Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: October 10, 15:34 Beijing time

Market Information

- European Central Bank: Stablecoins are highly influenced by U.S. monetary policy and are not a "safe haven" during market turmoil;

- OCBC Bank in Singapore will stop processing all transactions related to Russia starting November 1;

- Yesterday, the net inflow/outflow of the U.S. spot Ethereum ETF was zero;

- Andrew Kang: Market participants may overestimate the impact of the Federal Reserve's interest rate cuts and China's stimulus policies on cryptocurrencies;

- SEC Chairman Gary Gensler on cryptocurrencies: "This kind of thing is unlikely to become currency";

Market Review

Previously, we predicted that Bitcoin would experience a decline, and we need to pay attention to the support around 60,000. After two days of fluctuations, Bitcoin fell last night, with a low point at 60,301. The short position set up from above is expected to yield a profit of over 2,000 points. After Bitcoin dropped to around 60,000, it has currently shown a slight rebound, indicating that the short-term support at 60,000 is still effective. Ethereum's movement is similar, with a low point at 2,351. Although it is still a bit away from our target of 2,275, there is still a profit margin of 60-70 points. Ethereum's fluctuations are relatively smaller. As long as Bitcoin does not break below 60,000, the opportunity for Ethereum to test 2,100 will have to wait until next time. Currently, we need to focus on the situation of Bitcoin breaking the 60,000 support;

Market Analysis

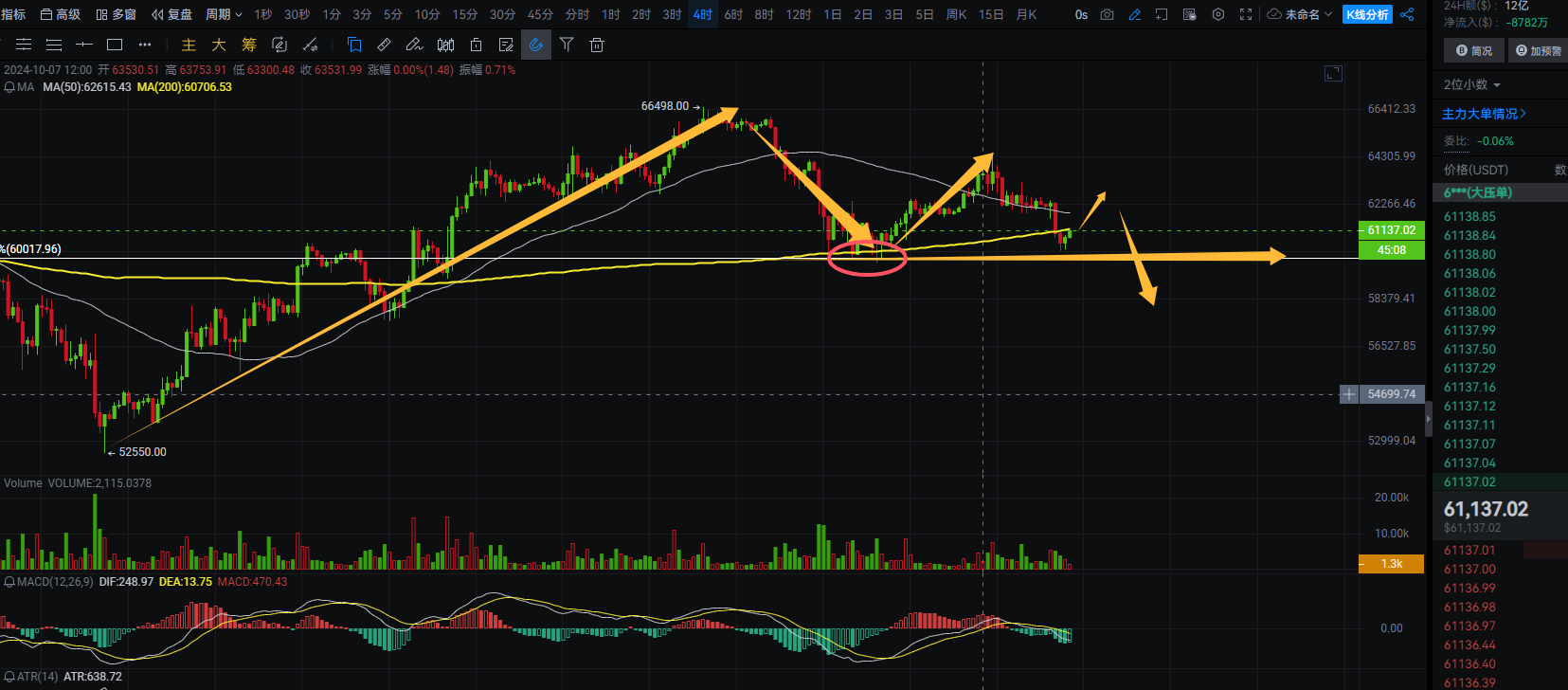

BTC:

Looking at the 4-hour chart, Bitcoin's recent decline is close to the support around 60,000. The previous decline also tested this position multiple times without breaking, leading to a rebound. In the short term, this position can serve as effective support. The market has also returned above the 0.786 Fibonacci retracement line of the previous short-term upward trend. There is a high chance of a rebound in the short term, with the rebound range expected to be between 62,900 and 63,500. After reaching this range, it may continue to decline. The subsequent decline is likely to break below the 60,000 support level. In the short term, we need to pay close attention to the situation of the 60,000 support. If it breaks, the range will be 57,900 to 55,500. For short-term trading, one can consider light positions around the short-term low of 60,301 with a stop loss, targeting above 62,900. After reaching this target, pay attention to the closing situation above before looking for short opportunities. In short-term trading, control risks and manage profits and losses independently;

ETH:

Looking at the 4-hour chart, Ethereum's rebound is relatively weak. This decline did not break the short-term low of 2,310, and it tested the 0.786 Fibonacci line support after the previous rebound, resulting in a slight rebound. There is also some rebound space during the day, with an expected range of 2,455 to 2,485. It would be good if it can reach around 2,455. The rebound of Ethereum is relatively weak, and it is not recommended to go long in the short term due to limited space. After reaching around 2,455, refer to whether Bitcoin reaches around 62,900. If it does, one can set up a short position to target a drop to around 2,100. Manage entry independently; in short-term trading, control risks and manage profits and losses independently;

In summary:

Bitcoin encounters support below, and we need to pay attention to the situation of breaking the support in the short term;

The article is time-sensitive, be aware of risks, the above is only personal advice, for reference only!

Follow the public account "Crypto Lao Zhao" to discuss the market together;

Buddha's words: "Impermanence" is the norm of life. The "impermanence" mentioned here refers to uncertainty and unpredictability. All the things that cause us pain are due to the excessive pursuit of certainty, such as: love, family, work, friendship. Therefore, investment is based on the foundation of retreating to safety and advancing to attack, using limited funds that can be tolerated to amplify infinitely, rather than being defensive everywhere; In short, use limited money that does not affect the quality of life to do things that, once successful, may change fate or improve life. Defense is just not worse than now, while offense can be better than now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。