Since the end of September, there has been a period without analysis of the cryptocurrency market trends. Recently, the A-shares have surged dramatically for several consecutive days, attracting global media and capital attention. The A-shares are undoubtedly on a bullish trend, and as they rise, they have absorbed a small portion of the funds from the cryptocurrency market, which is a fact. However, this is just a temporary phenomenon, and the overall cryptocurrency market is still in a phase of consolidation and accumulation.

The previous analysis article on BTC, titled "BTC Tests 65000 Strong Resistance Again, Whether It Can Break Through with Volume in the Short Term Becomes the Key to Trend Reversal!", indicated that if it cannot quickly break through the 65000 point with volume, it is highly likely to undergo a correction. In the 4-hour timeframe, it is advisable not to chase highs above the mid-short term central level and to focus on reducing positions.

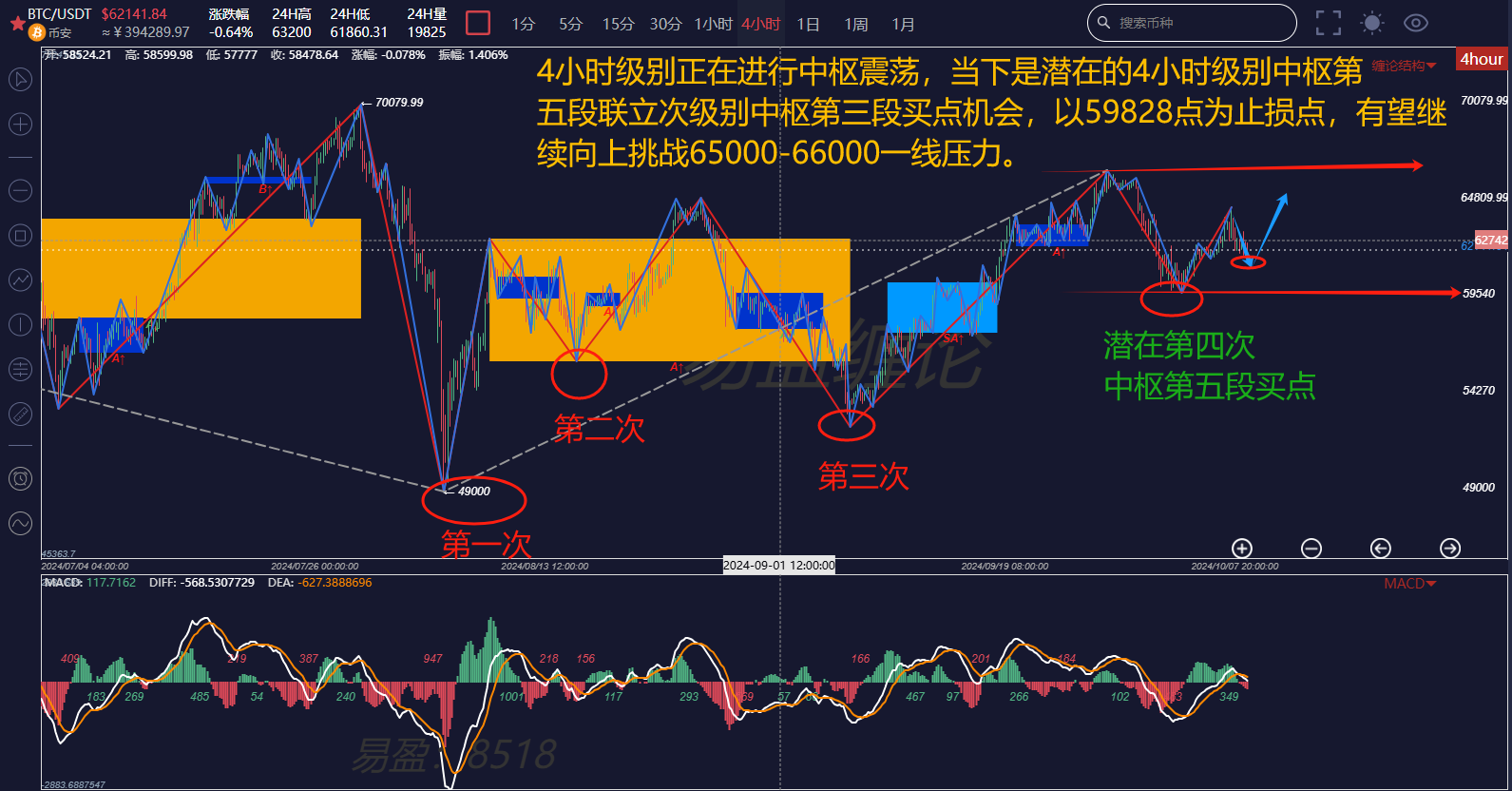

Reviewing the market, the final third buying point in the 4-hour central level failed to break through with volume after extending to 66498, leading to a reversal. During the National Day holiday on October 3, it fell below the 60000 integer mark, creating a correction low of 59828. As the trend continues to evolve, with the price dipping, a potential fourth buying opportunity has emerged again:

Looking directly at the 4-hour structure chart, the previous three buying opportunities were accurately pointed out in advance, and the current potential fourth buying opportunity has reappeared. From a structural perspective, the 4-hour level has retraced down to the middle of the 4-hour central level and found support, showing a secondary buy signal, similar to a secondary buy. Therefore, the probability of 59828 becoming the fifth buying point in the central level is quite high, and it is also an opportunity for the third buying point in the secondary central level. Gradual buying to go long can yield significant returns with a suitable risk-reward ratio. Of course, risk remains the primary concern, and going long at 59828 means setting a stop-loss point. If the trend does not meet expectations and falls below 59828, there is a very high probability that it will extend downwards towards the lower edge of the 4-hour central level.

From a broader perspective, we are currently in a phase of consolidation and accumulation before the peak of the bull market in the cryptocurrency space. Long-term holders can completely ignore short-term fluctuations, just like the A-shares. Only by enduring nearly two years of bear market trials, withstanding loneliness, and maintaining confidence can one fully enjoy the rapid wealth growth brought by a bull market. In the last live broadcast, this account mentioned that to capture the upward breakout at the weekly level, which offers the maximum profit potential, one must endure smaller fluctuations, unless one possesses exceptionally advanced trading skills for short-term trades.

Wealth always favors those who are prepared in advance!

The above analysis is for reference only and does not constitute any investment advice!

Friends, if you are interested in the Chan Theory and want to obtain free learning materials, watch public live broadcasts, participate in offline training camps, improve your trading skills, build your trading system to achieve stable profit goals, and use Chan Theory techniques to time the market effectively, you can scan the QR code to follow the public account and privately message to get in touch with this account on WeChat!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。