The crypto economy is undergoing a significant shift from speculative experiments to revenue-generating businesses and on-chain economies.

Written by: Ryan Watkins, Co-founder of Syncracy Capital

Translated by: 1912212.eth, Foresight News

There is a popular view in the industry that, aside from Bitcoin and stablecoins, there are no other valuable applications. The last cycle was entirely driven by speculation, and there has been little progress since the crash in 2022. The industry’s infrastructure is oversaturated, and the VCs funding them may pay the price for misallocated capital.

The latter part of this statement holds some truth as the market begins to punish blind infrastructure investments, with winners emerging based on the crypto economy. However, when we look at the data, we find that there are few applications relative to the infrastructure, and there has been almost no progress since the last cycle. The first part of the statement, therefore, does not hold water.

Contrary to popular belief, the era of applications has arrived, and many applications are generating revenue that exceeds that of the infrastructure. Mainstream platforms like Ethereum and Solana host a large number of applications with annual revenues in the 8 to 9 figure range, growing at triple-digit percentages each year. However, while these numbers are impressive, the trading prices of applications are still far below that of the infrastructure, which has an average revenue multiple about 300 times higher. While infrastructure assets like ETH and Solana, positioned at the center of the smart contract ecosystem, may maintain a value storage premium, the multiples of non-monetary infrastructure assets (like layer two tokens) may compress over time. Syncracy believes that the market has yet to fully recognize this reality, and as capital flows into non-monetary infrastructure, leading applications will begin to prepare for repricing, driving prices higher.

A turning point in future trends may be when applications capture a larger share of the blockchain fee pool and generate more revenue than most infrastructure assets. Data from the two mainstream application ecosystems, Ethereum and Solana, already shows that applications are taking a slice of the revenue pie from the platforms they rely on. As applications capture a larger economic share and achieve vertical integration to better control user experience, this trend may accelerate further. Even Solana applications, which pride themselves on synchronous composability, are keeping some operations off-chain and pushing for off-chain execution while utilizing L2 and sidechains for scalability.

The Rise of Fat Applications

Is the Rollapp theory inevitable? As applications strive to overcome the limitations of a single global state machine that cannot effectively handle all on-chain transactions, modularity between blockchains seems imperative. For example, while Solana's performance is impressive, it began to face issues in April due to millions of daily user transactions involving MEME. While Firedancer may help, it remains unclear whether it can provide the magnitude of performance improvement needed for billions of daily active users (including AI agents and enterprises). As mentioned, Solana's modularity has already begun.

The real question is to what extent this transformation will evolve and how many applications will ultimately move operations off-chain. Running the entire global financial system on a single server, which is the fundamental argument for any integrated blockchain, will require full nodes to operate in hyper-scale data centers, making it nearly impossible for end users to independently verify the integrity of the chain. This would undermine the fundamental attributes of a globally scalable blockchain, which ensures solid property rights and resists manipulation and attacks. In contrast, Rollups allow applications to distribute these bandwidth demands across a separate set of sorters, which can achieve hyper-scale performance while ensuring end-user verification through DA sampling of the underlying base layer. Furthermore, as applications scale and begin to establish close relationships with users, they may demand maximum flexibility from the underlying infrastructure to best meet user needs.

This is already happening in Ethereum, the most mature on-chain economy, where leading applications like Uniswap, Aave, and Maker are actively developing their own Rollups. These applications are pursuing not just scalability—they also require features such as custom execution environments, alternative economic models (like native yield), enhanced access controls (like permissioned deployments), and customized transaction ordering mechanisms. This way, applications can not only enhance user value and reduce operational costs but also gain greater economic control relative to their underlying infrastructure. Chain abstraction and smart wallets will only make this application-centric world more seamless and reduce friction between the currently disparate block spaces over time.

In the short term, next-generation DA providers like Celestia and EigenLayer will be key drivers of this trend, providing applications with greater scale, interoperability, and flexibility while ensuring cheap verifiability. However, in the long run, it is clear that every blockchain aiming to become the foundation of a global financial system will need to ensure cheap verification for end users while expanding bandwidth and DA. For instance, while Solana is conceptually integrated, it already has teams researching light client verification, zero-knowledge compression, and DA sampling to achieve this ultimate goal.

Again, the focus here is not on specific scaling technologies or blockchain architectures. It is likely that for integrated blockchains, token scaling, co-processors, and Rollups will be sufficient to achieve scalability and provide the necessary customizability for applications without compromising their composability. Regardless, the future trend points toward applications continuing to move toward greater economic control and technical flexibility. It seems inevitable that application revenue will exceed that of its underlying infrastructure.

On-chain Value Capture

A crucial question today is how value will be distributed between applications and infrastructure as applications gain more economic control in the coming years. Will this shift become a turning point that prompts applications to generate results similar to infrastructure in the coming years? Syncracy believes that while applications will continue to capture a larger share of the global blockchain fee pool over time, the underlying infrastructure (L1) may still yield greater results, albeit with fewer players involved.

The core argument supporting this view is that, in the long run, all base layer assets, such as BTC, ETH, and SOL, will compete as non-sovereign digital value storage means—this is the largest TAM in the crypto economy. While Bitcoin is generally seen as similar to gold and other L1 assets as akin to stocks, this distinction is primarily narrative-driven. Fundamentally, all native blockchain assets share common characteristics: they are non-sovereign, difficult to seize, and transferable in a cross-border digital environment. In fact, these attributes are essential for any blockchain aiming to establish an independent digital economy free from state control.

The key difference between them lies in the strategies for achieving global adoption. Bitcoin seeks to replace fiat currency as the dominant global value storage means, directly challenging central banks. In contrast, L1s like Ethereum and Solana aim to establish a parallel economy in cyberspace, creating organic demand for ETH and SOL as they grow. In fact, this is already happening. Beyond serving as a medium of exchange (fee payments) and unit of account (NFT pricing), ETH and SOL are the primary means of value storage in their respective economic systems. As proof-of-stake assets, they directly capture fees generated from on-chain activity and maximum extractable value (MEV), and both assets provide the lowest counterparty risk in their ecosystems, making them collateral on-chain. Meanwhile, as a proof-of-work asset, Bitcoin does not provide staking or fees to holders but operates purely as a commodity currency.

While the strategy of building a parallel economy may seem ambitious and nearly impossible to achieve ideally, it ultimately proves that competing with national economies, rather than directly confronting them like Bitcoin, may be easier. In fact, the approaches of Ethereum and Solana reflect how countries have historically vied for reserve currency status: first establishing economic influence, then encouraging other countries to adopt your currency for trade and investment.

It is easy to overlook the immeasurable monetization process and lean toward the quantifiable process of measuring value accumulation through fee generation, but the latter may lead to disappointing results. Aside from the obvious cyclical complexity of blockchain generating fees through unsupported, self-issued currencies, the potential fee capture may not be as large as people imagine in the foreseeable future.

Take MEV as an example. MEV is unlikely to become a sufficiently large industry to support current valuations, and its proportion as a share of on-chain activity may decrease over time, increasingly accumulating within applications. In traditional finance, high-frequency trading (HFT) is the closest analogy to MEV, with global revenues estimated between $10 billion and $20 billion. Moreover, blockchains may currently be earning too much on MEV, and as wallet infrastructure and order routing improve, along with applications committed to internalizing and minimizing MEV, it may decline over time. Do we really expect MEV revenue on a chain to exceed the entire global high-frequency trading industry and be 100% owned by validators?

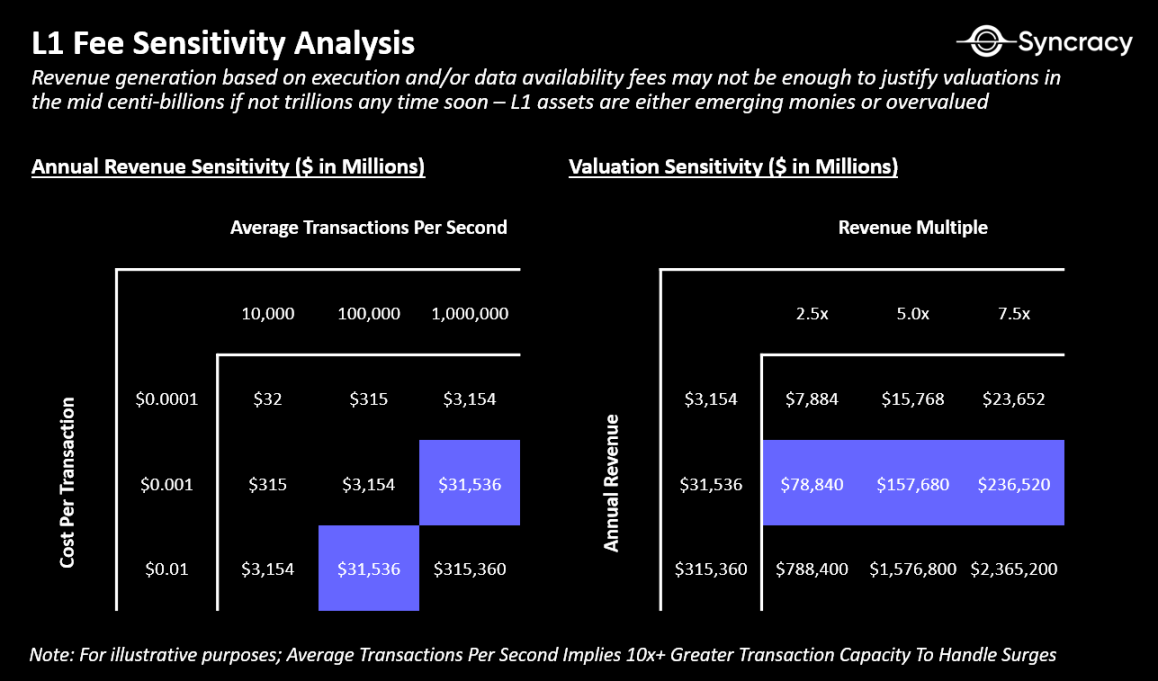

It is also worth noting that while execution and DA fees may be attractive sources of revenue, they may still be insufficient to justify their rationale if they cannot reach valuations in the trillions or even tens of trillions in the near future (there are only so many organizations on Earth with such high value). Transaction volume needs to grow exponentially while fees must remain low enough to facilitate mainstream adoption to reach an acceptable range—this process may take a full decade.

So, what can provide validators with enough value to continue their vital services? Just as they have done throughout history, blockchains can use monetary inflation as a permanent subsidy akin to taxation to sustain themselves. Essentially, asset holders will lose a small portion of their wealth over time to subsidize validators, who provide ample block space for applications, thereby bringing monetary value to the blockchain's underlying assets.

In summary, it is worth considering a more pessimistic view that the value of blockchain should be assessed based on fees, and over time, as applications gain greater economic control, these fees may not justify high valuations. This is not an unprecedented situation—during the internet boom of the 1990s, telecom companies attracted massive over-investment in infrastructure, but ultimately many companies commoditized. While telecom giants like AT&T and Verizon adapted and survived, most of the value shifted to applications built on these infrastructures, such as Google, Amazon, and Facebook. The likelihood of this pattern repeating in the crypto economy is not zero; chains provide infrastructure, but value is captured and surpassed at the application layer. However, for now, in the speculative early stages of the crypto economy, this is all a relative value game—Bitcoin chasing gold, Ethereum chasing Bitcoin, and Solana chasing Ethereum.

The Era of Applications, The Era of Cryptocurrencies

From a grand perspective, the crypto economy is undergoing a significant shift from speculative experiments to revenue-generating businesses and active on-chain economies, which bring real monetary value to blockchain-native assets. While current activities may seem small in scale, they are experiencing exponential growth as these systems expand and offer more attractive user experiences. Syncracy believes that in a few years, when we look back at this era, we will do so with a sense of humor, wondering why there were still doubts about the value of this field when so many obvious trends were emerging at the time.

The era of applications has arrived, and with it, blockchains will create a more powerful non-sovereign digital value storage than ever before.

Special thanks to Chris Burniske, Logan Jastremski, Mason Nystrom, Jonathan Moore, Rui Shang, and Kel Eleje for their feedback and discussions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。