This report delves into the performance of stablecoins in the face of changes in U.S. monetary policy, reaching a disturbing conclusion: as the Federal Reserve raises interest rates and gradually tightens liquidity, the market capitalization of stablecoins has significantly declined, demonstrating great vulnerability.

Translation: Aiying Team

In the world of crypto finance, stablecoins were once seen as a safe haven to avoid severe market volatility. However, a recent report released by the European Central Bank has thrown a deep-water bombshell into the industry: under the tightening of monetary policy, these "stability anchors" are not as secure as imagined.

This report delves into the performance of stablecoins in the face of changes in U.S. monetary policy, reaching a disturbing conclusion: as the Federal Reserve raises interest rates and gradually tightens liquidity, the market capitalization of stablecoins has significantly declined, demonstrating great vulnerability. This not only challenges the common perception of stablecoins as a "stable force" in the cryptocurrency ecosystem but also sounds the alarm for Web3 companies that rely on stablecoins for capital reserves and payments.

The report points out that the impact of the tightening U.S. monetary policy on stablecoins is far greater than the market generally expected. This means that Web3 companies not only have to face the inherent high volatility of the crypto market but also need to remain vigilant against the unforeseen risks brought about by changes in monetary policy. For stablecoins, a key player in the crypto finance sector, this "shaking" is undoubtedly a life-and-death challenge.

Aiying believes that for practitioners in the Web3 industry, understanding the implications behind this report is particularly important. Stablecoins are no longer merely "digital dollars"; they are subject to the complex changes of macroeconomic policies. In this increasingly intertwined world of crypto and traditional finance, compliance and risk management are becoming more important than ever. This report undoubtedly provides a "weather vane" for the future of the crypto world, reminding every participant: instability is not limited to Bitcoin and Ethereum; even stablecoins themselves are swaying under the shadow of U.S. monetary policy.

1. Comparison of Stablecoins and Money Market Funds: Surface Similarities and Underlying Differences

The latest working paper from the European Central Bank reveals both the similarities and stark differences between stablecoins and money market funds (MMFs). On the surface, these two financial instruments seem to share the same purpose and structure—providing stable, secure value storage and liquidity support—but a deeper analysis shows that their performance in the face of shocks is entirely different.

1. The Backing of Stablecoins: On-chain and Off-chain Assets

Stablecoins are a form of "digital dollars" that exist on the blockchain, with the core promise of maintaining stable value, typically pegged to fiat currencies like the U.S. dollar at a 1:1 exchange rate. To fulfill this promise, issuers of stablecoins usually hold a basket of off-chain assets to support their value, including U.S. Treasury bonds, commercial paper, and bank deposits among other short-term assets. This asset mix aims to maintain the liquidity and safety of stablecoins, ensuring that users can exchange stablecoins for an equivalent amount of fiat currency when needed.

However, the structure of stablecoins carries a "dual characteristic" of "on-chain and off-chain." Their issuance and circulation exist on-chain, while the reserve assets behind them are traditional fiat currency assets. This complex structure subjects them to challenges from two different worlds. When the financial system is stable, this arrangement may maintain value stability, but in times of market turmoil, liquidity issues with the assets are often magnified—especially when the held assets may not be quickly liquidated, putting the stability of stablecoins to a severe test.

2. Similarities and Differences Between Stablecoins and Money Market Funds

The European Central Bank's report provides a detailed comparison of stablecoins and money market funds. On the surface, the asset structures of these two tools are similar: they both achieve stability by holding short-term, safe fiat currency assets. However, in terms of their ability to respond to market shocks, the two have taken different paths.

In times of market turmoil, money market funds, especially prime MMFs, are often seen as a safe-haven tool, attracting significant inflows of capital. For example, under the Federal Reserve's continuous interest rate hikes in 2024, the asset management scale of MMFs has significantly increased. This growth is backed by investors' trust in their strict regulation, high transparency, and good liquidity. The types of assets in money market funds are strictly limited, and all portfolios must meet high liquidity requirements, ensuring that they can still meet investors' demands during interest rate fluctuations or market risks.

In contrast, stablecoins appear much more vulnerable when facing the same shocks. The European Central Bank's report shows that under the tightening monetary policy in 2024, the market capitalization of stablecoins declined by about 10%. This sharp decline reflects investors' concerns about the liquidity and management transparency of the reserve assets behind stablecoins. Since the assets of stablecoins are not subject to the same strict regulations as MMFs, their safety and liquidity cannot be fully guaranteed in critical moments, leading investors to prefer selling stablecoins in market panic and seeking more stable safe-haven assets.

3. Risks of Stablecoins: Lack of Transparency and Regulation

The risks of stablecoins are not only reflected in their vulnerability during market shocks but also in the insufficient management and transparency of their underlying assets. While most stablecoins claim that their reserve assets are sufficient to cover all circulating tokens, the actual asset holdings often lack adequate transparency and third-party audits. This means that in the face of market panic or macro policy changes, investors are uncertain whether these assets are enough to meet their demands.

In contrast, money market funds are not only subject to strict regulation but also required to regularly disclose their asset structure and liquidity status. This transparency instills confidence in investors, allowing money market funds to serve as a "safe haven" during crises. Stablecoins lack this transparency, and because they are not regulated by traditional financial institutions, they are exposed to greater risks in times of liquidity stress.

Aiying highlights a reality revealed by the European Central Bank's report: despite operating under the name of "stability," stablecoins are more susceptible to shocks under market pressure, while money market funds demonstrate stronger risk resistance due to their strict regulation and high transparency.

2. Stress Testing Stablecoins: Vulnerability Under Dual Tests of Crypto Market and Monetary Policy

The report thoroughly analyzes the performance of stablecoins in the face of two distinctly different shocks—shocks from the crypto market itself and changes in U.S. monetary policy. The results reveal a disturbing fact: these seemingly stable currencies appear far less solid when facing external turmoil than one might imagine.

1. Crypto Market Shock: Are Stablecoins Really "Stable"?

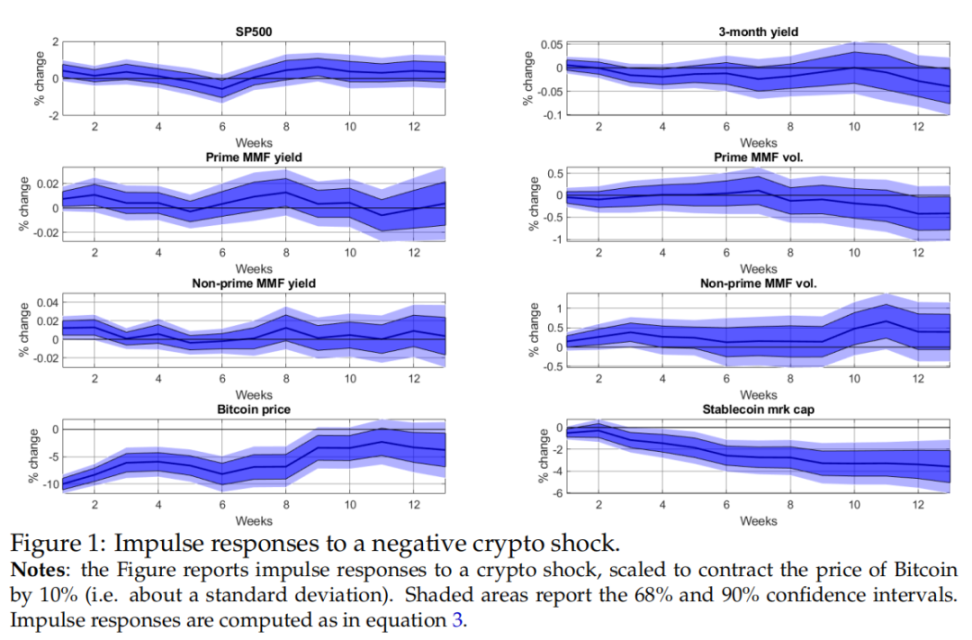

(If Bitcoin's price drops by 10%)

In the crypto market, stablecoins were once seen as an important tool to combat high volatility, serving as a "safe haven" for investors during storms. However, the data cited in the European Central Bank's report overturns this common understanding. The report shows that when Bitcoin's price plummets or the entire crypto market experiences severe volatility, the market value of stablecoins has not remained robust, instead declining by about 4% within three months. This indicates that stablecoins have failed to play their role as a hedging tool in response to shocks in the crypto market, appearing particularly vulnerable amid market panic.

For instance, in May 2022, the collapse of TerraUSD triggered severe volatility across the entire crypto market, leading to significant capital outflows from stablecoins. Data shows that after negative crypto shock events, major stablecoins (such as Tether and USDC) also faced massive capital losses, resulting in a significant decline in overall market value. This market reaction suggests that although stablecoins promise to be pegged to the dollar, the reserve assets behind them have not fully alleviated market panic, leading to shaken investor confidence.

2. The Challenge of Tightening Monetary Policy: The True Test for Stablecoins

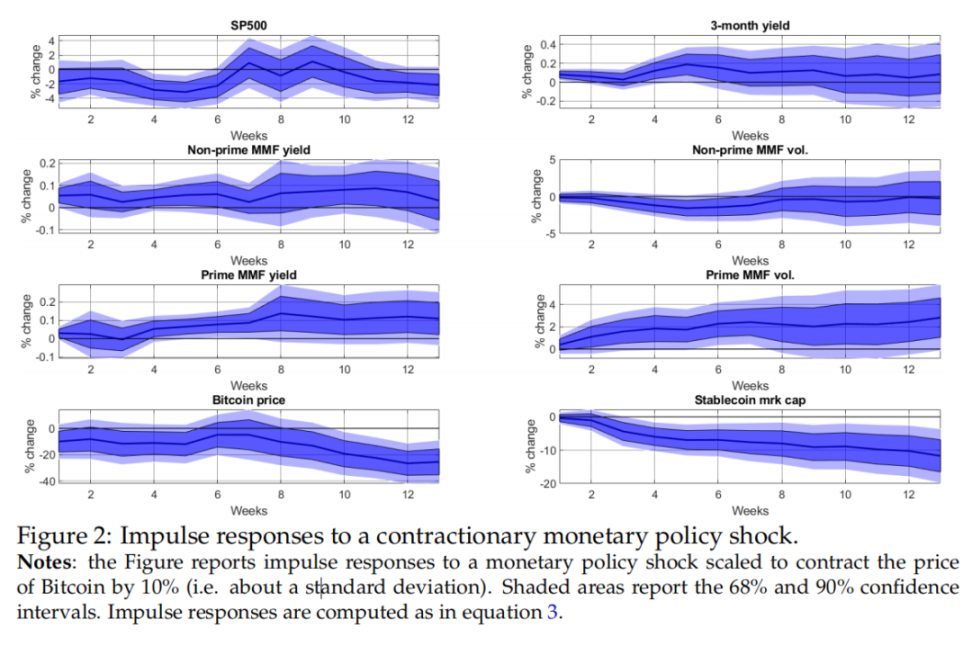

(If the Federal Reserve's interest rate hike causes Bitcoin's price to drop by 10%)

If the shocks from the crypto market reveal the "surface cracks" of stablecoins, then the tightening of U.S. monetary policy completely exposes their "structural fragility." The European Central Bank's research indicates that against the backdrop of continuous interest rate hikes by the Federal Reserve, the market value of stablecoins has dropped by about 10% within just three months. In an environment of rising interest rates, the opportunity cost of holding stablecoins, which are non-interest-bearing assets, significantly increases, leading investors to gradually abandon stablecoins in favor of traditional financial instruments that offer higher returns.

Specifically, the tightening of monetary policy means reduced liquidity of funds, making dollars available for lending scarcer in the market. For stablecoins, the liquidity of their underlying assets (such as short-term Treasury bonds and commercial paper) may also be affected in this environment, making it difficult to quickly liquidate when needed. This leads to a vicious cycle: stablecoin issuers struggle to guarantee immediate redemption capabilities, further eroding investor confidence and accelerating capital withdrawals from stablecoins.

This withdrawal is not just the behavior of individual investors but a collective market behavior. Aiying observes from the European Central Bank's analysis that since the reserve assets of stablecoins do not pay interest, when interest rates rise, the attractiveness of holding stablecoins rapidly declines, leading investors to prefer reallocating their funds to higher-yielding money market funds (MMFs). This reallocation of funds was particularly evident during the Federal Reserve's interest rate hikes in 2024: following the tightening of monetary policy, inflows into prime MMFs significantly increased, while stablecoins exhibited a continuous decline in market value. The tightening of monetary policy has resulted in starkly opposite trajectories for stablecoins and MMFs. For Web3 companies, this means that the role of stablecoins as a capital management tool is being weakened, and companies must consider more diversified reserve management and risk prevention measures to cope with future uncertainties.

3. Risks and Opportunities for Web3 Companies: New Tests Under the Shadow of Monetary Policy

For Web3 companies, this situation presents dual challenges. First, the price volatility of stablecoins means that companies relying on them for daily transactions and asset reserves may face liquidity issues. This implies that corporate managers must fully recognize the risks when considering using stablecoins as capital reserves, rather than blindly trusting their "stability." In an environment of high inflation and gradually tightening monetary policy, holding non-interest-bearing digital assets is becoming increasingly challenging.

Aiying suggests that in the face of these challenges, Web3 companies need to quickly adjust their financial management strategies and adopt more flexible and diversified approaches to cope with future uncertainties:

1. Diversified Reserve Management Mechanism:

- Relying solely on a single stablecoin is clearly no longer safe. Companies should consider establishing a diversified reserve management mechanism, allocating funds across different asset classes, including other cryptocurrencies, fiat currencies, and highly liquid traditional financial assets. This diversified reserve approach can reduce the systemic risk posed by the collapse of a single stablecoin and increase the resilience of funds.

2. Strengthen Monitoring of Macroeconomic and Monetary Policies:

- In the current macro environment, the changes in the market value of stablecoins are closely linked to monetary policy, making it necessary for companies to pay more attention to changes in global economic policies. Web3 companies should establish dedicated monitoring and analysis teams to closely track macroeconomic signals, including Federal Reserve policies, so that they can promptly adjust their fund management and asset allocation in response to market changes. This not only helps companies avoid potential risks but also allows them to seize market opportunities when the policy environment changes.

3. Prepare for Stricter Regulations in Advance:

- The vulnerability of the stablecoin market has drawn the attention of regulatory agencies worldwide, making the introduction of stricter stablecoin regulations almost inevitable. For Web3 companies, being proactive is key to survival and development. Companies need to prepare for compliance in advance, ensuring that their use and management of stablecoins meet potential future regulatory requirements, thereby reducing compliance risks and operational uncertainties in a tightening regulatory environment.

4. Consider New Payment Methods and Innovative Solutions:

- As stablecoins face more policy and market risks, Web3 companies should also explore new payment solutions. This includes adopting CBDCs (central bank digital currencies) or other more stable cryptocurrency payment methods, which may provide companies with more secure funding options and help them maintain flexibility amid market changes.

Although the "stability" of stablecoins is being questioned, this report presents not only a challenge for Web3 companies but also an opportunity to drive transformation and innovation. The turbulence in financial markets means that survival of the fittest prevails; only those companies that can quickly adapt and enhance their financial resilience will remain competitive in the future. Web3 companies should view this report as an opportunity to reassess their financial and risk management strategies, moving away from reliance on a single tool and instead establishing a more mature and diversified asset and payment system.

Stablecoins are no longer the impregnable "digital dollars"; they are becoming increasingly unstable with fluctuations in monetary policy. In this ever-changing crypto world, how companies respond to this uncertainty will be key to their future success.

Source: https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2987~1919e51abf.en.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。