Babylon has brought unprecedented returns to BTC, providing significant opportunities for DeFi. This article will conduct an early exploration of the BTC LST ecosystem.

Written by: IOSG Ventures

1. Introduction

Why Choose BTC-LST?

With the birth of Babylon, it has added extra returns to BTC by providing a security service known as timestamps. This re-staking service protects protocols built on Babylon by increasing the cost of attacks and enabling BTC staking through a time-lock mechanism.

Although there are no actual staking rewards in the first phase, but rather points awarded, the potential for BTC returns has sparked a wave of BTC liquidity re-staking tokens (BTC-LST), such as Lombard, babypie, FBTC, and SolvBTC.

Compared to wrapped BTC, which acts as a native cross-chain representation of BTC, BTC LST introduces a yield-bearing cross-chain BTC representation utilizing the Babylon protocol.

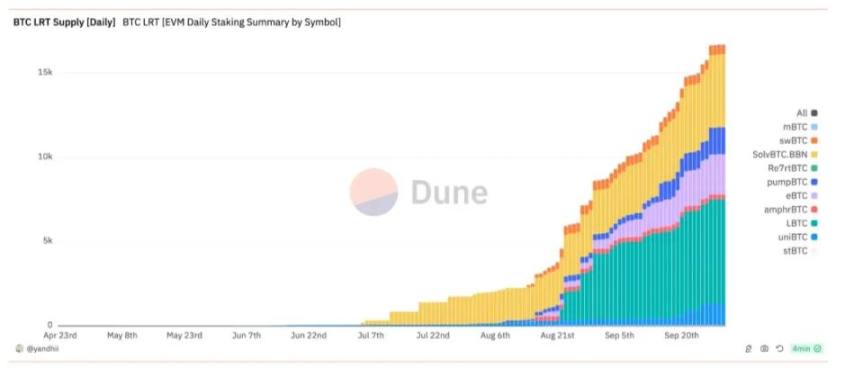

As of the writing of this article, the BTC LST market has reached $1.07 billion (excluding the 9BWBTC assets on Ethereum). The market is primarily dominated by SolvBTC and Lombard, with no signs of slowing growth.

Source: @yandhii, dune dashboard

On the other hand, many DeFi or re-staking platforms on Ethereum (such as Symbiotic, Karak, etc.) have seen opportunities brought by the influx of yield-bearing BTC assets and have begun to integrate these assets into their protocols to drive total value locked (TVL) and trading volume.

This phenomenon is extremely promising as the influx of assets can strengthen Ethereum's position as a liquidity hub in the DeFi space and continuously create a flow of economic activity.

As BTC becomes more accepted by institutions and the public, as observed from recent news such as BTC ETF and cbBTC, not to mention BTC's dominance (around 58%), it is expected that BTC adoption will continue to grow until new innovations emerge. Therefore, it is necessary to have a clear understanding of the current landscape of BTC LST-fi.

Source: Henry

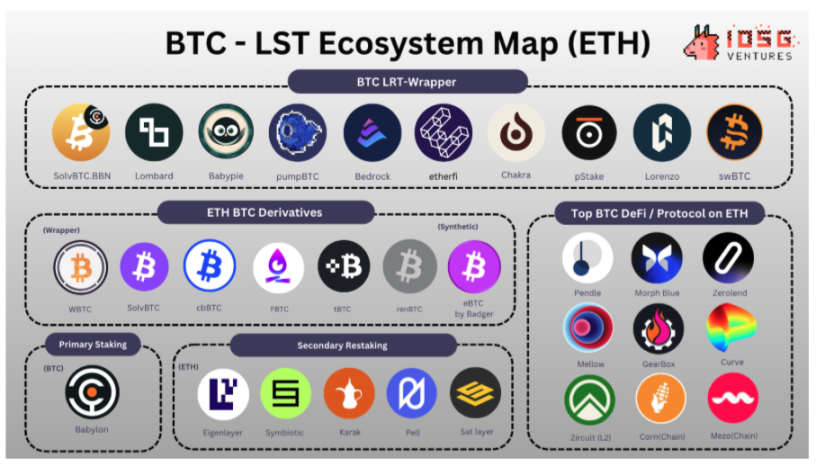

This study aims to comprehensively outline the existing BTC-LRT, BTC wrappers, and DeFi protocols following the emerging trend of BTC on Ethereum, making future navigation easier.

2. BTC-LST Ecosystem

Source: IOSG

Bitcoin LST Wrapper is a "new member" of this cycle, designed to unlock the liquidity of staked tokens in the BTC re-staking protocol Babylon.

BTC liquidity wrappers generally come in three forms:

- One is a one-way cross-chain wrapper, supported 1:1 by BTC staked in the BTC mainnet by Babylon. The "yield-bearing token" minted on ETH serves as a receipt for the staked BTC.

- Examples: LBTC, pumpBTC, mBTC from babypie, etc.

- Using LBTC or regular BTC (like WBTC) as collateral and re-staking the assets into re-staking platforms like Symbiotic and Karak. On Ethereum, LBTC or regular BTC (WBTC) is used as collateral, and these assets are then re-staked into re-staking platforms like Symbiotic and Karak.

- Examples: Etherfi's eBTC, Swell's swBTC

- The "reverse mode," where WBTC is used as collateral on ETH, and staking proof is sent to Bitgo via an oracle, allowing BTC unlocked from Bitgo to be staked in Babylon to generate yields. "Reverse mode" users can use WBTC as collateral to unlock native BTC on the mainnet and stake it on the Babylon platform. They send staking proof to Bitgo via an oracle, which unlocks BTC and uses it for staking on Babylon to earn yields.

- Example: Bedrock

While the first two types focus on bridging or unlocking more BTC assets from the BTC mainnet to the ETH ecosystem, the latter type extracts WBTC assets from ETH and "reverse" stakes them into the Babylon protocol. Architecturally, a common point of these wrappers is that BTC is stored with custodians (like Cobo or Copper) on the BTC mainnet to protect the assets, which is the cheapest and most convenient way. To clearly illustrate the entire BTC LST / LRT landscape, here is a summary of how some BTC LST / LRT operate:

Source: Henry

BTC LST Market Size

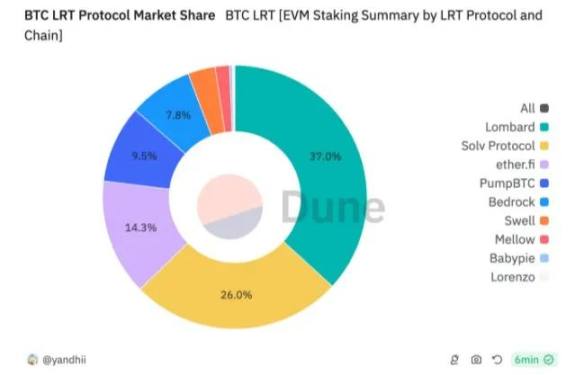

As of the writing of this article, LBTC holds a dominant market share of 37%, followed by solvBTC at 26% and pumpBTC at 9.5%. 79.6% of BTC LST is on the Ethereum mainnet, while the remaining 21.4% is distributed across networks like BNB Chain, Arbitrum, and Avalanche.

The two major players in the BTC LST market have taken different approaches. Lombard focuses on Ethereum, while SolvBTC adopts a multi-chain approach, opening up various networks including BNB, ARB, etc.

Source: @yandhii, dune dashboard

2.1 ETH BTC Derivatives (Wrappers and Synths)

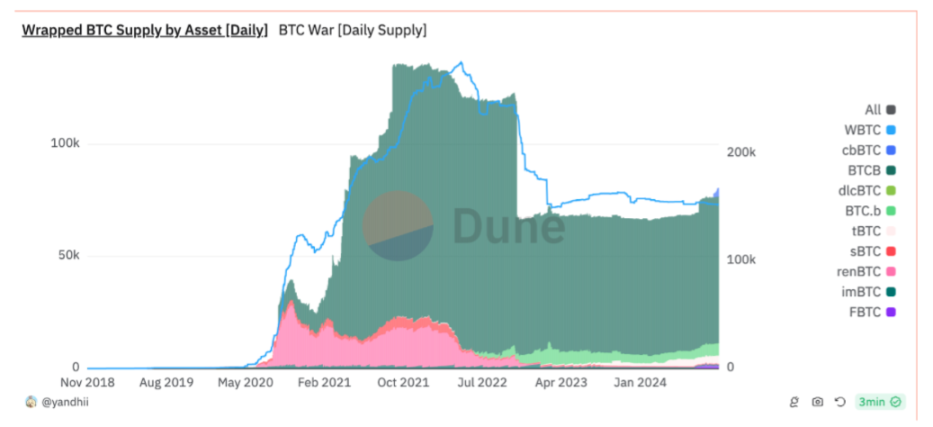

ETH BTC derivatives are wrapped BTC bridged from the BTC mainnet to the ETH network, typically facilitated by custodians. These wrappers are not competitors to BTC LST but are key drivers of LST growth.

Unlike BTC LST, these derivatives are not staked in the Babylon protocol and do not inherently generate yields. Instead, they serve as a regular representation of BTC on the ETH blockchain. Although not inherently yield-generating assets, ETH BTC derivatives have become a key component of today's ETH DeFi landscape.

Most DeFi and re-staking platforms accept WBTC because:

- They have been battle-tested

- They hold a high market dominance in the 2024 cycle

As of the writing of this article, since 2018, Bitgo's WBTC has bridged over $9 billion in assets from BTC to ETH. Of this, 21.5% (approximately $1.9 billion) has been deposited into Aave for loans, accounting for about 20% of Aave's total assets on ETH.

Most DeFi and re-staking platforms accept WBTC because:

- They have been battle-tested

- They have maintained high market dominance over the years

Source: @yandhii, dune dashboard

On the other hand, the new generation of wrappers (e.g., FBTC) has also accumulated over $152 million on ETH, with a monthly growth rate of 38% according to DeFillama. Another wrapper, SolvBTC, has attracted over $800 million in TVL on BSC and BTC L2 like Merlin.

These numbers not only showcase the importance of BTC assets in the ETH ecosystem but also highlight the immense potential for ETH DeFi to leverage this opportunity.

As mentioned above, the main issue with WBTC lies in the trust in custodians.

Recently, concerns have grown regarding WBTC's relationship with Justin Sun, leading Sky (formerly Maker) to consider removing WBTC variants from their vaults. BA Lab outlined the main concerns, primarily revolving around the argument that Justin Sun may have significant influence or control over the joint venture managing WBTC. However, Justin Sun himself claims he has no control over WBTC or the assets it holds. This transfer should also be viewed as a risk for WBTC.

2.2 BTC Re-staking

BTC re-staking refers to assets related to BTC on ETH (in the form of wrapped BTC or BTC LST) that have been re-staked to generate yields.

The table below shows the assets accepted on each staking platform and their respective TVL:

Source: Henry

Overall, approximately $150 million worth of BTC is being re-staked on ETH, with most of the staking belonging to Symbiotic, while a portion is deposited in SatLayer. Symbiotic alone holds BTC products worth $124 million, including WBTC and tBTC, as well as $10 million in staked BTC LST. In contrast, Karak's BTC assets amount to only about $100,000. Together, these BTC assets contribute 7% to Symbiotic's TVL.

On the other hand, Pell Network has successfully attracted a significant amount of BTC LST for re-staking through various BTC second-layer solutions (such as Bitlayer and B2network). These assets will be used to provide shared security services and generate yields, similar to the models adopted by Babylon Finance and Eigenlayer.

While BTC LST has already gained first-layer yields from Babylon, some protocols (like EtherFi) leverage BTC-LST by re-staking LST into other re-staking platforms (such as Eigenlayer, Symbiotic, and Karak) to generate second-layer yields.

Although this strategy allows stakers to enjoy leveraged returns and maximize capital efficiency for a single asset, they also face the same risks as ETH LST, namely being slashed simultaneously by multiple platforms (Babylon, Symbiotic).

Anti-slashing policies can prevent a certain degree of slashing on ETH, but further information regarding Babylon remains unclear.

2.2.1 BTC-DeFi

Undoubtedly, DeFi has been one of the most important areas driving blockchain economic activity. With the growth of the BTC asset market worth $9.5 billion on ETH, DeFi on ETH can benefit from the stability, institutional recognition, and potential yields provided by BTC.

Overall, aside from exchanges, BTC/BTC-LST related DeFi can be divided into two main areas:

- Money Markets & Interest Rate Swaps: Morph Blue, Aave, Pendle, Zerolend, Curve

- BTC Staking/Point Strategies: Corn, Meso, Gearbox, Mellow

Source: IOSG

2.2.2 Money Market

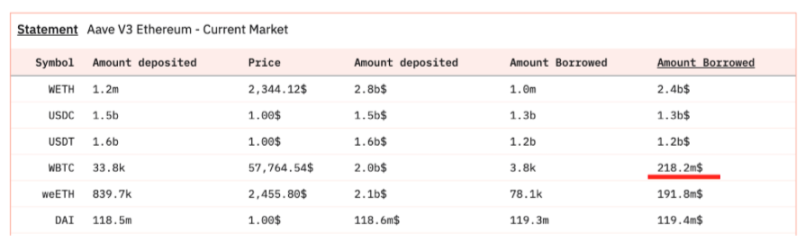

As the "safest" asset, BTC is commonly used as collateral in the ETH DeFi landscape. Aave is the oldest and most prestigious money market, with over $2 billion in WBTC deposits, but only $218 million in borrowing, resulting in a relatively low utilization rate (7.69%) compared to stablecoins (86.7%) or WETH (85%).

Source: @KARTOD, Dune dashboard

On the other hand, Morpho Blue, although having a smaller deposit base (20% of Aave's), has achieved a higher utilization rate. The most popular market on Morpho Blue is WBTC/USDC, with a utilization rate of up to 90%.

Source: WBTC/USDC Vault, Morphblue

So far, Aave and Morpho only accept WBTC. To stand out in the competitive lending market, Zeroland is the first market specifically targeting BTC LST tokens and supporting PT-eBTC. To date, they have a supply of $17 million in eBTC, with about $3.28 million borrowed, resulting in a utilization rate of 20%.

Additionally, Curve is not only a haven for stablecoin exchanges but also a popular destination for storing BTC-related assets. On Curve, BTC suppliers can do two things: first, they can provide liquidity for the three-pool. Second, they can use tBTC and WBTC as collateral to borrow crvUSD.

As of the writing of this article, approximately $50 million worth of BTC assets have been deposited for borrowing crvUSD. On the other hand, among the available pools, the tBTC-WBTC pool stands out with $25 million in assets and $2.24 million in daily trading volume. Unfortunately, despite the active BTC-related assets on Curve, $CRV incentives have not yet been provided to attract users.

2.2.3 Interest Rate Swap (IRS) Exchange

In addition to money markets, the interest rate swap (IRS) products offered by Pendle are also one of the most popular places for BTC LST DeFi.

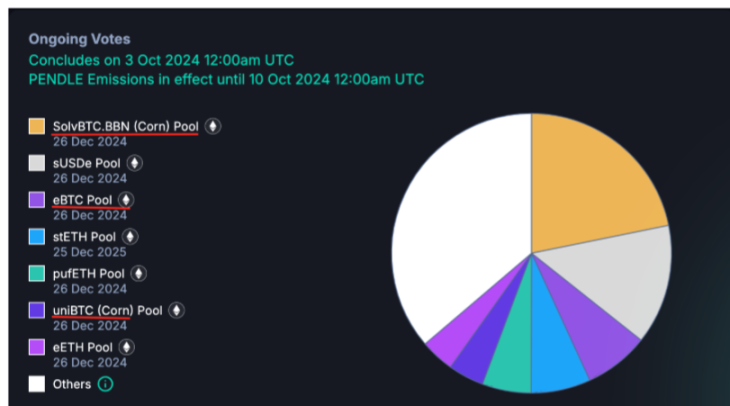

Pendle utilizes the future yields of BTC LST and speculation on points to create multiple dedicated markets: PT/YT for SolvBTC.BBN, LBTC, and eBTC, among others. These markets have collectively attracted over $136 million in funds, with a month-on-month growth of 150% driven by points and incentive farming.

A new round of voting incentives also marks an increasing interest in BTC LRT. For example, SolvVBTC in Corn was selected to attract the most emissions from Pendle. Therefore, it is expected that the supply of BTC LRT assets will continue to grow in the near future, considering the emission incentives.

Source: Pendle Dashboard

2.2.4 TVL Bootstrapping Treasury/Point Strategies

While Money Market and IRS products generate additional yields for BTC assets based on demand and supply on the ETH mainnet, TVL-guided treasuries prioritize the use of BTC to enhance their respective chains' TVL to promote ecosystem growth. Additionally, some treasuries provide leveraged point farming strategies by cycling or borrowing BTC to maximize returns with the same capital.

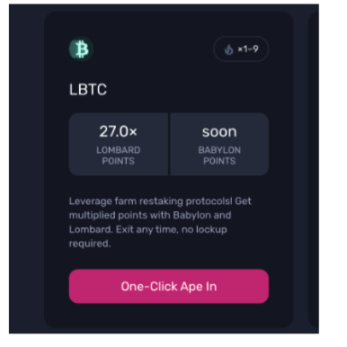

Gearbox offers up to 27 times Lombard points by leveraging borrowed WBTC (up to 7 times). However, this service is not popular due to the very limited supply in Gearbox (only about $3 million).

Source: gearbox.fi

In addition to point strategies, some second-layer networks, such as Mezo from Thesis and Corn supported by Binance Labs, are leveraging the value of BTC by allowing nodes to "stake" bridged BTC LSTs as collateral. In return, nodes earn $BTC fees by participating in the validation process, which is a good attempt to utilize BTC and guide the TVL of these networks to promote future ecosystem growth. So far, Mezo has attracted $121 million in BTC-related assets and $20 million in Corn.

So far, it is clear that most DeFi activities related to BTC LSTs are primarily driven by incentives. While BTC adoption is growing, the actual demand for generating BTC LSTs in the long run will highly depend on the yield performance of Babylon, which may make BTC LSTs more attractive assets than ETH.

2.2.5 Liquidity Issues

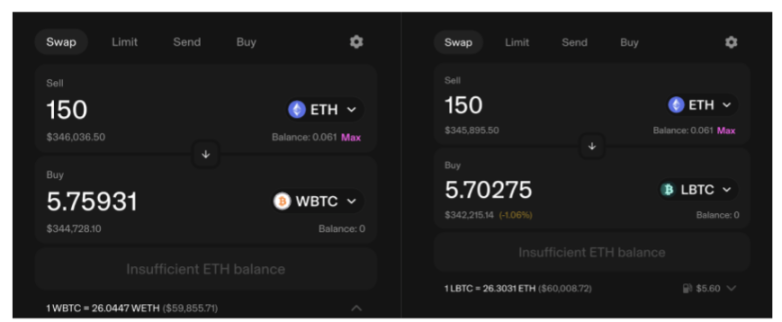

Despite having a TVL of $300 million, the deepest pools in the Uni v3 pool have a liquidity of only about $10 million (according to Nansen). Exchanging $345,000 worth of ETH for LBTC would result in a slippage of 1.06%, which is four times that of WBTC (approximately 0.4%). This discrepancy reflects a key issue that BTC LSTs must overcome: liquidity problems when exiting LBTC positions on a large scale.

Source: Uniswap

3. Summary

Bridging BTC can primarily take two forms: regular BTC, such as Wrapped BTC (WBTC), and BTC that is re-staked in Babylon, referred to as BTC-LST.

The landscape of BTC LST/LRT-Fi is still in its early stages but shows healthy signs of bridging more TVL from BTC to the ETH DeFi ecosystem.

With the increasing recognition and market dominance of BTC in the current cycle, BTC adoption is expected to rise. The opportunities for generating yields from BTC have also created a market for speculation and trading activities on ETH.

WBTC remains one of the most widely adopted forms of BTC on ETH. However, due to recent challenges posed by its association with Justin Sun, tBTC or LBTC is expected to gain more adoption.

It is becoming increasingly common to see BTC re-staking tokens being re-staked again in Symbiotic or Karak for leveraged farming. While this may yield higher returns, users must bear the risk of facing multiple slashing events.

Money markets and interest rate swaps are the most in-demand BTC DeFi activities on ETH, while attempts from second layers to use BTC as fees in the validation process are also quite interesting.

Currently, most BTC-related DeFi activities on ETH are primarily driven by points or reward incentives. To generate actual demand, BTC LSTs need to create value (possibly in the form of yields) that exceeds that of ETH LSTs.

Custodial risk, slashing risk, and liquidity risk are the main concerns in the BTC LST landscape.

* Note:

This research aims to provide a high-level overview of the rising trend of BTC LSTs on ETH and hopes to raise awareness of the opportunities and risks involved in handling this new generation of BTC assets. Future assessments of cross-chain financial potential will require further research into the impact of BTC assets on ETH and other chains.

If there are any oversights, please contact @poopmandefi on Twitter, and I will do my best to keep this research up to date.

References:

https://www.diadata.org/bitcoin-ecosystem-map/

https://dune.com/yandhii/btc-lrt-evm

Dashboard:

https://www.footprint.network/@Higi/Bitcoin-Bridge-BTC-to-Ethereum-WBTC?%253E%253D_date-98774=2022-01-01&%253C_date-98777=2024-09-09

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。