Author: CXO.eggtoshi.Adam

First, the conclusion: Only true cult memes will ultimately win the market

Several shocking events happened this week.

- The mysterious operation of SCROLL, first listing on the mining pool and then taking a snapshot, Binance took 5.5% of the total tokens, while the community could only get 7% (including independent developers).

- $popcat skyrocketed to a market value of $1.4 billion (mainly traded on Bybit and the SOL chain).

- $SPX surged more than ten times in two weeks to a market value of $550 million (mainly traded on the ETH chain).

The era of over-reliance on top CEXs may be coming to an end, as more mainstream investors accept on-chain trading, and top CEXs are no longer the absolute entry point for trading.

Let me explain slowly.

Huge Changes in Technology and User Habits

The SOL chain is a paradise for whales; on-chain trading is so smooth that it truly makes users forget about the technology. This is what good products and infrastructure look like. The current mass adoption in this cycle is mainly on SOL, and Iggy's $mother has broken the circle, no longer just a meme coin culture.

As a player in the BTC ecosystem, I envy the SOL chain. Trading tokens on the BTC chain is too difficult; large funds cannot enter the chain, and we can only hope that the future infrastructure of fractal CAT20 can keep up.

Last Year’s Anti-VC Movement Has Evolved into Anti-Top CEX

Last year, during the inscription era, the first shot against VCs was fired, and the fair launch mechanism of BRC20 successfully catered to market sentiment.

But the crux of the problem is not with VCs; the real issue lies with the top exchanges. They are the ones truly manipulating the market, standing at the top of the food chain to harvest profits. Binance's operation with $neiro, first listing the large contract, allows for shorting the large token while also bottom-fishing the small token. It's disgusting, but there's nothing you can do about it.

SCROLL is a leading ETH L2, and to get listed on Binance, it cost nearly $100 million worth of tokens in listing fees, which is indeed jaw-dropping. Who would want to take over in the secondary market?

A few days ago, I also tweeted that after Binance launched the Stamps protocol, the discussion about the BTC ecosystem extended, concluding that they are either ignorant or have a narrow vision, and it’s time to demystify them.

The Awakening of Capital

In the last round, VCs only needed to find good first-tier projects, invest in the first two rounds, and unlock to reap dozens or hundreds of times their investment.

Now, looking at the recent situation of VC unlocks, altcoins that have been waiting for one or two years to unlock are crashing, with massive selling pressure. With tens of billions in FDV, they also have to face the squeeze from top exchanges. The hardest-hit areas are ETH L2 and Gamefi. In the last cycle, apart from a few top VCs making profits, other VCs were also cut.

VCs Need to Make Money; They Need a Breakthrough!

The most typical example this year is the $brett on the Base chain, a pure follow-up to the $pepe memecoin, which peaked at a market value of $2 billion. VCs have changed their approach to participate in memecoins; they first launched it in a WL model, holding a large amount of chips in their hands, over 70% (previously, someone dug up addresses as solid evidence). However, it doesn't matter; they started community building from a market value of $1-2 million, with community leaders hosting real-time spaces with thousands of participants, continuously building the community, and raising funds step by step to achieve such a high market value.

Is $brett really a cult meme? Aside from some dark points during the launch, the subsequent actions of large funds did not disappoint the community retail investors. If you buy in after a market value of several million, tens of millions, or even $500 million, retail investors can still profit. This is a win-win for both VCs and retail investors, as VCs also leave free chips for large exchanges (retail investors have the chance to exit first). Upbit, Coinbase, and Binance (contracts) have all listed it.

Large funds from VCs operating on-chain with a memecoin, whether they start by acquiring chips like $brett or later accumulate large funds at a market value of millions or even hundreds of millions for memecoins with established cultures (like $degen and $pepe), the returns for VCs are very considerable. We should expect to see more projects like this in the future.

This type of operation is highly time-sensitive, with high returns possible in the short term or within three months. So why cling to first-tier projects with sky-high valuations and slow unlocks or invest in second-tier projects?

Web3 and the Crypto Circle Are Two Different Investment Lines

Projects in the Web3 line care about company operations, technology products, community, and the token itself. Even though many people say that the computing, infrastructure, and applications of Web3 have been disproven, and many teams in the market are just gathering without doing anything, we must believe that there will be teams with technical ideals that truly drive industry change through technology and products. This is why I still believe that Ordinals, Farcaster, BASE chain, TON ecosystem, and CAT20 protocol OPCAT will bring about change, and the external RWA Depin also retains these expectations.

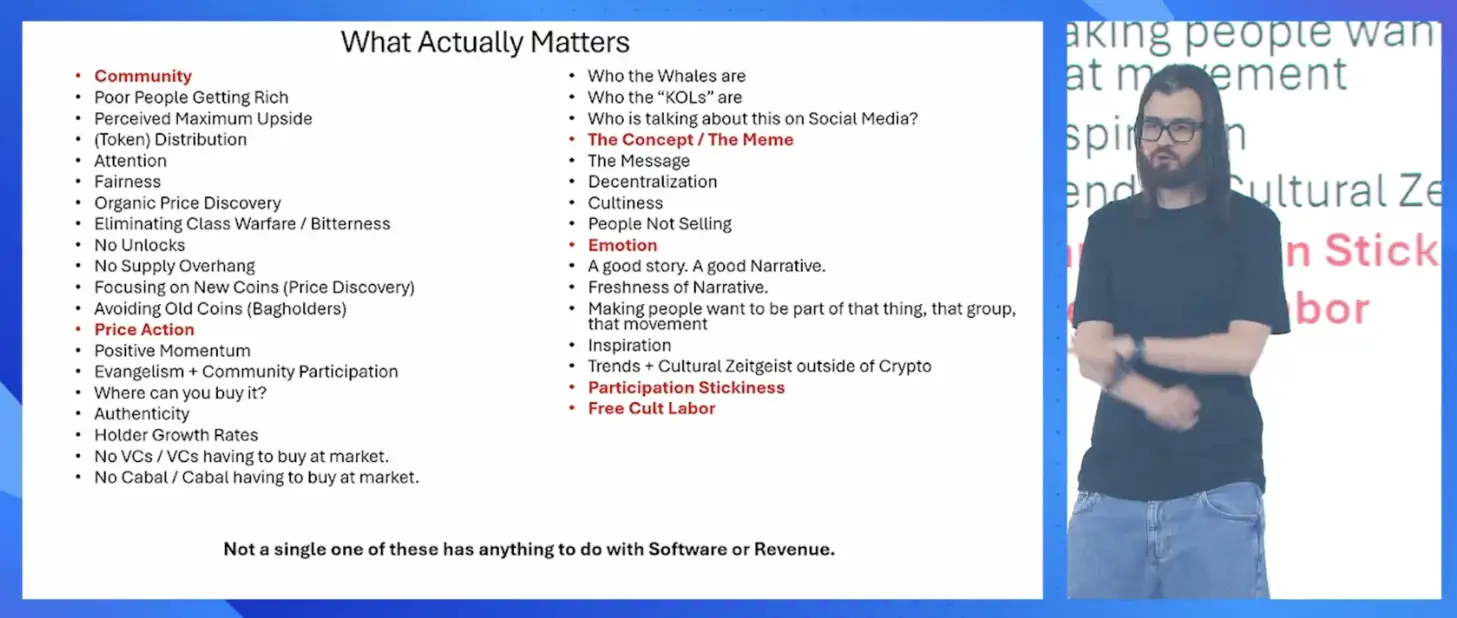

The crypto circle is another line, which is not about technology but about emotions and trends; this is a purely financial market. In this field, altcoins cannot compete with cult memecoins.

This Round of Memecoins Is Like Last Round's NFTs

The commonality is the weakening of technical product utility, focusing only on making money, socializing, being interesting, having a sense of participation, and emotional value. They offer a better on-chain trading experience, stronger liquidity, and a larger capacity for funds than NFTs.

Those who play $pepe, $wif, $mog, and $pups can experience the same joy as those who played with monkeys in 2021.

What Makes a Good Memecoin? Cult Memecoins Can Win

A good meme requires a special narrative + the meme's own tone + a strong spontaneous community + strong backing; all are indispensable.

Currently, there are fewer than 20 cult memecoins that can be identified in the entire market, leaving plenty of room for selection. Compared to the single market value and number of projects of altcoins in the last cycle, there is still significant growth potential.

The mainstream cult memes are well-known, with no low market value, and investing will carry risks, with expectations to outperform ETH, SOL, BNB, SUI, SEI, APT, ARB, and OP in a bull market.

The Logic of Memecoins Listed on Binance Is Different

For community coins (fair & free launch), Binance is quite restrained, currently dividing them into two categories:

A. Memes that have accumulated over time, where the listing logic is optimistic about the future market continuing to surge. For example, $wif was listed on March 5, and by March 15, the market reached its ATH; $ordi was listed on November 7 last year, and the market surged for over a month; the current $neiro is also a hint that Binance is optimistic about the market in Q4.

B. The overflow of emotions at the peak of the market, with $Bome as a case in point. It was launched at the market ATH, and it took just three days to get listed on Binance, precisely focusing on capturing market attention, with a stronger speculative nature in the short term. In other words, this type of meme has not undergone the time test like the first category, and the fundamentals mainly rely on Binance and the overall market.

Why Have $Bome, $slerf, and $mfer, These Phenomenal Memes This Year, Recently Performed Poorly? But They Previously Short-Term Surged to Market Values of Several Hundred Million to Over a Billion.

The importance of timing; the speculative nature is stronger in the short term.

$Bome was released in mid-March this year, coinciding with BTC's ATH of $73K. $slerf was released a few days after $Bome during a market thirst period, and $mfer was released at the peak FOMO moment of the Base chain (with $degen reaching an ATH of $2 billion that day).

These three coins are fundamentally different from $pepe, $wif, $degen, $mog, and $pups, which have time and depth. $Bome, $Slerf, and $Mfer are more like products of market sentiment.

Memecoins from NFT Communities

Even though $mfer previously had a strong community culture from mfer NFTs, it is evident that the overall NFT community this round is too weak. The monkey Degods' token launch is very centralized, and the market does not buy it because it is not a memecoin. Azuki is also about to launch a token, and I don't think the market will buy it.

Does $mfer still have a chance? Compared to other NFT projects launching tokens, the $mfer IP and community have already aligned closely with true cult memes. If only one established NFT project’s memecoin can take off, it is most likely to be $mfer.

As the strongest community among new NFTs, $mfer not only has the new narrative of Ordinals Runes but also benefits from the strengths of both SOL and BTC ecosystems. I firmly believe that in this cycle, meme coins can achieve great success.

Different Chains Have Different Characteristics, Different Memecoins Have Different Tastes

- BTC, aside from the deep and retro parody of puppets, does anyone have a distinct personal style?

- SOL, the hormones of the post-00s.

- ETH, pop culture acceptable to both 80s and 00s.

- BASE, industrial aesthetics, playful within rigor.

- ZORA, creativity, abstraction, art.

How to Choose Memecoins? Which to Buy?

There are thousands of new projects emerging every day, with the same narrative existing under different tickers, the same ticker on different chains, and dramas with different cases of capitalization. It’s too difficult to hit the right one early on.

Perhaps using three strategies simultaneously is the way to win:

- Directly choose already mature high-market-value memes in the secondary market, such as $pepe, $wif, $mog, $pups, etc.

- Take over mid-sized memes with market values in the millions or tens of millions; this requires very strong personal ability.

- Focus on new listings in the first tier, which has a high failure rate and requires skill, luck, and time; it’s quite exhausting.

Whether $neiro can truly withstand the test of time is hard to say; we will only know in a month or two if there is a community and meme culture with real core values. There is a question mark here.

In the past few days, I have been practicing the three strategies. I bought $mog, which slightly increased, and $neiro, which rose by several points. The new listings have performed poorly so far, and I need more practice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。