Today's homework is a bit difficult to submit. Last night, the US stock market tracked the A-share index and fell across the board, which made A-share partners gasp in surprise. On the first day of official trading, American investors submitted their answers, and of course, tomorrow will be a relatively important day. If the A-shares can regain the momentum to rise by 10% when they open on Wednesday, it might still boost the mood of American investors. Today's decline has basically wiped out the gains from the past three trading days.

Returning to #BTC, the continuous price drop has also caused headaches for many partners. Yesterday, when the US stock market fell, BTC performed relatively well, only starting to follow the decline later in the US trading session. However, today, even though the US stock market rose nicely, BTC fell even more severely, and many partners are still asking me why. The answer is probably that everyone has gone to invest in US stocks.

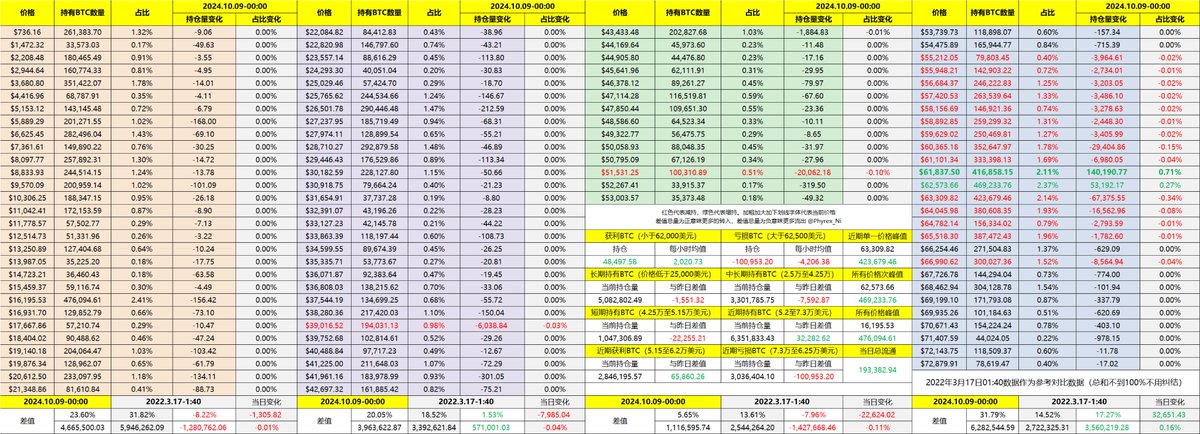

You say BTC is not good, but $MSTR is almost close to its historical high. This is also why I took the time to write four tweets about which "BTC" investment is more suitable; in reality, it is indeed the case. Leaving MSTR aside, BTC has seen significant turnover in the last 24 hours, with some early holders exiting. However, I checked the data, and it doesn't seem to be related to interactions with exchanges; it looks more like internal transfers within the exchanges. For now, let's not worry about it and observe for a few more days.

In the turnover data, the investors who bought the dip in the last two days are the ones exiting the most. This has been mentioned many times; currently, the main participants in turnover are short-term investors who sell after two days of gains and also sell after two days of losses. It feels like these short-term investors are similar to quantitative funds; perhaps they are just that.

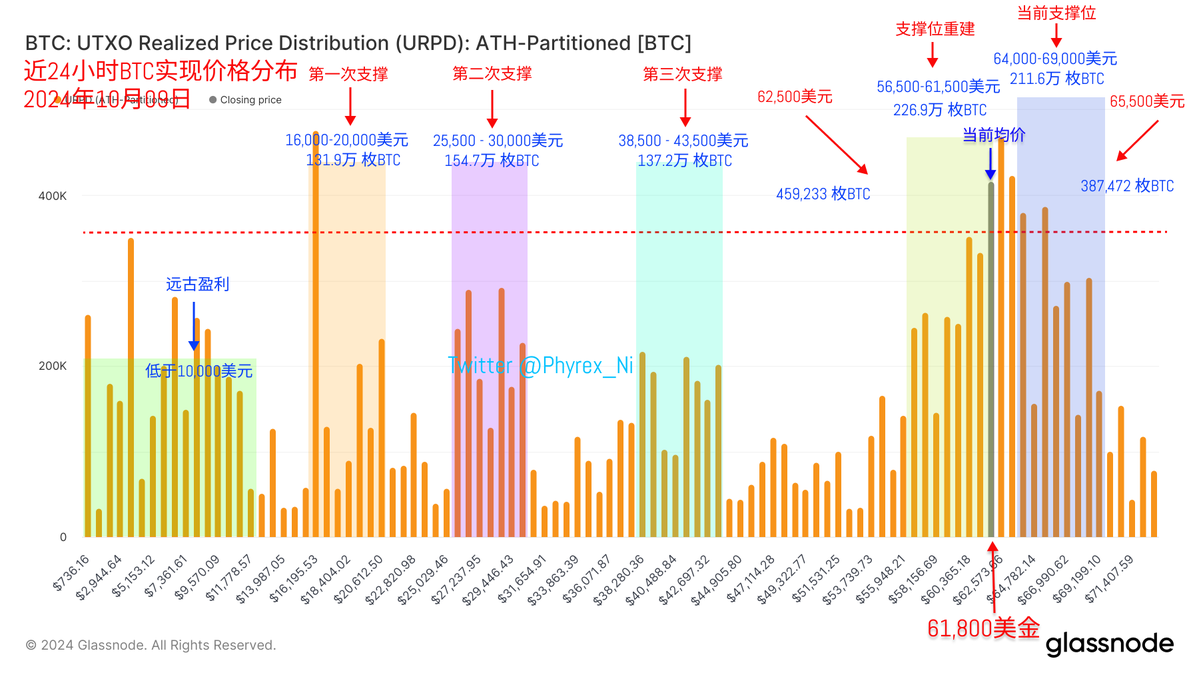

From a support perspective, it is still quite normal. Aside from the part that reconstructs support, there is still strong attraction between $64,000 and $69,000, and no large-scale exits have been observed. For this group of investors, who currently hold the most positions, if there is no large-scale exit, the impact on the price will not be significant.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。