Author: Paul Veradittakit, Partner at Pantera

Translation: 0xxz, Golden Finance

The prerequisite for any healthy market is regulation. Financial regulation allows for seamless capital exchange, antitrust laws control rent-seeking, and intellectual property laws encourage innovation. On the blockchain, since everything is code, those who write the code are the ones who make the laws.

This power is particularly prevalent at the very bottom of the blockchain stack—the block builders. The stakeholders competing to build blocks determine the success or failure of the blockchain itself; if block production stagnates or incentives encourage predatory behavior, the integrity of the blockchain collapses, and users disappear. For example, when Solana faced interruptions, users were unable to execute any transactions, meaning they could not deposit or withdraw tokens.

Block builders refer to those who physically take transactions from the memory pool and construct transaction blocks, which are then propagated to other blocks to reach consensus on the state of the blockchain. The design of how stakeholders interact during the block building process depends on the companies that build these systems. On Ethereum, Flashbots (a Pantera portfolio company) is the preferred choice. On Solana, Jito reigns supreme. And when Monad launches, aPriori will dominate.

MEVA

The term used to describe the problems these companies seek to solve is "MEV" or "Maximum Extractable Value." In short, individuals who sort transactions in these blocks are incentivized to maximize the fees they generate, which means they may maliciously reorder transactions to maximize their own profits and increase costs for users.

The Miner Extractable Value Auction Infrastructure (MEVA) aims to address design goals of gas fee stability, competitiveness, and centralization. Much of this boils down to incentives; if stakeholders are economically compensated for increasing positive externalities (or eliminating negative externalities) in block building, they will do so. However, there is no perfect harmony.

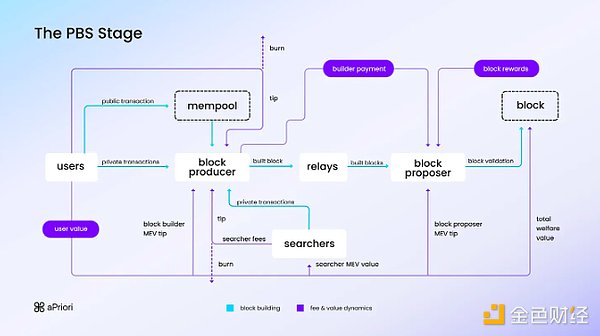

On Ethereum, the block time is about 12 seconds, giving all stakeholders time to access all transactions and simulate them to maximize their profits. With this in mind, the current gold standard approach on Ethereum is the proposer-builder separation (PBS). This setup divides the process into five stakeholders: users, block producers, relayers, block proposers, and seekers. By separating the value of block welfare among multiple stakeholders, they are incentivized to share information with each other, allowing for competitive block building while ensuring blocks remain profitable (thus minimizing failed transactions). But this also has its own issues; block producers have become centralized, with the top two builders extracting over half the value from block building. Applications have also realized they can capture their own MEV through mechanisms like MEV taxes, allowing them to participate in the transaction sorting process and reclaim value that would otherwise flow to block proposers.

Monad

Monad is an upcoming new chain that will become the most powerful EVM-compatible Layer 1 blockchain ever, capable of processing 10,000 transactions per second, with a block time of 1 second, single-slot finality, and low hardware requirements. One of the innovations to achieve this goal is the separation of the execution layer and the consensus layer, allowing the current block to run its consensus while executing the previous block. Monad Labs has raised $225 million and is expected to become the next major L1, currently amassing over 300,000 followers on Twitter.

This brings three design challenges:

1. Uncertainty of State:

Since the execution of the previous block has not been completed before the next block reaches consensus, there is no "current" state.

2. Limited Time Window for Simulating Complete Blocks:

The uncertain state and 1-second block time mean that block builders may not have time to simulate a complete transaction block and sort it to optimize profits.

3. Uncertainty of Execution:

The probabilistic nature of transaction sorting means that the current architecture may lead to transaction bundles being reversed on-chain, resulting in a higher transaction failure rate, thereby harming user interests.

Addressing these issues means designing an architecture that is cheap and has a low transaction failure rate for users while ensuring that the stakeholders in block building remain profitable.

aPriori Team

The founding team of aPriori has a unique advantage to succeed:

- Ray, CEO / Co-founder, experience in special projects at Jump Crypto, contributor to Pyth Network, quantitative trader at Flow Traders

- Olivia, CTO, former senior engineer at Coinbase, Bridgewater Associates

- Ed, researcher, former data scientist at VCRED, project lead at Los Alamos National Laboratory

Other members of the aPriori team have backgrounds in high-frequency trading, quantitative hedge funds, and other top crypto companies.

Liquid Staking

aPriori plans to leverage the infrastructure they have already built to launch liquid staking on the platform running their MEVA. Jito is doing just that, allowing users to stake SOL and receive a portion of the rewards earned by validators using Jito. Jito's fully diluted valuation (FDV) is $2 billion, with monthly revenues exceeding $800,000.

Testnet Launch

Once the Monad testnet is online and some final integrations are completed, aPriori will launch the liquid staking protocol on the Monad testnet. aPriori also plans to release an initial version of the MEVA system during the Monad testnet period, focusing on the following aspects:

- Guiding seekers and block builders to participate in block space auctions,

- Facilitating validator experiments and stress testing client software.

Designing MEVA is a fundamental component of any blockchain's internal pipeline. Monad's super-parallel EVM L1 is a new ecosystem that requires continuous innovation to ensure a good user experience and profitable block builders. The team has the experience, drive, and vision to continue doing so.

During this testnet phase, the team invites all parties to participate in testing and provide feedback, working towards mainnet readiness and further roadmap projects, such as protecting RPCs from sandwich attacks and analytical dashboards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。