $UNI as Uniswap DAO now has many more options for token utility.

Notice how Unichain's announcement doesn't mention token utility: they are keeping the options for now and discussions in the forum will start. Fee switch is not the only option anymore.

The good news: Uniswap decided to build on OP stack and implement native interoperability to enable single-block, cross-chain message passing among Superchain L2s.

This at least partly minimizes liquidity fragmentation. But liquidity fragmentation will likely worsen in the short term.

Is it bullish for $ETH, though? At least Uniswap is not launching their own L1.

But I believe Ethereum must find ways to accrue value from all these L2s launching on it. It's getting more urgent than ever.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。