Written by: Mankun Lawyer, Mankun Law Firm

With the rapid development of financial technology, traditional financial markets are gradually moving towards a new era of digital transformation. Against this backdrop, Hong Kong, as a leading global international financial center, is actively exploring the tokenization of real-world assets (RWA), striving to promote further development of the financial market through innovative technologies. The Ensemble project recently announced by the Hong Kong Monetary Authority (HKMA) is a concrete embodiment of this innovative effort.

*Image source: Ensemble project document

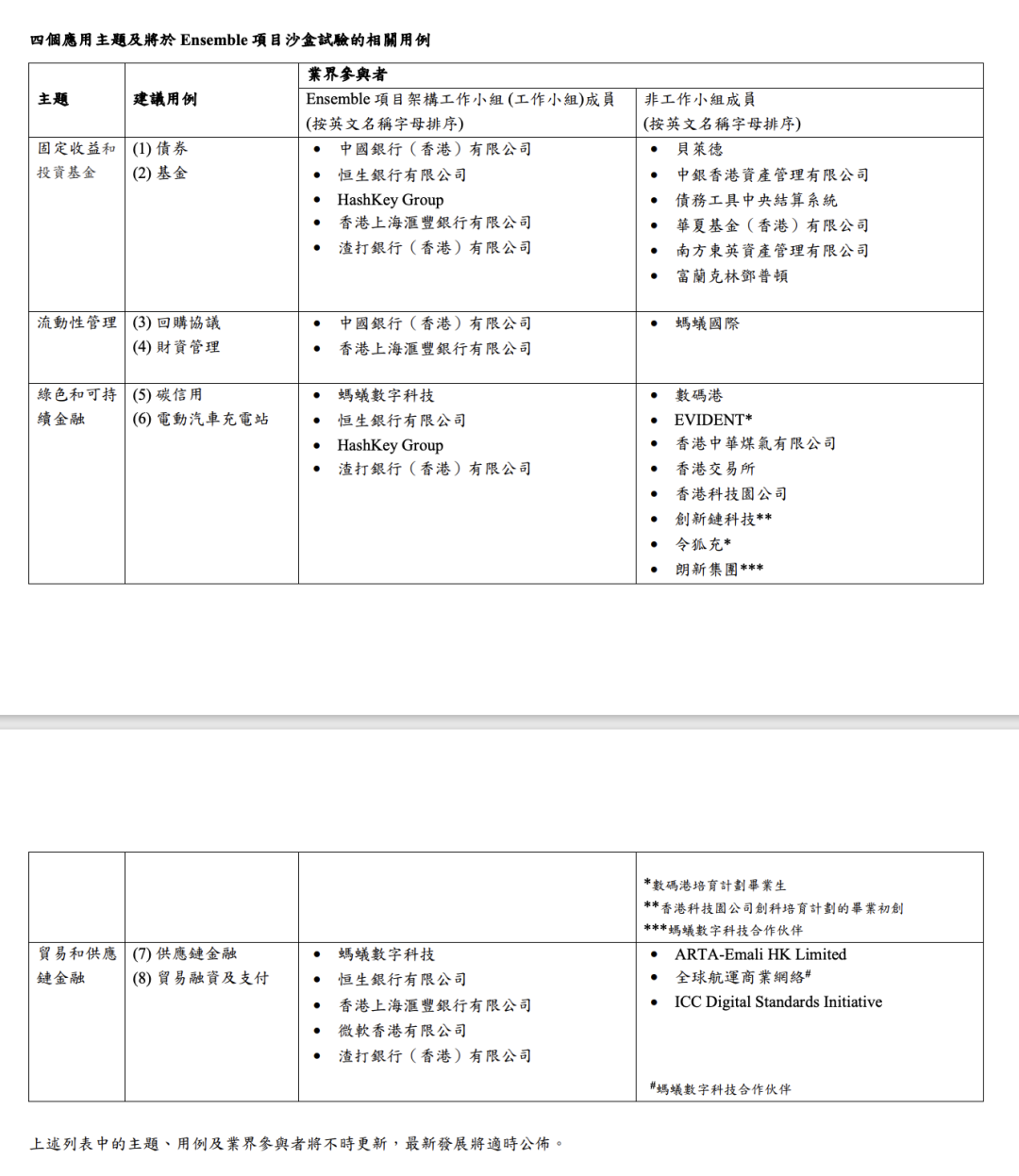

The first phase of the Ensemble project covers four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing. Through these experiments, Hong Kong hopes to consolidate its position as an international financial center while promoting the exploration and development of new economic fields. Notably, Ant Group's deep involvement in these experiments, especially in the cases of green and sustainable finance and trade and supply chain finance, showcases the tremendous potential of Ant Chain's blockchain technology and AIoT technology.

"Green and Sustainable Finance" Case Study

Through Ant Chain's blockchain and AIoT (Artificial Intelligence + Internet of Things) technology, the operational status of physical assets can be recorded in real-time and securely uploaded to the blockchain. This technology not only enhances the asset valuation for enterprises but also enables all parties involved to assess asset value and collaboratively manage risks, ultimately improving the financing efficiency and accessibility for enterprises. With the support of Ant Group and the HKMA's Ensemble project, the domestic listed new energy company Longxin Technology, through its digital platform New Electric Path, has successfully obtained the first cross-border financing for RWA (Real World Assets - tokenization) in Hong Kong, using some of the charging piles operated on the platform as RWA anchor assets. This financing will be used for energy storage and charging pile industries in the new energy sector.

"Trade and Supply Chain Finance" Case Study

Through the tokenized asset platform built by Ant Group, the Global Shipping Business Network (GSBN) issued electronic bills of lading (eBL). In this process, HSBC, Hang Seng Bank, and Bank of China (Hong Kong) facilitated the settlement of the transfer of electronic bills of lading using tokenized deposits. Ant Group's CEO Zhao Wenbiao attended the HKMA's launch event, stating that Ant Group is honored to be one of the first participants in the Ensemble project, providing technology and solutions. With the support of the HKMA, Ant Group can participate in various innovative projects and apply the digital technologies accumulated over the years. In the future, we will also collaborate with more partners to launch diversified RWA projects, providing technical support for high-quality projects in China and globally, especially in new energy physical projects, helping them gain more development opportunities. We also welcome willing partners to explore how new technologies can support the real economy together.

Among the two case studies mentioned above, the "Green and Sustainable Finance" theme, developed in collaboration between Ant Group and Longxin Technology, has already achieved remarkable results. Therefore, this article will focus on analyzing and discussing this case study, exploring how RWA based on new energy physical assets can achieve cross-border financing through technological innovation, and providing an in-depth interpretation of the legal and compliance issues involved in this process.

RWA Based on New Energy Physical Assets

According to reports from CCTV, Longxin Group and Ant Group have collaborated to complete the first domestic RWA (i.e., physical asset tokenization) based on new energy physical assets in Hong Kong, amounting to approximately 100 million RMB.

New Electric Path, operated by Longxin as a digital platform for new energy, currently covers nearly 400 cities nationwide, with over 1,800 cooperative operators, connecting more than 1.4 million charging devices and over 15 million registered users. In this first attempt at RWA, New Electric Path used some of the charging piles operated on the platform as RWA anchor assets, issuing "charging pile" digital assets on the blockchain based on credible data, with each digital asset representing a portion of the revenue rights corresponding to the charging pile.

Ant Group's Ant Chain provides technical support, ensuring the security, transparency, and immutability of data on the asset chain. This innovative approach significantly enhances asset management efficiency and risk control capabilities while creating a clear and trustworthy green investment environment for investors.

Longxin Group pointed out that in the future, it will continue to empower the development of new energy RWA with professional services, helping small and medium-sized operators enhance asset value and obtain convenient financing opportunities, thereby releasing business development momentum through the infusion of long-term capital.

Industry insiders believe that the credible on-chain financing method for new energy RWA utilizes various technologies such as the Internet of Things, blockchain, and artificial intelligence, providing a unique and innovative financing channel with broad development prospects for new energy asset investors and offering a new investment channel for global investors to invest in Chinese new energy assets, linking the supply and demand sides of assets and funds in a novel way. The innovative financing method of credible on-chain new energy RWA will help activate high-quality existing assets for China's numerous small and medium-sized energy enterprises, such as energy storage and charging pile operators, enhance the liquidity of heavy assets, form a virtuous cycle of investment and financing, accelerate the green transformation of China's energy structure, and truly realize the technological empowerment of physical assets. The injection of new capital will promote the advancement of new energy towards intelligence and greenness, supporting the construction and development of China's new energy industry.

Although the initial phase of the Ensemble project focuses on specific themes such as green finance and fixed income, Mankun Lawyer predicts that it will expand to a broader range of asset classes over time. As the HKMA further refines its understanding of the tokenization of real-world assets, Ensemble may extend to areas such as real estate, trade financing, and intellectual property tokenization. A reasonable timeline for this evolution may occur within the next 2-3 years, aligning with the broader adoption curve observed in financial technology innovation. This gradual expansion could impact Hong Kong's financial ecosystem, further integrating tokenized assets into institutional frameworks and increasing liquidity in niche markets. Such expansion will not only contribute to establishing a robust RWA ecosystem in Hong Kong but also enhance investor confidence. With increased transparency and expanded access to tokenized assets, this development has the potential to solidify Hong Kong's position as a regional digital financial center.

What are the Legal Compliance Points for Hong Kong RWA?

RWA projects often involve assets that span different legal jurisdictions, such as Longxin Group's new energy assets located in mainland China while financing activities occur in Hong Kong. This necessitates coordination of the laws of both regions. In mainland China, asset management and financing for new energy projects must comply with local energy regulatory policies and financial laws, while in Hong Kong, compliance with local securities laws and financial regulatory regulations is required. This cross-border legal coordination requires detailed legal due diligence to be conducted before project implementation to ensure smooth progress.

Compliance Issues for Token Issuance Under Hong Kong Law

Issuing tokens in Hong Kong involves compliance requirements across multiple legal levels, particularly under the existing financial regulatory framework, where issuers must handle matters cautiously to ensure compliance with the regulations of the Securities and Futures Commission (SFC) of Hong Kong.

First, issuers must clarify whether their tokens possess the nature of securities. According to the Securities and Futures Ordinance (SFO) of Hong Kong, the definition of securities includes various forms such as shares, bonds, unit trusts, and derivatives. The SFC's guidelines clearly state that if a token grants the holder rights to share in the company's profits or participate in management, then that token will be considered a security. Therefore, the actual function of the token and the rights of the holder are key considerations, and mere formal design cannot circumvent the applicability of securities laws.

Once a token is determined to be a security, the issuer must prepare and publish a prospectus or offering document that complies with the requirements of the Securities and Futures Ordinance. These documents should disclose in detail the nature of the token, risks, issuance methods, the issuer's financial status, and management information. Failure to comply with these disclosure requirements may result in the issuance activity being deemed illegal. However, in specific circumstances, such as when tokens are offered only to professional or qualified investors, the issuer may obtain an exemption from the requirement to publish a full prospectus. Nevertheless, even with an exemption, the issuer must still comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Additionally, if the token issuance involves intermediary activities, such as arrangements for token sales or providing consulting services, relevant entities or individuals may need to apply for appropriate licenses (e.g., Type 1 license: securities trading license) under the Securities and Futures Ordinance. Engaging in regulated activities without a license will be considered illegal and may result in fines or criminal liability. As Hong Kong strengthens its regulation of the cryptocurrency market, virtual asset service providers (VASP) must also ensure that their services comply with SFC requirements, including applying for licenses and adhering to relevant regulations.

Investor protection is also a crucial consideration in token issuance. When selling tokens to investors, issuers must conduct suitability tests to ensure that investors understand the investment risks and possess the corresponding risk tolerance. Strict scrutiny is especially necessary for retail investors to prevent investment losses due to information asymmetry or insufficient investor education. At the same time, the SFC adopts a zero-tolerance policy towards market manipulation and false statements, and issuers must ensure that all public statements and promotional materials are truthful and accurate, avoiding misleading statements or exaggerating the potential returns of the tokens.

Transparency and ongoing disclosure obligations are also key compliance requirements that token issuers must adhere to. Once a token is determined to be a security, the issuer must promptly disclose any significant events or information, such as changes in financial status or management changes, to ensure market transparency and investors' right to know. Furthermore, token issuers may need to submit regular reports to the SFC, detailing the operational status, market performance, and compliance status of the tokens, to assist regulatory authorities in monitoring market operations and preventing potential risks.

Foreign Exchange Management and Cross-Border Capital Flow

When it comes to cross-border financing, it is also necessary to consider the regulatory provisions regarding foreign exchange management and cross-border capital flow. RWA projects based on new energy physical assets typically involve large amounts of cross-border capital movement. According to China's current foreign exchange management regulations, cross-border capital flows must be conducted under the supervision of the State Administration of Foreign Exchange. Therefore, project parties need to pay special attention to the compliance of foreign exchange management to ensure that they do not violate relevant regulations during project financing, avoiding situations where capital flow is restricted.

Let’s use a simple case to explain the compliance issues related to cross-border capital flow:

Suppose Xiaoming owns a new energy company in mainland China that specializes in operating charging piles. To expand his business, Xiaoming decides to raise funds through the financial market in Hong Kong.

- Xiaoming establishes an SPV company in Hong Kong

In cross-border financing, establishing an SPV (Special Purpose Vehicle) is a common structured approach. According to China's Company Law and relevant laws in Hong Kong, enterprises can establish independent SPVs in Hong Kong for specific purposes, such as asset holding and financing.

Xiaoming sets up an SPV in Hong Kong with the aim of tokenizing his new energy charging pile assets through the SPV and financing in the Hong Kong market. By using the SPV, Xiaoming can flexibly manage assets and finance while avoiding the complexities of conducting such transactions directly in mainland China.

- Financing in Hong Kong through the SPV

According to the Securities and Futures Ordinance of Hong Kong, if securities or tokens are issued in Hong Kong, compliance with Hong Kong's securities regulatory requirements, including registration, disclosure, and investor protection requirements, must be adhered to. Additionally, token issuance may be regarded as securities and must comply with the Hong Kong securities regulatory framework.

Xiaoming's SPV company is financing through the issuance of tokens related to new energy charging piles. Xiaoming needs to ensure that the issuance of these tokens complies with Hong Kong's securities regulations, including the necessary registration and disclosure with the Securities and Futures Commission (SFC) of Hong Kong, to protect the rights of investors.

- Remitting funds back to the mainland

China's Foreign Exchange Management Regulations stipulate that enterprises must comply with the regulations of the State Administration of Foreign Exchange (SAFE) when conducting cross-border capital flows. Particularly for large amounts of funds being remitted, enterprises must submit relevant applications to the foreign exchange administration, explaining the purpose of the funds and obtaining approval.

After successfully financing in Hong Kong, Xiaoming's SPV company needs to remit the funds back to mainland China. According to the Foreign Exchange Management Regulations, Xiaoming must submit an application to the State Administration of Foreign Exchange, explaining the source of the funds (financing through the Hong Kong market) and the purpose (for the expansion of new energy projects). Once the foreign exchange administration approves the application, Xiaoming can legally remit the funds back to the mainland.

- Use and management of funds

According to the regulations of the State Administration of Foreign Exchange, funds remitted from abroad typically need to be deposited in special purpose accounts (such as foreign exchange capital accounts) and used according to the approved purposes. The usage of the funds may need to be reported regularly to the foreign exchange administration to ensure compliance.

Once the funds are remitted back to mainland China, Xiaoming's company needs to deposit these funds in a dedicated foreign exchange account and use them according to the purposes stated in the initial application. For example, purchasing new charging pile equipment or constructing new charging stations. If the use of the funds changes, it may be necessary to re-declare and obtain approval from the foreign exchange administration.

Cross-border data and privacy protection

Cross-border data transmission is a highly sensitive compliance area, especially concerning data flow between mainland China and Hong Kong. Enterprises must meet the regulatory requirements of both regions when conducting cross-border data transmission, ensuring the security and legality of the data transfer. This includes not only technical measures for data processing but also user awareness, privacy protection, and compliance processes. By strictly adhering to the legal framework, enterprises can reduce compliance risks associated with cross-border data transmission, protect user privacy, and ensure the legal operation of projects.

Regulatory requirements in Hong Kong:

In Hong Kong, the Personal Data (Privacy) Ordinance (PDPO) is the main legal basis for regulating the processing of personal data. This ordinance outlines the basic requirements for enterprises when collecting, processing, storing, and transmitting personal data. Particularly in cross-border data transmission, enterprises need to focus on the following aspects:

- Legality and transparency of data transmission. When transmitting personal data outside of Hong Kong, enterprises must ensure that such transmission is legal and transparently disclose to users the purpose, location, and identity of the recipient of the data. According to Section 33 of the Personal Data (Privacy) Ordinance, although this section has not yet been formally implemented, it generally stipulates that enterprises may not transmit personal data to regions with lower privacy protection standards than Hong Kong without the approval of the Office of the Privacy Commissioner for Personal Data (PCPD). Therefore, enterprises must conduct due diligence to ensure that the data privacy protection standards of the recipient's country or region are equivalent to or higher than those of Hong Kong.

- User informed consent. According to the PDPO, enterprises must obtain explicit consent from users before conducting cross-border data transmission. This means that enterprises need to clearly inform users how their data will be processed, the destination of the transmission, potential privacy risks, and other relevant information. If users refuse to provide consent, enterprises must offer reasonable alternatives or take measures to limit the scope and type of data transmission.

- Data minimization and purpose limitation. The principle of data minimization requires enterprises to collect only the minimum amount of data necessary to complete a specific task. For example, an e-commerce company should only collect the personal information needed for users to complete their purchases and should not collect unrelated data. The purpose limitation principle requires that data processing be limited to the originally set purposes to prevent data misuse.

- Responsibility of data processors. Hong Kong law requires enterprises to ensure that foreign data processors have adequate privacy protection capabilities when selecting them. Enterprises must sign legally binding agreements with foreign processors that clearly outline their responsibilities. These agreements should cover technical measures, data breach response plans, and other aspects to ensure that foreign data processors take appropriate protective measures.

- Data retention and deletion policies. The PDPO requires enterprises to establish clear data retention and deletion policies, ensuring that personal data is retained only for the necessary period and securely deleted after the retention period is reached. For data transmitted across borders, enterprises must also ensure that foreign processors comply with this policy. For example, when users request data deletion, both the enterprise and the processor must take measures to ensure that the data is completely removed to prevent secondary leakage.

Regulatory requirements in mainland China:

In mainland China, cross-border data transmission is subject to strict legal regulation. The Cybersecurity Law, Data Security Law, and Personal Information Protection Law constitute the main legal framework for enterprises conducting cross-border data transmission. These laws clearly outline the responsibilities and obligations of enterprises in protecting personal information and important data, particularly during data transmission and storage.

Zero-Knowledge Proof (ZKP) as a privacy protection and compliance technology can effectively help enterprises meet these legal requirements.

First, mainland China requires enterprises to conduct strict security assessments and obtain explicit user consent when conducting cross-border transmission of personal information and important data. These measures ensure that ZKP technology meets compliance requirements for cross-border data transmission while safeguarding data privacy. Enterprises must also sign legally binding agreements with foreign entities receiving the data to ensure adequate security protection measures are in place.

Second, enterprises need to establish a sound compliance mechanism, regularly record and audit cross-border data transmissions, and conduct timely risk assessments and compliance reviews to meet the regulatory requirements of both mainland China and Hong Kong. This process helps enterprises proactively identify potential risks in data processing and cross-border transmission and take corrective measures to ensure compliance in their operations.

Regular compliance reviews and risk assessments: To ensure the long-term compliance of RWA tokenization projects, enterprises need to conduct regular compliance reviews and risk assessments. As global data privacy protection laws continue to evolve, enterprises must continuously adjust their data management strategies to ensure that their data processing procedures comply with the latest legal and regulatory requirements. Particularly in Hong Kong and mainland China, ZKP technology can serve as an effective tool to help enterprises address the evolving challenges of privacy protection and regulation, ensuring their continued operation and growth in a strictly regulated environment.

Zero-Knowledge Proof (ZKP) allows one party to prove the truth of a statement without revealing any additional information, thus achieving both data verification and privacy protection. This technology complies with the regulatory requirements for data privacy in both Hong Kong and mainland China while providing enterprises with effective means to address compliance challenges.

In RWA tokenization, ZKP can be applied in the following areas:

- Asset ownership verification. ZKP can prove that a certain entity owns a specific tokenized asset without revealing the identity of that entity or other sensitive information.

- Transaction compliance verification. ZKP can prove that a transaction complies with relevant regulations and agreements without disclosing the specific details of the transaction.

- User identity verification. ZKP can prove that a user's identity meets specific conditions (e.g., investor qualifications) without revealing the user's personal information.

By adopting ZKP technology, RWA tokenization platforms can maximize user privacy protection while ensuring data security and transparency, thus promoting the healthy development of the RWA tokenization industry. Additionally, enterprises can use privacy-enhancing technologies, such as ZKP and hybrid chain technology, to address the dual challenges of data privacy and compliance requirements, ensuring data security and preventing the leakage or misuse of sensitive information during transmission.

Tax implications of RWA projects

Asset tokenization will bring a series of complex tax considerations for asset owners and investors, involving multiple aspects. First, the sale or transfer of tokenized assets may trigger capital gains tax or stamp duty, depending on the nature of the underlying assets. For example, the tokenization of real estate or financial assets may be subject to different tax rules. Furthermore, due to the decentralized and global nature of tokenization, transactions involving such assets often involve cross-border activities, further complicating tax issues. Cross-border tax issues may include withholding tax, double taxation, and how tax treaties between different jurisdictions apply to tokenized asset transactions.

Moreover, in certain cases, investors and companies may face challenges in classifying and reporting tokenized assets. For instance, whether to classify tokenized assets as securities, commodities, or currencies directly impacts their tax treatment. Given that tax compliance involves a wide range of regulations and rules, unclear regulatory guidance may expose companies and investors to significant fines or litigation risks, especially in complex structures involving multinational investors and different tax systems.

Therefore, a clear tax and regulatory framework for such assets is crucial to ensure the smooth development of tokenized assets. Tax authorities in various countries will need to provide detailed guidance to help market participants better understand the tax treatment of tokenized assets, reduce compliance risks, and pave the way for tokenization innovation in the global market.

Legal documents and dispute resolution

In RWA projects, clear legal documents and effective dispute resolution mechanisms are key to ensuring the smooth progress of the project and protecting the rights of stakeholders. Given that RWA projects involve complex cross-border transactions and multiple participants, the accuracy and completeness of legal documents are particularly important. Additionally, the design of the dispute resolution mechanism directly relates to how disputes arising during project implementation will be handled and resolved.

First, all parties involved must sign detailed legal contracts that clearly outline the rights, obligations, and responsibilities of each party. In RWA projects, contracts typically cover multiple levels of content, including the tokenization process of assets, the rights of token holders, the distribution of profits, and clauses related to data management and privacy protection. The rights of token holders must be clearly listed in the contract, especially regarding profit distribution, which needs to specify the calculation methods, distribution cycles, and various factors that may affect profits. Furthermore, the contract should include clear breach of contract liability clauses. If a party fails to fulfill its contractual obligations, the contract should detail the legal responsibilities and compensation measures that the breaching party must undertake. This not only helps reduce disputes arising from misunderstandings or performance issues during project operation but also provides clear legal grounds for all parties to resolve issues quickly in the event of a dispute.

For parts involving cross-border transactions, legal documents need to pay special attention to the legal differences between jurisdictions. Since RWA projects may involve the laws of multiple countries or regions, the contract should clearly specify the applicable law and the jurisdiction for dispute resolution to reduce future complexities arising from legal conflicts. Typically, choosing a neutral jurisdiction that all parties can accept can lower legal risks and improve the efficiency of dispute resolution. Arbitration clauses are a common method of dispute resolution in cross-border transactions. By including arbitration clauses in contracts, parties can seek fair adjudication through arbitration institutions in the event of a dispute, avoiding lengthy and complex court litigation processes. Arbitration institutions usually have experience in handling complex disputes involving multiple legal jurisdictions, making them better suited to address such issues. Therefore, it is advisable to clearly specify arbitration as the preferred method of dispute resolution in the contract and designate an internationally recognized arbitration institution, such as the International Chamber of Commerce (ICC) or the Hong Kong International Arbitration Centre (HKIAC). Additionally, the contract should stipulate the applicable law in the event of a dispute. Since RWA projects typically involve multiple national laws, selecting a country with a stable legal environment that all parties can accept as the applicable law can provide clearer legal grounds for dispute resolution. Hong Kong law, with its mature commercial legal system and independent judiciary, is often chosen as one of the applicable laws in cross-border transactions.

Continuous updates and reviews of documents. Legal documents are not static; as the project progresses and external conditions change (such as updates to laws and regulations or changes in market conditions), contracts and related legal documents may need to be updated and revised. To this end, project participants should establish a regular document review mechanism to ensure that the contract content remains consistent with the actual situation of the project and legal requirements. When potential risks or compliance issues are identified, participants should promptly revise the contracts to avoid disputes arising from outdated or inaccurate legal documents. Through well-designed legal documents and dispute resolution mechanisms, RWA projects can operate effectively in the complex environment of cross-border transactions, reducing risks arising from ambiguous contracts or legal conflicts. All parties should fully discuss and determine an appropriate legal framework and dispute resolution mechanism at the project's outset to ensure the legal security and sustainability of the project.

Summary by Lawyer Mankun

RWA projects in Hong Kong, such as Ensemble, demonstrate the deep integration of fintech and green finance, providing valuable experience for the digital transformation of global financial markets. As the RWA field rapidly develops, enterprises and investors need to face increasingly complex compliance challenges. Therefore, understanding and complying with local and international regulations, as well as developing comprehensive legal documents and dispute resolution mechanisms, will be key to the success of the project.

In the future, the Ensemble project is expected to collaborate or share knowledge with international projects such as Singapore's Ubin, contributing to the establishment of global tokenization and blockchain regulatory standards, further enhancing Hong Kong's international status. By learning from the experiences of other financial centers, Hong Kong can accelerate the development of its RWA ecosystem.

As the Ensemble project transitions from sandbox to practical application, the regulatory environment will also evolve. A customized licensing system is expected to be introduced in the future, particularly strengthening regulations in KYC, AML, data governance, and cybersecurity. Additionally, the regulatory sandbox may expand to emerging technology areas such as DeFi, AI, and digital identity solutions, ensuring that Hong Kong's regulatory framework is both flexible and supportive of innovation.

The continued development of Ensemble will drive the transformation of Hong Kong's financial market. Traditional banks will be forced to accelerate their pace of innovation, fintech companies will expand their market through projects, and institutional investors will be able to broaden their investment options with tokenized assets. As global demand for sustainable development increases, the application scenarios of RWA, especially in financing for the real economy such as new energy, will further expand. In summary, RWA projects are expected to become an important force driving the transformation of the global financial system in the coming years, with Hong Kong playing a crucial role in this transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。