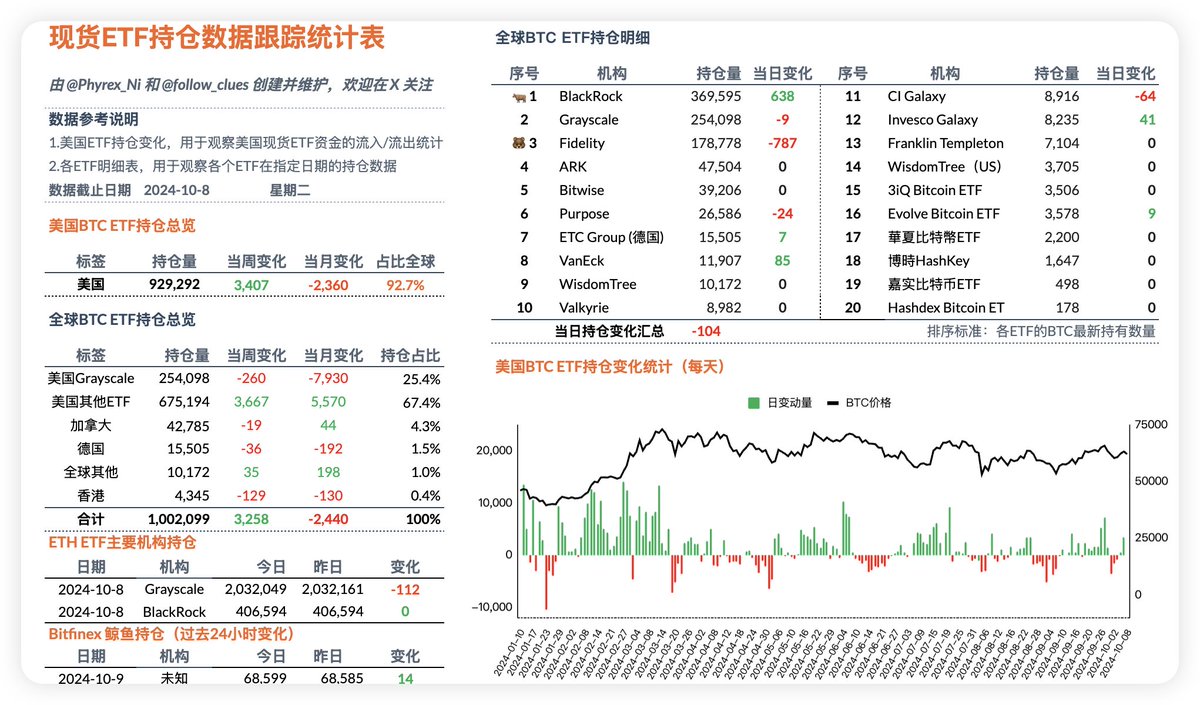

When looking at the ETH data earlier, it was also mentioned that the BTC data is not good either. From the data, first of all, the recent two days of net inflow have been interrupted. Although there was only a net outflow of 33 BTC, it still reflects a decline in overall buying sentiment. As before, GBTC is no longer the main force behind BTC selling; it has now shifted to Fidelity. There has been significant selling in ETH, and the same goes for BTC, with 787 BTC sold in the last 24 hours.

GBTC has only sold 9 BTC, but compared to ETH, BlackRock's investors are still continuing to buy BTC. VanEck and Invesco also have a small amount of net inflow, while others are at zero.

As mentioned during the ETH discussion, although the non-farm data brought a boost to prices, it dissipated easily. Currently, the overall sentiment among investors is still quite poor. From a liquidity perspective, just one interest rate cut is not enough; it doesn't even count as increasing liquidity, and the improvement in users' risk appetite is minimal. In the short term, it may still rely on the effects of the upcoming elections to stimulate active liquidity in the market.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。