Click to watch the video: https://www.bilibili.com/video/BV1zn2pYDEWS/?vd_source=04332ad6ecefd22ffa3d1b9032b40fb3

Currently, Bitcoin is facing resistance around the 64500 area. How should we deal with this volatility and consolidation? First, we see that on the 4-hour chart, I mentioned to some friends yesterday that the range above 64000 and 64600 is not a place to chase long positions.

I also mentioned that there would be wide fluctuations. Currently, our wide fluctuation range is between 62000 and 64600, which is about a 2000-point space.

So, if you don't chase the highs, you usually won't incur losses. Because if you are going long from a lower position and take profit at the top, it doesn't mean you have to short at the top, but you should not chase long positions above.

Currently, we can see that the moving averages on the 4-hour chart have entered a consolidation state, which means that the current support will be washed out up and down. The 4-hour EMA 20, 50, and 100 are basically not usable or referenceable.

However, one thing we need to pay attention to is that the bottom on the 4-hour chart is rising. This means that the most critical support is at the 4-hour EMA 200 position.

Therefore, at this position, the advisor does not recommend chasing shorts in the short term unless there is an effective breakdown and it cannot rebound. Then we can consider a short strategy.

Otherwise, at this position, the advisor does not recommend chasing shorts but should pay attention to whether there will be continued bottom consolidation and then a rebound.

So, during the day, we should focus on whether the area around 61700 to 62300 will not break down and continue to fluctuate. Only then do we have the opportunity to attempt a short-term rebound trade.

Otherwise, there is currently no major direction for you to trade because the wide fluctuations are washing out from around 62000 to 64600. So, I currently suggest that everyone can look to buy on dips and not chase long positions at highs. Currently, these are the only thoughts we can see on the daily level.

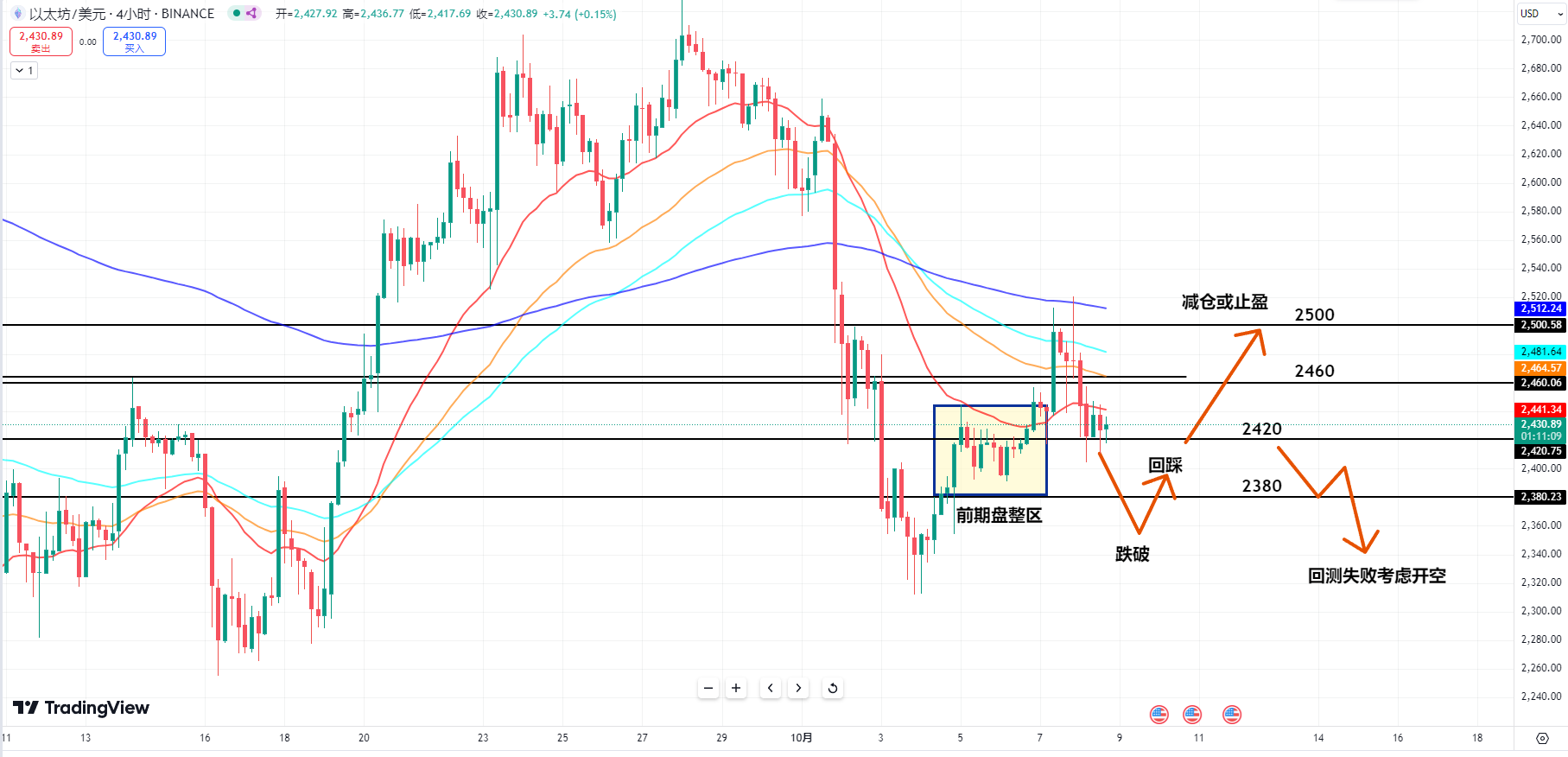

Now let's take a look at the Ethereum 1-hour chart. The pressure above is also very significant, and the advisor will not chase long positions. Currently, the moving averages on the 1-hour chart have also been suppressed.

However, this area on the 4-hour chart is also a previous consolidation area, so it is best not to chase shorts in a demand zone. The moving averages above are also in a consolidation state, with no strong turning point.

Currently, we should pay attention to the demand during the day, roughly between 2420 and 2380. It is still not recommended to chase shorts unless it can effectively break down and fail to retest. Then we can consider whether to short.

Otherwise, the current daily level's wide fluctuations will be similar to Bitcoin, consolidating in the range of 2400 to 2500. So currently, you can look to gamble on a long position on dips.

When reaching the upper pressure around 2460 to 2500, you can reduce your position or take profits. As for the downside, the advisor suggests that you should only short after a real breakdown below 2400 or if the retest fails. Otherwise, we are currently in a very uncomfortable consolidation washout.

This article is exclusively planned and published by Advisor Chen (WeChat public account: Coin God Advisor Chen). If you want to learn more about real-time investment strategies, liquidation, spot contract trading techniques, operational skills, and knowledge about candlesticks, you can add Advisor Chen for learning and communication. I hope it can help you find what you want in the crypto world. Focused on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates on macro analysis articles, mainstream and altcoin technical indicator analysis, and spot long-term price prediction videos.

Warm reminder: This article is only written by Advisor Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。