The prediction market has a positive significance in improving the transparency of social information.

Written by: Revc, Golden Finance

Introduction

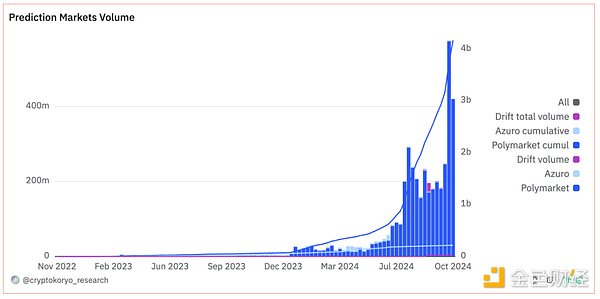

The popularity of prediction markets continues to rise, with trading volumes hitting new highs. In the last week of September, Polymarket and Azuro reached a trading volume of $570 million, showcasing the robust development potential of the sector, with innovative products continuously emerging.

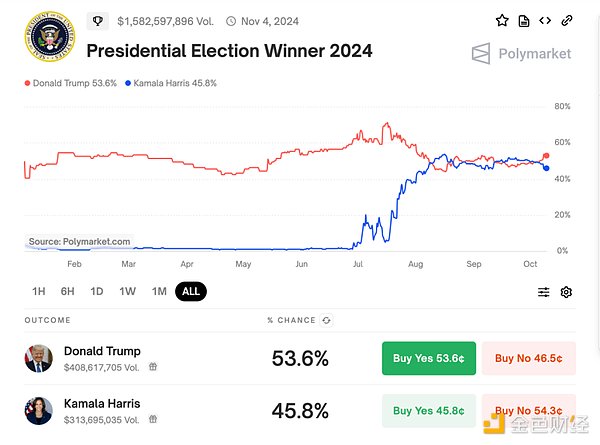

In the short term, the U.S. elections play a crucial role in the development of prediction markets. Including congressional campaigns, the total expenditure for this election cycle may reach nearly $16 billion, making it the most closely watched event by the American public. However, the market is generally not optimistic about the performance of prediction markets after the elections.

PolyMarket

According to data from Dune, Polymarket's total trading volume has exceeded $4.1 billion, with users generating nearly 5.2 million transactions.

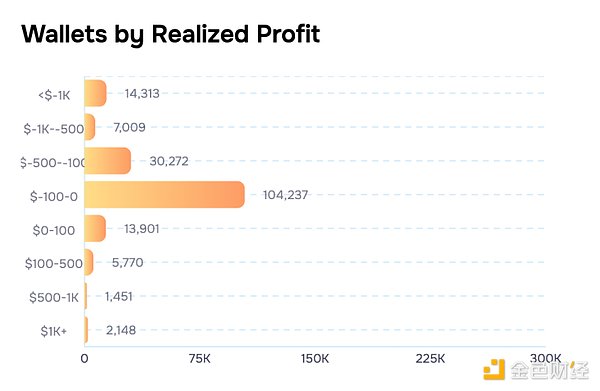

However, the overall profitability level for users is not optimistic. According to on-chain analysis tool Layerhub, among the 171,113 crypto wallet addresses on Polymarket, 149,383 (87.3%) have not made a profit. There are 21,730 wallets confirmed to be profitable, accounting for 12.7% of all participating crypto wallets. Among the wallets reporting profits, only 2,138 users have made over $1,000, with most profits ranging between $0 and $100.

This situation may change with the settlement of the largest prediction events, as the betting volume for the 2024 presidential election has already exceeded $720 million.

Let’s review the design mechanism of Polymarket:

Polymarket converts binary outcomes on the Polygon network into ERC1155 tokens. This allows collateral to be split into outcome tokens and re-merged after the event results are revealed (i.e., the probability becomes 0 or 1).

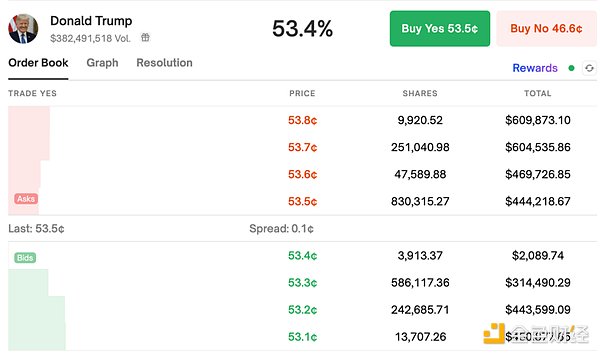

Polymarket employs a hybrid decentralized order book model, also known as a Central Limit Order Book (CLOB). Operators provide off-chain matching and sorting services, but the actual settlement and execution of trades occur on-chain in a non-custodial manner. Additionally, users can choose to trade through an automated market maker (AMM).

- Polymarket resolves market disputes through UMA's optimistic oracle. If there is a dispute over the event outcome, UMA token holders will vote to determine the correct result.

Polymarket charges a 2% fee on winning bets to reward liquidity providers. So far, Polymarket has paid over $3 million in USDC rewards to liquidity providers to enhance market liquidity.

However, since the trading prices (probabilities) of prediction events tend to approach 0 or 1, which differs from the price fluctuation logic of traditional assets, liquidity providers face a higher risk of impermanent loss. Therefore, a more comprehensive reward mechanism is needed to cover the capital costs and impermanent losses of liquidity providers.

What are Quality Prediction Events

Polymarket's success benefits from the U.S. elections, with the leading prediction events being related to the elections, and product explosions coinciding with the election cycle. Under the backdrop of strong regulation in the U.S., people's trading demands are released on Polymarket.

Quality prediction events are the core of maintaining competitiveness in prediction markets and typically need to possess the following factors:

The social media influence of event-related individuals, such as Elon Musk, who carries the aura of X CEO and the world's richest person, supporting Trump's election.

Huge social attention, as mentioned above, with nearly $16 billion in campaign spending during election years for both parties.

Prediction events with relatively balanced probabilities, where the potential of the relevant parties is comparable, the influencing factors of the game are numerous, and the choice set is limited. This can attract sufficient liquidity aggregation, reducing users' initial losses (information asymmetry losses) and liquidity providers' impermanent losses.

In contrast to the third point, overlapping and mixing prediction events increase the randomness of outcomes and the entropy of the entire process, catering to the needs of users with a higher risk preference.

New Development Trends in Prediction Markets

Currently, prediction markets are mainly innovating in liquidity and user participation, but the innovations are limited. Future competition will primarily occur at the event operation level. Micro-innovations are mainly reflected in the following aspects:

By using a peer-to-pool liquidity model, funds are concentrated to meet market demands, ensuring that even niche markets have sufficient liquidity. However, prediction markets inherently have a random wandering characteristic in liquidity based on the degree of information dispersion. If too much focus is placed on liquidity without reasonably covering its costs, it will affect the long-term development of prediction markets. Aggregating liquidity means a certain degree of market distortion.

Allowing users to make more complex leveraged bets increases market attractiveness but requires attention to risk management.

Utilizing social media for promotion, integrating specific scenarios, and increasing user participation.

Additionally, the potential applications of AI in event selection, information aggregation analysis, and automated trading are also worth exploring. The process of pricing information is essentially about information dissemination, and the main line of development for prediction markets is to make information dissemination more efficient and maximize economic benefits.

Regulatory Impact

The CFTC (Commodity Futures Trading Commission) prohibits any contracts involving illegal activities or activities that violate public interest. In 2024, the CFTC introduced a new rule banning contracts for political event outcomes, viewing them as violations of public interest. This has impacted platforms that rely on political prediction markets, such as Polymarket, PredictIt, and Kalshi. Elizabeth Warren has even publicly called for the CFTC to completely ban these election prediction markets, fearing they may interfere with the democratic process. As regulations become increasingly stringent, platforms urgently need to adapt to the new environment; otherwise, their business development will be restricted.

Prediction markets are reshaping the boundaries between politics and business, providing new possibilities for social decision-making. Currently, although they offer economic freedom, their social and political influence is being eroded. The key issue lies not in the prediction behavior itself but possibly in the regulatory adaptation to emerging technological business models. Prediction markets that can leverage regulatory space and innovate business models will achieve better development.

Conclusion

According to Layerhub data, Polymarket currently has nearly 180,000 independent users. Although it has not yet significantly impacted the overall user scale of the crypto market, as an economically reasonable and user-friendly Web3 product, it has built a complete crypto trading solution that is worth referencing for the industry.

With the end of the U.S. election cycle, prediction markets still face many challenges. In the short term, their role in decision-making and collective intelligence has yet to be realized, and issues such as insufficient market demand and liquidity need to be addressed urgently. Furthermore, the continuous changes in regulatory policies also bring uncertainty to the development of prediction markets.

The prediction market has a positive significance in improving the transparency of social information, especially against the backdrop of declining credibility in traditional information channels. Its successful cases also provide insights for other Web3 projects: focusing on mid-term sustainable development in niche scenarios to meet broader user needs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。