Author: Coingecko

Compiled by: Felix, PANews

Recently, Coingecko released a research report on cryptocurrency enforcement actions in the United States. This study is based on official announcements from January 1, 2019, to October 9, 2024, examining the monetary value settlements reached between cryptocurrency companies and U.S. regulatory agencies in federal and state court cases, excluding charges against individuals. Below are the details of the report.

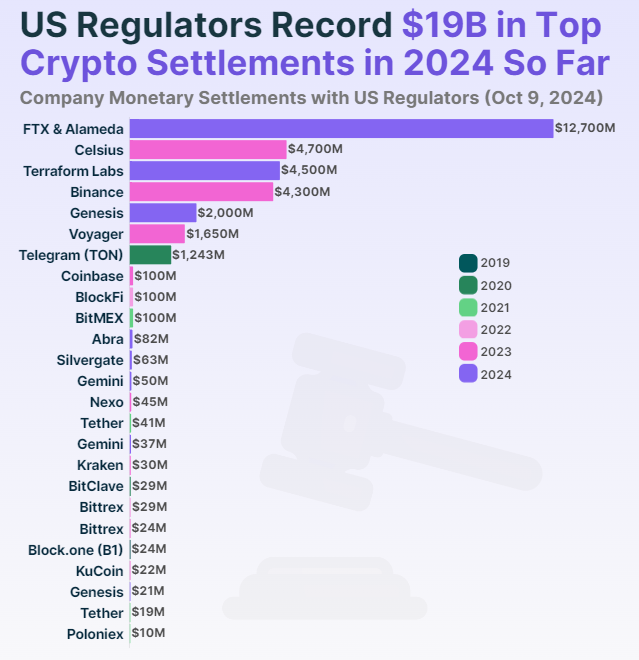

Settlements Totaling Nearly $32 Billion, with FTX and Alameda Accounting for Nearly 40%

The primary cryptocurrency enforcement action by U.S. regulators is against the bankrupt cryptocurrency exchange FTX and its affiliated trading firm Alameda, which together have paid the largest settlement amount to date of $12.7 billion. The lawsuits against FTX and Alameda were led by the Commodity Futures Trading Commission (CFTC), with the settlement agreement announced in August 2024, less than two years after FTX's collapse. Although this ruling does not include lawsuits against individual company executives by the CFTC, the $12.7 billion settlement will be used to repay FTX customers and creditors (approximately $11.2 billion).

The second-largest cryptocurrency enforcement action by U.S. regulators is against the bankrupt cryptocurrency lending institution Celsius ($4.7 billion), former industry leader Terraform Labs ($4.5 billion), and cryptocurrency exchange Binance ($4.3 billion). Notably, the mid-2022 collapses of Celsius and Terraform Labs marked a key event signaling the shift from a bull to a bear market in the cryptocurrency sector, ultimately leading to the downfall of FTX and triggering a new round of regulatory scrutiny in the U.S.

The settlement with Binance represents a milestone victory for U.S. regulators. Although it ranks fourth in terms of settlement amount, it is the only operational cryptocurrency company to have paid a multi-billion dollar settlement to date. This leading global cryptocurrency exchange agreed to plead guilty in November 2023 to resolve lawsuits with multiple U.S. regulatory agencies, including the Department of Justice (DOJ), the Treasury Department, and the Commodity Futures Trading Commission (CFTC).

Currently, U.S. regulators have undertaken 25 cryptocurrency enforcement actions, with each settlement amount exceeding $10 million. Overall, the total highest settlement amount reached by U.S. regulators against cryptocurrency companies is $31.92 billion.

Surge in Enforcement Actions Over the Past Two Years, with Settlements Exceeding $19.4 Billion This Year Alone

Among the 25 major cryptocurrency enforcement actions in the U.S., 16 settlements were reached in the past two years, reflecting an increase in regulatory scrutiny since the collapse of FTX at the end of 2022. Specifically, U.S. regulators resolved 8 lawsuits in 2023, totaling $10.87 billion, setting a historical record, with settlement amounts increasing by 8327.1% compared to the previous year.

Subsequently, U.S. regulators have reached another 8 settlements in 2024, valued at $19.45 billion, accounting for nearly two-thirds of the total settlement amount. Even with only a few months left in the year, the settlement amount for 2024 has already increased by 78.9% compared to 2023. Given that U.S. regulators show no signs of slowing down their scrutiny of the cryptocurrency industry, 2024 may see more lawsuit settlement records than last year.

From 2019 to 2022, U.S. regulators won 8 cryptocurrency lawsuit settlements. At the end of 2019, U.S. regulators reached the first significant cryptocurrency lawsuit settlement with Block.one, the company behind EOS (now renamed B1), with the Securities and Exchange Commission (SEC) settling for $24 million.

In 2020, the SEC won two major cryptocurrency lawsuits, with ICO issuer BitClave settling for $29.34 million in May, and Telegram settling for $1.24 billion regarding the issuance of its Gram tokens under its subsidiary TON Issuer. The $1.24 billion Telegram settlement included $1.22 billion in illegal proceeds and a $18.5 million civil penalty.

During the bull market in 2021, U.S. regulators successfully took three cryptocurrency enforcement actions against well-known industry participants. Stablecoin issuer Tether reached a $18.5 million settlement with the New York Attorney General (NY AG) in February, followed by a $41 million settlement with the CFTC in October, claiming that USDT was fully backed by dollar assets. The CFTC also reached a settlement with Tether's parent company Bitfinex, with a lower fine for illegal trading of $1.5 million. Meanwhile, cryptocurrency exchanges Poloniex and BitMEX settled for $10.39 million and $100 million, respectively, in August.

In 2022, cryptocurrency lending institution BlockFi reached a $100 million settlement with the SEC and the North American Securities Administrators Association (NASAA), while cryptocurrency exchange Bittrex settled for $29 million with the Treasury Department.

Related Articles: FTX Compensation Imminent: Compensation May Be Less Than a Quarter, Shareholders "Cut in Line" for $230 Million Distribution

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。