Written by: Liu Honglin, Huang Wenying, Mankun Law Firm

Virtual currency exchanges should be one of the primary ways for most newcomers in the crypto space to enter Web3. In addition to daily buying and selling of virtual currencies, most virtual currency exchanges also offer a variety of wealth management services, some of which claim low risk and guaranteed returns, while others have complex gameplay and mechanisms. Among these, simple earning products are often recommended to new users due to their user-friendliness.

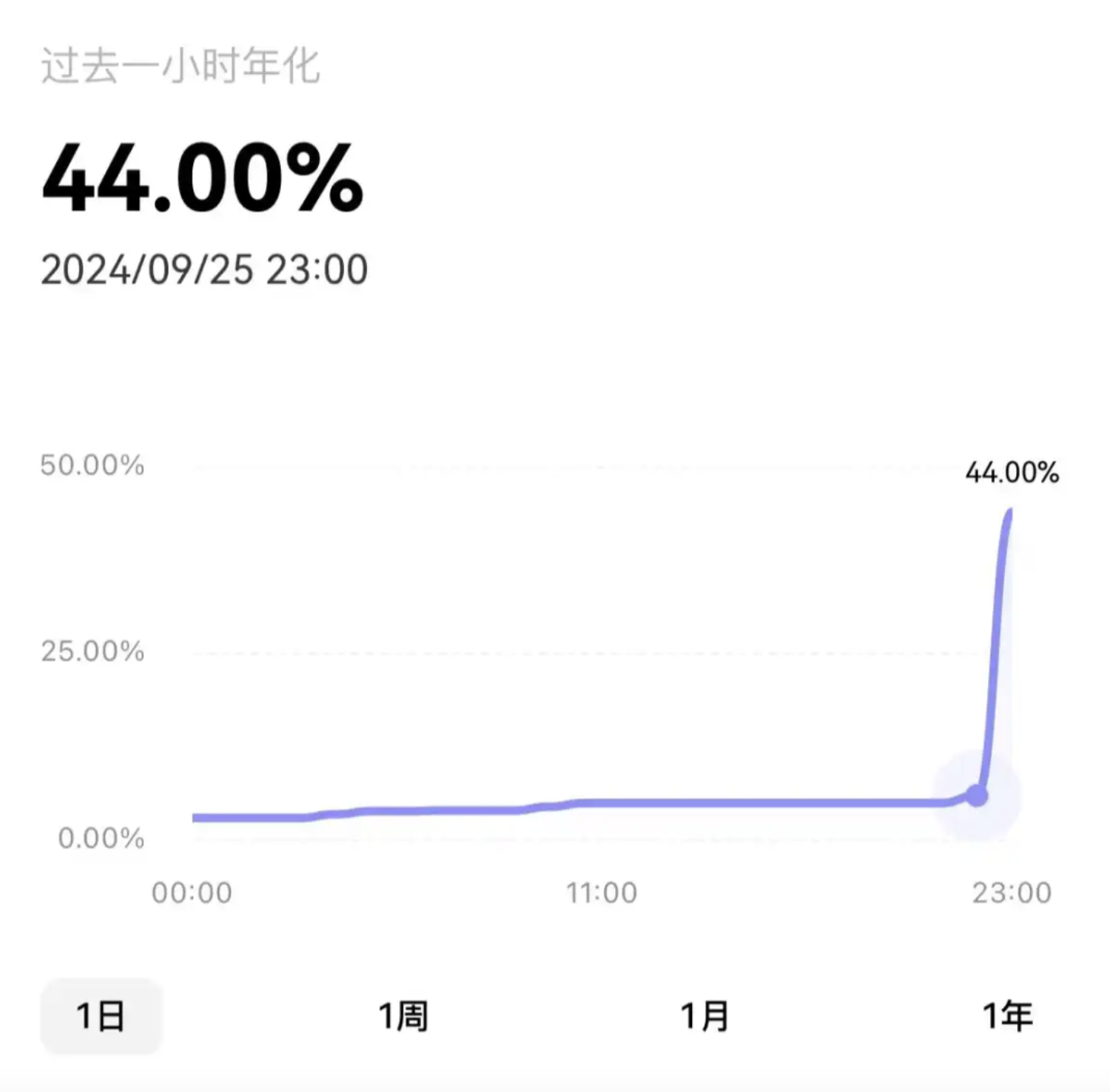

Yesterday, a simple earning wealth management product from a certain exchange gained attention due to a surge in the interest rate for USDT savings. Generally, the interest rate for this product is 6%, but yesterday at 23:00, it skyrocketed to 44%.

Image source: Screenshot of a certain exchange's wealth management page interest rate

Today, Mankun Law Firm will use the user agreement of the exchange's "Simple Earning Service" as an example to briefly discuss what these wealth management products are all about.

Overview of Simple Earning Service

The simple earning service (Earn) provided by virtual currency exchanges offers digital asset holders a convenient way to increase their value. Users can deposit their virtual currencies into the platform and choose between flexible or fixed-term wealth management products based on their liquidity needs and expected returns.

From the perspective of fund usage, this type of simple earning service is a lending-based service, where users deposit their virtual currencies on the exchange platform, and the exchange lends these virtual currencies to those in need, charging a fee and distributing a portion of the profits to users. Currently, most exchanges support mainstream coins for investment and wealth management, such as USDT, USDC, BTC, and ETH for flexible or fixed-term simple earning products.

After depositing tokens, if the lending demand of the user successfully matches the borrowing demand of other users, they can earn returns hourly before the order period ends. Moreover, users can choose to enable the automatic reinvestment feature. Thus, at the end of the term, the order will automatically match again, continuing to generate returns.

Financial Attributes and Legal Definition

When comparing the simple earning service to traditional financial products, we can see that simple earning is similar to deposits or wealth management in traditional finance, with the earned virtual currency equivalent to interest or investment returns. However, compared to traditional financial products, the simple earning service of virtual currency exchanges relies on blockchain technology, featuring decentralization and global reach, with stronger liquidity and relatively higher returns.

However, to provide such services, compliance and licensing of the platform is the first step. There are significant differences in regulatory requirements and qualifications for virtual currency exchanges across different countries and regions. For example, in Hong Kong, virtual currency exchanges need to apply for Type 1 (Securities Trading) and Type 7 (Automated Trading Services) licenses from the Securities and Futures Commission (SFC).

Image source: Hong Kong SFC official website

In addition, different countries and regions have varying legal positions on virtual currencies, which directly affects the legal attributes of financial services based on virtual currencies. In China, regulatory authorities have taken a strict stance on virtual currencies. The People's Bank of China and six other ministries issued the "Announcement on Preventing Risks of Token Issuance Financing" in 2017, clearly stating that token issuance financing activities are essentially unauthorized illegal public financing. Furthermore, it has been explicitly prohibited for financial institutions and payment institutions to engage in activities related to virtual currencies.

In such a regulatory environment, the simple earning service, as an unapproved financial activity, may be deemed illegal. For investors, if they knowingly or should have known that the service may be illegal yet still accept it and establish a legal relationship with the exchange, that legal relationship may be deemed invalid. In the event of a dispute, investors will find it difficult to obtain effective legal protection.

Legal Risks and Recommendations

Therefore, when investors use the simple earning service of virtual currency exchanges for virtual asset wealth management, they should fully understand the compliance of the exchange and correctly assess trading risks based on the user agreement to avoid unnecessary financial losses during the investment process. Specific methods that can be adopted include:

Image source: User Agreement for Simple Earning from a certain exchange

Pay attention to changes in regulatory policies. Regulatory agencies in various countries may implement stricter measures on virtual currency exchanges for various reasons, such as protecting investors, maintaining financial market stability, and preventing money laundering and terrorist financing. For example, they may require exchanges to comply with specific registration and reporting requirements, restrict their operations, or even completely halt related services in extreme cases. Investors may face liquidity risks, affecting the recovery of their principal and expected returns. For instance, the once-prominent FTX exchange disclosed liabilities of up to tens of billions of dollars when it filed for bankruptcy, resulting in millions of retail investors losing their investments and even impacting well-known investment institutions like Sequoia and Temasek. Therefore, investors should closely monitor regulatory dynamics and assess the potential impact of policy changes on their investments when participating in simple earning services.

Focus on risk and rights assessment. In traditional finance, regulatory agencies typically require financial service providers to ensure adequate protection for investors. However, in the virtual currency investment field, most service providers minimize their risks through agreement terms. Therefore, investors should fully understand the service terms, risk disclosures, and their own risk tolerance when participating in simple earning services.

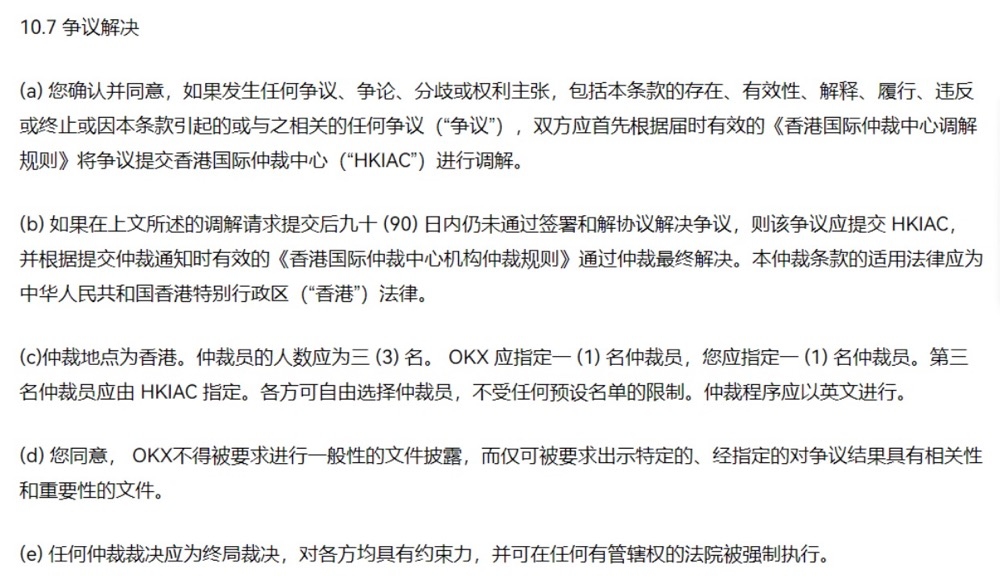

Pay attention to dispute resolution clauses. These clauses often appear in user agreements as standard terms, and the platform often sets the dispute resolution methods from the perspective of maximizing its own interests, such as agreeing to arbitration abroad. Users may not fully pay attention to jurisdiction clauses during the registration process. In the event of a dispute, such dispute resolution clauses often impose additional time and economic costs on users.

Some jurisdictions require platforms or service providers to reasonably alert users to the existence of these clauses when using standard terms, especially those that may be detrimental to users. If the provider of standard terms fails to reasonably alert the other party or if the content of the terms is excessively unfair, the court may deem the clause invalid. However, even if such a claim is supported, it usually requires a lengthy negotiation, consultation, or even litigation process, which is not conducive to the efficient resolution of disputes.

Summary by Mankun Law Firm

The low risk and stable return rates promised by simple earning services appear particularly attractive in the risk-laden Web3 space, but such promises often require investors to approach them with caution.

Before participating in such services, investors should fully understand relevant regulatory policies, assess risks, and pay attention to the relevant provisions in the user agreement. In different countries and regions, the legal status and regulatory requirements for virtual currencies vary significantly, and investors need to closely monitor policy changes to avoid unnecessary legal risks and financial losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。