Trader Chen Shu: 10.10 Bitcoin and Ethereum Market Strategy *1, Focus on Range Breakout and 6.05 Gains and Losses

In the analysis provided on October 9th, the strategy suggested going long at 6.2/2430, and if breaking below 6.2-6.15, to look for shorts targeting 6.05. For Ethereum, a short at 2460 would yield some gains if followed. The overall analysis was basically correct, with an 80% accuracy rate for October trading. Currently, the market has temporarily stopped falling; please see the following analysis for operational guidance.

From the daily chart of Bitcoin, yesterday's close was an entity bearish candle that broke below 6.2, accelerating the decline to the daily MA60 moving average (6.05). It has temporarily stabilized at the 6.05 level. For today, first focus on the gains and losses at 6.05; if it breaks below, it will continue to test the 5.95 level. The short-term support on the 4-hour chart is also at the MA256 moving average, which is the 6.05 level. This level also serves as support for the 12H MA120 moving average. A rebound is expected today, followed by a retest of the 6.05 support to check its validity. The resistance level can be referenced at the 6.15-6.2 top-bottom conversion position.

Ethereum's decline is slightly weaker compared to Bitcoin. After dropping to 2350, it has returned to oscillate around 2400. The price range of 2400-2420 is the support level that has been frequently tested by the 5-day moving average. Currently, the short-term trend should focus on the gains and losses at 2400, with the support level referenced at the previous low of 2300.

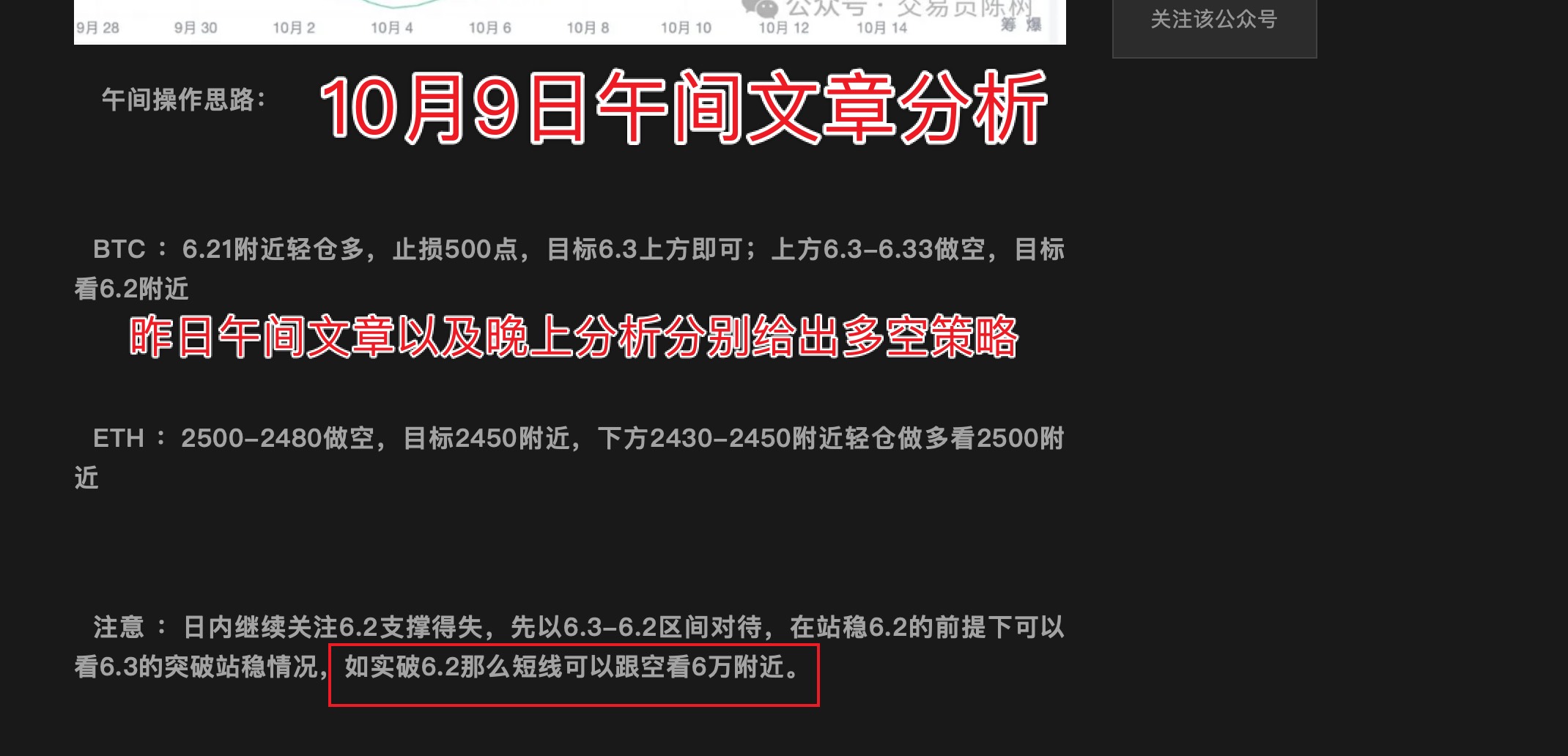

Afternoon Operational Thoughts:

BTC: Short in the 6.15-6.2 range, targeting 6.05-60. Long positions can be taken near 60 with a small stop loss for short-term trades.

ETH: Short in the 2430-60 range, targeting 2400-2380.

Note: Treat the short-term trend as weak oscillation. Until the price stands above the 6.15-6.2 range, treat rebounds as opportunities to go short. If a rebound at 6.15-6.2 meets resistance and falls back down, this level will shift from previous support to resistance, forming a top-bottom conversion pressure level. The short-term support level will depend on whether 6.05 can be completely broken; treat the range of 6.05-6.2 accordingly.

The daily analysis strategy has a very high win rate! Analysis is not easy, so I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave messages for discussion below; I will reply to each one!

For real-time market strategy exchanges and inquiries about market issues, you can follow my personal account homepage, the original (Coin World) ranked number one personal KOL main influencer, providing free guidance and answers to trading questions. Welcome everyone to communicate and exchange!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。