Good market conditions are not about sudden waterfalls that leave you in despair or arrogance, but rather about a steady stream of unilateral gains that provide you with compound interest. Running is for better progress, while letting go is a higher state of being. A master is not someone who plays a bad hand well, but someone who knows when to fold at critical moments, not risking everything for an uncertain future. Those who are good at preaching can stand undefeated; do not always sacrifice everything you have experienced just to match your ambitions.

The current market is essentially a question of value and price. After more than a month of rising, there is an issue of excessive profit-taking. Therefore, there is no need to over-interpret anything in the current market. Right now, Bitcoin resembles the benefits of diamonds; everyone knows its actual value. However, the commercial implications of this are unknown. The previous mindset should remain unchanged; be prepared for what needs to be prepared. At this stage, short-term trading is better than medium-term. Only under the premise of clear signals should one engage in medium-term speculation.

Chu Yuechen: 10.9 Bitcoin and ETH Market Analysis and Trading Reference

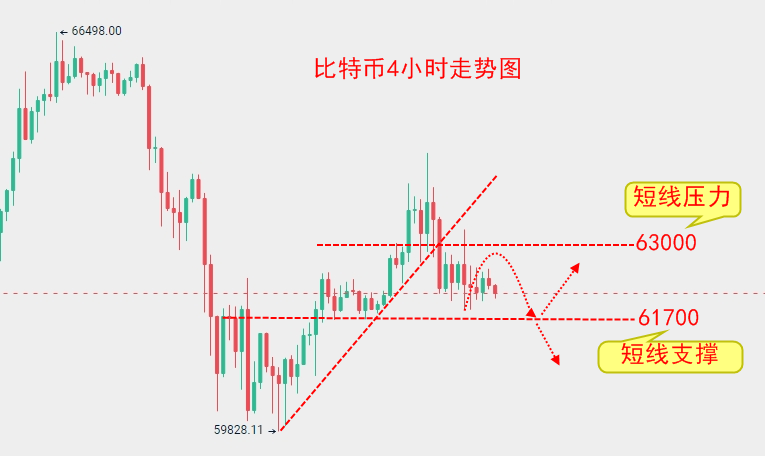

First, let’s review yesterday’s market. Last night, we provided a short position near 63000 for Bitcoin, and the price peaked around 63200 before starting to decline, with a low of about 61800. Our short position was successfully exited at around 62000, yielding a profit of about 1000 points, which is quite good. Congratulations to those who were able to follow along.

Today’s market has seen relatively small fluctuations, generally oscillating within the 62000—62500 range, with no suitable positions to trade. The technical analysis on the 4-hour chart remains as we analyzed yesterday; the range of 63000—61700 for Bitcoin has not been broken, and the range of 2460—2390 for ETH has also held. Short-term, it remains in slight fluctuations.

Overall, the short-term still favors bears, so for short positions, we will continue to choose to set up shorts in the 62800—63000 range, with a stop loss at 63500 and a take profit at 61800. At the same time, we need to pay attention to whether the short-term support at 61700 will break; if it does, we will follow up with short positions, looking down towards the 60000 level.

The same reasoning applies to ETH; the entry point has slightly moved up. We will consider setting up short positions in the 2500—2520 range, with a stop loss at 2550 and a take profit near 2400. We will provide specific entry orders in real-time during trading.

For medium to long-term positions, it’s best not to make any moves for now, as the fluctuations are small and the market direction is not clear. In other words, while many may feel that Bitcoin and ETH might have room to rise in the future, if your entry point is not good, you may not withstand a pullback. Therefore, with small fluctuations, we will focus on short-term trades. Once there is a clear directional signal, we will set up medium to long-term positions. Good hunters need to be patient and wait.

Specific Operation Suggestions (based on real-time market orders)

For Bitcoin near 62800—63000, when the market slightly rebounds to this position, we can enter a short position, with a stop loss at 63500 and a take profit at 61800.

For the 2500—2520 range, set up a short position with a stop loss at 2550 and a take profit at 2400. If it breaks below 2390, we will follow up with short positions, looking towards the 2300 level.

Before the market moves, any analysis can be correct and has its reasons, but no position will be absolutely accurate; there are always risks involved. Therefore, the premise of making money is to manage risk well. The market changes in real-time, and strategy points are for reference only, not as entry criteria. Investment carries risks, and profits and losses are your own responsibility.

Many individual investors find it difficult to enter the trading door, often simply due to the lack of a guide. The problems you ponder may be easily solved with a single pointer from an experienced person. Daily real-time market analysis, along with experiential group guidance, evening practical trading guidance, welcome to receive real-time guidance. Evening live broadcasts explaining real-time market conditions at irregular times.

For more real-time market analysis, please follow the public account: Chu Yuechen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。