The Federal Reserve has begun a 50 basis point rate cut as expected, officially starting a new rate cut cycle, which will usher in a new period of global liquidity easing. As a result, global stock markets have collectively risen, with the S&P 500 and Dow Jones Index continuing to hit historical highs, and the Asia-Pacific stock markets performing impressively. The crypto market is enjoying the benefits of the rate cut, with Bitcoin's price breaking through $66,000, indicating that a new upward trend may be brewing.

Before this month's FOMC meeting, the U.S. released the latest non-farm payroll and inflation data: the latest non-farm employment numbers increased by 142,000, falling short of expectations; the August CPI rose 2.5% year-on-year, marking a decline for five consecutive months. At this critical juncture of rate cuts, the disappointing non-farm data may actually be a positive sign, increasing market expectations for rate cuts.

Subsequently, under market scrutiny, the U.S. Federal Reserve announced on the 18th local time that it would lower the target range for the federal funds rate by 50 basis points, bringing it to a level between 4.75% and 5.00%. After four years, the Fed has finally entered a new rate cut cycle. Thus, the global liquidity cycle will enter a new easing phase, allowing investors to breathe a sigh of relief.

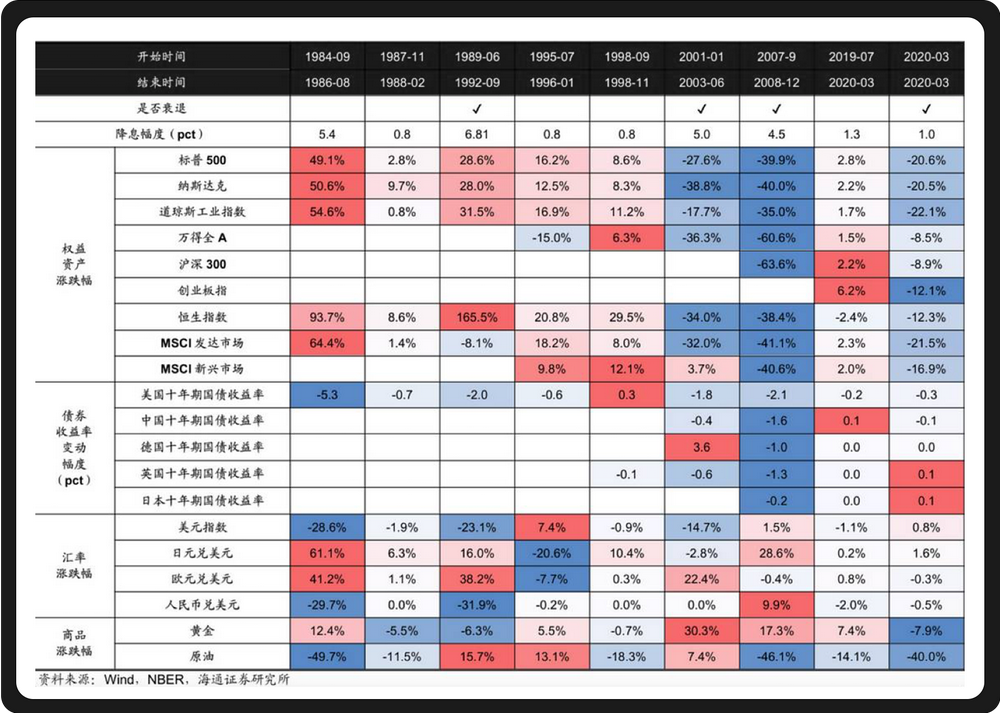

After the rate cut in 2024, the main changes in various major assets are as follows:

1. U.S. Treasuries: Typically, U.S. Treasuries rise before a rate cut, as the market anticipates the rate cut. After the cut, short-term volatility may increase, but over time, interest rate trends will diverge under different economic recovery scenarios.

2. Gold: Gold often performs well before a rate cut due to increased safe-haven demand. After the cut, gold may continue to be favored, but the specific situation will depend on whether the economy achieves a "soft landing" and other market factors.

3. Nasdaq: In a recessionary rate cut, the performance of the Nasdaq depends on the recovery of fundamentals. After a preemptive rate cut, the stock market often rises due to the positive economic effects brought by the rate cut.

4. BTC: Compared to the 2019 rate cut cycle, BTC's adjustment under the expectations of a rate cut in 2024 has come earlier. Although BTC may experience fluctuations or corrections in the short term, the long-term outlook remains bullish, and the expected magnitude and duration of the correction will be less than in 2019.

After the rate cut, the flow of gold ETFs and stock ETFs can reflect changes in market preferences for different assets. The Fed's adjustments to GDP growth, unemployment rate, and inflation forecasts will influence the market's outlook on the economic prospects, thereby affecting asset prices. While the rate cut may boost market sentiment and increase demand for risk assets, the gap between market expectations and actual economic data may also trigger emotional fluctuations, and these changes are influenced by various factors such as economic data, market expectations, and policy trends.

The magnitude of this rate cut slightly exceeded Wall Street's expectations; historically, the Fed has only aggressively initiated a 50 basis point cut in scenarios where the economy is in recession.

However, in Powell's speech, the U.S. economy is still operating under controllable conditions, with no significant recession concerns. As mentioned in our previous monthly report, this rate cut by the Fed is a "preemptive rate cut," and the initiation of 50 basis points demonstrates the Fed's attitude towards combating recession risks. An aggressive start does not imply sustained aggression. The Fed has revised down its GDP growth forecast (from 2.1% to 2.0%) and raised its unemployment forecast (from 4.0% significantly up to 4.4%), cautiously maintaining the development path of a soft landing for the economy.

Historically, unless it is an emergency rate cut after a recession, previous preemptive rate cuts have prompted bull markets for global assets, while the increase in the supply of dollars has led to a depreciation of the dollar. This rate cut is a typical preemptive rate cut, and we have reason to believe it will further drive asset prices to replicate historical trends.

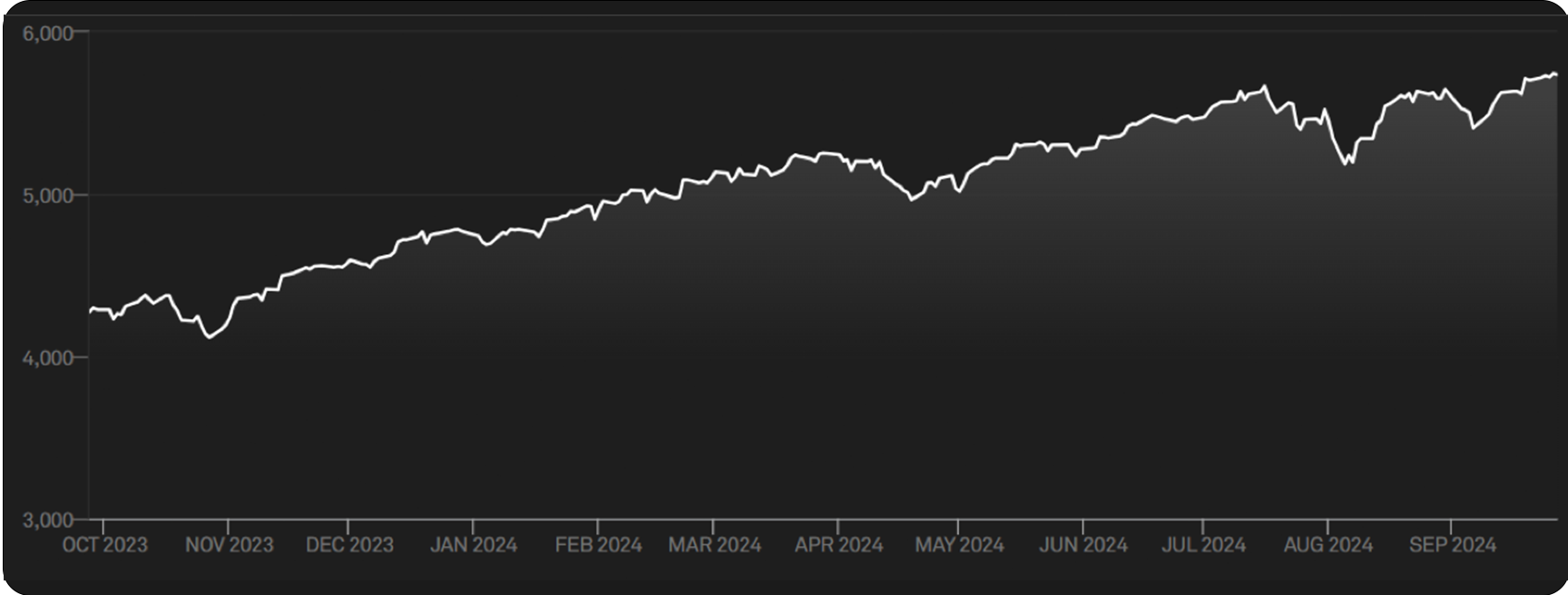

The market's divergence before and after the rate cut was very pronounced. On the 3rd and 6th of the month, U.S. stocks experienced two days of significant declines; after the rate cut, U.S. stocks gapped up and surged, with the S&P 500 once again hitting a historical high.

As analyzed in the previous chapter, in the case of a preemptive rate cut, asset prices often trend upward. Although the initiation of 50 basis points inevitably raises concerns about a recession, leading to a continuous rise in gold prices, we still believe there are opportunities in U.S. stocks—liquidity easing and declining borrowing costs will offset hidden recession concerns in the market.

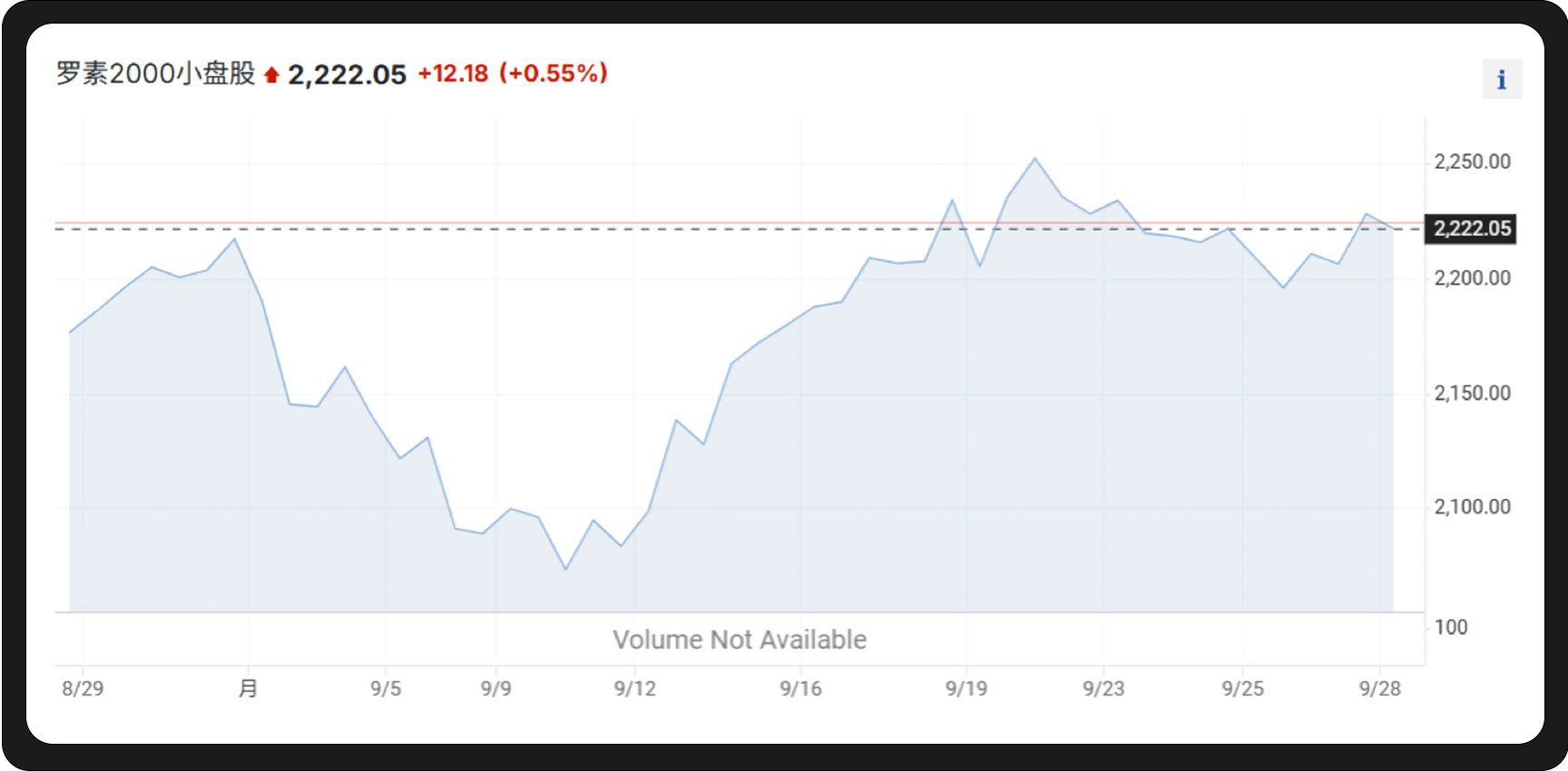

Generally speaking, rate cuts first benefit small-cap stocks, as changes in market risk preferences will first lead to capital flowing into high-volatility assets. From the Russell 2000 index, the market is indeed moving in line with this expectation.

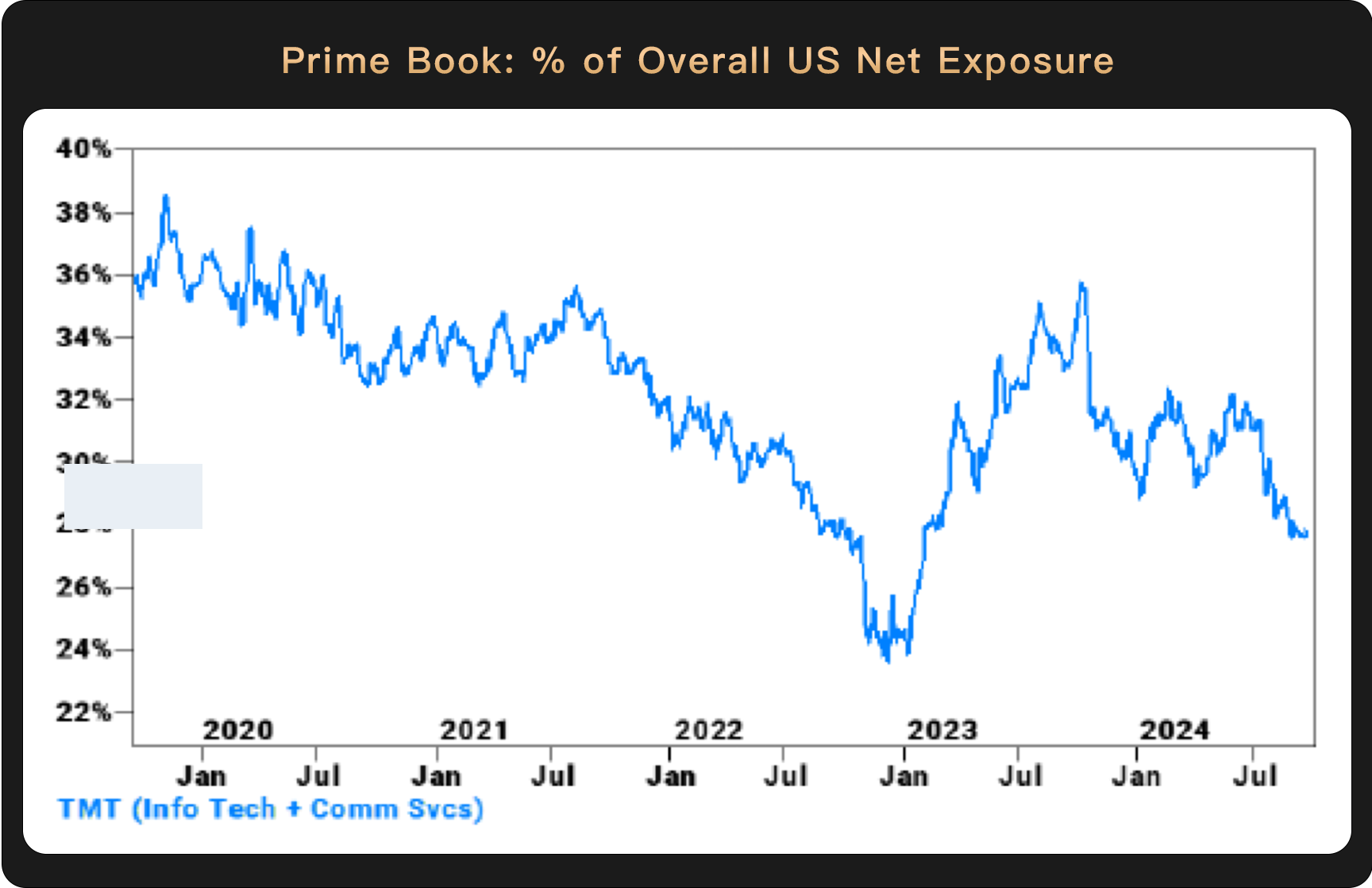

However, hedge funds do not seem to think so. According to Goldman Sachs' main broker weekly report as of September 20, hedge funds bought U.S. tech stocks, media stocks, and telecom stocks at the fastest pace in four months last week, continuing to pursue AI-related thematic investments.

On the day after the Fed's rate decision, the Nasdaq 100 index recorded its largest intraday gain since early August. However, on a weekly basis, the Russell 2000 index outperformed the tech-heavy Nasdaq 100 index. On the surface, gold, small caps, and large caps are all rising, but behind the scenes, some are betting on a recession, some are trading on the rate cut, and others continue to embrace AI. The market does not have a unified expectation, but overall, it is logically enjoying the benefits of liquidity easing.

From a global market perspective, the rate cut has indeed brought positive feedback. This month, in addition to the S&P 500 and Dow Jones, Germany's DAX, India's Bombay Sensex 30, Indonesia's Jakarta JKSE, and Singapore's Straits Times Index (STI) all reached historical highs, with the Asia-Pacific market performing exceptionally well. Therefore, from a global perspective, investors remain very confident in the investment environment after the rate cut, and we look forward to the continuation of the bull market.

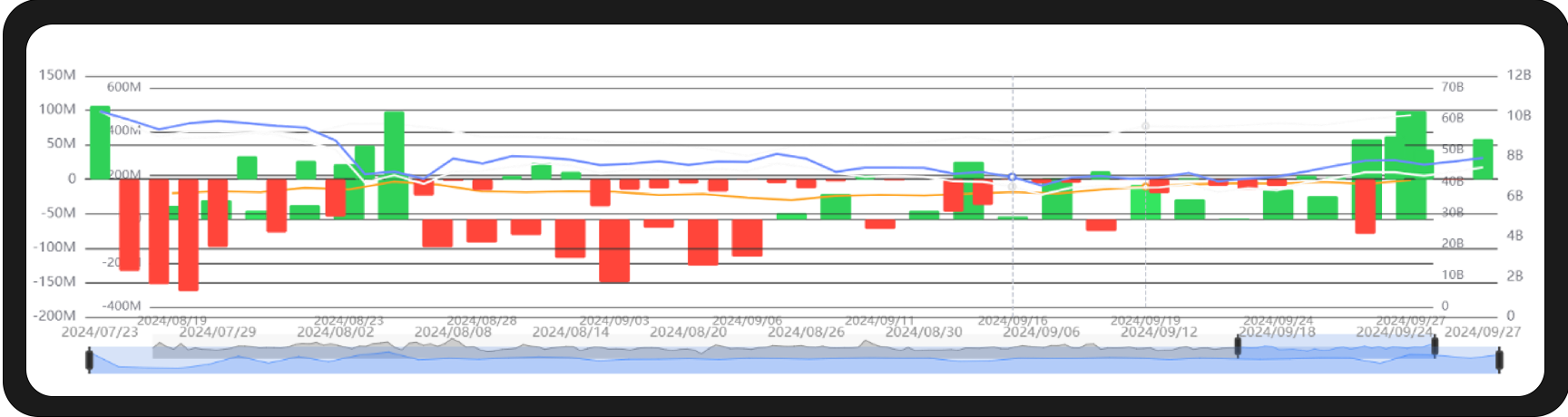

The impact of the rate cut is not only reflected in traditional financial markets but has also spread to the crypto space. Although spot ETF data does not directly determine price trends, it can reflect the sentiment of U.S. investors. Previously, investor sentiment was low, and purchasing power was weak, but after the first rate cut, investors' risk appetite has increased. The latest BTC spot ETF data shows that only three institutions have unchanged positions, Grayscale slightly reduced its holdings by 9 BTC, while other institutions like BlackRock, Fidelity, and ARK have increased their holdings by over 1,000 BTC.

Bitcoin's price experienced several large bearish candles at the beginning of the month, followed by a rebound, rising from below $53,000 to over $66,000, completing a significant turnaround. As a risk asset, Bitcoin will inevitably enjoy sufficient benefits from the rate cut. From the inflow data of Bitcoin ETFs, since the rate cut on the 18th, U.S. Bitcoin ETFs have shown a trend of net inflow.

From the inflow data of ETH, ETH has rarely seen consecutive inflows since its listing. We believe the ETH/BTC exchange rate has fallen below 0.04, making it highly cost-effective, and in subsequent asset allocations, it is advisable to follow Ethereum ETFs for some bottom-fishing.

During the 2019 rate cut cycle, Bitcoin (BTC) experienced a brief rise after the first rate cut but then entered a downward trend, retreating from its peak and undergoing a 175-day adjustment period, with a price drop of about 50%. Unlike 2019, this year, due to the continuous changes in market expectations for rate cuts, BTC's adjustment has come earlier. Since reaching its annual peak in March, BTC has experienced a 189-day period of fluctuating corrections, with a maximum decline of 33%. Historical data indicates that although BTC may continue to fluctuate or correct in the short term, the expected magnitude and duration of the adjustment will be less than in the 2019 cycle. In the long term, BTC's outlook remains bullish.

This month, BlackRock's latest report on Bitcoin—"Bitcoin: A Unique Diversification Tool"—has garnered significant attention. The subtitle of this research report states: Bitcoin's appeal to investors lies in its detachment from traditional risk and return drivers. The article is authored by Samara Cohen, Chief Investment Officer of BlackRock's ETF and Index Investment division, Robert Mitchnick, Head of BlackRock's Digital Assets division, and Russell Brownback, Head of Global Macro Fixed Income Positions at BlackRock.

The report points out that Bitcoin is highly volatile and, when viewed in isolation, is clearly a "high-risk" asset. However, most of the risks and potential return drivers that Bitcoin faces are fundamentally different from those of traditional "high-risk" assets, making it unsuitable for most traditional financial frameworks, including the "risk on" and "risk off" frameworks adopted by some macro commentators. Currently, the market's understanding of this emerging asset remains immature.

It is worth mentioning that BlackRock noted in the report that many people have consulted BlackRock about increasing Bitcoin in their asset allocation, expressing concerns about U.S. debt issues and seeking investment products to hedge against dollar risks, with Bitcoin becoming their focus. This naturally decentralized asset can hedge against the inherent structural risks of centralized central banks.

Therefore, as the global investment community strives to cope with escalating geopolitical tensions, concerns over U.S. debt and deficit conditions, and increasing global political instability, Bitcoin may be viewed as an increasingly unique diversification tool that can withstand some of the fiscal, monetary, and geopolitical risk factors that investors may face in their portfolios. We have reason to believe that this will become a consensus among global investors, as we have never stopped seeking risk hedges.

The liquidity easing cycle has arrived as expected, with the Fed's 50 basis point cut affirming its determination to combat economic recession. Global assets (whether risk assets or safe-haven assets) are all moving in an upward direction, each playing out their respective expectations. In an environment of dollar easing, there is no need to overly worry about the "this for that" situation caused by uneven liquidity distribution. Therefore, embracing cryptocurrencies may be a wise move to enjoy the "Davis Double Play" of liquidity easing and hedging against U.S. debt issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。