Puffer has personally invested $1.8 million to compensate users. Such a noble project makes me want to research it further.

I previously regarded Puffer as a Restaking project, but I found that this is just the tip of the iceberg.

Puffer has become a decentralized infrastructure provider for Ethereum, with products including:

1) Based Rollup solution Puffer UniFi,

2) Preconfirmation (Preconf) technology solution UniFi AVS,

3) Restaking product Puffer LRT.

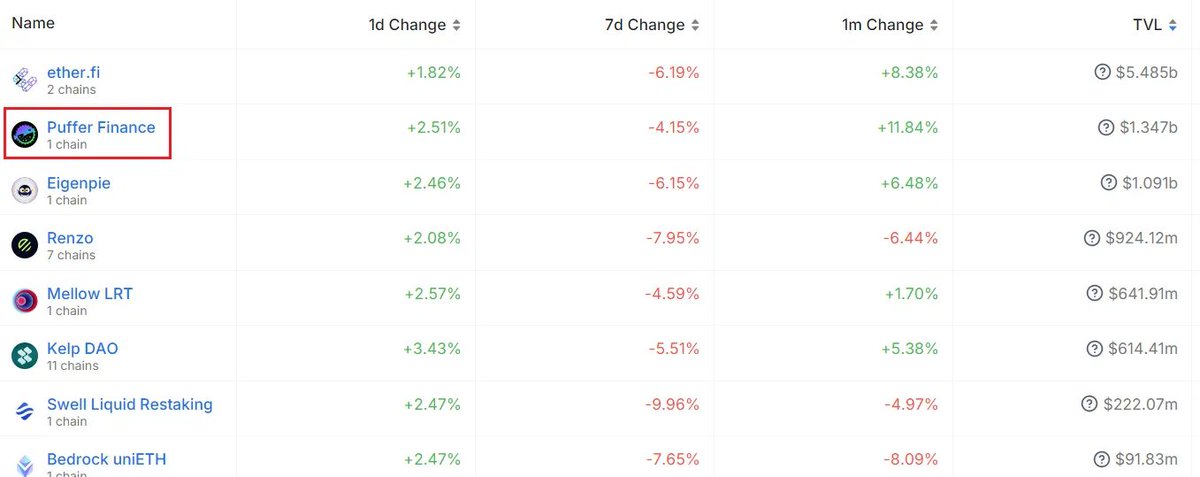

Puffer's Restaking business itself is also very impressive, with a TVL of up to $1.3 billion, ranking second among its peers.

Let's talk about Puffer UniFi.

The current landscape of Ethereum reminds me of the ancient Zhou Dynasty. The Zhou Dynasty implemented a feudal system, distributing land and power to vassals, creating a structure where the Zhou emperor was the king, and various vassals managed local affairs. On the surface, it appeared very powerful, but in reality, there were open and covert struggles, and when it came to core interests, everyone had their own agendas. This is very similar to the current situation centered around ETH, which has hundreds of layer 2 solutions like Arbitrum, Optimism, Starknet, etc. Each vassal governs independently, with their own rules and gameplay, leading to a fragmented situation. The efficiency of asset usage across multiple chains is low, and the cost for dApp developers to maintain multiple layer 2s significantly increases, all of which reduces the overall value of the system.

To address this issue, Based Rollup was proposed, also known as L1 sequencing Rollup. Based Rollup allows L1 validators to determine the order of layer 2 Rollup transactions. By shifting these responsibilities, Rollup users no longer need to trust a centralized sequencer to deliver transactions but can leverage Ethereum's decentralized validator set for a more reliable and trustworthy neutral transport layer. The advantages of Based Rollup are quite evident, such as inheriting the security and decentralization characteristics of Ethereum L1. It can also enhance Ethereum's control and effectively solve the fragmentation problem within the Ethereum ecosystem.

Although Based Rollup is very powerful, it has its own Achilles' heel, which is confirmation time. If it relies on Ethereum validators for ordering, it requires a 12-second block generation time. Such a slow speed is indeed a significant delay, which is why Puffer UniFi has emerged, with the core point being the adoption of a preconfirmation mechanism. Preconfirmation is akin to a reservation voucher; when the time comes, it's your turn. Validators will provide preconfirmation before packaging transactions into L1 blocks. These preconfirmations are not final confirmations, but they assure users that their transactions are about to be included in the blockchain. If the preconfirmers fail to deliver on their promises, they will face penalties such as forfeiture. The preconfirmation mechanism can reduce transaction confirmation time to about 100 milliseconds, which is perfect. The advantages of Puffer UniFi include:

● High security and decentralization: UniFi inherits the security and decentralization characteristics of Ethereum Layer 1, as it directly utilizes Ethereum validators for transaction ordering. Unlike traditional Rollups that rely on centralized sequencers, UniFi is not affected by single points of failure or censorship risks.

● Synchronous composability: UniFi supports synchronous composability with other Based Rollups, meaning users can interact with smart contracts on different Rollups within the same transaction.

● Near-instant transaction confirmation: By integrating UniFi AVS, UniFi can provide near-instant transaction confirmations (about 100 milliseconds).

● Native yield and gasless transactions: UniFi users can earn native yield by staking Puffer's liquid staking token (LRT) pufETH. unifiETH serves as the universal gas token within the UniFi ecosystem, and its yield can be used to subsidize gas fees, enabling gasless transactions.

● Facilitating Ethereum L1 value capture: The Based Rollup structure of UniFi allows gas fees to be returned to Ethereum block proposers, which helps enhance the economic security of Ethereum L1.

● Application chain-based integration: UniFi allows developers to launch their own Based application chains, enabling them to directly obtain economic benefits and promote interoperability within the broader Ethereum ecosystem.

Now let's discuss Puffer UniFi AVS.

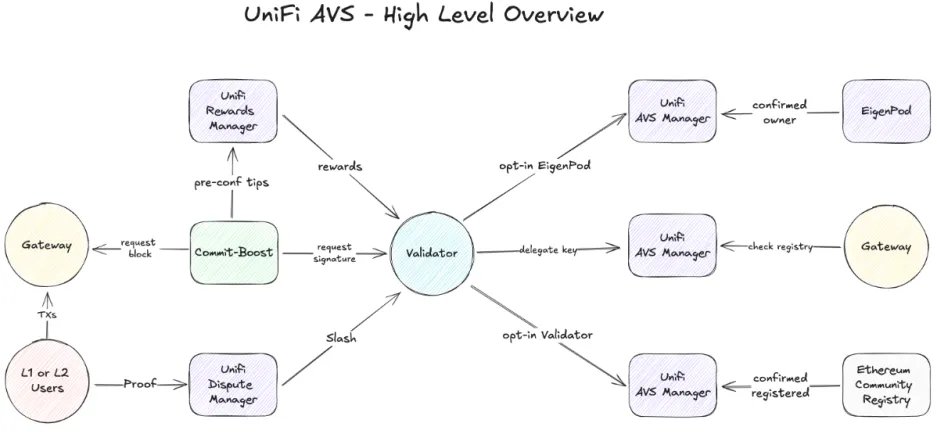

In the preconfirmation section, we talked about how preconfirmers face penalties if they fail to deliver, ensuring they work diligently. So how are these penalties enforced? Instead of requiring the staking of some tokens or ETH, Puffer has come up with a better solution: utilizing EigenLayer's AVS service. Simply put, it uses ETH that is restaked on EigenLayer as collateral.

UniFi AVS is built on EigenLayer and involves pre-processing registration, rewards, and penalties. For validators on EigenLayer, they can register as preconfirmation validators for Puffer UniFi without permission, earning additional rewards.

The entire process is roughly as follows: in the base rollup ecosystem, users submit transaction requests. When Puffer validators (acting as preconfirmers) receive a transaction, if they choose to provide preconfirmation, they will issue a commitment to the user within about 100 milliseconds. Then, the validators will package these transactions with others and propose a new block to Ethereum L1. The Puffer Sequencer Contract accepts this batch of transactions, thereby confirming the transaction status. The on-chain registration and forfeiture mechanism of UniFi AVS runs throughout the process, ensuring that validators are held accountable for their preconfirmation commitments.

Now, regarding the Restaking aspect of the business, Puffer's data is also quite impressive. According to Defillama's data, Puffer's TVL has reached $1.3 billion, ranking second among all Liquid Restaking protocols, surpassing Eigenpie and Renzo.

In summary, as an important participant in Ethereum's decentralized infrastructure, Puffer, with its innovative technological solutions and strong product ecosystem, is providing critical support for the expansion and optimization of the Ethereum ecosystem. Whether through Puffer UniFi's Based Rollup to address Ethereum's fragmentation issues or through preconfirmation technology to significantly enhance transaction confirmation speeds, Puffer has demonstrated its profound strength in improving security, decentralization, and user experience. Additionally, with the integration of UniFi AVS and EigenLayer, Puffer also offers validators more flexible staking and yield options, further solidifying its leading position in the Restaking field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。