On October 9, 2024, delta network announced the completion of a $11 million seed round investment, led by Variant and DBA, with participation from Figment, Castle Island, Delphi, and others.

According to official information from delta, delta network is a network of networks that shares a global state while allowing for local customization, representing a new type of permissionless network. It addresses the sovereignty and interoperability of applications through zk settlement.

So what exactly is delta network? Why are crypto VCs rushing to invest in delta network? Please see below.

What is Delta Network

Source: delta team, translated by Golden Finance

Today's developers must make a choice: they can build under the constraints of a one-size-fits-all blockchain, or they can create their ideal product as an application chain, but face challenges in transforming interoperability and guiding their own ecosystem.

Developers should not be forced to make this choice. If we could redesign blockchains with all the knowledge we have today, we believe they would look like delta.

What Delta Looks Like

Delta believes that developers should have maximum local control without sacrificing global connectivity.

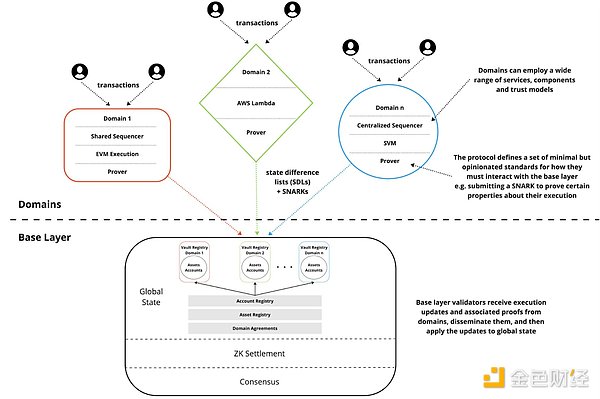

Delta is a network composed of autonomous execution environments that are connected through a decentralized, censorship-resistant base layer. Delta separates (1) execution and ordering from (2) data availability and settlement. (1) occurs on domains (similar to Rollup/execution sharding), while (2) is provided by a network of validators operating the base layer. The sum of these components constitutes a unified global state machine.

While the global state is shared, domains will have complete control over their block space. Domains can be application-specific or general-purpose computing platforms; they can use any existing virtual machine or develop their own custom programs; their operational models can be decentralized, centralized, or even permissioned. Any application, business, or service provider can set up their own domain without permission. Their users can pay fees in any token through off-chain subscriptions or not pay fees at all.

Users gain censorship resistance from the base layer. They decide how to use their assets and maintain the ability to self-custody— their funds are secure, and they have the right to exit the domain without permission. Assets exist on the base layer, so there is no need for each domain to implement them separately.

The base layer facilitates native interoperability between domains. For users, Delta provides an experience of moving assets between domains instantly, almost for free, and without the need for bridges.

The key to achieving these properties is zero-knowledge settlement. Similar to rollups, domains can take various forms, but they all settle to the same base layer. Unlike rollups, they achieve settlement through zero-knowledge proofs that are directly integrated into the base layer. This "built-in" zero-knowledge settlement approach enables unprecedented levels of global interoperability between local networks. Domains can interact with each other and even perform atomic interactions without the need for global coordination like blockchains.

Delta's state model supports leaderless consensus protocols, which perform far better than any blockchain. Domains in delta inherently isolate the ability to change the global state based on spending. Due to this limitation, there is no need for transactions to be fully ordered on the base layer. Without ordering, domains can continuously stream their state changes using minimal Byzantine Reliable Broadcast (BRB) protocols. In addition to reducing the communication overhead of each transaction, delta's leaderless, unordered consensus is more robust and scalable than the fully ordered consensus implemented by all blockchains to date. Unlike these systems, delta can linearly scale throughput simply by adding more machines.

Solving the Biggest Problems in Cryptocurrency

We believe that in such a world, platforms and applications will have as much optionality as Web2 and will be as composable as smart contracts on the same blockchain. Unfortunately, application chains and rollups do not have the right form factors. They require complex interoperability solutions to "glue" independent blockchains together. The downsides of this approach currently far outweigh the benefits of sovereignty.

For example, consider the challenges new chains face in guiding users.

All on-chain applications should provide a seamless experience for new users to deposit assets like stablecoins. Today, the new chains chosen to facilitate this experience bring significant challenges:

Getting stablecoin issuers to natively deploy on your chain is not easy in terms of cost and process. This option is only available to the most capital-rich and resource-rich projects.

Requiring users to bridge from the rollup's settlement layer has good security, but it creates significant friction for any user who does not already have stablecoins on the rollup's settlement layer.

Appchains and Rollups can collaborate with third-party bridges, but this approach has significant downsides. Relying on a single provider may pose unbearable security risks, while using multiple providers can lead to a poor user experience, as users must consider multiple versions of the same underlying asset.

Because it is an integrated system, delta addresses the most important challenges associated with launching an appchain or rollup:

Distribution

- On an integrated chain, attracting users and liquidity is a joint positive-sum effort between the chain and its applications. On an application chain, builders can only rely on their own efforts—users and assets cannot be shared.

- On delta, assets and users are shared globally—once they are added to delta, they can be accessed by all domains built on delta. At the same time, domains retain maximum control to own and optimize their user experience.

Interoperability

- Users want to interact with multiple applications simultaneously without any friction. To facilitate this experience, application chains must reintroduce intermediary services (third-party infrastructure and liquidity providers) to abstract away a lot of complexity. Blockchains are designed to eliminate these intermediaries, but each layer of abstraction takes us further away from this original value proposition.

- On delta, because the state is globally shared, domains no longer need intermediaries to connect with other domains. Users can move from one domain to another without any friction caused by intermediaries or routing complexity.

Barriers to Entry

- Building and maintaining an application chain or rollup requires more cost and resources compared to deploying a set of smart contracts on an integrated chain.

- On delta, domains can be lighter than other forms of application chains and rollups. Unlike rollups, domains do not have to prove a complete execution path and/or handle long withdrawal periods related to fraud proof dispute periods. Unlike independent application chains, domains do not need to bootstrap a validator set.

Returning to the challenge of stablecoin accessibility mentioned above, this challenge does not exist for domain builders on delta. On delta, stablecoin issuers only need to deploy once, and all domains can access their holders and liquidity equally without sacrificing control and reasoning about interoperability complexity.

Delta's Vision

Delta will broadly enhance the vision of application chains and horizontal scaling. But delta not only addresses the problems of existing approaches; it also creates an unprecedented new design space.

Delta provides its users with two inalienable rights—self-custody and permissionless exit rights. With these guarantees, delta can safely reintroduce a range of trust models at the execution layer. For the first time, blockchains can offer permissioned services while still ensuring that user funds are completely secure and can be withdrawn at any time. This allows a new category of enterprise, gaming, and even government blockchains to coexist on public networks alongside trustless and decentralized blockchains, achieving unprecedented levels of interoperability between them.

Variant: Why We Led the $11 Million Seed Round Investment in Delta

Author: jessewldn.eth, Co-founder of Variant Fund; Cooper, Alana Levin, Partners at Variant Fund; translated by Golden Finance

On October 9, 2024, Variant is pleased to announce that we led the $11 million seed round investment in delta alongside DBA.

For the past decade, the blockchain industry has been in constant debate over the right architectural trade-offs—on X (formerly Twitter), in research forums, and through the actual implementation of these multi-billion dollar systems. We have seen a multitude of networks exploring this new paradigm, aiming to carve out a unique position in the competitive landscape.

It is clearer now than ever that L1 blockchains as a single execution environment will not scale to the inevitable on-chain future with billions of active users. Ethereum first formally acknowledged this in 2020 when Vitalik released the "Rollup-Centric Roadmap." Ethereum did not horizontally scale the L1 network through sharding or increased hardware requirements but instead took the path of vertical scaling. Solana has similar architectural characteristics, positioning their version of Rollup and vertical scaling roadmap as "network scaling." There is even meaningful momentum in building similar systems on Bitcoin, in the context of increasing awareness of the op_cat and taproot wizards cultural phenomena.

These trends are evident and widespread. The current state of multi-billion dollar infrastructure projects is that they must quickly adapt to support the next generation of on-chain applications and users—dealing with a significant amount of technical debt and the difficult reality of ensuring backward compatibility first. Ultimately, this leads to poorly designed solutions that, in hindsight, may resemble Rube Goldberg machines (overly complex mechanical devices) rather than the future of finance.

However, the research and efforts of the past decade have proven fruitful. We now understand how to vertically scale blockchain networks through ZK cryptography and succinctly verify computations without re-executing them. We have many virtual machines and execution environments that offer different functionalities beyond the Ethereum Virtual Machine. By combining these insights without the burden of technical debt or the constraints of maintaining backward compatibility, we can create a new foundation for future applications.

Introduction to Delta

Delta is a novel network of networks that strikes a balance between interoperability, customizability, and sovereignty—designed from the ground up with a clear vision of how blockchains should leverage the research of the past decade and the latest zero-knowledge cryptography for vertical scaling.

Delta draws on the best features of integrated architectures like Solana and combines them with the expressiveness and customizability of a more modular ecosystem. Developers of various skill levels can leverage application-specific "domains" that can run any type of custom logic in any programming environment. These domains can be as simple as cloud functions running in a managed environment, or they can be fully permissionless rollups, or any form in between. As long as a domain adheres to a minimal set of globally defined rules—such as providing specific proofs that transactions have valid signatures and comply with account spending permissions—it can utilize this infrastructure, share accounts and assets, and interoperate with other domains. Fundamentally, the shared state and improved interoperability address the cold start problem affecting those who wish to launch their own application-specific infrastructure but do not yet have sufficient adoption, distribution, or visibility to attract an initial user base. This resolves one of the main friction points of modular ecosystems (fragmentation) while allowing for the scale and seamless user experience of integrated solutions.

We believe delta will power the next generation of application-specific infrastructure and usher in a new era of innovation. The network's implementation of a CRDT-based state model and "order-less" consensus protocol allows for unique performance optimizations that have not yet appeared in the trade-off space. The team's combination of technical and business expertise is just right to bring this vision to market, composed of computer scientists, protocol engineers, and former research directors from major digital asset institutions, including delta founder Ole, Castle Island investment member Ria, Eigen Foundation advisor, and ReverieVC partner Myles.

We are excited to support Ole, Ria, Myles, and the broader team on this journey.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。