Author: Lydia Wu, Researcher at Mint Ventures

Data as of October 8, 2024

TL; DR

In a narrow sense, prediction markets typically do not include traditional gambling and sports betting, but emphasize information discovery and public decision-making reference functions.

Prediction markets cannot remain "correct"; cases of failure occur when people treat the probabilities given by prediction markets as established facts.

Cryptocurrencies bring more freedom in trading amounts and a smoother payment experience to prediction markets.

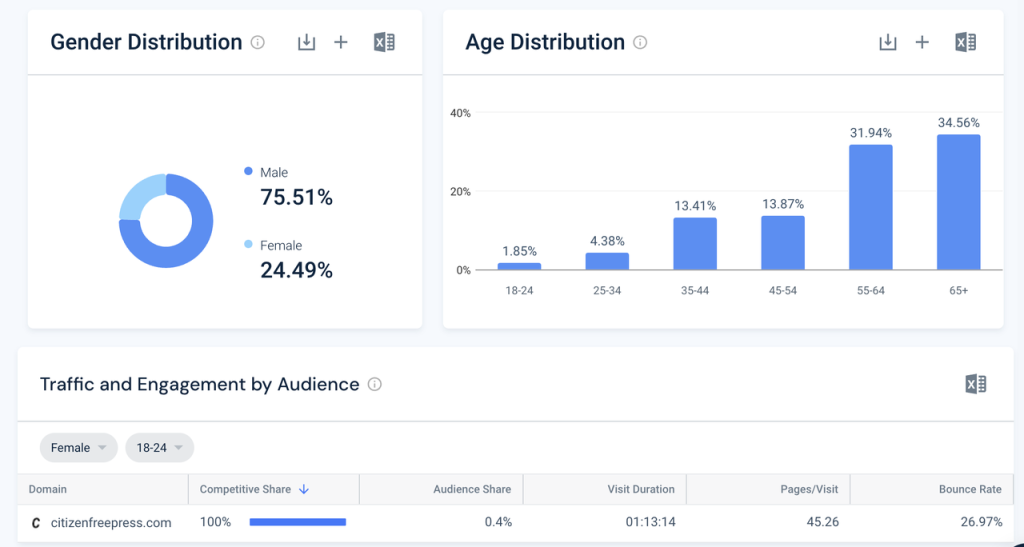

The user profile of Polymarket differs significantly from crypto-native users such as NFT traders and meme players; they are generally older, do not pursue extreme profit-loss ratios, and have a strong motivation for information acquisition and analysis.

The competitive factors of prediction market products lie in how to arrange higher quality events and gather rational bettors (creators). Polymarket's competitive advantage is the attention (liquidity) base brought by its outreach.

Polymarket is very cautious about trading volume incentives and more complex trading functions. New projects entering prediction markets from a derivatives trading perspective may face functional mismatches leading to poor adaptation.

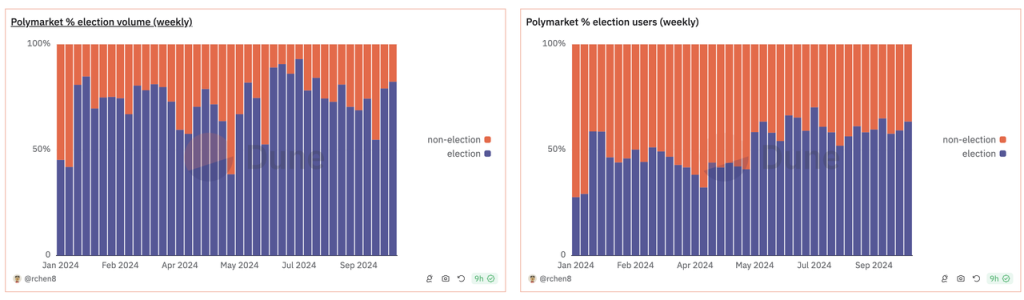

After the election on November 5, Polymarket is expected to face a significant withdrawal of liquidity, and the public's evaluation of its election performance, as well as Polymarket's next strategic planning, may have a profound impact on the future of prediction markets.

The Rise of "That Prediction Market"

Polymarket is currently the largest "2024 U.S. Election Prediction Market," with users having bet nearly $1.5 billion on the question of who will be elected between Harris and Trump, far surpassing its Web2 competitors PredictIt and Smarkets, which have trading volumes of $37 million and $9 million, respectively, on the same question.

Polymarket 2024 U.S. Election Interface

Conceptual Clarification of Prediction Markets

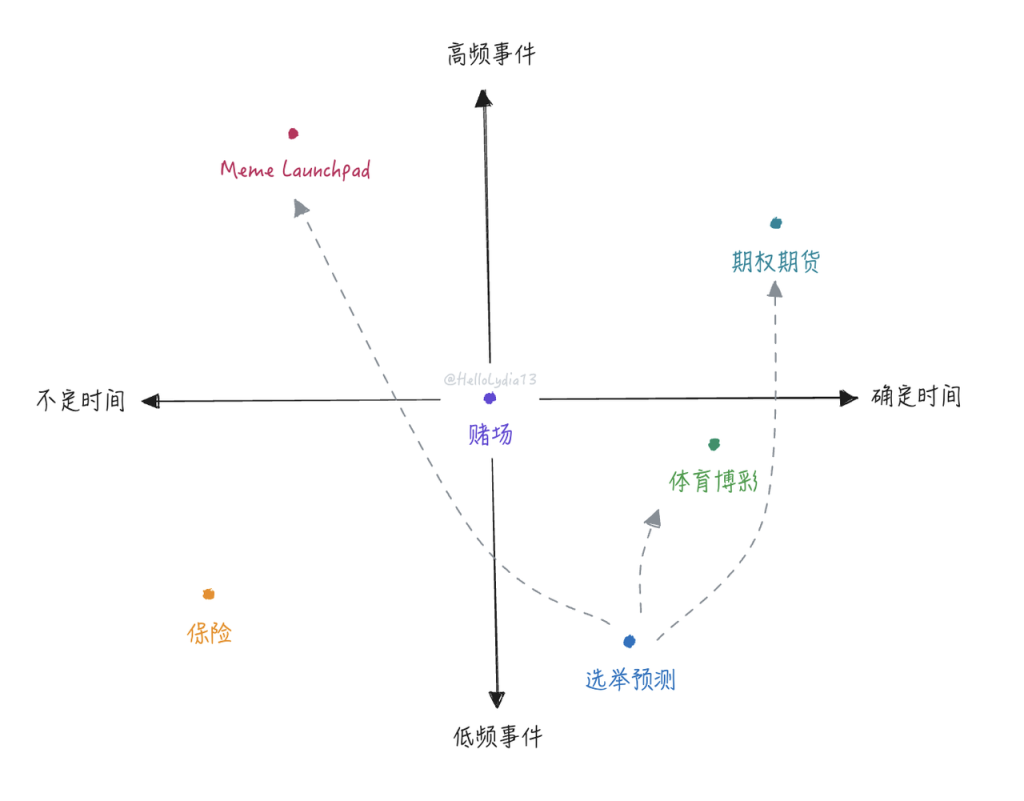

In a broad sense, prediction markets have evolved from gambling and betting markets, referring to people investing funds based on their expectations of an event's outcome in hopes of receiving returns.

In a narrow sense, prediction markets typically do not include traditional gambling and sports betting, but refer to a broader range of political, economic, and cultural events, emphasizing the information discovery function, which may provide references for policy-making or public decision-making. This nature of prediction markets can be traced back at least to the early 16th century papal elections, and the Iowa Electronic Markets launched during the 1988 U.S. presidential election is one of the earliest modern electronic prediction markets.

Crypto Prediction Markets = Truth Machines?

Vitalik Buterin may be the most influential advocate for prediction markets in the Web3 world. As early as 2014, he discussed prediction markets as a practice of Futarchy (a future form of government proposed by Robin Hanson that governs through betting); in a 2020 article exploring "credible neutrality," he again used prediction markets as a case study, subsequently proposing a design for prediction markets that binds bets to highly improbable events; in 2021, he published a systematic discussion on the value support of prediction markets and the advantages of decentralization; since this cycle, he has frequently expressed optimism about prediction markets and participated in Polymarket's Series B funding in May of this year.

Different Understandings of Prediction Markets

To understand the underlying concepts of prediction markets and the aspirations that crypto enthusiasts have for them, we can start with three small questions:

What do prediction results represent?

How accurate are prediction markets?

What do cryptocurrencies bring to prediction markets?

Due to space limitations, I will provide brief answers to these three questions.

- What do prediction market results represent? Is it the truth?

The notion of a truth (Truth) machine is controversial. Prediction markets measure people's understanding of symbolized events (Event) and use this as a basis for inferring future objective facts (Fact); this process does not produce truth but rather reflects participants' probability estimates of event outcomes. Even if the prediction results align with the facts, it is merely a post-fact verification.

- How accurate are prediction markets?

The legitimacy of prediction markets can generally be traced back to Hayek, Bayesian theorem, Futarchy, efficient market hypothesis, etc. Here, I attempt to blend them into one statement: although knowledge is decentralized in human society, if there are enough market participants who continuously update their views based on newly emerging evidence, an effective market can form that reflects all publicly available information in asset prices, thereby aiding decision-making.

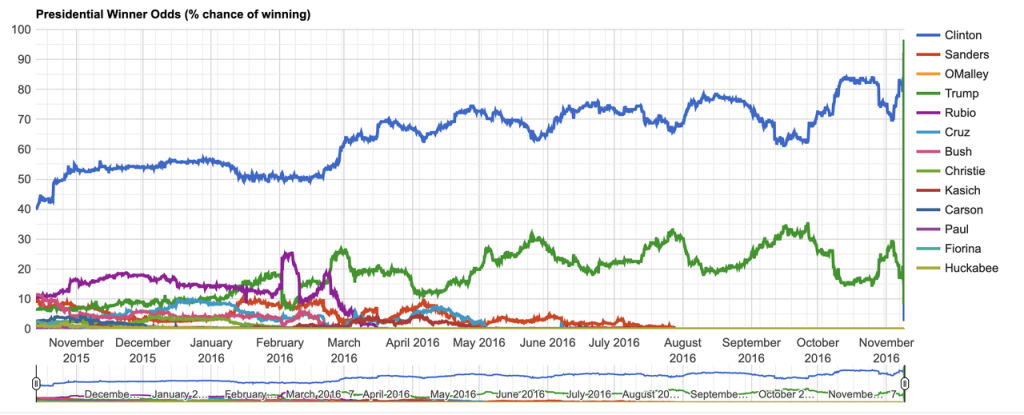

Supporters of prediction markets often cite cases such as the 2008 U.S. election and Polymarket's performance during the COVID-19 pandemic, but the underwhelming performance of prediction markets in the 2016 Brexit and U.S. elections weakens this argument. The "failure" of prediction markets, according to people's post-fact reflections, lies in traders treating the probabilities given by prediction markets as established facts, neglecting timely updates from external information, leading to overly stable prices. This also suggests the reflexivity of prediction markets—people's trust is damaging the foundation of credibility.

Betting odds for the 2016 election, where Hillary consistently maintained an absolute lead

- What role has cryptocurrency played in the long history of prediction markets?

From the perspective of the conceptual practice of prediction markets, decentralized prediction markets typically do not have limits on betting amounts (in contrast, PredictIt has a betting limit of $850), allowing people to assign monetary weight to their views more freely based on their confidence levels, potentially capturing market trends more accurately.

From the operational perspective of prediction markets, using cryptocurrencies not only allows for more immediate payments but also significantly reduces the proportion of customers requesting refunds (i.e., chargeback fraud) after the fact; well-known online gambling platform Stake only accepts cryptocurrency payments.

The Rise of Polymarket

A widespread question is: since the concept and practice of prediction markets have a long history, and their combination with cryptocurrencies is not new, why has Polymarket emerged as a standout, competing in the existing market with an on-chain presence and capturing the largest market share, to the point of almost becoming synonymous with "prediction market"?

First, it is worth mentioning that 2024 is a rare global election year. According to incomplete statistics, 76 countries/regions will hold elections in 2024, covering 4.17 billion people. Among them, the U.S. election undoubtedly receives the most attention, with Biden's potential withdrawal and Trump's assassination attempt adding twists and turns to the process.

Additionally, global events such as the opening of the Paris Summer Olympics, the Federal Reserve's interest rate cut decisions, geopolitical crises, and advancements in artificial intelligence have received widespread reporting and attention. In the Web3 world, Bitcoin halving, Bitcoin and Ethereum ETFs, etc., have also created enough topics—this is undoubtedly a "golden age" for prediction markets.

Moreover, Polymarket's own success is often attributed to a smoother UX/UI compared to previous generations of products, a more seamless deposit and withdrawal experience, and a more transparent mechanism and non-extractive design compared to Web2 competitors. With the favorable winds of the times, it has quickly gained prominence.

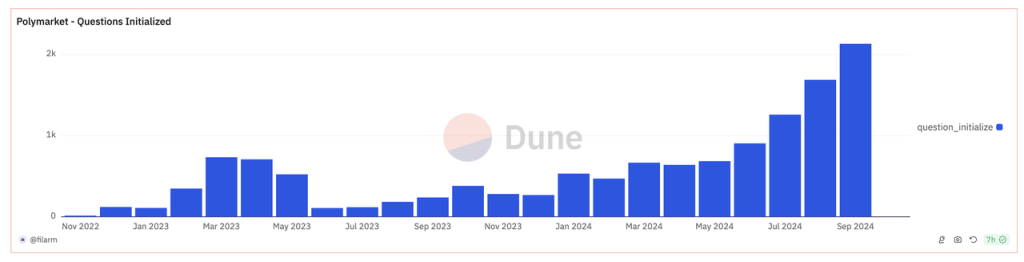

Significant increase in the number of events created on Polymarket in 2024

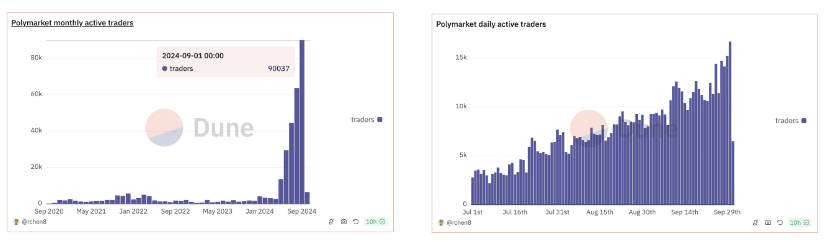

The influx of new users has rapidly increased Polymarket's user base

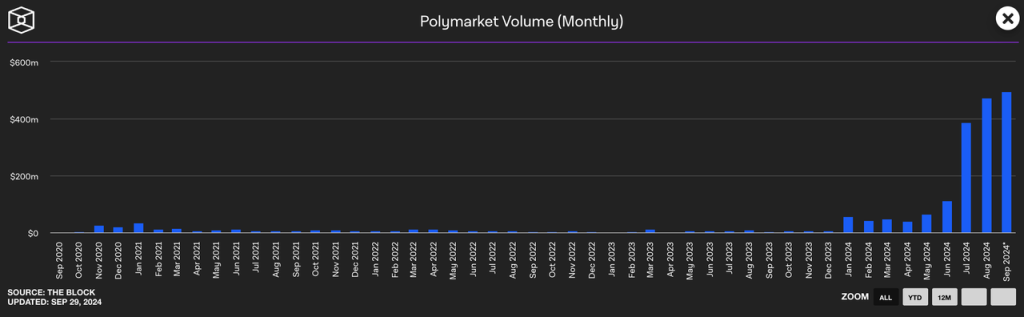

Polymarket's trading volume has significantly increased in 2024

The changes in the situation, the accumulation within the industry, and the product iterations of Polymarket itself are certainly important, but this article aims to focus on a currently under-discussed perspective—Polymarket's market strategy and our potential misunderstandings about Polymarket.

Misunderstanding: "Event Trading Platform"

To be clear, compared to the utopian "prediction market" or the narrow "event trading platform," a more precise and deflated description of the current Polymarket might be "crypto media/creator ecosystem/information platform."

The Hidden Audience of News Readers

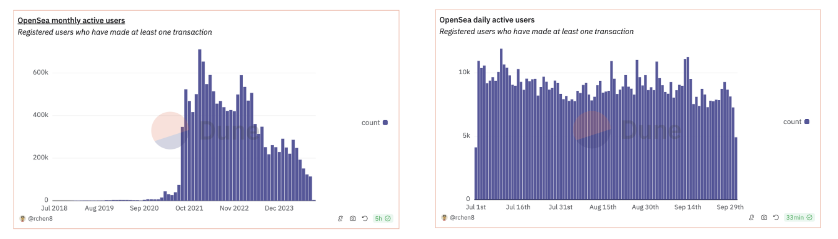

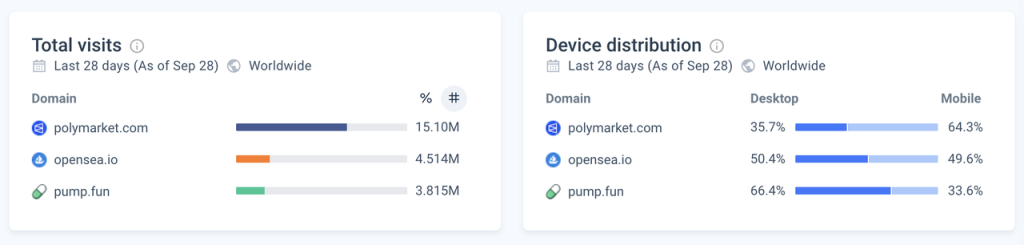

Polymarket set a new high of 90,000 monthly active users in September, with daily active users generally above 10,000. However, the website traffic for Polymarket reached 15 million in September, resulting in a traffic to monthly active users ratio exceeding 166.

In comparison, Opensea had 110,000 monthly active users in September, with daily active users around 9,000, which is close to Polymarket. Opensea's website traffic in September was 4.5 million, with a traffic to monthly active users ratio of about 41.

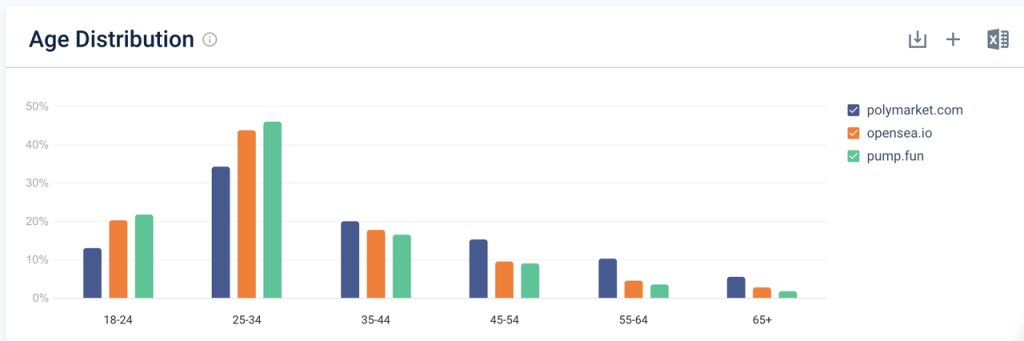

If we include pump.fun and further compare these three star products within their respective domains, we can see that Polymarket's traffic and the proportion of mobile users are significantly higher than the other two—reflecting that Polymarket likely has a "news-reading audience" that differs from NFT traders and meme players.

Polymarket's monthly and daily active user data

Opensea's monthly and daily active user data

Website data comparison of Polymarket, Opensea, and pump.fun, source: similarweb

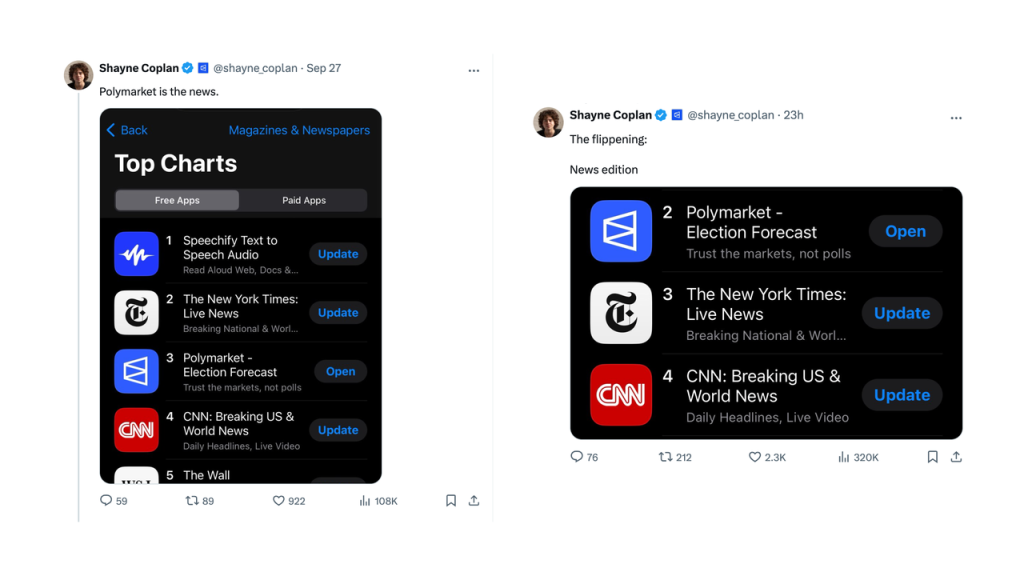

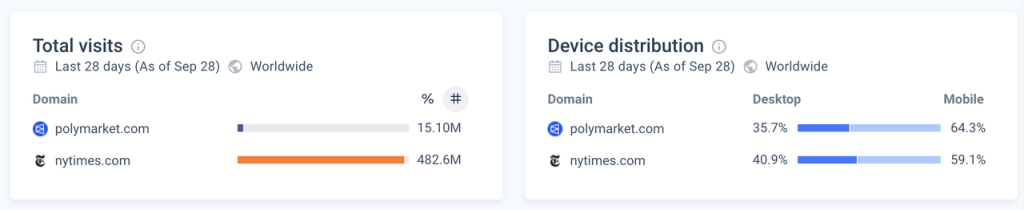

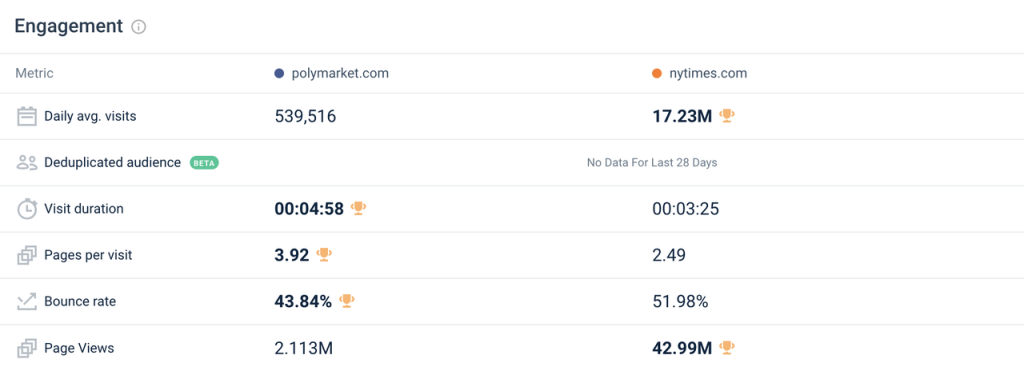

In fact, Polymarket's founder Coplan has consistently used terms such as "alternative news source" and "the future of media" to describe his product on X, and has frequently referenced Polymarket's ranking in the App Store news section. Data shows that while Polymarket's website traffic is only 3% of that of The New York Times, it performs well in metrics such as page dwell time and bounce rate.

Additionally, Polymarket plays a role as a "reverse oracle" through its integration with media and information platforms like Substack and Bloomberg, representing a more diverse range of opinions and sentiments from the Web3 world.

Coplan believes Polymarket is the news

Website data comparison of Polymarket and The New York Times, source: similarweb

Unique Traders

Polymarket does not require a large editorial team; the core content production is completed by traders who bet real money, and this group is Polymarket's intellectual asset. The concept of prediction markets and their past failures emphasize the importance of market participants; their rational analysis and continuous reassessment of new information are the foundation for the "accuracy" of prediction markets.

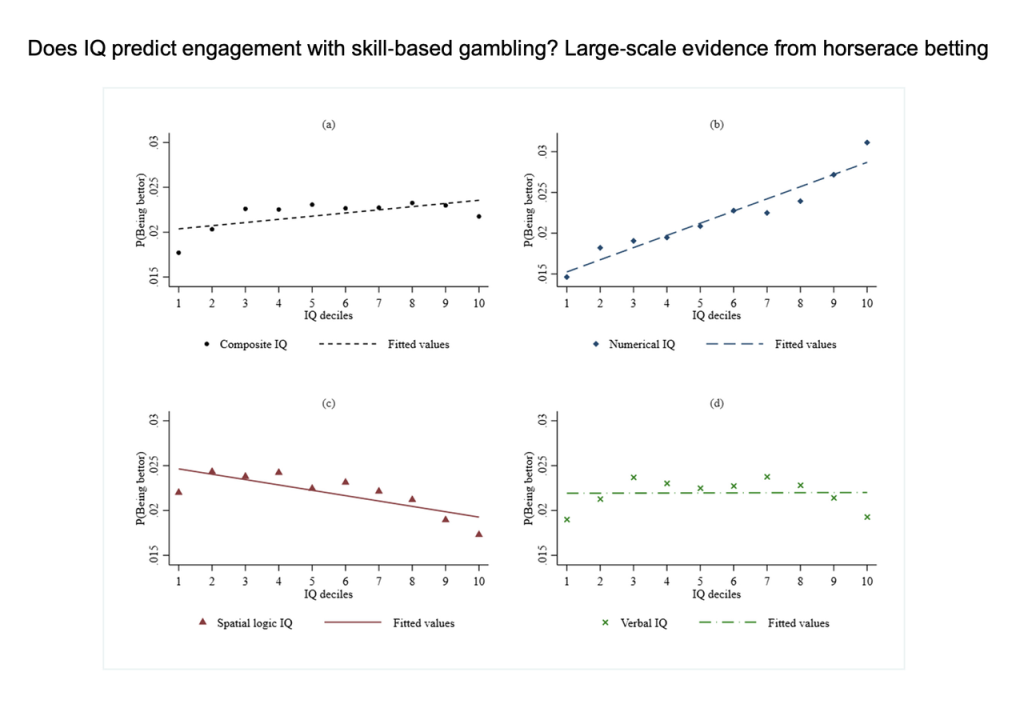

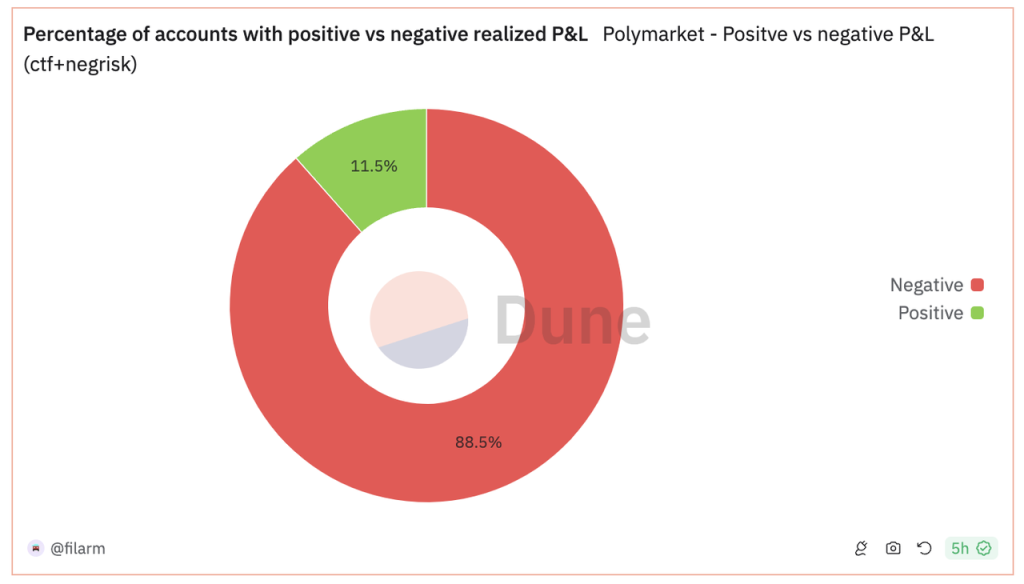

A study published in 2022, focusing on the online horse betting behavior of over 40,000 Finnish residents, shows that individuals with higher numerical IQ (i.e., performing better in arithmetic reasoning, mathematical problem-solving, and quantitative analysis) exhibit a significantly higher willingness to participate in skill-based gambling (as opposed to luck-based gambling). The study also indicates that among the total betting population, about 9% of players have earnings greater than losses. In Polymarket, this proportion is 11.5%.

(a): Overall, there is a positive correlation between composite IQ and willingness to participate in horse betting

(b): There is a significant positive correlation between numerical IQ and willingness to participate in horse betting

(c): There is a significant negative correlation between spatial logical IQ and willingness to participate in horse betting

(d): There is no correlation between language IQ and willingness to participate in horse betting

Polymarket player P&L situation

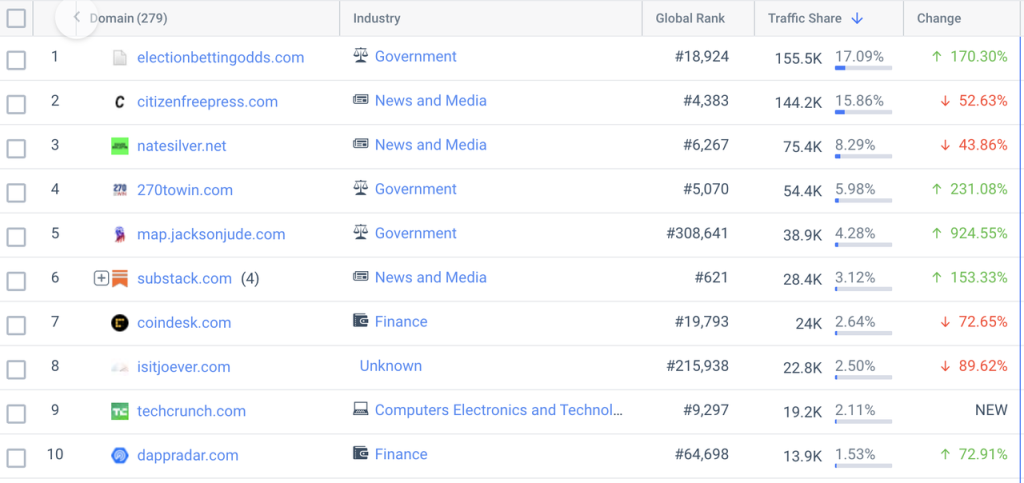

Polymarket's advertising link sources also reveal some strategies regarding "what kind of people to attract and convert."

The top-ranked electionbettingodds.com is a well-known election prediction market aggregator that consolidates data from five prediction markets, including Polymarket.

citizenfreepress.com is a conservative-leaning U.S. political news aggregation site, with half of its users being American men over 55 years old.

natesilver.net is the Substack of statistician, writer, and poker player Nate Silver. Nate's election prediction system successfully predicted the results in 49 out of 50 states in the 2008 U.S. presidential election, and he joined Polymarket as an advisor in June of this year.

Among the top 10, only Coindesk and DappRadar primarily target crypto-native users.

Compared to Opensea and pump.fun, Polymarket's user age distribution is more balanced, with a significantly higher proportion of users aged 35 and above.

Top 10 websites for Polymarket's advertising link sources

User gender and age distribution of citizenfreepress.com

User age composition of Polymarket, Opensea, and pump.fun, source: similarweb

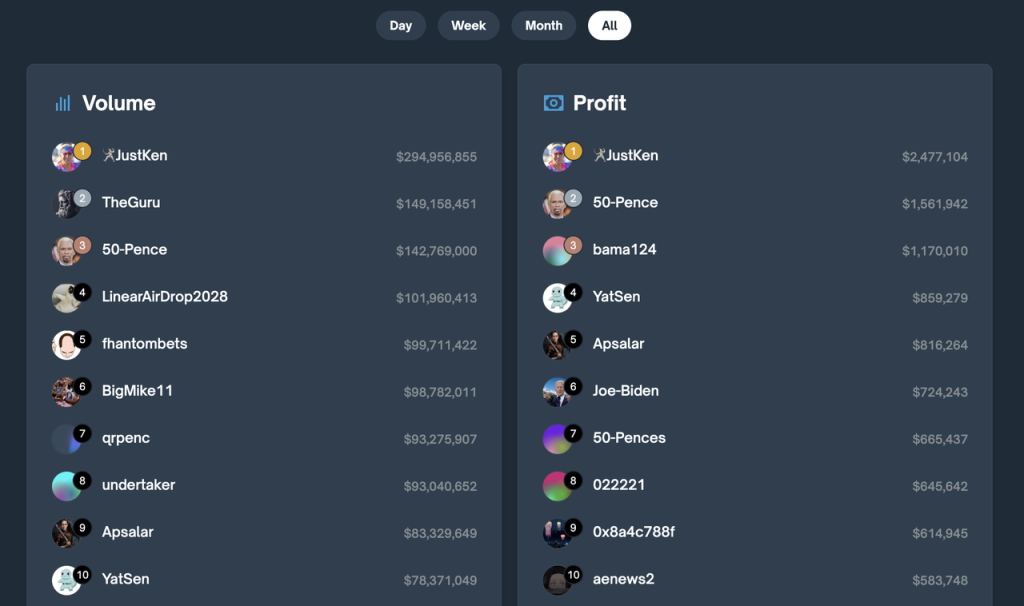

We have hardly heard stories about "legendary traders" on Polymarket. This is determined by the nature of prediction markets—controlling odds within a reasonable range to avoid significant deviations from the actual likelihood of events.

The leaderboard data from Polymarket supports this. Currently, there are only 3 users with total profits exceeding $1 million, while there are 197 addresses on pump.fun with total profits exceeding $1 million. Considering that Polymarket's monthly active users in September were only 14% of pump.fun's, and it was established in 2020, the probability of getting rich through Polymarket seems even smaller.

Correspondingly, Polymarket's trading functions are also quite restrained. Aside from deposits and withdrawals, it only offers the most basic market order and limit order functions. Although it open-sourced a lending protocol called Polylend in June this year, which allows users to collateralize assets to borrow USDC, Polymarket has made it clear that this feature will not be used in production and is merely for community building. Additionally, Polymarket has not implemented large-scale liquidity incentives. Polymarket seems to believe that overly complex trading functions would blur users' betting intentions, and that market making and liquidity incentives would distort market effectiveness.

While it is difficult to estimate the actual conversion from "reading news" to "trading," we can roughly outline the ideal profile of the crowd gathered on Polymarket—this is a relatively rational and mature group, likely with limited prior knowledge of cryptocurrencies, generally more economically stable, not pursuing extreme profit-loss ratios, and enjoying the pleasure of proving themselves right through analysis and judgment. This image is far removed from the typical crypto gambler and is also difficult for current Web3 products to reach.

Stalling: The Critical November

In aviation terminology, "stalling" refers to the angle of an aircraft's wings relative to the airflow becoming too great, insufficient to generate enough lift, resulting in a rapid loss of altitude. When faced with a stalling aircraft, the pilot needs to push the nose down and increase thrust to restore lift.

The rapid rise of Polymarket and its election "big product" strategy have raised concerns in the market about its subsequent momentum—after the U.S. election on November 5, where will Polymarket go? After all, Polymarket is never short of competitors eyeing it, ambitious new entrants, and persistent skeptics.

Trading volume related to elections on Polymarket reached 70%, with user numbers reaching 60%

Polymarket's Moves

For Polymarket, the results of this election are crucial, as they pertain to the credibility of the prediction market itself and whether Polymarket can isolate the political inclinations of its team and investors, truly "representing public opinion."

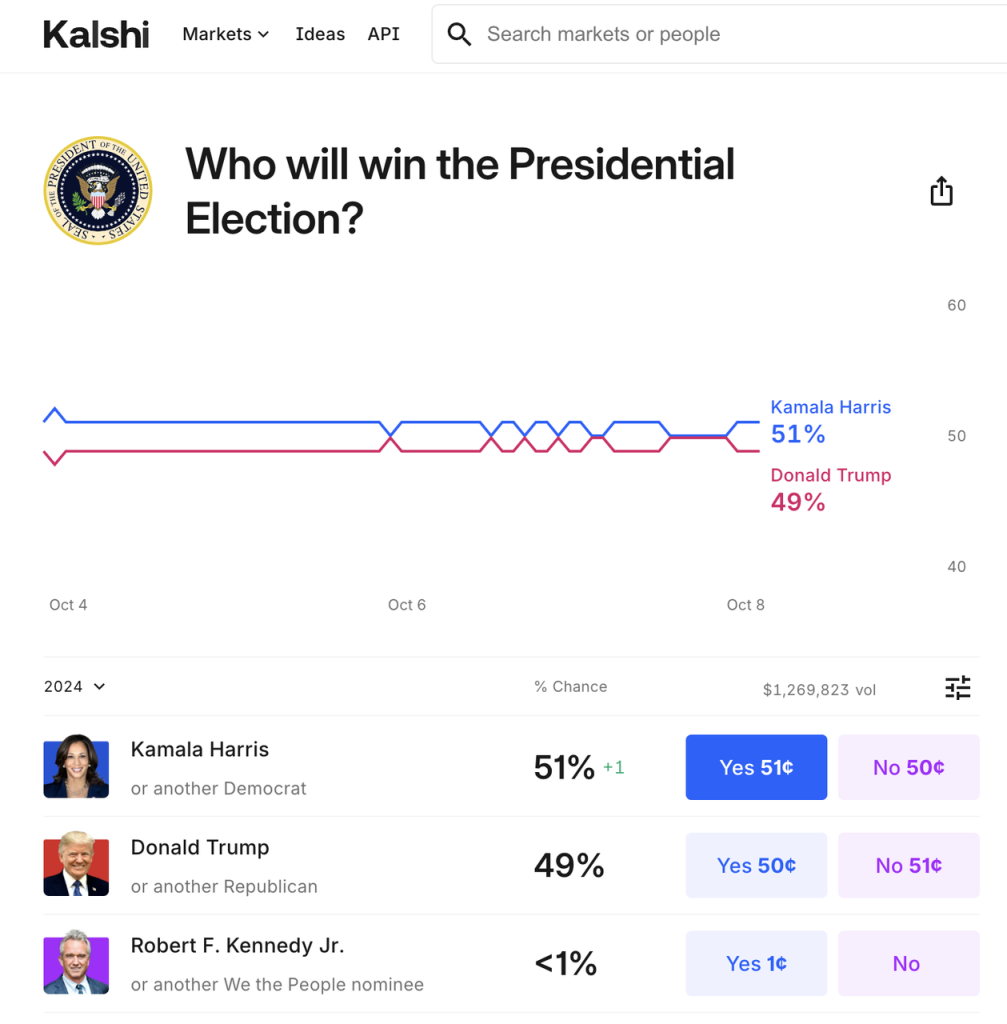

Unlike the latest reversal of Trump on Polymarket, another prediction market, Kalshi, consistently shows Harris in the lead.

After the election, facing declining trading volume and user attrition, the strategies currently discussed for Polymarket's response (which are also the directions coveted by new entrants) can be roughly divided into three categories:

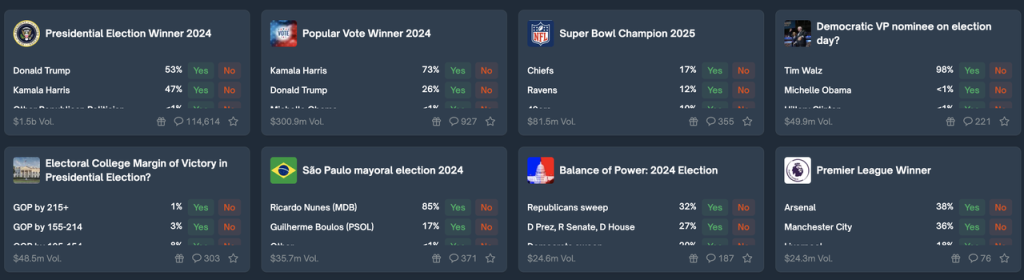

- Develop sports betting

Sports betting is currently the second-largest event category on Polymarket, following elections, but the trading volume still has a significant gap, likely mainly benefiting from the traffic overflow of election topics. Whether this traffic can be retained long-term after the election is questionable.

Super Bowl and Premier League sports events rank among the top 8 in trading volume on Polymarket

Not to mention that sports betting is an extremely fragmented and saturated market, and sports betting is not the core area of prediction markets. Factors driving fan betting are often emotionally driven, enjoying immediate excitement and enhancing the viewing experience, rather than pursuing long-term profits, which contradicts the filtering logic of prediction markets.

- Increase derivative trading

This is also a saturated market, and for Polymarket, it is undoubtedly a case of avoiding weaknesses.

- Become the "pump.fun of events"

This is a popular idea, describing an open market where anyone can issue events and make predictions, seemingly addressing the characteristic of Polymarket's users being unable to create markets independently and needing the team to concentrate on "initiating events." However, if we analyze the characteristics of the most popular election events, we find that elections themselves:

Have a very broad impact → ample liquidity

Have a longer cycle, interspersed with multiple process events → information can circulate as fully as possible

Have a definite time and binary results → clear settlement

Similarly, the considerations for "initiating events" published by Polymarket include:

Is there sufficient trading demand to generate accurate probabilities?

Does the probability result of the event have social or news value?

Can the event achieve a clear result within a defined time frame?

For most people, coming up with a clearly defined binary question, then expressing it in accurate, unambiguous, and not overly technical language, setting a clear settlement point and standard, and ensuring the result has some social significance… this is much more challenging than uploading an image to create a meme.

Even Polymarket has faced controversy over unclear standards regarding issues like "ETF approval" and "Trump's son participating." If a completely open market is created, the risks of malicious actions (e.g., an event about whether Trump will say a certain word in his next speech) and controversial adjudications (e.g., how to define whether Trump participated) will place a significant burden on the platform.

Thus, we find that these three seemingly related transformation directions for Polymarket are by no means easy. The core issue is that Polymarket finds it difficult to strengthen, and should not strengthen, the attributes of trading and speculation. Even with reports of intent to issue tokens, Polymarket should be cautious in its use of incentives, such as incentivizing more quality questions and correct results, rather than trading volume.

The "transformation ideas" for election predictions differ from existing business in terms of event characteristics and time cycles.

Regulation in the Room

Before the regulatory situation becomes clearer, Polymarket's token may not arrive anytime soon.

Markets related to gambling have always faced very strict regulations. Polymarket was ordered by the CFTC in 2022 to pay a $1.4 million fine and cease operations in the U.S. In May of this year, the CFTC (Commodity Futures Trading Commission) proposed a rule aimed at prohibiting all derivative trading related to U.S. elections. In the $70 million financing announced in May, Polymarket stated that its mission is to provide the public with more accurate, real-time event predictions as a public good.

Good news came in the final weeks before the election. Following a local court in Columbia's decision to support election prediction markets last month, a federal appeals court also rejected the CFTC's request to block election betting. Previously, the CFTC had warned that "the use of such contracts could adversely affect the fairness of elections or perceptions of election fairness."

The market's attention has once again turned to the results that Polymarket is about to deliver.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。