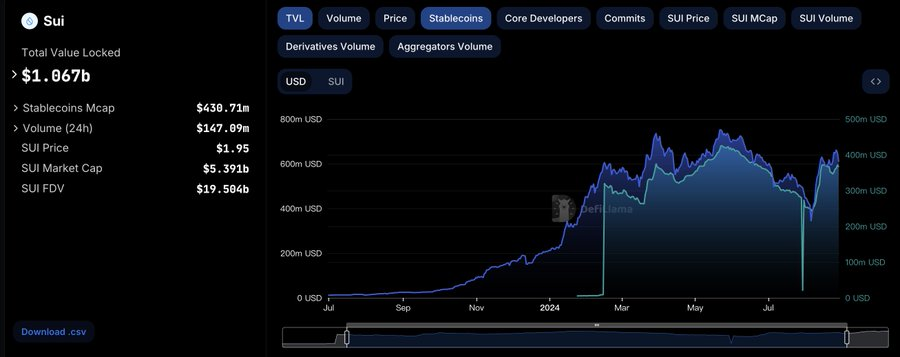

Just this week, with the unlocking of SUI tokens and the launch of the cross-chain bridge mainnet, along with the unprecedented popularity of memes, SUI has led a new wave of growth, advancing its market capitalization to the 20th position.

Overview

Sui is a permissionless, PoS-based Layer 1 blockchain developed by Mysten Labs, designed to provide instant settlement and high throughput, supporting a wide range of next-generation latency-sensitive decentralized applications. The project was established after the dissolution of the original Facebook project Libra/Diem team and has garnered attention and funding from investors.

Market Performance

According to market data for 2024, SUI has performed exceptionally well, as detailed below:

- Market Cap Growth: SUI has shown strong performance since Q4 2023, with a quarter-on-quarter market cap increase of 120%, followed by a further 176% growth in Q1 2024.

- Price Trend: SUI has exhibited some volatility in 2024 but has shown an overall upward trend. Notably, on March 27, 2024, SUI reached an all-time high of $2.18. As of October 3, 2024, SUI's price further increased, hovering around $1.92 at the time of writing.

- Current Price: $1.92 (as of October 3, 2024, noon)

All-Time High Price: $2.18 (March 27, 2024)

Increase: Over 100% increase in the past three months

Sui Ecosystem Projects

Since the launch of Sui's mainnet, its ecosystem has rapidly expanded, attracting numerous developers and enterprises.

This article provides a brief overview, highlighting several projects that have launched on the Sui blockchain:

DeFi Projects:

DeFiLlama shows that there are currently 5 protocols with over $100 million in TVL, which are:

Decentralized Exchanges (DEX)

- Cetus: In the SUI ecosystem, Cetus holds a significant market position with its $180 million TVL. As an efficient decentralized trading platform, Cetus offers a user-friendly trading experience, supports a wide range of token swap options, and allows users to participate in liquidity pools to earn potential trading fee income.

- DeepBook: The first order book DEX in the Sui ecosystem, providing a decentralized liquidity layer for Sui. DeepBook is co-built by MovEX and the Sui Foundation and has been integrated into Sui's official framework.

Lending Protocols

- Navi: As the largest lending platform in the SUI ecosystem by TVL, Navi manages up to $410 million in assets. This protocol allows users to collateralize their assets to borrow other assets, providing flexible funding options and supporting various investment and financial strategies.

- Scallop: Another key lending protocol, Scallop also holds a significant position in the SUI ecosystem, managing $170 million in assets. It offers users additional funding options, supporting the financial diversity and robust growth of the SUI ecosystem.

- Suilend: The Suilend lending protocol is the first project outside of the Solana ecosystem for Solend. By launching on Sui, Solend leverages the inherent security features integrated into the Move language, providing built-in protection for its smart contracts.

Wallet Solutions

- OKX Wallet: As a comprehensive digital asset management tool, OKX Wallet supports multi-chain functionality, including seamless integration with the SUI chain.

- Sui Wallet: Sui Wallet is one of the most widely used wallets in the SUI ecosystem, known for its comprehensive features and user-friendly interface.

- Suiet: Suiet (pronounced "sweet") is a self-custodial wallet built on the Sui blockchain, with all content being open source.

Gaming Projects:

- SuiPlay0x1: A lightweight handheld gaming device that has already conducted a pre-sale, selling over 2,000 units, featuring native Web3 capabilities and planning for a global launch in 2025.

- DARKTIMES: A battle royale game on Sui, developed by Animoca's VIP game studio Blowfish Studios, supported by Animoca Brands. DARKTIMES utilizes the unique properties of Web3 technology to host digital assets through Sui, including the $TIMES token, Genesis NFTs, and various decorative items for in-game characters.

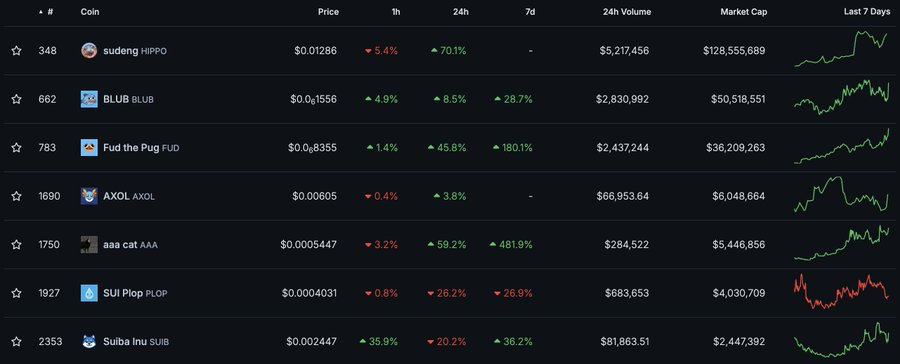

Meme Tokens

The recent meme wave on Sui has indeed referenced many successful memes from Solana, combined with Sui's own water-themed characteristics, creating a sense of familiarity.

It is worth mentioning that the current meme tokens on Sui are quite volatile and carry significant risks, so users should exercise caution to minimize the risk of being scammed or losing funds.

Below are some data provided by Coingecko for reference.

Coingecko

$Hippo: The Hippo in the Water

Market Cap: $128,555,689

Twitter: https://x.com/blubsui

Telegram: https://t.me/HIPPO_SUI

Project Introduction: Recently gained widespread attention as its market cap surpassed $100 million, the official website indicates that this community will donate a portion of its profits to wildlife conservation organizations around the world.

$BLUB: The Pepe in the Water

Current Market Cap: $50,518,551

Twitter: https://x.com/blubsui

Telegram: https://t.me/blubsui

Project Introduction: $BLUB started in late June 2024. Its design feels similar to Pepe, resembling a "Pepe in the water," combining the Pepe image with Sui's water droplet theme. Compared to Hippo, BLUB appears slightly less prominent in price action, but since Sui's meme scene is still in its early stages, it is worth watching to see if it could become the second project to surpass a $100 million market cap.

$FUD: The Dog in the Water

Current Market Cap: $36,209,263

Twitter: https://x.com/fudthepug

Telegram: https://t.me/fudthepug

Telegram Bot: https://t.me/FUDSuiBot

Project Introduction: FUD was airdropped to the Sui NFT community in December 2023. Interestingly, $FUD has no team allocation or pre-sale allocation. Due to its early launch, $FUD has a more complete community and ecosystem, and on October 3, it also released a Telegram bot for quick trading. Additionally, FUD is widely integrated into multiple DeFi and GameFi projects on Sui.

Team Members

Mysten Labs is a research and development company founded by former executives from Meta (Facebook)'s Novi Research and the chief architect of the Diem blockchain and Move programming language.

- Evan Cheng: Co-founder and CEO of SUI, former engineering director at Facebook, responsible for Novi research.

- Sam Blackshear: Technical lead and primary designer of the Move programming language.

- George Danezis: Chief Scientist, Cambridge PhD, USL professor, with extensive experience in blockchain and privacy technology.

- Avery Ching: Chief Technology Officer, former senior engineer at Facebook.

It is evident that the team has a very close relationship with Meta. After the failure of Meta's payment stablecoin Diem (formerly Libra) business in 2019, they seemingly disappeared from the crypto scene; however, the pressure from legislation and compliance has always loomed large. Whether Meta will leverage the former team members' connections with Aptos and Sui to make a comeback remains uncertain.

Token Economics

- Total Supply: 10 billion SUI tokens

- Distribution:

- Allocations beyond 2030: 52.2% (522 million tokens)

- Community Reserve: 10.6% (106 million tokens)

- Staking Subsidies: 9.5% (94.941 million tokens)

- Series A Investors: 7.1% (71.417 million tokens)

- Series B Investors: 7% (69.556 million tokens)

- Early Contributors: 6.1% (61.337 million tokens)

- Community Access Program: 5.8% (58.2 million tokens)

- Mysten Labs Treasury: 1.6% (16.348 million tokens)

Unlocking Plan

Approximately 52.2% of the tokens will be unlocked after 2030 to ensure long-term project funding and development support. Regular token unlocks may trigger market volatility, so investors need to closely monitor relevant announcements and economic activities.

Economic Model

The economic model of SUI aims to maintain network activity and growth through sufficient staking rewards and community incentives, while driving the actual use of tokens through innovations in smart contracts and decentralized applications.

Inflation and Supply Dynamics: SUI has designed a supply model that balances inflation and scarcity to ensure flexibility in early development and value support in later stages.

Staking Mechanism: By allowing token holders to participate in staking, SUI's economic model emphasizes the value of decentralization and community involvement.

It is worth mentioning that the founder of CyberCapital pointed out that in the publicly stated token economics of Sui, the locked tokens are held by third-party custodians. Unlocking these "unallocated" supplies in 2030 is merely an unsupported promise. We must trust the foundation, which has provided itself with all legitimate escape routes; custodians typically do not provide locking!

Key Events in 2024

In 2024, Sui is actively laying out plans across various aspects, from technology to market:

1. Network Iteration Updates:

The SUI network underwent two significant updates in September, and the Sui mainnet has now been upgraded to version V1.34.2, with the protocol upgraded to version 60.

2. New Platforms and Tools:

Hydropower Program: An eight-week virtual accelerator program providing hands-on workshops and industry expert guidance to promote the construction of the SUI ecosystem. The application deadline is October 16.

Enoki Platform: A corporate solutions platform launched by Mysten Labs, allowing businesses to embed public ledger solutions into their applications, products, and services.

3. Circle's Native USDC Officially Launches

SuiCircle, the USDC issued by a global fintech company, is set to launch on the Sui network. This integration will enhance Sui's utility and interoperability, bringing higher liquidity and a streamlined trading experience. Circle's native USDC will boost Sui's competitiveness in the DeFi space and support cross-chain asset transfers through the Cross-Chain Transfer Protocol (CCTP), enabling users to easily build cross-chain processes from other chains (such as Solana and Ethereum).

4. Sui Bridge Officially Launches Mainnet

The Sui Bridge officially launched on the mainnet in 2024, providing a native connection between Ethereum and Sui. The launch of the Sui Bridge marks a significant advancement in interoperability for the Sui network, allowing users to seamlessly transfer assets between Ethereum and Sui. This bridging solution not only enhances the efficiency of cross-chain asset transfers but also provides more opportunities for DeFi and other application areas. The Sui Bridge is secured by the validating nodes of the Sui network, ensuring the security and reliability of cross-chain transactions.

5. Grayscale Fund

In August of this year, Grayscale launched the SUI Trust Fund, with assets under management (AUM) quickly surpassing $1 million. The Grayscale SUI Trust ("Trust") is one of the first securities fully invested in SUI ("SUI") and derives value from its price, allowing investors to access SUI in the form of securities while avoiding direct purchase, storage, and custody of SUI.

As of October 2, Grayscale's official website shows that the assets under management have exceeded $2.5 million, with a net asset value per share (NAV) of $26.99.

6. Community Activities:

For more Sui activities, please visit: https://sui.io/community-events-hub

Sui Builder House Singapore Station:

A community event showcasing significant announcements and breakthrough collaborations for SUI.

(1) Circle's native USDC is set to launch on Sui.

(2) Walrus releases white paper and token.

(3) Decrypt collaborates with Walrus to store media content.

(4) Electric vehicle brand DeLorean Labs collaborates with Sui to accelerate innovation.

(5) Combat sports media ONE Championship utilizes Sui to transform sports.

Sui Connect New York Station:

A community gathering hosted by SUI aimed at bringing the Web3 community together to share ideas, learn about the blockchain industry, and network with other builders in the ecosystem.

Sui Technical Advantages

The Sui blockchain platform offers several unique technical advantages that not only drive its innovation in the cryptocurrency space but also provide significant benefits to developers and users. Here are the main technical advantages of Sui:

1. Object-Oriented Account Model

Sui adopts a revolutionary object-oriented account model, treating all assets and smart contracts as independent objects, each with its own properties and methods.

This model provides greater flexibility and scalability, making asset management more intuitive and efficient. Objects can operate independently of each other, allowing for parallel processing and updates, significantly increasing the network's throughput and response speed.

Sui's object-oriented approach offers a more intuitive user experience, which can be understood through the analogy of owning a house or a car. On the Sui platform, you can freely lend, transfer, or modify the state of these objects without the complex accounting processes or tracking of small portions involved in the UTxO model. Additionally, each object in Sui possesses self-integrity, allowing for independent management, enabling users and developers to treat their operations as interactions with real-world items rather than merely manipulating a series of abstract ledger records.

In my opinion, the #sui object account abstraction integrates the eth and btc UTxO account models, representing a new generation of blockchain account abstraction that coexists with concurrency and decentralization.

2. Native Randomness

Sui provides native on-chain randomness support, achieved through secure random numbers generated by its validating node network. This native randomness provides a solid foundation for developing various applications, especially in scenarios involving probabilistic games, random allocation of NFTs, and any situation requiring fair and unpredictable outcomes. Compared to randomness solutions that rely on external sources (such as oracles), Sui's native randomness does not require trust in third parties, reducing manipulation risks and enhancing the overall security and transparency of the system.

3. Native zk (Zero-Knowledge Proof)

Sui supports native zero-knowledge proofs (ZKP), a technology that allows for the verification of transaction legitimacy without disclosing any specific information. ZKP plays a crucial role in protecting user privacy, enabling users to verify transactions while keeping their personal data confidential.

Sui's zkLogin is a native feature, pioneering a truly trustless, reliable, and user-friendly authentication mechanism in Web3. Through zkLogin, developers can create convenient registration and login processes, allowing users to easily create and manage Sui addresses using familiar Web2 credentials (such as Google or Facebook).

Prospects and Challenges

Advantages:

- Outstanding Technology: SUI leverages the Move programming language, providing higher security and scalability, addressing issues faced by existing smart contract platforms.

- Strong Team: With top talent from Facebook and Novi Research, SUI's development level is high.

- Market Enthusiasm: SUI has gained widespread market attention and capital support, including active collaborations with gaming companies and significant partnerships with Red Bull Racing.

Challenges:

- Market Competition: Facing fierce competition from other L1 projects, such as Solana and Aptos.

- Follow-up Momentum of Memes: Although the current meme projects in the Sui ecosystem have attracted some new attention through price surges, overall, this pool is still relatively small.

- Lack of Blockbuster Applications: Unlike Solana, which saw strong wealth effects and breakout DApps like Pumpfun and MagicEden in the last bull market, such applications have yet to emerge on Sui.

- Transparency Issues: The community has certain doubts about the token economics and project transparency, which requires proactive responses from the project team.

Conclusion

The SUI project, with its innovative technical architecture and strong team support, has the potential for long-term development in the future. Its unique features, such as the object-oriented account model, native randomness, and zero-knowledge proofs, set SUI apart in the blockchain space. However, despite the significant technological breakthroughs achieved by SUI, challenges remain for the future.

Therefore, while the technological prospects of SUI are promising, potential investors should closely monitor the progress of its ecosystem development, especially the launch of new applications and innovations, and conduct a detailed assessment of market risks before making investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。